Summary

Honey lets you search for coupon codes, track prices and earn rewards in just a few clicks. Here’s how to make the most of the app and decide if using it is worth your while.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

Capital One Shopping compensates us when you get the Capital One Shopping extension using the links we provided.

The Bank of America content was last updated on May 3, 2021.

PayPal’s Honey app is a popular deal-finding tool designed to help shoppers track prices, save money and earn rewards on online purchases. At a glance, signing up seems like a no brainer: It costs nothing to use, can be installed in just a few clicks and, according to Honey, has saved its users over $1 billion to date.

But Honey is not without its critics. Indeed, Amazon recently warned its shoppers that Honey could be a security risk and recommended uninstalling the app.

Here we break down how Honey works, what you should know about the site’s privacy and security and how to pair Honey with a rewards credit card to maximize your savings when shopping online.

See related: Best cash back apps

A short guide to Honey

What is the Honey app?

Honey is a free browser extension that searches the web for coupon codes and tests them at checkout, automatically applying the code that saves you the most money. You can also earn rewards on certain purchases through the app’s Honey Gold rewards program or use Honey’s Droplist tool to keep track of price changes for individual items on sites like Amazon.com.

Founded in 2012 and acquired by PayPal in 2019 for a whopping $4 billion, Honey boasts over 17 million users and works with thousands of online retailers, ranging from fashion and technology to travel and food delivery.

How does Honey work?

Similar to apps like Capital One Shopping, Honey automates the deal-finding process by looking at the items in your cart and searching the web for relevant coupon codes. Honey then automatically tests any codes it finds until it lands on one that works. If multiple codes work, Honey applies the one that gives you the biggest discount. This streamlines your coupon hunt by saving you the trouble of manually searching coupon sites like RetailMeNot and trying out codes individually.

Which websites does Honey work on?

According to the vendor, you can use the Honey plugin with over 40,000 online retailers in the U.S., Canada, Australia, United Kingdom and more. Once you’ve installed Honey, you’ll see an an “h” logo and the number of available coupons at the top of your browser window if the site you’re visiting supports the app (in the upper right-hand corner of the Chrome, Firefox, Opera and Edge browsers, or the upper left in Safari).

While Honey does not list all eligible retailers, Honey-supported websites include Adidas, Amazon, Apple, J. Crew, GameStop, Gap, Home Depot, Lowe’s, Macy’s, Old Navy, Sephora, Target, Ulta, Walmart, Wayfair and more.

How to use Honey

To get started, you’ll need to install the Honey browser extension and create an account at joinhoney.com. Though this process will vary slightly depending on which browser you use, it should only take a few clicks.

You can use Honey on most web browsers, including Google Chrome, Firefox, Edge, Safari and Opera, and you can sign up for a Honey account using your email address or your existing Google, Facebook, PayPal or Apple account.

Once you’ve installed the extension and created an account, you’re ready to start using Honey to search for coupon codes and (hopefully) save money when shopping online.

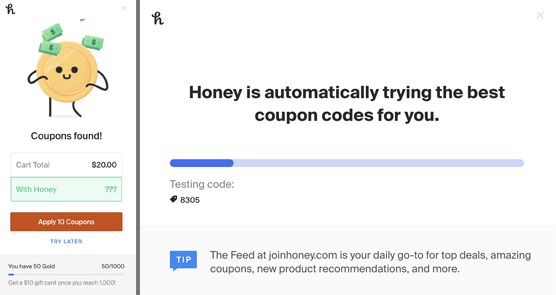

How to use Honey’s coupon-finding feature at checkout, step by step:

- Add items to your cart as you normally would, and check to see if the online store that you’re visiting supports Honey. The browser extension’s logo should light up in green or red (depending on your browser) if coupon codes are available.

- Before you submit your order, click the Honey icon to check for coupon codes. You can usually do this either from your cart or during the checkout process, depending on where in the checkout process your store accepts promo codes.

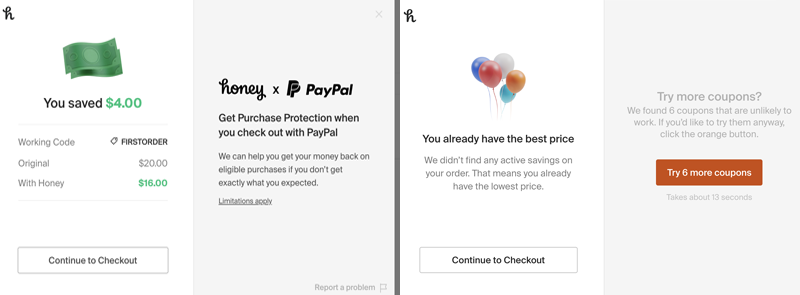

- Honey will tell you if it’s found any coupons and how many it will try. Click “apply coupons” to test all of the available codes.

