| Cash Back Rating: | 3.7 / 5 |

| Rewards Value: | 2.3 |

| Annual Percentage Rate: | 1.0 |

| Rewards Flexibility: | 5.0 |

| Features: | 3.0 |

| Issuer Customer Experience | 4.0 |

In a Nutshell:

With a decent sign-up bonus, unlimited 1.5 percent cash back on every purchase and few restrictions on redemption, the Quicksilver Cash Rewards card offers a fair amount of value; but it doesn’t offer nearly as much cash back as other cards.

Rewards Rate

|  |

Sign-up Bonus |  |

Annual Bonus |  |

Annual Fee |  |

Average Yearly Rewards Value ($1,325 monthly spend) |  |

APR |  |

Rewards Redemption

Cons

|  |

Capital One Customer Service Ratings

|  |

Other Notable Features: Free credit score monitoring with CreditWise, no foreign transaction fee, purchase security, roadside assistance, baggage insurance, travel upgrades and savings, VIP access to events See Rates and Fees

| Low Interest Rating: | 3.0 / 5 |

| Rates, Fees, Penalties: | 3.2 |

| Rewards: | 2.8 |

| Features: | 5.0 |

| Issuer Customer Experience | 4.0 |

In a Nutshell:

The Capital One Quicksilver Cash Rewards credit card is a good option for saving on interest, due to a long introductory APR on new purchases and balance transfers.

Regular APR |  |

Introductory Purchase APR |  |

Introductory Balance Transfer APR Balance transfer fee: 3% for the first 15 months; 4% at a promotional APR that Capital One may offer you at any other time (See Rates and Fees) |  |

Fees

|  |

Penalties

|  |

Capital One Customer Service Ratings

|  |

Other Notable Features: Free credit score monitoring with CreditWise, no foreign transaction fee, purchase security, roadside assistance, baggage insurance, travel upgrades and savings, VIP access to events (See Rates and Fees)

Capital One Quicksilver review: More details

Before you apply for the Capital One Quicksilver Cash Rewards Credit Card, you should ask yourself: What kind of cardholder am I? Are you someone with good to excellent credit, who pays bills on time, but has little time or patience for credit card upkeep or for juggling more than one card at once? Or, are you willing to pour time into your cards to earn extra cash back?

For cardholders who want to keep things simple, the Quicksilver card is a good choice. But cardholders ready to go the extra mile with their credit cards may be majorly missing out with this all-too-simple cash back card. Read on to see why.

See related: Capital One Quicksilver video review

A just-decent everyday cash back card

The Quicksilver card’s earning scheme is designed for users who prefer simplicity rather than for maximizing value. You earn unlimited 1.5 percent cash back on every purchase, as well as 5% cash back on hotels, vacation rentals and rental cars booked through Capital One Travel. This is a great option for a cardholder who wants a low-maintenance rewards card it, but it gives you few options for strategizing and boosting your cash back earnings.

While the card’s boosted rate on hotels and rental cards through Capital One Travel sets it apart from the slew of cards that reward 1.5 percent back on every purchase, these purchases don’t make up a huge portion of the average person’s spending. Most people will likely earn more with a flat-rate card that earns higher rate of cash back, including the Citi Double Cash® Card, which offers up to 2 percent cash back – 1 percent when you make a purchase and 1 percent when you pay for your purchase.

Average sign-up bonus

The Quicksilver card Earns a one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening. This is a solid offer for a no annual fee card See Rates and Fees, a slightly lower offer than what is currently available on the Capital One Savor Cash Rewards Credit Card and matching the offer currently available on the Chase Freedom Flex® among others.

See related: Earn $200 bonus cash back with Capital One Quicksilver Cash Rewards credit card

Easy cash back redemption

If you are looking for ultimate ease, redemption is where the Quicksilver card has the edge. Your cash back never expires, you can redeem any amount of cash back at any time and Capital One gives you multiple redemption options, including statement credits, checks, gift cards and more.

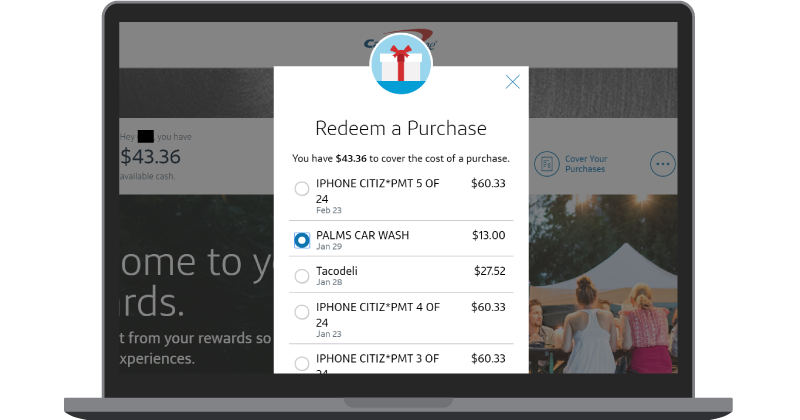

You can also log into your account and apply your cash back as credits to your statement to cover purchases as far back as 90 days. Thanks to Capital One’s user-friendly interface, it’s a seamless process: You simply log into your account, visit the Rewards center, click the icon to “Cover Your Purchases” at the top of the page and choose from the list of purchases to apply your statement credit:

You can also issue your cash back as a check – a nice option to have in case you want to close your card and cash out your rewards.

