Summary

Preapproved offers in CardMatch offer the best opportunity to qualify for a credit card that doesn’t involve a hard pull to your credit.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

Some of the offers below are no longer available and may be out of date.

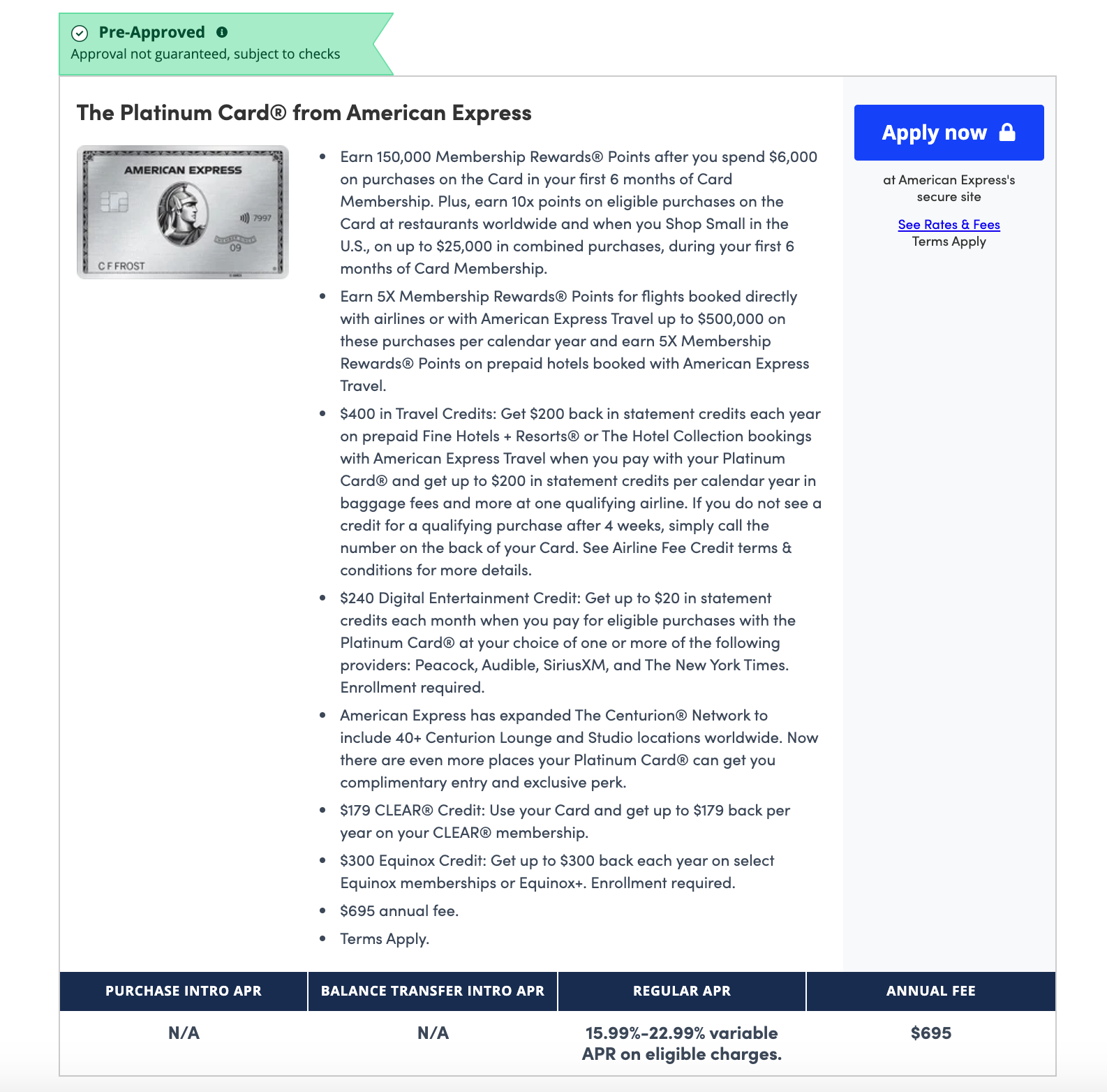

Amex has recently updated one of its most famous products, The Platinum Card®, from American Express. The card costs more now – the annual fee has increased to $695 – but it also boasts new premium benefits with up to $1,400 in annual value from statement credits alone.

