Summary

Walmart Pay bills itself as “convenience in an app” and could help you skip the line, track spending, make returns and more.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

One of the most intriguing features of the Capital One® Walmart Rewards® Mastercard® is its generous 5% cash back rate on in-store Walmart purchases for the first 12 months when you use Walmart Pay at checkout. But if you’re not already a diehard Walmart fan, you’re probably wondering: What is Walmart Pay?

Designed exclusively for Walmart shoppers, Walmart Pay is the company’s answer to mobile wallets like Apple Pay and Samsung Pay and is just one feature of the Walmart mobile app. Walmart Pay is available at more than 4,600 Walmart stores across the country and makes it easier for customers to check out, track spending, make returns and more.

Here’s everything you need to know about Walmart Pay and the Walmart app.

What is Walmart Pay?

Walmart Pay is Walmart’s addition to the growing mobile payment market. Like Apple Pay, Google Pay, Samsung Pay and other popular mobile wallets, Walmart Pay lets you link your credit, debit and gift cards to your mobile device and use it to pay at checkout. But while other mobile wallets are accepted at a wide variety of stores, gas stations and even vending machines, Walmart Pay is accepted only at Walmart.

Why should I use Walmart Pay?

Walmart Pay’s main selling point is convenience. You can link your preferred payment methods to your mobile device and quickly scan to pay at checkout, avoiding the hassle of carrying a wallet full of cards.

Or, maybe your card always gives you trouble at the register. Just manually enter your credit card number into Walmart Pay and you should have a smoother checkout. Walmart Pay also has the unique ability to automatically save receipts in the Walmart app, making it easier for Walmart shoppers to track spending and return items. Additionally, if you have the Capital One Walmart Rewards Mastercard, you can earn bonus cash back for the first 12 months when you use Walmart Pay.

What’s the difference between Walmart Pay and the Walmart app?

You won’t find a standalone Walmart Pay app in the App Store or Google Play Store. Walmart Pay lives inside the Walmart app and is just one tool included in the app. The Walmart app and Walmart Pay work with both iOS and Android devices.

How do I set up Walmart Pay and add a card?

Setting up Walmart Pay is very simple and should only take a couple of minutes. All you need to get started is a Walmart.com account, the Walmart app and any credit, debit or gift cards you want to link to Walmart Pay. Walmart Pay cannot be directly linked to a bank account.

Here’s how to set up Walmart Pay and add a card, step-by-step:

- Download and launch the Walmart app.

