| Cash Back Rating: | 4.2 / 5 |

| Rewards Value: | 4.0 |

| Annual Percentage Rate: | 1.0 |

| Rewards Flexibility: | 5.0 |

| Features: | 3.0 |

| Issuer Customer Experience: | 4.0 |

In a Nutshell:

Thanks to its flexible redemption scheme and great rewards rate on practical purchases like grocery pickup, the Capital One Walmart Rewards Mastercard should offer a lot of value to cardholders who do most of their everyday shopping at Walmart.

All information about the Capital One Walmart Rewards® Mastercard® has been collected independently by CreditCards.com and has not been reviewed by the issuer.

Rewards Rate

|  |

Sign-up Bonus

|  |

Annual Bonus |  |

Annual Fee |  |

Average Yearly Rewards ($1,325 monthly spend) |  |

APR |  |

Rewards Redemption

Cons

|  |

Other Notable Features: Instant issuance via Walmart App, real-time purchase notifications, security alerts, $0 fraud liability for unauthorized charges, ability to lock or unlock card via Capital One mobile app

The Capital One Walmart Rewards Mastercard is a practical, flexible cash back card that could offer a lot of value to frequent Walmart customers.

The card’s generous cash back rate on Walmart.com purchases and the option for free in-store pickup makes the Walmart Rewards Mastercard a great choice for online grocery shopping. The card’s reasonable APR and hassle-free redemption scheme also set it apart from many other store-branded cards, which tend to be much more restrictive.

If you’re a regular Walmart customer and are open to doing most of your shopping online, the Walmart Rewards Mastercard could be a great addition to your wallet. However, if you prefer the flexibility of shopping around and comparing prices, it might be best to opt for a general rewards credit card that isn’t tied to a specific store.

Why you might want the Walmart Capital One Rewards Mastercard

Frequent Walmart grocery customers who shop online – or are willing to start shopping online – will benefit greatly from 5% back on grocery purchases made on Walmart.com. The card also comes with an introductory rewards rate of 5% on purchases in Walmart stores for the first 12 months when you use your card with Walmart Pay, making it a great rewards earner initially. Weave these in with flexible redemption options and this card stands apart from other cards in the retail card space.

One of your best options for grocery pickup or delivery

Even if you don’t think of yourself as a frequent online shopper, you could still squeeze unexpected value out of the Walmart Rewards Mastercard thanks to its inflated rewards rate on online grocery purchases.

While in-store grocery purchases only earn 2% back, if you order your groceries online for pickup or delivery, you get the card’s maximum cash back rate of 5%. Delivery costs vary based on which time slot you book, but pickup is free and usually available as soon as the same day you order. Your order must total at least $35, however, so be sure to plan ahead.

If you’re willing to order online, the Walmart Rewards Mastercard’s rewards rate on groceries is one of the best on the market, beating out many of the best credit cards for grocery shopping, including the American Express® Gold Card (4 points per dollar at U.S. supermarkets on up to $25,000 in purchases annually, then 1 point per dollar) and the Bank of America® Customized Cash Rewards credit card* (2% cash back on grocery stores and wholesale club purchases on up to $2,500 combined grocery store, wholesale club and now 6% cash back for the first year in your choice category purchases quarterly (after the first-year bonus you’ll 3% cash back up to the quarterly maximum), then 1%).

Generous first-year rewards rate for in-store purchases

The Walmart Rewards Mastercard also offers an introductory rewards rate of 5% cash back on in-store purchases for the first 12 months you own the card. The only catch is you’ll have to charge your card via Walmart Pay, the company’s addition to the increasingly popular mobile wallet market.

Using Walmart Pay is simple, and your Walmart Rewards Mastercard is automatically loaded into the Walmart App (required to use Walmart Pay). All you need to do is scan a QR code at checkout and payment is processed automatically.

This introductory bonus is certainly welcome and – at least for the first year – could gives the Walmart Rewards Mastercard a higher rewards rate on many general purchases available at Walmart than you’ll find on competing flat-rate and no annual fee credit cards. Keep in mind that this inflated rewards rate is only available for the first 12 months of owning the card.