- Honey will try out the codes, which usually takes a few seconds. It automatically applies the working code that saves you the most money and tells you how much you’ve saved. If Honey can’t find any working codes, the app will tell you that you already have the best price.

Is Honey safe to use?

Adding the Honey browser extension allows the app to see the contents of your cart, analyze information on the site you’re visiting and track your purchases in order to share information about deals, prices and products with other Honey users.

The site’s privacy policy is explicit that Honey does not share or sell your information, and instead makes money via referral fees from its retail partners. But some users have expressed concern about security.

While it’s true that Honey can read or change data on the websites you visit, other browser extensions work similarly. Additionally, the app’s coupon-finding and testing functionality would be impossible without this ability.

If you’re not comfortable with enabling the extension to keep track of the sites you visit and your purchasing behavior, you will have to miss out on Honey and similar add-ons. But the app likely poses no more of a security risk than any other browser extension – if you use it on sites you trust.

How to maximize your savings with Honey

Along with testing coupon codes at checkout, you can take advantage of the Honey app’s other savings tools and be strategic about how you pay in order to rack up rewards and get an even bigger discount on online purchases. Here are a few tips.

Earn gift cards with the Honey Gold rewards program

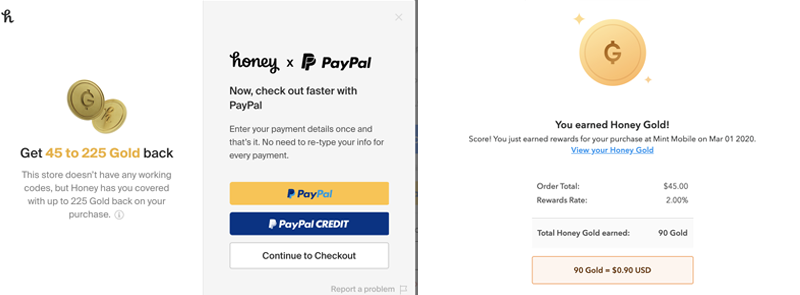

Honey offers a free rewards program, Honey Gold, that lets you earn points on certain purchases. Similar to shopping portals like Rakuten and Ibotta, the Honey Gold rewards program is set up so that when you buy certain items, Honey earns referral fees from select retail partners. Then, the Honey Gold program passes a portion of those fees back to you in the form of cash back rewards.

Honey Gold is automatically activated when you test coupon codes at checkout with an eligible retailer, even if a site doesn’t have any working promos. Once you complete your purchase, your Honey Gold will appear as pending in your account within a few days.

It’s possible to earn Honey Gold even if you can’t find any coupon codes

It’s possible to earn Honey Gold even if you can’t find any coupon codes

You can also shop at the Honey website or via Honey’s Smart Shopping Assistant mobile app to earn Honey Gold on select purchases. Simply click “activate offer” from the store page you’re interested in and follow the link to start shopping.

Activate Honey Gold offers when you shop online

Activate Honey Gold offers when you shop online

Unfortunately, Honey Gold rewards can only be redeemed for gift cards, not “true” cash back in the form of a check or deposit. Rewards redemption is also a bit restrictive: Once you stockpile 1,000 points, you can redeem for a $10 gift card at Amazon, Walmart, Target, eBay, Nordstrom, Sephora, Groupon, Macy’s, 1-800 Flowers, Nike, Lowe’s, Google Play or the App Store & iTunes.

Additionally, Honey Gold is not offered at all stores that support Honey’s coupon-finding feature. Amazon, for example, does not offer Honey Gold.

See related: Guide to card-linked offer programs

See when you should buy with Honey’s price history and Droplist features

Another great Honey app feature is its price history tool, which allows you to see recent price changes on items at select online stores. This could help you gauge how frequently an item’s price changes and anticipate whether you should wait for a price drop or buy now.

