Summary

An Affirm payment plan can be a great way to pay off a large purchase over time, but since financing terms vary by retailer, it might not always be the best payment option.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

If you are a frequent online shopper looking for a way to pay off large purchases over time, payment solution company Affirm has partnered with thousands of merchants to provide financing solutions. Built right into the checkout of online retailers, Affirm offers competitive payment plans with a wide range of repayment terms and interest rates. In many cases, you can pay off your purchase while accruing very little interest – and boost your credit score along the way.

What is Affirm?

Affirm is an installment payment service built right into the site of your favorite online retailers, offering shoppers the ability to split up big purchases over time. From a Wayfair furniture order to a new Casper mattress or glasses from Warby Parker, Affirm can be used to slowly pay off purchases made with top brands.

Most Affirm loans last three, six or 12 months. If your loan is relatively small, you might only get one month to pay it off; if your loan is unusually large, your repayment period could last long as 48 months.

Your Affirm interest rate could be as low as 0% or as high as 30%, depending on what each merchant offers. When you pay off a purchase with Affirm, you won’t have to worry about being charged fees for late payments, but late payments could still have a negative effect on your credit score.

How Affirm works

Affirm is built directly into the checkout of thousands of online retailers specializing in fashion, travel, home, electronics and more. Depending on the loan size and retailer, Affirm offers financing terms that range between one and 48 months, with interest rates starting at 0%. Unfortunately, APRs can reach as high as 30%.

To get started using Affirm while you shop, you should first create a free account on the Affirm website. In doing so, you’ll give some basic information that helps Affirm determine your creditworthiness in order to make checkout faster when you want to apply for a financing plan.

Tip: Affirm doesn’t have a set loan limit for customers. Each financing plan is approved on a case-by-case basis. However, Affirm does consider your payment history when approving you for a loan, as well as your credit utilization. If you have a history of late payments or are juggling more than you can pay off, you might not be approved for a new plan.

Keep in mind there’s no hard credit pull for using Affirm, but you might not be approved for as good of terms if you are building up your score. Additionally, some Affirm loans are reported to credit bureaus, so you’ll want to ensure you can pay on time to avoid dinging your score.

Once you create your account, you can find online merchants that offer payment plans through Affirm on the service’s website. When you shop with a retailer that offers Affirm financing, you should see the Affirm logo upon checkout – and often throughout product pages as well.

Tip: If an item has “Prequalify now” listed while you shop, you can get an idea of how much you’ll be allowed to finance through Affirm prior to actually purchasing the product.

If you find an item you’d like to purchase with an Affirm financing plan, you’ll simply select the option to pay with Affirm on checkout. When you select this payment method, you’ll get a pop-up from Affirm asking you to sign in to your account to see which terms you qualify for. You might also be prompted to provide additional information to help determine creditworthiness.

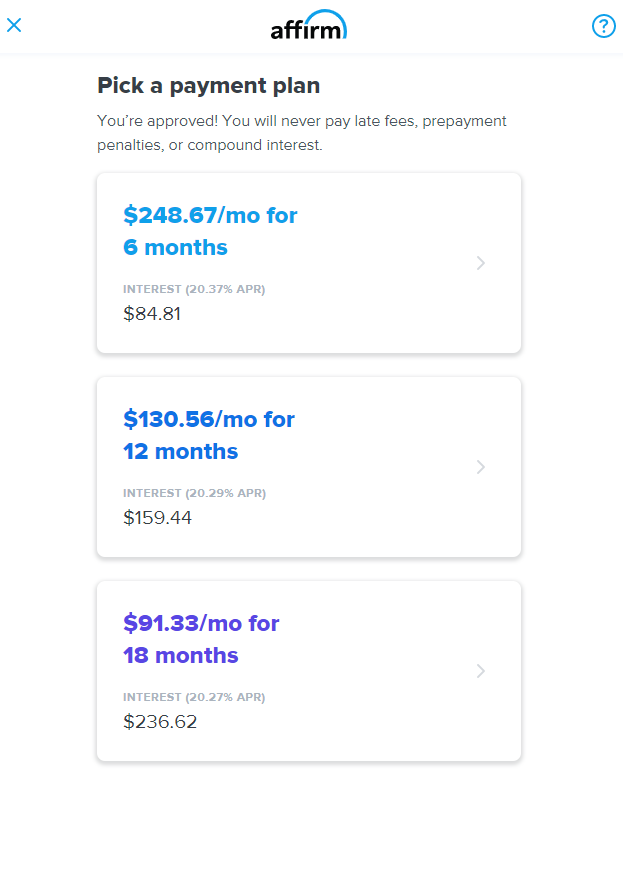

If you are approved for a financing plan, you’ll see a screen detailing the payment terms offered by this particular merchant.

Then, just select the one that works best for you and complete check out as normal. You can even set up Autopay with the card you link so you don’t have to worry about keeping track of due dates.

Tip: For Affirm payments, you’ll be prompted to either link a checking account or enter your debit card information. You may also be able to make some Affirm payments with a credit card, although not all credit card issuers allow you to use their credit cards for Affirm payments.

Each merchant offers different payment plans, so repayment periods and interest rates can differ drastically from site to site. Be sure to carefully read the terms of your payment plan before purchasing an item.

