Summary

Capital One is one of the easiest issuers to apply for a card upgrade or downgrade with – allowing you to earn better rewards or save on an annual fee.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

There are a lot of ways you can outgrow your credit card. Maybe you signed up for a student card or secured card, but you now have a better credit score and can qualify for something better. Maybe a card with a high annual fee no longer makes sense in your budget, and you are hoping for a no-fee alternative.

No matter the reason, you might be looking to apply for another credit card as the next step. But before you suffer a hit to your credit score by applying for a new card (or canceling one you don’t get much use out of anymore), consider another option. Most credit card issuers allow users to upgrade or downgrade their cards to another product with the bank. You’ll typically have to meet certain requirements to take advantage of this option, but you can easily switch to a better offer for your lifestyle without sacrificing points from your credit score.

Considering upgrading or downgrading a card with Capital One? Read on to learn more about how to start the process with the issuer and what eligibility requirements you’ll need to meet.

Upgrade process

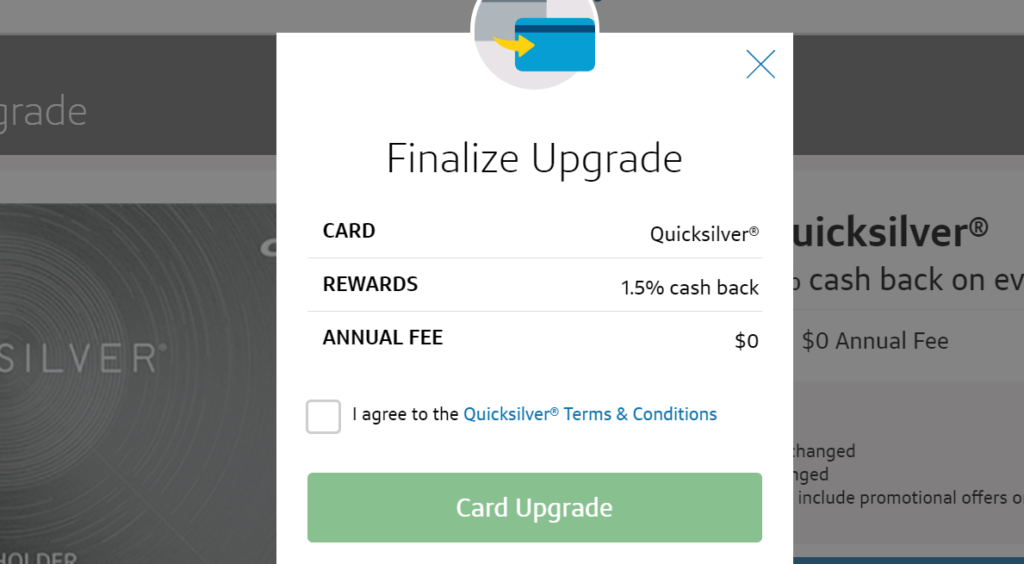

Capital One is one of the easiest card issuers to upgrade or downgrade a credit card with, as the bank frequently releases targeted offers for a product change. When you log in to your account, you might get a notification on the portal with offers targeted to you – which you are prequalified for.

If you don’t have a targeted offer, you still might qualify for a card upgrade or downgrade. You can call the customer service number on the back of your card to ask about your options, or you can log in to your online Capital One account.

Once you’ve found a new card that makes sense for you, you can complete the entire upgrade process either online or over the phone.

Eligibility requirements

According to a customer service representative with Capital One, the issuer reviews your account regularly for product change offers. Your card offers are updated regularly, so continue to check back either online or over the phone to see if your desired card is available for upgrade or downgrade. If you have a different Capital One card you are hoping to qualify for, there are a few eligibility requirements to keep in mind:

How long you’ve had your current card

Capital One does not have a hard and fast rule for how long you must have one card open before you are eligible to upgrade or downgrade, but we estimate a good rule of thumb is at least six months of card ownership. While we found upgrade offers on younger accounts, six months is a solid period of time to demonstrate your reliability of making on-time payments to the bank.

The type of card you want

Unlike many card issuers, Capital One does allow customers to change from a cash back to a travel card or vice versa. For example, we found an offer to upgrade from the Capital One Savor Cash Rewards Credit Card to the Capital One VentureOne Rewards Credit Card. This is a huge perk in terms of flexibility, as you can likely switch to a different product that better suits your spending patterns.

Account standing

To qualify for a good upgrade or downgrade offer with Capital One, you should first ensure that your account is in good standing. If you have a positive reputation of on-time payments with the bank, you are more likely to be allowed a product change.