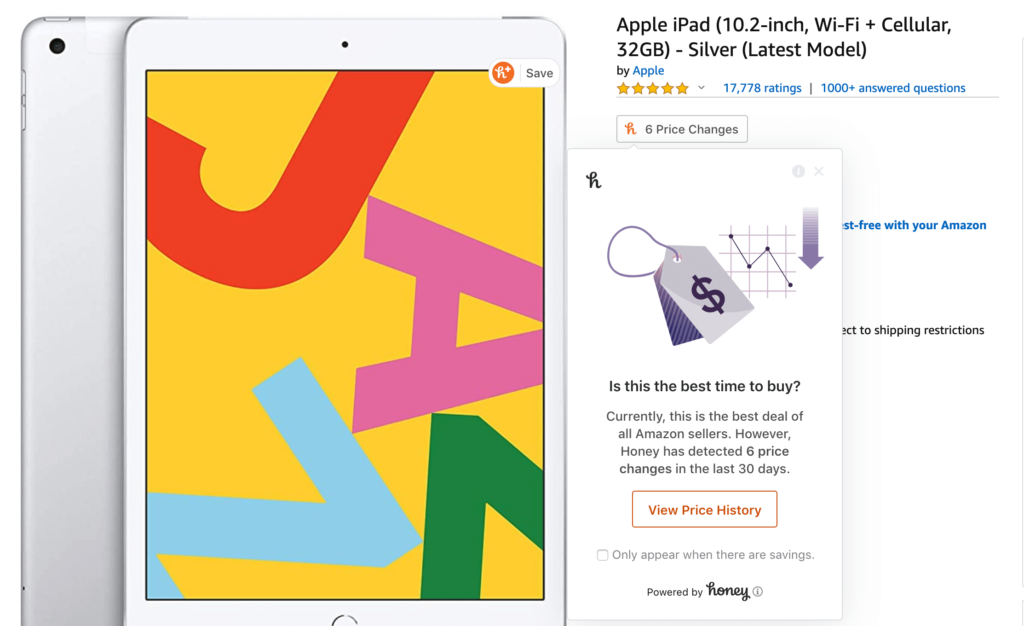

When browsing on Amazon, for example, you can judge how the price you’re seeing compares to the one offered by all other Amazon sellers, as well as any recent price changes. Simply click the Honey button embedded in the Amazon product page and Honey will let you know if you’re getting the best deal.

Honey helps you see if now is the best time to buy on Amazon

Honey helps you see if now is the best time to buy on Amazon

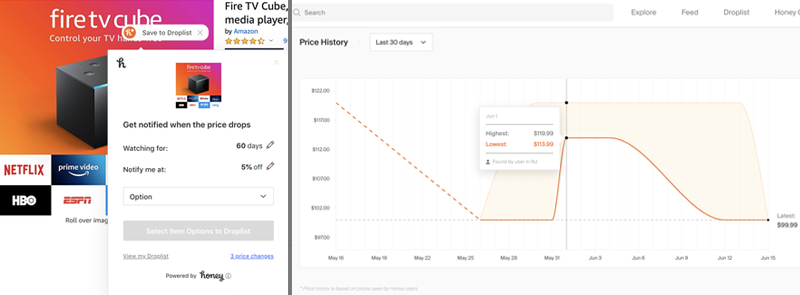

Even better, Honey comes with a tool called Droplist that sends alerts when a specific item drops in price. You can add an item to your Droplist to track its prices for 30 to 120 days and get notifications when it drops by anywhere from 5% to 95%. You can also see an item’s 30-, 60- or 120-day price history to get a sense of pricing trends, or use Droplist to monitor prices and claim a price match or adjustment if an item’s price drops soon after you purchased it.

Honey will automatically send you an email when an item on your list drops to the price point you’ve set.

Add items to your Droplist, track prices and get alerts when they change

Add items to your Droplist, track prices and get alerts when they change

See related: Guide to Cashback Monitor

Use Honey with a rewards credit card

If you don’t mind being strategic with which payment method you use when shopping online, you could save even more by combining Honey’s rewards program, coupon-finding and price-tracking tools with a rewards credit card.

For example, the Bank of America® Customized Cash Rewards credit card earns 3% cash back in a category of your choice, including online shopping, as well as 2% cash back on grocery store and wholesale club purchases (on up to $2,500 in combined spending each quarter). You’ll also earn 1% back on all other purchases. Opt for this card’s online shopping bonus category and you have a ton of flexibility in where you can earn 3% cash back, on top of the discounts and rewards you’re already getting via promo codes, price drop notifications and Honey Gold rewards.

Alternatively, a flat-rate cash back card will earn rewards at the same rate on every purchase, regardless of whether you buy online or in person.

Should you install Honey?

We tested Honey’s deal-finding tool on dozens of sites, including Amazon, Walmart, Home Depot, Lowe’s, Old Navy and more, but had trouble finding many working codes. In most cases, we had to wait several seconds as Honey tested options, only to find that we already had the best price available.

Additionally, the Honey Gold rewards program, though a nice perk, is somewhat restrictive, offering only select gift cards as payment and imposing a $10 minimum redemption threshold. That said, Honey’s program is about on par with alternatives from Rakuten and Capital One Shopping.

Nevertheless, Honey offers savings-minded shoppers a convenient way to see if they’re getting the best deal available when shopping online. Even if Honey doesn’t find any codes, it’s worth checking to be sure you’re not missing out on any discounts. You can also earn rewards on purchases in just a few clicks and take advantage of Honey’s Droplist tool to compare prices and strategically plan purchases.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.