Summary

The Chase Sapphire Reserve card comes with numerous perks that can help justify the annual fee, and authorized users can take advantage of several major benefits.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

The Chase Sapphire Reserve card is one of the best premium travel cards on the market. It’s a great option for travelers looking to take advantage of a wide variety of benefits, including a $300 travel credit and generous sign-up bonus. This card also features noteworthy authorized user benefits.

Becoming an authorized user on another person’s credit card account has many benefits, for both the additional user and the original cardholder. By becoming an authorized user, you’ll be able to boost your credit score while utilizing a card you potentially couldn’t qualify for on your own. You’ll also be able to take advantage of the card’s rewards offers, which will pool in the main cardholder’s rewards account.

On the other end of the spectrum, adding an authorized user to your own account can help you earn more rewards over time because, as stated above, rewards that authorized users earn will be collected in one account. You can also keep all your spending in one account for the sake of simplicity, which can make sense if you want to pay just one credit card bill for yourself and your partner or a young adult.

Some rewards credit cards even extend important cardholder benefits to authorized users – and for a much lower annual fee than the primary account requires. The Chase Sapphire Reserve is one such card. You’ll only pay $75 per year for an authorized user to be added to your account, but the secondary user can glean much more than that in value.

Chase Sapphire Reserve: At a glance

Why should you get this card? The price of admission for this luxury card is steep, but its large sign-up bonus and generous travel allowance more than make up for the annual fee. | Other things to know:

|

Which benefits are extended to additional cardholders?

The Chase Sapphire Reserve offers too many elite perks and benefits to count, which is why the primary cardholder pays an annual fee of $550. But some of the perks apply to the $75 Chase Sapphire Reserve authorized user account, and we’ve outlined each of them below.

| Benefit | Do authorized users qualify? |

| Earning rewards points | Yes; All points are pooled in the primary cardholder’s account. |

| Introductory bonus | No; only the primary cardholder earns the introductory bonus. |

| Priority Pass Select airport lounge membership | Yes; both the primary cardholder and the authorized user can enroll in Priority Pass and have their own membership. |

| Global Entry or TSA PreCheck credit | Yes; this credit can apply to any Global Entry or TSA PreCheck membership charged to the primary cardholder’s account or the authorized user account, but there is only one credit. |

| $300 annual travel credit | Yes; charges made on an authorized user’s card are eligible, but there is no extra credit. |

| Lyft Pink membership | Yes; authorized users can enroll for their own membership. |

| Travel insurance benefits like trip cancellation and interruption insurance | Yes; important travel insurance benefits apply to trips charges to authorized user accounts. |

One of the most valuable Chase Sapphire Reserve authorized user benefits is the Priority Pass Select airport lounge membership, which is worth approximately $429 if you purchase a similar membership on its own. This membership enables users to access more than 1,300 airport lounges worldwide, and while the primary cardholder is allowed to bring two guests into the lounge with them, an authorized user may want their own membership if they travel alone.

How much does it cost to add an authorized user to the Chase Sapphire Reserve?

Adding an authorized user to your Chase Sapphire Reserve account will set you back $75 per year. You can add multiple authorized users to your account, although a separate charge will apply for each card. To add four authorized users to your account, for example, you would need to pay an additional $300 per year on top of the annual fee for the primary account.

How to add an authorized user on the Chase Sapphire Reserve

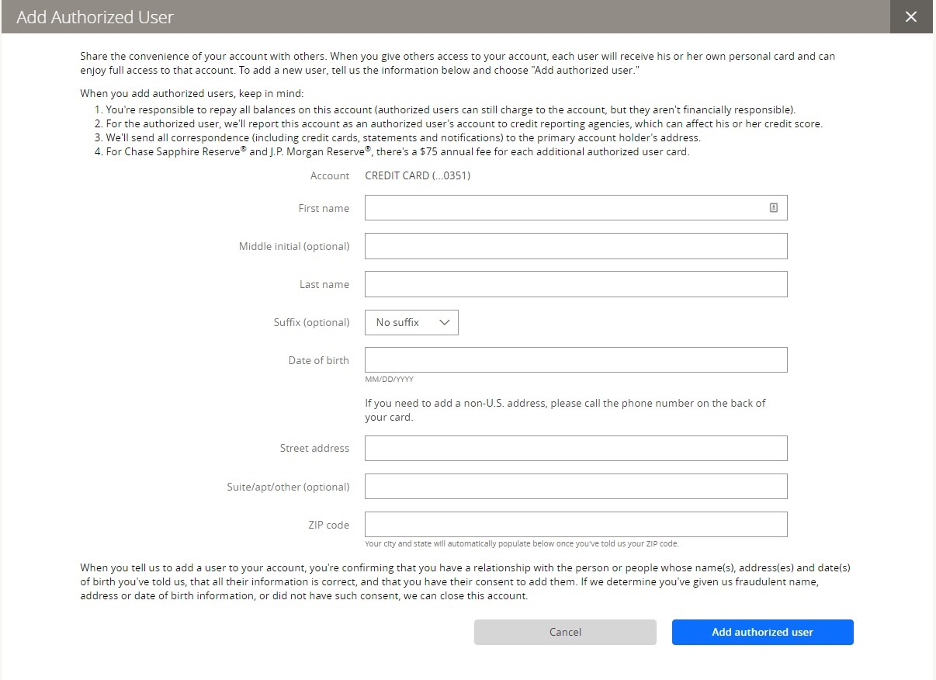

All you have to do to add an authorized user to your Chase card is log in to your online account management page with Chase. From there, you can click on “things you can do” and select “add an authorized user.”

At this point, you’ll be presented with a form to fill out with information on your authorized user. In addition to their name, you’ll need to include their birth date and address.

Should you add an authorized user to your Chase Sapphire Reserve card?

If you want a spouse, partner or someone else to have access to some major benefits like airport lounge access and travel insurance protection, adding them to your Chase Sapphire Reserve account as an authorized user can make a ton of sense. You’ll only pay $75 per year for each authorized user, yet they’ll receive benefits that can be worth considerably more than that if used often enough.

Having an authorized user attached to your account can also help you earn points faster. And if your authorized user travels with you or might otherwise benefit from the rewards on your account, you may as well have them doing their part to boost your rewards balance with their purchases.

Just remember that when you add an authorized user to your account, you are solely responsible for repaying any balances they charge to their card.

Other Chase cards with authorized user benefits

As you compare Chase credit cards to find the right fit, don’t forget that some other Chase cards offer a few benefits for authorized users. Here are some of the main cards and authorized user benefits to be aware of.

| Chase credit card | Rewards rate | Authorized user benefits |

| Chase Sapphire Preferred Card | 5X points on travel purchased through Chase Ultimate Rewards; 3X points on restaurant, select streaming service and online grocery purchases (excluding Target, Walmart and wholesale clubs); 2X points on general travel; 1X points on everything else |

|

| Chase Freedom Unlimited | 5% cash back on travel through Chase Ultimate Rewards; 5% back on Lyft purchases (through March 2025); 3% back on dining and drugstore purchases; 1% back on everything else |

|

Bottom line

The Chase Sapphire Reserve is one of the best rewards cards due to its generous rewards structure, credits and other perks.

What’s also notable about this card is that these benefits extend to authorized users for a much lower annual fee than the primary cardholder pays. Authorized users are able to earn rewards, which will then pool in the main cardholder’s account.

Overall, the Sapphire Reserve can prove to be a valuable rewards card for both travelers and their authorized users.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.