Summary

Unique features like comprehensive spend tracking and daily cash back add to Apple Card’s appeal if you use it strategically.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

The Apple Card has drawn a lot of hype since its launch, but it’s also been met with mixed reviews.

Die-hard Apple fans sing its praises, while many experts are not quite as impressed. Critics point out that the rewards structure is less valuable for those who don’t regularly use Apple Pay, while fans note that if you are already using the mobile payment system, the card can easily bring in 2% cash back on every purchase.

If you are a fan of Apple Pay and spend a significant amount on Apple purchases (including in-app purchases and Apple music subscriptions), the rewards rate on the Apple Card can be particularly lucrative.

You’ll earn 3% back on all Apple purchases as well as Apple Pay purchases with select merchants – currently limited to Panera Bread, Exxon Mobil, Nike, T-Mobile, Uber, Uber Eats, Walgreens and Duane Reade stores – 2% back on other purchases when you use Apple Pay and 1% back on everything else.

Applying for the Apple Card

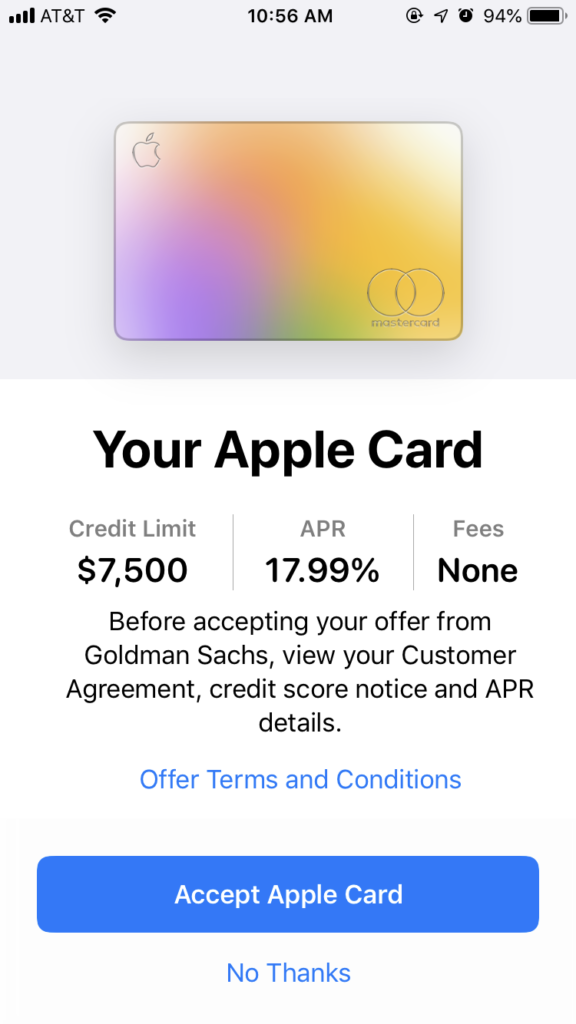

Apple Card is built directly into the Wallet app on iPhone, and the application process is seamless. Applicants are prompted to input basic information, including their name, income and the last four digits of their Social Security number. Then they can view their approved Apple Card offer with their APR and credit limit before choosing to accept the card.

You can also apply for the Apple Card online when buying an eligible Apple product with monthly installments, but you’ll still need an existing Apple ID to apply.

One great thing to note about the Apple Card is that you will only have a soft pull on your credit until you accept the terms offered by Apple and Goldman Sachs. That means you can fill out the application to see if the proposed APR and credit limit suit your needs before a hard pull to your credit is triggered. Just keep in mind that as soon as you accept your Apple Card offer, you will have the standard hard pull on your credit.

See related: Apple Card application denied? Possible causes and next steps

Credit score requirements

According to Apple, you might not get approved for the Apple Card if your FICO Score 9 is lower than 600.

Additionally, Goldman Sachs can factor in other details of your credit profile when determining whether to approve you for the card. For example, late payments, high credit utilization or too many recent hard inquiries can prevent the issuer from approving your application.

Using the Apple Card

As soon as you are approved, new Apple cardholders will have access to a virtual card right in the iPhone Wallet app. For purchases that can’t be made on the mobile wallet, you will receive a titanium card. On top of a rewards rate tailored for Apple enthusiasts, the card comes with some other unique features:

Weekly and monthly spend reports

Directly in the Wallet app, you can see a detailed breakdown of your weekly and monthly spending. Not only will you be able to compare the number of transactions and spend in individual categories (like dining or travel), but you’ll see a daily breakdown designed to help you identify what kinds of purchases you spend the most on.

Daily cash back

Rather than issue cash rewards at the end of a statement period, the Apple Card offers users daily cash back for their purchases. Cash back is deposited into your Apple Cash card every day, where you can use it for Apple Pay purchases or send it to friends and family. For cardholders without an Apple Cash account, your cash back can be applied as a statement credit.