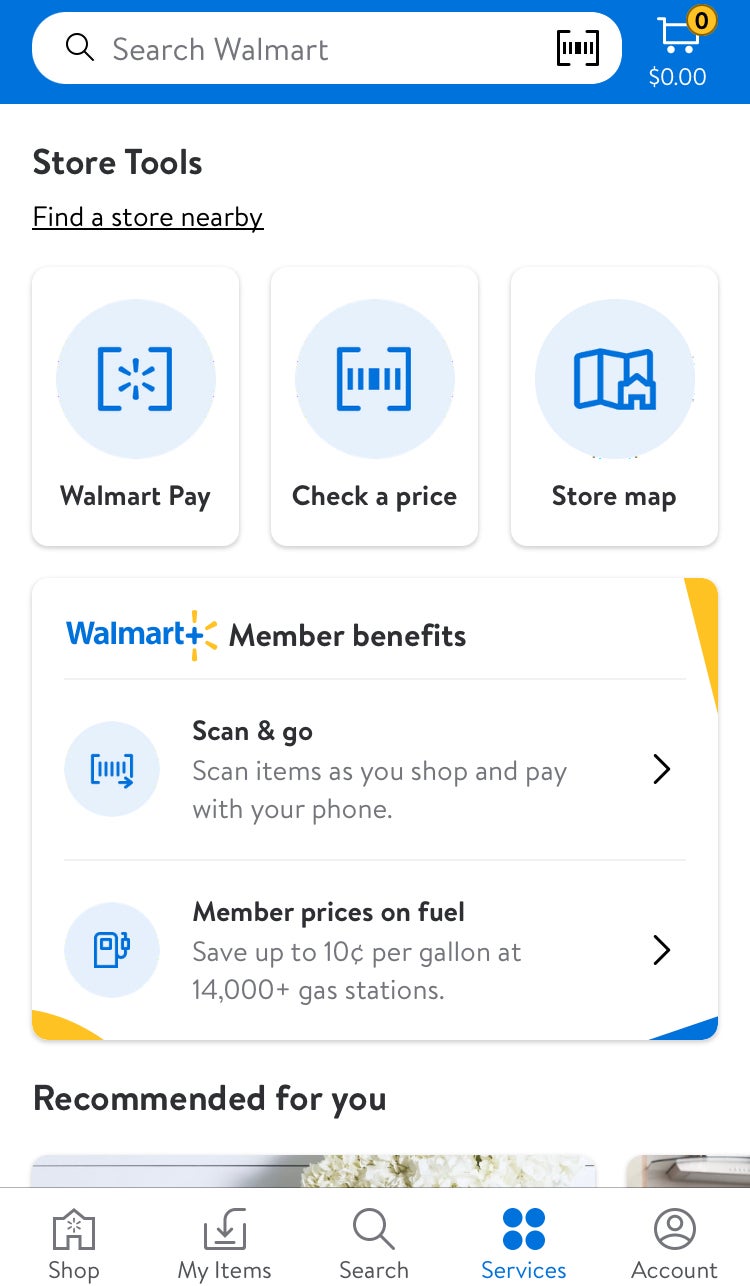

- Tap Services from the list of features.

- Tap Walmart Pay.

- If you do have a Walmart account, you can sign in using your email address and password. If not, tap Create an account to make one. You won’t need to leave the Walmart app.

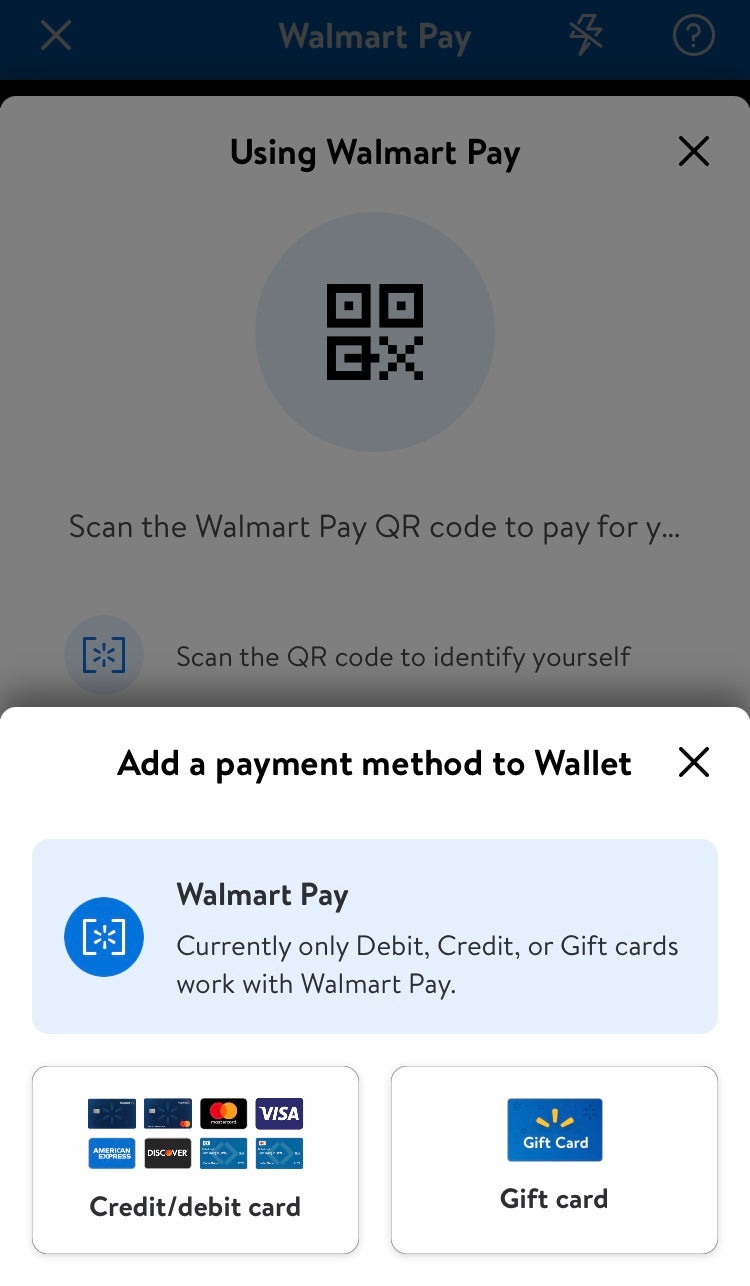

- Tap Add payment method.

- Tap Credit/debit card or Gift card based on which payment method you want to use.

- Enter your card information and billing address, then tap Save card.

- You’ll have the option to add additional cards to your wallet. When you’re done, tap Continue.

- You can now use your camera to scan the Walmart Pay QR code at checkout.

How do you use Walmart Pay at checkout?

As is the case with most mobile wallets, using Walmart Pay is pretty straightforward. Walmart Pay works at both staffed and self-checkout registers and you can use it at any point in a transaction – before, while or after you scan your items.

Here’s how to use Walmart Pay at checkout:

- Open the Walmart app and launch Walmart Pay.

