Summary

Rakuten is a cash back online store that partners with countless major brands and retailers. See how it works – and how you can make the most of it.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

It’s always smart to look for ways to save on shopping – because you can almost certainly find them every time you do.

You can take advantage of coupons, find items on sale or keep an eye on special offers. You can also get a cash back card to earn a bit of money back on your purchases.

However, rewards credit cards aren’t the only way to get cash back. For instance, some online shopping portals also return a percentage of what you spend on eligible purchases.

See related: Use airline and hotel shopping portals to maximize online shopping rewards

One of the most popular cash back sites is Rakuten, and it can be an amazing shopping tool – if you’re a disciplined shopper.

What is Rakuten?

Rakuten, formerly Ebates, is an online store that allows you to receive a percentage of your purchase amount back when you shop from its partners. Additionally, you can find coupons and special deals.

Currently, Rakuten features over 3,500 stores online and offers many types of products, from clothing to electronics to vacation rentals. It partners with major retailers and companies such as Microsoft, Target, Nike and many others.

How does Rakuten work?

Rakuten is an affiliate marketing website that receives a commission when a customer uses it to make a purchase with one of its partners. A part of its commission is then returned to the shopper in cash back.

You don’t have access to your cash back right away. It’s mailed in the form of a check – which Rakuten refers to as “big fat check” – every three months following a schedule:

- On May 15 for all purchases made between January 1 and March 31

- On August 15 for all purchases made between April 1 and June 30

- On November 15 for all purchases made between July 1 and September 30

- On February 15 for all purchases made between October 1 and December 31

To get paid, you need to have accumulated at least $5 in cash back. If your approved cash back is less than that, it will carry over to the next payment period.

How to use Rakuten online

To start using Rakuten online, visit the website or download the app and sign up with your email, Google or Facebook account. Once you sign in, you can start browsing stores and deals – and get to shopping.

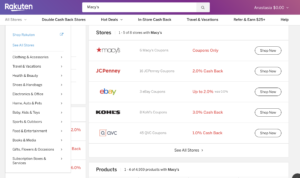

You’ll see the shopping categories under the search bar at the top of the page (or the bottom if you’re using the app). If you hover over “All Stores,” you’ll find a drop-down menu with store categories as well. If you already know what you’re looking for, you can also type the store’s name into the search bar or search by product.

When you’re ready to shop at the store of your choice, click “Shop Now,” and you will be redirected to the store’s website. There, just make a purchase as you’d normally do – cash back will be automatically activated.

If you’d rather skip browsing the portal and go directly to your shopping site, Rakuten offers a convenient browser extension called “the Rakuten Cash Back Button” available for Chrome, Firefox, Safari and Edge. After you download and activate it, shop at your favorite online stores like you normally do. The extension will let you know if there are coupons or cash back available and apply them to your order.

How to use Rakuten in-store

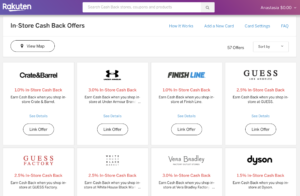

You can also receive cash back from Rakuten when shopping in-store. In the shopping categories menu, you’ll find the “In-Store Cash Back” section. Here you’ll see all the stores that are currently offering Rakuten cash back at their physical locations.

When you find an offer you like, click “Link Offer,” which will prompt you to add a debit or credit card. Use that card in the store when making a purchase, and you’ll receive cash back from the transaction.

See related: Guide to card-linked offer programs: Earn more rewards

Rakuten can be especially convenient when you’re already at the store doing some unplanned shopping. Check your Rakuten app and see if there’s cash back available, and if there is, link your card and receive cash back for your purchase.

How to maximize your Rakuten cash back

What could be better than earning double cash back or extra rewards? If you’re strategic about using Rakuten, you can up your chances of scoring a good deal and fattening up your “Big Fat Check.”

Using a rewards credit card

If you shop using Rakuten and charge your purchase on your rewards credit card, you can earn cash back twice on the same transaction. It’s an excellent way to rack up even more cash back on your regular spending.

For instance, at the time of this writing, Rakuten is offering 1% cash back on purchases at Albertsons. If you have, say, the Blue Cash Preferred® Card from American Express, which comes with a 6% cash back rate on U.S. supermarket purchases (on up to $6,000 in purchases annually, then 1%), your total cash back will be 7%. This means that if you buy $250 worth of groceries, you’ll get $17.50 in cash back just by doing your normal shopping.

If you’re diligent about using the right cards and tracking deals, your yearly earnings can be significant.

See related: How much can you really make with a cash back card?

Earning Rakuten Membership Rewards

If you own a rewards-earning American Express card, you can also receive Amex Membership Rewards instead of Rakuten cash back. Considering Rakuten offers a 1,500-point bonus for users who spend least $25 in the first 90 days of membership, it’s a great way for Amex cardholders to stockpile rewards.

You can switch from earning cash back to Membership Rewards points by linking an eligible American Express card and setting American Express as a redemption option in the “How would you like to get paid?” section of your Account settings page. Unfortunately, the cash back already present in your account will not be automatically converted to Membership Rewards points. Only future purchases will earn points instead of cash back.

Some users have also reported earning Membership Rewards points on Rakuten purchases after this switch even if they do not use their linked Amex card for purchases. This means if you used the Rakuten Cash Back Visa Credit Card (which gives you 3% cash back on qualifying purchases made through Rakuten.com, in-store cash back offers, Rakuten hotels and travel, as well as 1% cash back on all other purchases) after linking an eligible Amex card, you could earn 3 Membership Rewards points per dollar on Rakuten purchases.

While other rewards cards may offer better value and more flexibility, it can still be a good addition to your wallet when paired with an Amex rewards card. Earning 3% more in cash back means you might be able to earn 3 points per dollar if you redeem for American Express Membership Rewards. However, keep in mind that it might not be possible as Rakuten doesn’t guarantee you’ll earn points if you don’t use your Amex card.

Keeping track of Rakuten deals

Even if you’re not an Amex cardholder, they are still many ways you can maximize your Rakuten account’s value. Make sure to frequent the “Double Cash Back Stores” and “Hot Deals” sections to be on top of cash back opportunities and look out for limited time offers.

For example, right now you can get $30 if you refer someone and they spend $30 through the portal. The person you’ve referred will get $30 as well. The offer ends on May 11, 2020.

One essential thing to remember to make the most out of Rakuten is to be disciplined. Even though it’s easy to get carried away hunting down deals, a good deal itself shouldn’t be the only reason to buy. Websites like Rakuten work best when they help you earn a bit of money back on something you’d buy anyway, not make you spend more.

Should you sign up for Rakuten?

Rakuten is a simple and convenient way to earn cash back from online shopping. You can maximize your earnings by tracking deals and special offers. If you have an Amex card that earns American Express Membership Rewards, you can also opt in to get Amex points or miles instead of cash back.

However, it’s important to use Rakuten as a tool that helps your budget and avoid unnecessary spending. If you’re a responsible buyer, Rakuten can enhance your shopping, but if you’re prone to impulse purchases, the platform might encourage you to overspend.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.