Summary

Pay It Plan It® is a flexible payment option offered by American Express in some personal credit cards. Is it worth it? Here’s everything you need to know, including fees and tips.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

Carrying a credit card balance can be convenient but interest charges make purchases more expensive the longer you take to pay. Interest also takes away from the value of any rewards you might have earned.

American Express is making paying over time – and potentially saving on interest – easier with Pay It Plan It®, a flexible financing option. The issuer has also recently made “Plan It” available for airfare purchases through the American Express Travel portal.

“Flexible financing can be a great way to avoid interest payments on big-ticket items,” says Steven Millstein, certified credit counselor and editor of credit education site CreditRepairExpert. “If you can pay off your balance early, you can avoid future monthly fees, too.”

Pay It Plan It may not be right for everyone, however. This guide explains the program guidelines and how it compares to other flexible financing options.

See related: 8 steps to reducing credit card debt

Amex Pay It Plan It guide

Pay It Plan It basics

Pay It Plan It covers two different payment options:

- Pay It allows you to cover small purchase amounts (less than $100) right away using the American Express app.

- Plan It lets you split up larger purchases (over $100) into monthly payments with a fixed fee.

Both features are available on eligible personal credit cards issued by American Express, including:

- The Platinum Card® from American Express

- American Express® Gold Card

- American Express® Green Card*

- Blue Cash Everyday® Card from American Express

- Blue Cash Preferred® Card from American Express

- American Express Cash Magnet® Card

- Blue from American Express card*

While Pay It Plan It does not require any form of enrollment on the Amex Gold, Amex Green and Amex Platinum cards, eligibility for the program is based on your account and credit history. If you’ve paid your bill late in the past, for example, Amex may not extend this benefit.

|  |  |

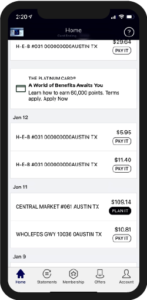

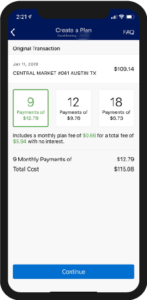

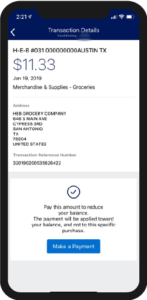

Eligible transactions will show a Pay It or Plan It button on the Amex mobile app (left). When creating a Plan It plan, you will see three different payment options (center), along with total fees and cost. When choosing Pay It, you will be given the option to make a payment (right).

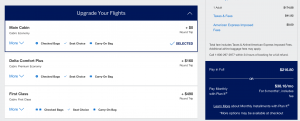

When you’re using Plan It to book travel with Amex, the feature will be available during the checkout.

How Pay It works

Log in to the American Express app and view the purchases that are eligible. Click the ones you want to pay, then schedule a payment from a linked bank account.

Sounds simple, but the Amex rep clarified a few rules:

- You must use the app to use Pay It – this feature won’t work from your desktop.

- A purchase must have the Pay It icon next to it in order to use the feature.

- You can make up to five payments per day, but that’s an aggregate of all payments made through the app, online or by phone.

Also, take note: You’re not necessarily paying off a specific purchase, per se; you’re just paying a specific amount toward your balance.

How Plan It works

This feature allows you to set up a custom payment plan if you need to pay a purchase over time. Payment plans can last from three to 24 months.

It works like this:

- You choose up to 10 eligible purchases that you want to pay over time, either through the American Express app or your online account.

- Amex then gives you one to three payment plan options to choose from.

- Each payment option shows the number of payments included in the plan, the amount you’ll have to pay each month, the monthly plan fees and the total plan fee.

- You pick the one you want and pay off the purchase according to the repayment schedule.

Millstein says the feature’s main value lies in its transparency and simplicity.

“It’s designed to appeal to people who want to know exactly what they’re getting into, regarding the monthly fees,” he says, which is helpful for credit card users who may not fully understand how interest compounds.

Plan It: Payoff options, fees, minimum payments

According to the Amex rep, you can have up to 10 Plan It plans at a time. Additionally, you can combine up to 10 eligible purchases into a single plan. Again, it sounds easy enough but there are a few wrinkles to be aware of.

- Payment plan terms aren’t uniform for every card member. According to the Amex rep, plans are offered on a case-by-case basis based on your credit history, account history and the amount of the purchase.

- Your Plan It fee is fixed and is based on the purchase amount and the length of the payment plan.