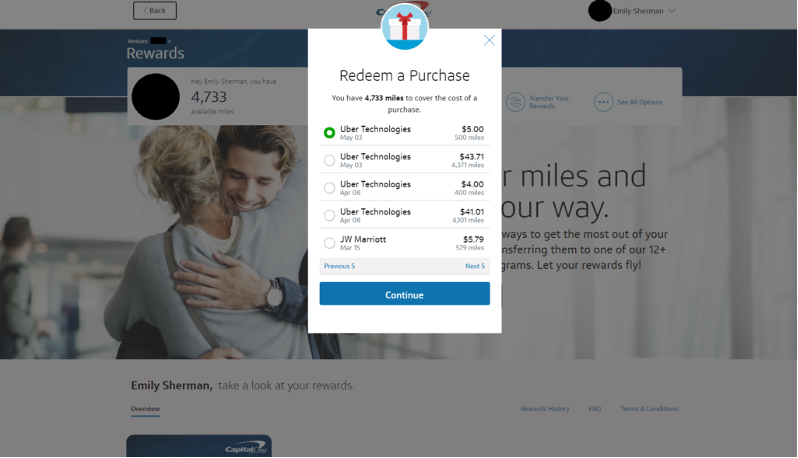

Flexible redemption options

Unlike many store-branded cards, which limit when, how and how much you can redeem, the Walmart Rewards Mastercard offers a refreshingly flexible cash back redemption scheme. Cash back is available outside of Walmart, no minimum redemption is required and cash back never expires.

While there’s no option to request your cash back as a direct deposit, you can redeem it as a statement credit at Walmart.com during checkout, for gift cards or for booking travel through the Capital One travel portal.

Since the card is co-branded, you can also take advantage of a unique savings tool that will come in handy if you spend a decent amount on travel. Capital One lets you use your rewards to redeem for eligible purchases, including flights and hotel stays as well as Uber rides, UberEATS orders, public transportation and more.

Favorable approval odds and low-end APR

The Walmart Rewards Mastercard offers a variable APR of 19.48% or 29.99%. While the maximum APR is a bit higher than the average APR for a retail card, the low-end APR is very good for a retail card.

The card is also fairly easy to qualify for – open even to those with fair or average credit – so it could be a good option if your credit history has a few blemishes and you’re looking to work on your score while earning much better-than-average rewards than are typically available with a card at this credit level.

Easy application, instant use

The Walmart Rewards Mastercard takes a unique “digital-first” approach to card application and use. Not only can you apply online through Walmart or Capital One, you can also text to apply and complete your application right from your mobile device.

Once you’re approved, your Capital One Walmart Mastercard is instantly issued and ready to be used in the Walmart App. This is an especially great feature since the card is geared toward everyday purchases, as you won’t miss out on any cash back while waiting for the card to come in the mail.

Digital tools from Capital One

Because it’s co-branded, the Walmart Rewards Mastercard also lets you take advantage of several digital tools offered by Capital One, including real-time purchase notifications, security alerts, $0 fraud liability for unauthorized charges and the ability to lock and unlock your card via the Capital One mobile app. While these are not earth-shattering perks, they’re a welcome addition, given that many store-branded cards are much more bare-boned.

Why you might want a different rewards card

The Walmart Rewards Mastercard is a great option for online shoppers and those who don’t mind funneling purchases through Walmart Pay for the first year to take advantage of an inflated rewards rate. However, if you’re only an infrequent Walmart shopper, there are better options for grocery purchases or flat-rate rewards on all purchases.

Infrequent Walmart shoppers may find a better deal elsewhere

If you’ve done the math and it turns out you don’t spend as much money at Walmart each month as you’d thought, a general use rewards card might be more to your benefit than a co-branded rewards card.

Lots of rewards cards let you earn cash back or points at a high rate in specific spending categories like groceries or online shopping without limiting you to a single retailer. These cards often also come with flat-cash bonuses when you reach a set spending threshold, which will likely be more convenient and possibly more lucrative than the Walmart card’s first-year 5% cash back rate on in-store purchases when you use Walmart Pay.

Boosted cash back rate only applies on online purchases

The Walmart Rewards Mastercard’s biggest selling point is an impressive 5% cash back rate on Walmart.com purchases. While this matches the rate offered on online purchases by other popular retail co-branded cards like the Prime Visa and the Target REDcard, those cards carry the same high cash back rate on relevant in-store purchases.

Unlike the REDCard – which offers a 5% discount on both online and in-store Target purchases – and the Prime Visa – which offers 5% back at Whole Foods locations – the Walmart Rewards Mastercard offers just 2% back if you buy in-store. While you can still earn the maximum cash back rate if you order online and pick up at the store, this limitation could be a sticking point for shoppers who don’t always plan their purchases ahead of time.