Note, Capital One also advertises an automatic redemption option for cash back on its site. However, Capital One recently removed the feature that allows you to set your rewards to redeem automatically in your online account. You’ll have to call a representative to set up an automatic redemption, as well as to make updates to your redemption amounts – not very convenient!

| Tip:The Quicksilver card is a true cash back card and does not earn Capital One miles. If you’re hoping to earn flexible, transferable miles, you should check out Capital One’s list of miles cards. |

See related: How four different issuers grant cash back

Financing purchases with the Quicksilver card

For cardholders who need to transfer a pay off purchases over time, the Quicksilver card could be an attractive option. The card offers a 0% introductory APR on new purchases and balance transfers for the first 15 months of card membership (then 18.49% - 28.49% (Variable)). There’s also a balance transfer fee of 3% for the first 15 months or 4% at a promotional APR that Capital One may offer you at any other time See Rates and Fees. This gives you the ability to finance large purchases or strategically carry a balance without sacrificing rewards.

Beware of late fees and high interest

You’ll want to be sure to pay off your statement in time each month with the Quicksilver card. While the card, fortunately, does not include a penalty APR, it does come a higher-than-average regular APR and there is a penalty for late payments. If you send in a payment past your due date, you will owe interest on your balance plus a late fee.

Other Quicksilver benefits

One of the biggest perks of the Quicksilver card is its lack of a foreign transaction fee – a benefit usually reserved for cards with annual fees. You can use your Quicksilver card outside the U.S. (and for purchases on foreign websites) without having to pay a 2% to 3% fee for the privilege. On top of that, the card provides a pretty standard set of travel and purchase protections for a card in its class, including:

- 24-hour travel assistance – If your card is lost or stolen on a trip, you can get an emergency replacement, plus a cash advance.

- Extended warranty – You get an extra year of warranty on eligible items purchased with your card, for warranties of three years of less.

- Premier access – Card membership entitles you to VIP access to a limited selection of dining, sporting and music events.

- CreditWise – Capital One’s CreditWise service monitors your credit for free, including credit report and SSN alerts.

The CreditWise service is a fairly unique feature. While most issuers offer free credit scores, Capital One’s free email alerts could come in handy for cardholders keeping close tabs on their credit scores.

Approval odds

Capital One recommends the Quicksilver card for customers with good to excellent credit (a score of 670 or higher). The lower you fall along this spectrum, the lower your chances of approval. You must also be a U.S. resident with adequate income (at least $425 more than your rent or monthly mortgage payment) with no overdue amounts with Capital One. Capital one may decline you if you have applied for a Capital One card at least twice in the past 30 days, or if you have five or more cards open with Capital One.

If your credit score doesn’t meet the threshold for the Quicksilver card, Capital One offers two excellent cards that can help you build credit with responsible card use: the Capital One QuicksilverOne Cash Rewards Credit Card and the Capital One Platinum Credit Card.

How does the Quicksilver compare to other cards?

If you’re searching for the simplest option for cash back rewards, the Quicksilver card may be the best way to go. However, there are plenty of more rewarding cards than the Quicksilver card, including several cash back cards:

|  |  |

Rewards rate

| Rewards rate

| Rewards rate

|

| Sign-up bonus | Sign-up bonus | Welcome bonus |

Annual fee

| Annual fee

| Annual fee

|

Other things to know

| Other things to know

| Other things to know

|

Chase Freedom Unlimited

The Chase Freedom Unlimited card is another simple cash back card. It offers similar flexibility as the Quicksilver card – you can redeem any amount of cash back at any time for a variety of rewards, including merchandise and statement credits.

However, the card has an additional feature that gives it an edge: You can transfer your rewards as points to certain premium Chase cards. The Chase Sapphire Preferred® Card gives you a higher bonus on points when you redeem them for travel through the Chase portal, and the Chase Sapphire Reserve® card gives you a higher travel redemption bonus when redeemed through the Chase portal. These bonuses can potentially boost the value of your rewards.