See Related: Apple Card Daily Cash: Deep dive

Interest calculator

In case you need to carry a balance month to month, the Apple Card comes with an interest calculator to help you determine your monthly payments. The calculator breaks down how much you’ll be charged in interest based on what payment you input – as well as how long it will take to pay down your balance – to help you decide how much you can afford.

No fees

While the Apple Card comes with its drawbacks, it is an inexpensive card to own – which can be a huge plus for some types of cardholders. For starters, you won’t be charged an annual fee. There’s also no cash advance fee, foreign transaction fee or late fee. That offers peace of mind for frequent travelers or cardholders who occasionally have to make a late payment. Plus, if you do have to make a late payment, you won’t suffer a steep penalty APR.

Map your purchases

You can use Apple Maps to track the location of a purchase in case a mysterious transaction appears on your statement.

No card number

The Apple Card is loaded with security features, the most notable being that it doesn’t have a full card number. This adds an additional level of protection for your card information, as merchants will never have access to your card number. When you shop online, you can generate a secure, virtual card number to safely pay for your purchase.

As far as other security features, the card comes with real-time fraud alerts and the ability to freeze your card if you lose it. Apple has also stated that it will never view your data, while Goldman Sachs (the card’s issuer) has promised never to share or sell user information.

Managing your card online

Apple launched a website to allow Apple Card users to manage their card online, which can be useful if you lose your Apple device. You can sign in using your Apple ID to schedule or cancel payments, review your monthly statements and manage your Daily Cash. There’s also a support section where you can find a card user guide and a customer service number you can call in case you need help or have any questions about your account.

Some features, however, are missing from the website. For instance, you can’t remotely lock the card or request a replacement through the portal if the card has been lost or stolen. Those features are only available with the Wallet app.

Interest-free installment plan for Apple purchases

When you buy a new iPhone with your Apple Card, you’ll unlock an interest-free installment plan. Cardholders get a generous 24 months to pay off their new iPhone in equal payments. Plus, your installment plan payment is added to your minimum card payment each month, so you don’t have to keep track of more than one bill.

See related: The best credit cards for Apple purchases

Apple also recently announced it would be offering installment plan options for other Apple products – including Mac, iPad, AirPods and more. Exact repayment terms vary by product, but none charge interest. Just look for the monthly installment payment option at checkout when you shop online.

Adding authorized users

With the Apple Card Family feature, cardholders can add authorized users to their account right on their iPhone or iPad. You can add up to five other people who are 13 years or older and members of the same Family Sharing group. Additionally, you can select a transaction limit amount and set up notifications about the card’s activity.

With all these features in mind, it is clear that the Apple Card has some unique offerings. However, it still might not be the best option for every kind of cardholder.

Who should get the Apple Card?

While the Apple Card is packed with features that are great for many spenders, there are a few cardholders who can get the most value out of the product:

- Apple enthusiasts who spend plenty of money with the brand and use Apple Pay regularly

- Cardholders seeking insight into spending who will take advantage of spend reports and tracking tools

- Cardholders who occasionally carry a balance or make late payments seeking a card that’s easier on the fees and penalties

- Cardholders looking for a metal card with no annual fee, as the design is usually limited to pricier alternatives

If you don’t use Apple Pay regularly, the lower rewards rate on everyday purchases means the Apple Card is probably not the best choice for you. Flat-rate cash back cards can offer up to 2% cash back on every purchase you make, making them more lucrative for those who don’t make use of the mobile wallet. Though the budgeting tools and lighter fees are a big plus for Apple-lovers, they aren’t enough to set the card apart if you won’t earn significant cash back.

Additionally, Apple Card is only available to current iPhone or iPad users with an Apple ID. If you use another mobile device, you won’t be able to apply for the card. According to the Apple Card Customer Agreement, you also risk having your account closed if you make changes to your device that void its warranty – including the process known as “jailbreaking.”

Tips for maximizing the Apple Card

If you decide the Apple Card is a good addition to your wallet, follow a few tips to boost your rewards potential:

- Whenever possible, shop at retailers who accept Apple Pay to boost your cash back rate.

- Shop at current 3% cash back partner retailers to maximize your rewards.

- Take advantage of spend reports to identify where you are spending money and adjust your budget.

- Use the card for all Apple purchases to take advantage of bonus cash back and installment plans, where applicable.

- If you can’t pay off your balance in full each month, use the interest calculator to find a payment plan that matches your budget.

- Consider pairing the card with one that offers a better flat rate on general purchases in case you can’t use Apple Pay for a transaction. For example, the Capital One Quicksilver Cash Rewards Credit Card offers 1.5% back on every purchase, getting you a better value on non-bonus category purchases.

Final thoughts

Though the Apple Card has been criticized for a rewards rate that appeals only to die-hard Apple fans, it can still be a great choice for the right kind of cardholder. Unique features like comprehensive spend tracking and daily cash back add to its appeal – especially if you use them strategically. Plus, the new variety of interest-free installment plans for select Apple purchases makes it a great choice for financing a new Apple device.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.