Plus, while you earn 2% back at Walmart-branded gas stations and Murphy USA gas stations, the Walmart Rewards Mastercard’s gas rewards are bested by those of the Prime Visa card, which offers 2% back at all gas stations.

Meanwhile, the Walmart card’s 2% back on all dining and travel purchases and 1% back on all other purchases are fair but unremarkable compared to many other no-annual-fee credit cards.

How the Walmart Rewards Mastercard compares to other cash back cards

While the Walmart Rewards Mastercard offers cash back at a terrific rate on Walmart.com purchases, it’s not your only option for earning rewards on purchases made at the store or online. A number of cash back cards earn flat-rate or bonus category rewards comparable to those you’d earn on in-store purchases with the Walmart Mastercard while also offering greater flexibility to earn rewards on shopping outside of Walmart. Here are a few of our favorites.

|  |  |

Rewards rate

| Rewards rate

| Rewards rate

|

| Introductory bonus | Introductory bonus

| Introductory bonus

|

| Annual fee $0 | Annual fee $0 | Annual fee $0 |

Other things to know

| Other things to know

| Other things to know

|

Citi Double Cash Card

Offering one of the best flat cash back rates available, the Citi Double Cash Card is a great no-frills, all-purpose rewards card. You earn 2% cash back on all purchases (1% when you buy and an additional 1% as you pay off those purchases), regardless of where, when or how they’re made. You can earn up to 2% on all purchases at Walmart, online or off. This is an especially good card if you don’t want to track spending categories or be forced to shop online or at a specific store to earn rewards. Keep in mind, however, that the Walmart rewards card will earn you a higher rate for online purchases when shopping on Walmart.com.

Chase Freedom Flex

The Freedom Flex earns 5% cash back in rotating categories that you must enroll in each quarter (on your first $1,500 in spending, then 1%), as well as bonus cash back on travel booked through the Chase Travel℠ portal and at restaurants and drugstores. The Chase cash back calendar regularly lists Walmart purchases as eligible for 5% back, so it could be a good option if you only occasionally visit Walmart and can strategically plan your purchases for a certain quarter to maximize rewards. The card also carries an introductory APR on new purchases, so you can finance a big-ticket item from Walmart while saving on interest charges.

Bank of America Customized Cash Rewards credit card

A popular choose your bonus category rewards card, the Bank of America Customized Cash Rewards credit card now offers 6% cash back for the first year in the category of your choice: gas and EV charging stations; online shopping, including cable, internet, phone plans and streaming; dining; travel; drug stores and pharmacies; or home improvement and furnishings. You’ll automatically earn 2% cash back at grocery stores and wholesale clubs, and unlimited 1% cash back on all other purchases. After the first year from account opening, you’ll earn 3% cash back on purchases in your choice category. While Walmart is not included as an eligible grocery store, Walmart.com purchases would be eligible for 6% back if you chose online shopping as your 6% bonus category (other options include gas, dining, travel, drugstores and home improvements). Such variety could make this card a good option if your spending habits change from month to month and you aren’t a frequent Walmart grocery customer.

How to use the Capital One Walmart Rewards Mastercard:

- Whenever possible, make Walmart your first stop for household purchases.

- Order online and pick up when possible.

- Order all of your groceries online at Walmart.com and pick them up at the store.

Is the Capital One Walmart Rewards Mastercard right for you?

The Capital One Walmart Rewards Mastercard is a good choice if you do most of your household shopping at Walmart and is especially valuable if you’re open to ordering groceries online. While a general rewards card will offer more flexibility, the Walmart Rewards Mastercard’s cash back rate on groceries is hard to beat without paying an annual fee.

*All information about the Bank of America® Customized Cash Rewards credit card has been collected independently by CreditCards.com and has not been reviewed by the issuer.

Frequently Asked Questions

All reviews are prepared by CreditCards.com staff. Opinions expressed therein are solely those of the reviewer and have not been reviewed or approved by any advertiser. The information, including card rates and fees, presented in the review is accurate as of the date of the review. Check the data at the top of this page and the bank’s website for the most current information.

Responses to comments in the discussion section below are not provided, reviewed, approved, endorsed or commissioned by our financial partners. It is not our partner’s responsibility to ensure all posts or questions are answered.