- You can’t pay off your plan early. The only way to pay a Plan It balance off ahead of schedule is to pay your entire card balance in full.

The Amex representative also explained how Plan It payments work if you have a balance that’s not on the payment plan.

- You have a minimum monthly payment that’s 1% of your total balance plus interest, in addition to the monthly Plan It payment.

- That means you could end up with a higher combined minimum amount due each month between the two payments.

- That’s important to know so you don’t end up with a monthly card payment you can’t afford.

If you’re looking to use Plan It to purchase airfare, you’ll find the feature during the checkout process.

- You can be offered up to three plan duration options, depending on the total amount of the purchase, your account history, creditworthiness and other factors.

- Your plan will typically be set up within 48 hours of the purchase but may take up to five days.

- You can’t use “Pay with Points” and Plan It together on AmexTravel.com. However, you can pay with points and cash at the checkout and then create a plan for the charge in your Amex app.

Alternative flexible financing options

Pay It and Plan It aren’t the only ways to pay over time. Along with the Pay Over Time program from American Express, which lets you pay both small and large purchases off over time, there is a number of other options.

App-based payment options: Plan terms

- Pay over three, six or 12 months (up to 39 months at select stores).

- APR range: 0% to 30%, based on credit check.

- Down payment may be required for some users.

- Pay in four equal installments, spread over six weeks.

- You’ll pay 0% interest and no fees when you pay on time.

- 25% of the balance is due at the time of purchase.

- Pay in four equal installments (spread over six weeks), 30 days after purchase or select from three- to six-month financing plans.

- You won’t pay interest or fees for installment or 30-day plans. Competitive interest rates for financing plans.

- The app allows users to pay in installments with any online retailer.

- Pay in four equal installments, spread over six weeks.

- You’ll pay 0% interest and no fees when you pay on time.

- 25% of the balance is due at the time of purchase.

Millstein says that might appeal to millennials who may not have a credit card yet and want a way to pay over time without paying high interest rates or fees. QuadPay and Afterpay work with your credit or debit card at checkout.

Of the choices here, Affirm has the longest repayment period, at 12 months, compared with up to 24 months with Plan It. Afterpay and QuadPay require you to pay off a purchase in a matter of weeks.

You’ll also pay up to a 30% APR with Affirm, versus no interest charges for Plan It.

Retailer-specific payment plans

In-store promotional financing is another flexible way to pay. These types of programs offer 0% APR financing for a set time.

Josh Hastings, founder of finance blog Money Life Wax, has used deferred interest financing from Best Buy and Apple for large purchases in the past.

However, he says, “whether flexible financing works for you depends on your ability to make payments on time and adhere to the repayment plan.”

Deferred-interest offers are usually advertised as charging “no interest until” a certain date. After that date, however, interest that has been accruing since the purchase date is charged to the account.

Being able to spread out payments is a plus if you don’t want to part with a large chunk of cash all at once. However, “if you’re someone who’s already tight on income each month, adding an additional payment for something that might not be 100% necessary isn’t the best idea,” Hasting says.

“If you’re someone who’s already tight on income each month, adding an additional payment for something that might not be 100% necessary isn’t the best idea.”

0% balance transfers

Pay It Plan It has its benefits, but don’t count out 0% APR credit cards or balance transfer credit cards for large purchases.

James Boston, co-founder of Paperlust, a custom wedding invitation and stationery company, used that option when buying equipment for his business.

He used one business card for the purchase to earn rewards and later transferred it to a different card with a 0% balance transfer offer.

He then created his own installment payment plan for the card to get the balance paid off before the interest charges kicked in.

“We simply calculated the payback over 20 months and set up an automatic debit monthly to pay the balance down,” says Boston.

See related: What is a balance transfer and how does it work?

Pay attention to the annual fee and balance transfer fee – usually between 3% and 5% of the amount transferred. Break those costs down monthly and compare it to what you’d pay for the Plan It monthly fee.

American Express offers a pre-purchase calculator that you can use to run the numbers and estimate what your payments and fee would be with “Plan It.”

Should you use Pay It Plan It?

Pay It Plan It may be a convenient option, but run the numbers first: Will Plan It save you the most money? Consider the alternatives before using the feature.

With any financing option, make sure it fits your budget first.

“Flexible financing is not an excuse to rack up debt with the premise of paying it off when you can afford to,” says Millstein.

*All information about the American Express Green Card and the Blue from American Express Card has been collected independently by CreditCards.com and has not been reviewed by the issuer.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.