No matter what interest rate and repayment period your Affirm financing plan comes with, you can rest assured that the service never charges any late fees. You can also pay off your loan early for no fee to save on interest that hasn’t been charged yet.

Pros and cons of paying with Affirm

Choosing an Affirm payment plan can be a great way to pay off a large purchase over time, but since financing terms vary by retailer, it might not always be the best payment option. Here’s are some of the pros and cons of using the service:

Pros

- Pay off more expensive purchases over time, often with a lower interest rate than a credit card. Some sites even offer interest-free financing.

- No late fees.

- Some Affirm loans appear on your credit report and can boost your score.

Cons

- While Affirm can offer some very competitive interest rates, in many cases the rate you get might not be better than a credit card.

- Not all retailers accept the payment method.

- If you return an item, you’ll only be refunded the purchase price – not any interest you’ve paid.

- Not all Affirm loans appear on your credit report, so they might not help your score.

- You can’t pay with a credit card.

Tips for maximizing Affirm payments

If you decide that an Affirm payment plan makes the most sense for your purchase, keep the following tips in mind to make the most of the offer:

Always pay on time

While Affirm does not charge a late payment fee, you should be careful to make your scheduled payments on time. Since some Affirm loans are reported to credit bureaus, late payments can damage your credit score. You are also less likely to be approved for a new financing plan if you have a history of late payments.

Don’t take on too many plans at once

Affirm allows you to take out payment plans with multiple merchants, but be careful not to take out more than you can pay off. It can be tempting to finance all your major purchases with Affirm, but you should avoid overextending your budget.

Keep a close eye on your credit report

Not all Affirm loans are reported to credit bureaus, but some are. Additionally, there is no hard and fast rule to know if your Affirm loan will be reported. You’ll want to keep careful track of your credit score and report to monitor how your payment plans affect them.

Other installment plan services

If you are looking for a payment plan solution, there are plenty of services to choose from beyond Affirm. If you have an American Express credit card, for example, you can take advantage of “Pay it Plan it®” – the issuer’s own solution for paying off large purchases over time. Beyond this offering, plenty of third-party services have popped up over the last few years, each with its own unique benefits.

Afterpay

- Pay in four equal installments, spread over six weeks

- Zero interest and no fees when you pay on time

- 25% of the balance is due at the time of purchase

QuadPay

- Pay in four equal installments, spread over six weeks

- Zero interest and no fees when you pay on time

- 25% of the balance is due at the time of purchase

Klarna

- Pay in four equal installments (spread over six weeks), 30 days after purchase or select from three to six-month financing plans

- No interest or fees for installment or 30-day plans; competitive interest rates for financing plans

- App allows users to pay in installments with any online retailer

Details on the new Affirm Card

In February 2021, Affirm announced plans to launch the Affirm Card, the first U.S. debit card that gives cardholders the opportunity to pay for eligible purchases in installments. When you use your Affirm Card to make an in-person or online purchase over $100, you can either pay off the entire purchase at once or split your payment into four interest-free installments.

Like the Affirm app, the Affirm Card has no late fees, no prepayment fees and no annual fees, making it an affordable option for people who are interested in taking advantage of Affirm’s installment payment services.

The Affirm Card is scheduled to release by the end of the year, so if you’re interested in signing up, you might want to get on the Affirm Card waitlist.

Is the Affirm Card a credit card?

The Affirm Card is debit only and must be connected to a qualifying bank account. As of this writing, there is no Affirm credit card.

Is the Affirm Card a virtual card?

The Affirm Card is a debit card that can be used in-person and online. As of this writing, it is unclear whether Affirm will also offer virtual debit cards to increase the security of your online purchases. We’ll have to wait and see whether an Affirm virtual card becomes part of the Affirm Card package.

The Affirm Card vs. Upgrade Card

The Upgrade Visa® Card with Cash Rewards is a credit card that allows cardholders to pay off their balance in installments while earning 1.5% cash back rewards on purchases every time they make a payment. Essentially, the Upgrade Card combines the flexibility and rewards of a rewards credit card with the steady monthly payments of a personal loan. Want to know more? Read our in-depth guide to the Upgrade Card.

How does the Affirm Card compare to the Upgrade Card? The Affirm Card is a debit card, which means that you are never making purchases on credit. Anything you buy with your Affirm Card comes out of a linked bank account, whether you pay off your entire purchase at once or divide it into installments. This can help keep you from going into debt, which is a plus, but you won’t be able to earn cash back rewards on Affirm Card purchases – which could be viewed as a minus.

Is the Affirm Card right for me?

If you like the idea of paying off large purchases in installments, the Affirm Card could be right for you. Since the Affirm Card is a debit card, you won’t have to worry about running up debt you can’t pay off – but you’ll still need to make sure that you have enough money in your linked bank account to make your Affirm installment payments, which might take a little planning ahead.

The Affirm Card is good for people who want to cover a major expense with multiple paychecks. It’ll cost you a little extra to pay in installments, but it might be worth it to be able to buy what you need now and pay it off over time.

Final thoughts

Affirm offers plenty of great payment solutions for frequent online shoppers, but you should keep a watchful eye on your plan’s terms to make sure you are getting a good deal. While many Affirm payment plans can save you in interest charges, that might not always be the case – so make sure that paying through Affirm is less expensive than paying with a credit card before you make your purchase.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.