Summary

Requesting a credit limit increase with the Apple Card is incredibly simple and could help you boost your score or finance a new device. Just be sure you have a good grasp of where your credit stands and why you want a higher limit.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

Whether you were an early adopter of the Apple Card or only signed on recently, you may be wondering if it’s time you got a higher credit limit.

A higher limit on your Apple Card could not only help you lower your credit utilization and potentially boost your credit score, but it could also give you more buying power. That last point will hold special appeal if one of the main reasons you applied for the Apple Card was to take advantage of its no-interest financing on Apple products.

Though Goldman Sachs, the card’s issuer, does not offer cardholders a concrete checklist of credit limit increase requirements, there are some basic steps you can take to give yourself better odds of approval. Plus, you can complete the entire process in just a few steps via your Apple device.

See related: Guide to the Apple Card

Requesting a higher credit limit with the Apple Card: Things to know

Eligibility requirements

As is the case with most issuers, Goldman Sachs does not list any specific requirements for getting a credit limit increase on the Apple Card. However, Apple’s help pages note that Goldman Sachs evaluates credit limit increase requests using much of the same criteria it uses in making Apple Card approval decisions and setting your initial credit limit.

You’re more likely to qualify for an Apple Card credit line increase if:

- You pay on time and use your card responsibly. Paying your balances on time and keeping your credit utilization ratio low are key indicators of creditworthiness. If you frequently pay late, max out your cards or otherwise have a hard time managing your current credit limit, it’s unlikely Goldman Sachs will want to take the risk of extending you even more credit.

- You’ve been a cardholder for six months or more. While the Apple Card’s financial health help page says you can request a credit limit increase after “as little as four months,” other Apple Card documentation mentions establishing credit history for “six months or more” before you apply. Six months is a fairly standard time frame for demonstrating that you’re a responsible cardholder, but the longer you’ve held the Apple Card, the more information Goldman Sachs has to use in evaluating your request.

- You haven’t recently requested a credit line increase. Too many requests for additional credit could indicate financial hardship. Even if you’ve successfully requested a credit line increase in the past, be sure to wait at least a few months before trying again.

All of these factors will impact not only whether your request is approved but also how large a credit limit increase you receive.

Before you request a credit limit increase

Being patient, keeping balances low and maintaining positive payment history with your Apple Card should give you a much better chance of having your credit limit increase request approved. But before you submit your request, make sure you know where your credit stands and what you’re hoping to achieve with a higher credit limit.

Do you want to boost your credit score? If so, remember that a higher limit alone won’t help your score if you increase your card balances to match. Want to use the card to finance a new iPhone? Your credit score may take a hit if you use up too much of your newly available credit and maintain a high credit utilization ratio.

Additionally, be sure to check your credit score and report before you submit your request, so that you have a clear idea of where you stand. Any recent negative items that appear on your report could hurt your chances of getting a higher credit line.

The same holds true if you’ve taken on any new debt obligations – like housing or car payments – since you applied for the card. Assuming your income hasn’t changed, new debt will increase your debt-to-income ratio and could give Goldman Sachs the impression that you won’t have enough disposable income left to cover your card payments after paying your existing debt obligations.

Finally, have a clear idea of how much of a credit limit increase you’re hoping to get. While you may want to double or triple your credit limit (and issuers are sometimes generous in this way), it’s more likely that you’ll receive a modest increase.

You should be safe asking for a 10% or 20% increase, but whatever number you have in mind, be prepared to explain why you need the extra credit and how your credit profile helps your case.

Process for requesting a credit limit increase

Goldman Sachs does not offer automatic credit line increases on the Apple Card or any specific guidance on the best time to try – it’s up to you to submit your request when you feel ready.

Luckily, though, the process is simple, and you can request a credit line increase in a few taps with your Apple device by chatting with an Apple Card Specialist.

Here’s how to request a credit limit increase with the Apple Card, step-by-step:

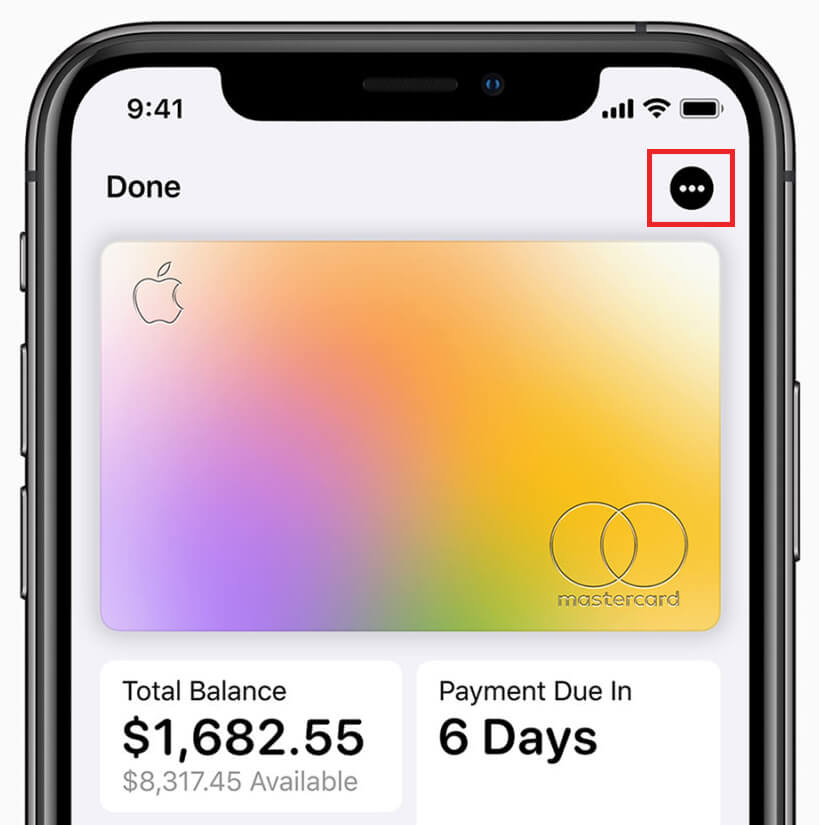

- Open the Wallet app on your device and tap Apple Card.

- Tap the More Options icon

.

.

- Tap the Message icon. This will allow you to start a chat with a Goldman Sachs representative.

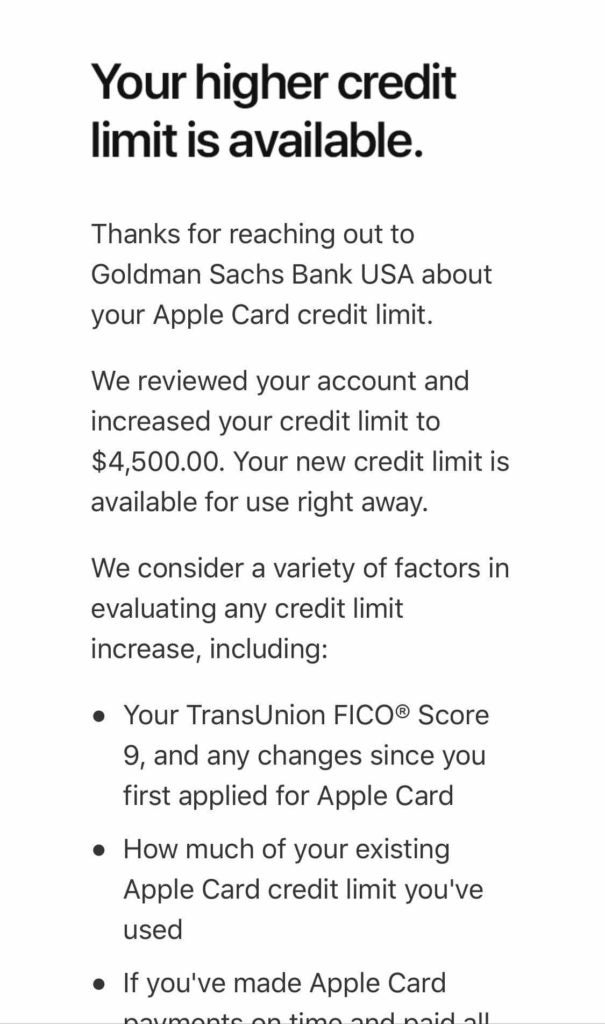

- Send a message requesting a credit limit increase. You may be asked about changes in your income (if your income has increased, be sure to mention it) and other details related to your request. It may take up to 30 days to have your request reviewed and find out if you were approved or denied. However, a number of users have reported near-instant approval and have seen an increased limit shortly after closing the chat.