Changes to your credit card

So what exactly happens when you upgrade or downgrade a card instead of applying for a new one? You’ll keep the same account – just with a new card – so the following things will stay the same:

- Your card number does not change, but your CVV and expiration date will change, so you’ll need to update any automatic payments.

- Your current rewards balance will carry over to your new card. If you switch from a card that offers cash back to one that offers miles, you will receive 100 miles for every dollar in cash back you’ve earned.

- Your credit limit and APR will also stay the same.

Keeping the same card number, credit limit and APR make it easy to manage your new card, as the following features will change when you upgrade or downgrade:

- Your rewards rate will change as reflected in the new card’s terms and conditions. You’ll start earning your updated rate within two to three business days.

- You won’t receive a new introductory offer or qualify for the new card’s intro APR (if applicable).

- If you downgrade from a card with an annual fee to one without a fee, you are responsible for any fee charged prior to the product change.

- You’ll receive a new card with the same card number, but updated card art, security code and expiration date within seven to 10 business days.

Benefits of upgrading or downgrading your card with Capital One

If your Capital One credit card is no longer suited to your needs, upgrading or downgrading to another Capital One product can be a great way to ensure you are still earning rewards that make sense for you without a hit to your credit score. When you upgrade or downgrade, you don’t have to close a card or fill out a new application, meaning you essentially get a new card with no hard pull on your credit and no negative impact on your average age of open accounts.

Plus, it is a great way to adjust how much you spend on credit cards each year. If you are paying an annual fee that is too expensive for your current budget – but you still like some of your card’s perks – you can often downgrade to a lower annual-fee version of the card.

One great example of this is the Capital One Savor Cash Rewards Credit Card*, which charges a $95 annual fee. For cardholders who still want to earn top-notch dining rewards, the SavorOne card offers a similar earning scheme without a high annual fee.

On the flip side, you can upgrade a card to take advantage of better benefits, and then you don’t have to worry about carrying a card you no longer have use for. For example, if you applied for the Capital One Platinum Credit Card as a way to build your credit score, but now qualify for one of Capital One’s many great rewards cards, you can change to a better rewards rate without having to close the Platinum.

Perhaps you want to upgrade to Capital One’s newest premium travel card, the Capital One Venture X Rewards Credit Card. The Venture X comes with up to $300 in annual credits, plus a notable sign-up bonus. The Venture X currently offers 75,000 bonus miles for spending $4,000 on purchases in the first three months with the card. The spending requirement is hefty, but the reward is well justified as 75,000 miles can be redeemed for $750 in travel. The Capital One Venture X is the ideal credit card for people interested in premium travel credit cards, but with a price tag at less than $500 per year.

Additionally, there have been reports that you can only have two Capital One cards at a time, excluding the secured card and co-branded cards. While it’s unclear whether this is an official issuer policy or just a rule of thumb, upgrading your card can help you get the product that you want while keeping the number of cards under the limit.

Tips for making the most of your upgrade or downgrade

- If you are downgrading to a card with a smaller annual fee (or none at all), do so before the fee posts to avoid an extra charge.

- Check for prequalified offers regularly – either by phone or online – as Capital One evaluates your account on a regular basis.

- Make sure to read the new card’s terms and conditions carefully before accepting an upgrade or downgrade offer.

- Before applying for a new credit card, make sure you don’t have a product change offer from Capital One that will suit your needs. You might be able to avoid a new account and hard pull on your credit.

Popular Capital One credit cards

| Card | Rewards rate | Annual fee |

| Capital One Venture X Rewards Credit Card |

| $395 |

| Capital One Venture Rewards Credit Card |

| $95 |

| Capital One VentureOne Rewards Credit Card |

| $0 |

| Capital One Savor Cash Rewards Credit Card |

| $95 |

| Capital One SavorOne Cash Rewards Credit Card |

| $0 |

| Capital One QuicksilverOne Cash Rewards Credit Card | 1.5% cash back on every purchase | $39 |

| Capital One Quicksilver Cash Rewards Credit Card | 1.5% cash back on every purchase | $0 |

| Journey Student Rewards from Capital One |

| $0 |

Final thoughts

Upgrading or downgrading your credit card can be a great way to make sure you are still earning rewards that match your lifestyle, without suffering a hit to your credit score. Plus, Capital One’s process is very straightforward and easy to take advantage of.

While you won’t be able to enjoy the introductory bonus on your new card, you’ll maintain your account history and card number and start earning your new rewards in just a few days.

*All information about the Capital One Savor Cash Rewards Credit Card has been collected independently by CreditCards.com and has not been reviewed by the issuer. The offer is no longer available on our site.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.