Citi Double Cash Card

Discover it® Cash Back

For cardholders who don’t mind a bit of card maintenance, the Discover it® Cash Back lets you earn a little more on your spending thank to its 5 percent rotating bonus categories. You have to activate the categories each quarter to earn the bonus, which is capped at $1,500 in purchases per quarter (you earn 1 percent on all purchases thereafter).

Despite the spending cap, you can earn more rewards with the Discover it® Cash Back card just by putting all your purchases on one card. Also, Discover matches your cash back at the end of your first year of card membership, basically doubling all your earnings for that year.

If you want to boost your cash back earnings even more, you can pair the Discover it® Cash Back card with a flat-rate card that earns a higher rate on general purchases (including the Quicksilver card) and dedicate your Discover card to rotating bonus category purchases.

See related: Capital One Quicksilver vs. Discover it® Cash Back

Capital One Quicksilver vs. QuicksilverOne

Since both the Quicksilver and QuicksilverOne cards are issued by Capital One and carry a base cash back rate of 1.5% on general purchases, it’s easy to get them confused. Other than their cash back rate, however, the cards are designed for very different consumers.

While the Quicksilver is geared toward applicants with good or better credit, you can qualify for the QuicksilverOne with a limited credit history or an average credit score. The cards also carry much different costs of ownership: The Quicksilver charges no annual fee See Rates and Fees, while the QuicksilverOne charges a $39 annual fee (See Rates and Fees). The QuicksilverOne also carries no sign-up bonus, charges a higher APR and offers an initial credit limit of just $300, which means you may have a harder time keeping your credit utilization ratio low.

| Card | Sign-up bonus | Rewards earned (based on average consumer spending) | Annual fee | Total earned in first year, minus annual fee |

|---|---|---|---|---|

| Capital One Quicksilver card | $200 after spending $500 in the first 3 months | $15,900 * 1.5% back = $239 | $0 (See Rates and Fees) | $439 |

| CapitalOne QuicksilverOne | None | $15,900 * 1.5% back = $239 | $39 (See Rates and Fees) | $200 |

If you have a good credit score, the Quicksilver is the clear winner thanks to its sign-up bonus and $0 annual fee, but the QuicksilverOne could still be a great starting point if you have a thin credit file or middling credit score. You may be eligible to increase your credit limit on the QuicksilverOne after six months of timely payments and if your credit score improves and you use your card responsibly, you may be able to switch to a different Capital One card, like the Quicksilver.

See related: Quicksilver vs. QuicksilverOne

Why get the Capital One Quicksilver card?

- You prefer earning cash back over earning credit card points.

- You want one of the simplest cash back rewards programs available.

- You want to earn a high rate of cash back on all your purchases without having to rotate cards.

- You want a card that earns more than 1% back on general purchases to pair with a bonus category card.

- You’re searching for a no-annual-fee card without a foreign transaction fee.

How to use the Capital One Quicksilver card

- Use it as your go-to card to pay for all your purchases or rotate it with a card with bonus categories, using the Quicksilver card to pay for purchases that don’t fall in a bonus category.

- Set your account to autopay for the most hands-off approach. (However, keep a close eye on your account to make sure you don’t accrue any interest or late fees.)

- Make sure you spend $500 in the first three months to earn the sign-up bonus.

- Use the card to finance a large purchase for 15 months of 0% intro APR (then 18.49% - 28.49% (Variable)) See Rates and Fees.

- Pay off your balance in full each month to avoid the card’s high interest rate.

- Use the card while traveling abroad or for purchases from foreign sites – you won’t be charged a foreign transaction fee See Rates and Fees.

- Use CreditWise to monitor and improve your credit score.

- Pair the Quicksilver card with the Capital One Savor Cash Rewards Credit Card to earn extra cash back on dining and entertainment purchases.

Is the Quicksilver card worth it?

For a cardholder who prefers the utmost simplicity and wants to earn a steady rate of cash back without much thought, the Quicksilver card is one of the best options. However, if you want to maximize your rewards earnings, there are many other cards out there with much higher earning rates. Before you apply for the Quicksilver card, you should take a look out the full array of cash back cards to make sure you aren’t missing out on a better value.

*All information about the Chase Freedom Flex has been collected independently by CreditCards.com and has not been reviewed by the issuer.

For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Our reviews and best card recommendations are based on an objective rating process and are not driven by advertising dollars. However, we do receive compensation when you click on links to products from our partners. Learn more about our advertising policy

All reviews are prepared by CreditCards.com staff. Opinions expressed therein are solely those of the reviewer and have not been reviewed or approved by any advertiser. The information, including card rates and fees, presented in the review is accurate as of the date of the review. Check the data at the top of this page and the bank’s website for the most current information.

Responses to comments in the discussion section below are not provided, reviewed, approved, endorsed or commissioned by our financial partners. It is not our partner’s responsibility to ensure all posts or questions are answered.

Partner Offer: carefully review product terms on Capital One's site before applying