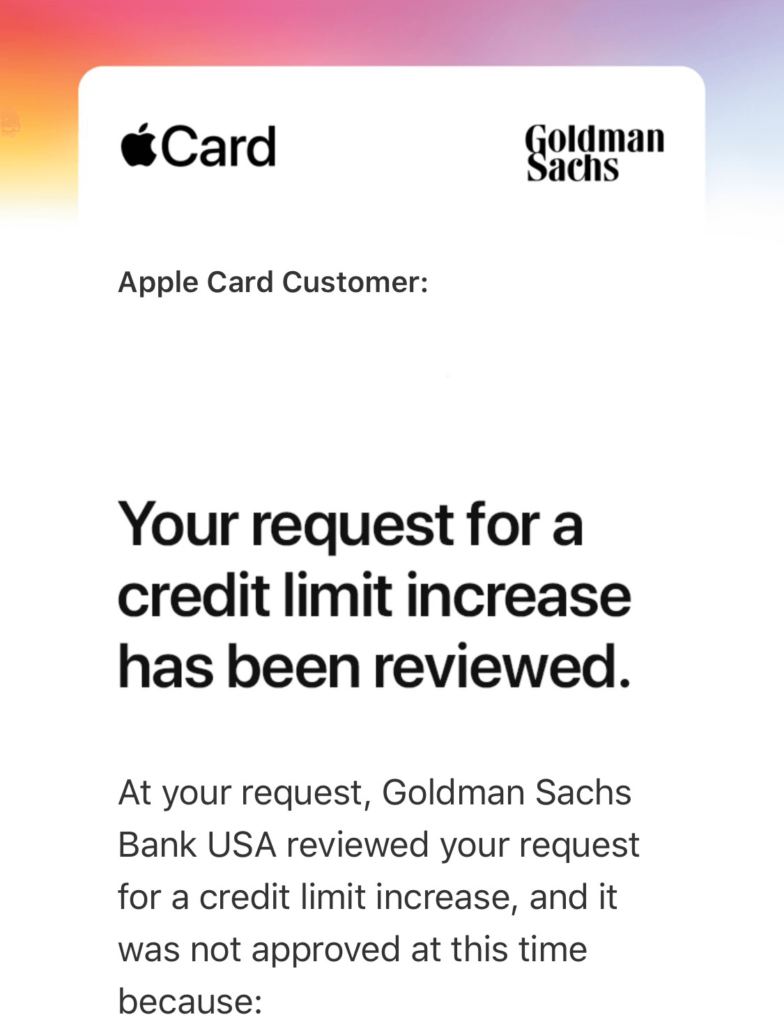

What to do if your request is denied

As you can see, requesting a credit limit increase on your Apple Card is as easy as asking – but there’s no guarantee you’ll be approved or that you’ll be given as large an increase as you’d hoped.

If your request is denied, don’t despair. You can try again in a few months, after you’ve worked on your credit score, increased your income or simply have a bit more Apple Card history for Goldman Sachs to draw upon.

Consider these next steps if your credit limit increase request is declined:

- Opt in to share additional personal data with Goldman Sachs. As reported by TechCrunch, the Apple Card’s recently updated privacy policy mentions that Apple Card applicants may be given the option of sharing additional information with Goldman Sachs “for re-evaluation of their offer of credit or to increase their credit line.” This could include information about your Apple product purchase history, the cards linked to your account and more. However, it’s still unclear whether this option will also be available to current cardholders seeking to increase their credit line.

- Work on building your credit. If you have a thin credit file, mediocre credit score or negative items on your credit report, focus on making on-time payments and paying off balances in full for a few months before you reapply.

- Reduce your debt and reel in your credit utilization by paying down balances on any other cards you have. This can also lower your debt-to-income ratio.

- Use your Apple Card regularly, as Goldman Sachs may see no reason to extend you additional credit if you don’t pay with the card often.

- Consider asking during a different time of year. A TransUnion study showed that credit limit increases are more common between January and May.

- Consider other financing options if your credit limit doesn’t cover the cost of the device you wanted to finance with the Apple Card. You can use a prequalification tool like CardMatch to see if you have good approval odds for a card with a 0% intro APR on new purchases, finance a new device through a wireless carrier or opt for a low-interest financing tool like the Upgrade Visa® Card with Cash Rewards. You may also be able to use Apple’s Trade-in program to reduce the cost of your new purchase.

Pros and cons of a higher credit limit

Requesting a higher credit limit is generally a smart idea, as a higher limit will give you more room to breathe and additional purchasing power. But depending on your personal financial situation, it may not be the best way forward. Consider these pros and cons if you’re still trying to decide.

Pros

- A higher limit could help you lower your credit utilization and boost your credit score.

- You’ll have more flexibility to make large purchases. You can even avoid interest for a few weeks if you take advantage of your Apple Card’s grace period.

- You may be able to cover the cost of a new Apple device and take advantage of the Apple Card’s no-interest financing for 24 months, which is a much longer promotional period than you’ll find on 0% intro APR credit cards.

- You can earn spend more with the card and earn more Daily Cash back in the process.

Cons

- If Goldman Sachs performs a hard pull of your credit report, your credit score will take a temporary hit, which could affect your ability to qualify for the best interest rates on loans and mortgages.

- A higher credit limit could tempt you to spend more, which could hurt your finances or lead to interest charges if you aren’t able to pay off your card balance each month.

- Using your higher credit limit to finance an Apple device may significantly increase your credit utilization, which will hurt your credit score – at least until you’ve paid it off.

Final thoughts

Requesting a credit limit increase on your Apple Card is exceedingly simple and could allow you to finance your dream device without paying interest. If you’ve been a cardholder for six months or more and have used your card responsibly, it’s definitely a next step worth considering.

That said, it’s not necessarily your best or only option. Before you make your request, be sure your credit is in order and you have a clear idea of why you want a higher limit. Having concrete goals will help you keep your financial life on track and continue to prove your creditworthiness.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.