- Enter your PIN or use fingerprint ID to log in.

- Aim your device’s camera at the QR code on the PIN reader or self-checkout screen.

- A sound or vibration on your device should indicate when the QR code is scanned successfully, and an eReceipt is saved to your account.

Is Walmart Pay safe?

Security-conscious cardholders will be pleased to learn that Walmart Pay does not store card details on customers’ devices and none are exchanged at checkout. Additionally, since you need a PIN or fingerprint ID to use Walmart Pay, in-store fraud is unlikely.

Unlike other mobile payment services, however, Walmart does store payment information on its computer servers. This could be a concern, especially in the wake of data breaches at stores like Target, Macy’s and more.

What other features does the Walmart app offer?

Along with Walmart Pay, the Walmart app offers a number of convenient tools for Walmart shoppers, including a robust list-making feature, easy prescription refills and more.

Here are a just few useful Walmart app features:

- Lists: The Walmart app’s list-making tool is surprisingly powerful. Not only can you create a basic shopping list but you can also type a simple phrase like “chips” into the app, and it will search Walmart.com and your local store then return a list of relevant products. Even better, since lists are connected to the Walmart store map, you can quickly get an item’s price and precise location. You can also invite other users to add or edit your list.

- Barcode Scanner: A great feature should you happen upon a misplaced item or be unable to find an item’s price, the Walmart app’s barcode scanner lets you look up any barcode, QR code or Walmart shelf tag and instantly get pricing information and other details.

- Start a Return: If you used Walmart Pay to purchase an item, you’ll have your receipt automatically saved in the Walmart app. This allows you to use the Start a Return feature to initiate the return process before you head to the store. When you arrive, you can take a fast-track through the Customer Service line via the Mobile Express Lane. All you’ll have to do is scan the QR code displayed on the card reader and hand the item you’re returning to the store associate.

- Pharmacy: You can use the Walmart app to refill your prescription, and you’ll get a notification when it’s ready. You can even start the payment process right from the app before you head to the store. When you arrive, you can skip the line at the standard pickup counter and use the Mobile Express Lane. Scan the QR code at the register and a pharmacy associate will bring you your order.

Does Walmart Pay still offer the Savings Catcher or price matching?

No. Regular Walmart shoppers may remember Walmart’s Savings Catcher, a popular price match tool integrated with Walmart Pay. After purchasing an item with Walmart Pay, you could submit receipts to the Savings Catcher and it would compare the price you paid to the advertised prices of other retailers in your area. If a competitor beat Walmart’s price, you’d automatically get the difference back as an eGift card.

Unfortunately, the Savings Catcher was discontinued in May of 2019 because, according to Walmart, it was no longer necessary since the store already offers the lowest prices in most cases.

Walmart currently only offers price-matching for in-store items that are cheaper on Walmart.com and at a selection of online retailers like Amazon.com and Target.com.

Can I use Walmart Pay at Sam’s club?

No. Though Sam’s Club is owned and operated by Walmart Inc., Walmart Pay can only be used at Walmart stores.

Can I use Walmart Pay for gas?

No. According to Walmart, Walmart Pay cannot be used for fuel at this time.

Does Walmart take Samsung Pay, Apple Pay or other mobile wallets?

No. Walmart Pay is the only form of mobile payment accepted at Walmart stores and Walmart currently has no plans to accept Apple Pay, Google Pay or any other mobile payment method. While some users have reported success using Samsung Pay for Walmart in-store checkout, it’s not an officially accepted payment method and seems to only work sporadically.

Things are not so black-and-white at Walmart.com, however, where you can use a variety of payment methods including PayPal and Affirm installment financing.

The inclusion of PayPal is especially good news if you’re a Discover it® Cash Back cardholder, since Discover’s cash back calendar usually includes PayPal as one of its rotating categories (5% cash back on rotating categories upon enrollment, on up to $1,500 in combined quarterly spending, then 1%).

Can I get cash back with Walmart Pay?

Yes. Walmart Pay is closely tied to Walmart’s new rewards cards, the Capital One Walmart Rewards Mastercard – a credit card you can use anywhere Mastercard is accepted – and the Walmart Rewards™ Card – a store credit card which you can use only at Walmart and Sam’s Club stores and Fuel Stations.

The Capital One Walmart Rewards Mastercard offers 5% cash back on Walmart.com purchases, including grocery pickup and delivery. After the first 12 months of card membership, you can still earn 2% cash back on in-store purchases. This 5% back rate also applies to the Walmart Rewards store card for purchases made in the first 12 months.

If you’re planning to use a different cash back credit card, however, you’ll need to check how your issuer classifies Walmart (whether as a grocery store, superstore or other) to ensure you’re getting the most out of your card’s rewards program.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.