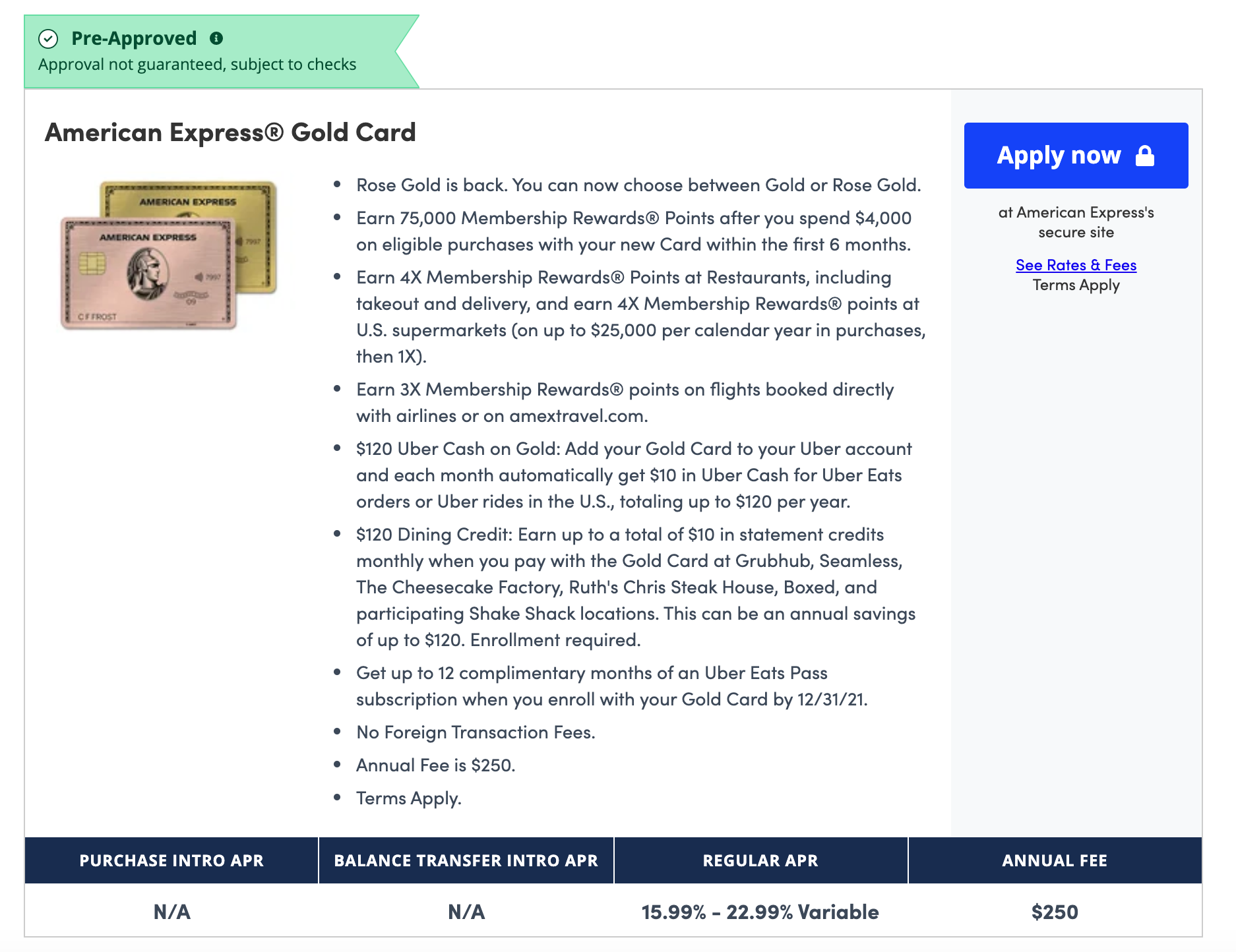

If you’re thinking of applying, now might be the best time to do so. On July 15, 2021, American Express launched preapproved offers in CardMatch™, including the 150,000-point welcome offer on the Amex Platinum (after spending $6,000 in the first six months). Additionally, CardMatch users may get preapproved for the American Express® Gold Card, Blue Cash Everyday® Card from American Express and Blue Cash Preferred® Card from American Express. (Note many of the offers in CardMatch are targeted, which means you might not see the same cards or welcome bonuses featured below.)

What is a preapproved offer in CardMatch?

CardMatch is a service offered by CreditCards.com that provides credit card recommendations based on the user’s credit profile. All the recommendations you see when checking CardMatch are tailored to your credit, meaning you have good chances of approval. Getting access to your card matches doesn’t trigger a hard inquiry, so you can browse them without any impact to your credit scores.

With some offers in CardMatch, you can gauge your approval chances even better. For example, if you find a prequalified offer, that’s an indicator you’re even more likely to get approved if you apply.

A preapproved offer is a step above a prequalified offer. It’s the highest certainty an issuer can provide without guaranteeing approval and placing a hard inquiry on your credit.

See related: Prequalified vs. preapproved: What’s the difference?

All special offers, including preapproved and prequalified offers, will have a badge on them indicating what type of offer you’re seeing.

Prequalified offers have a blue ribbon on the top explaining the kind of offer, and preapproved offers have a wider green one.

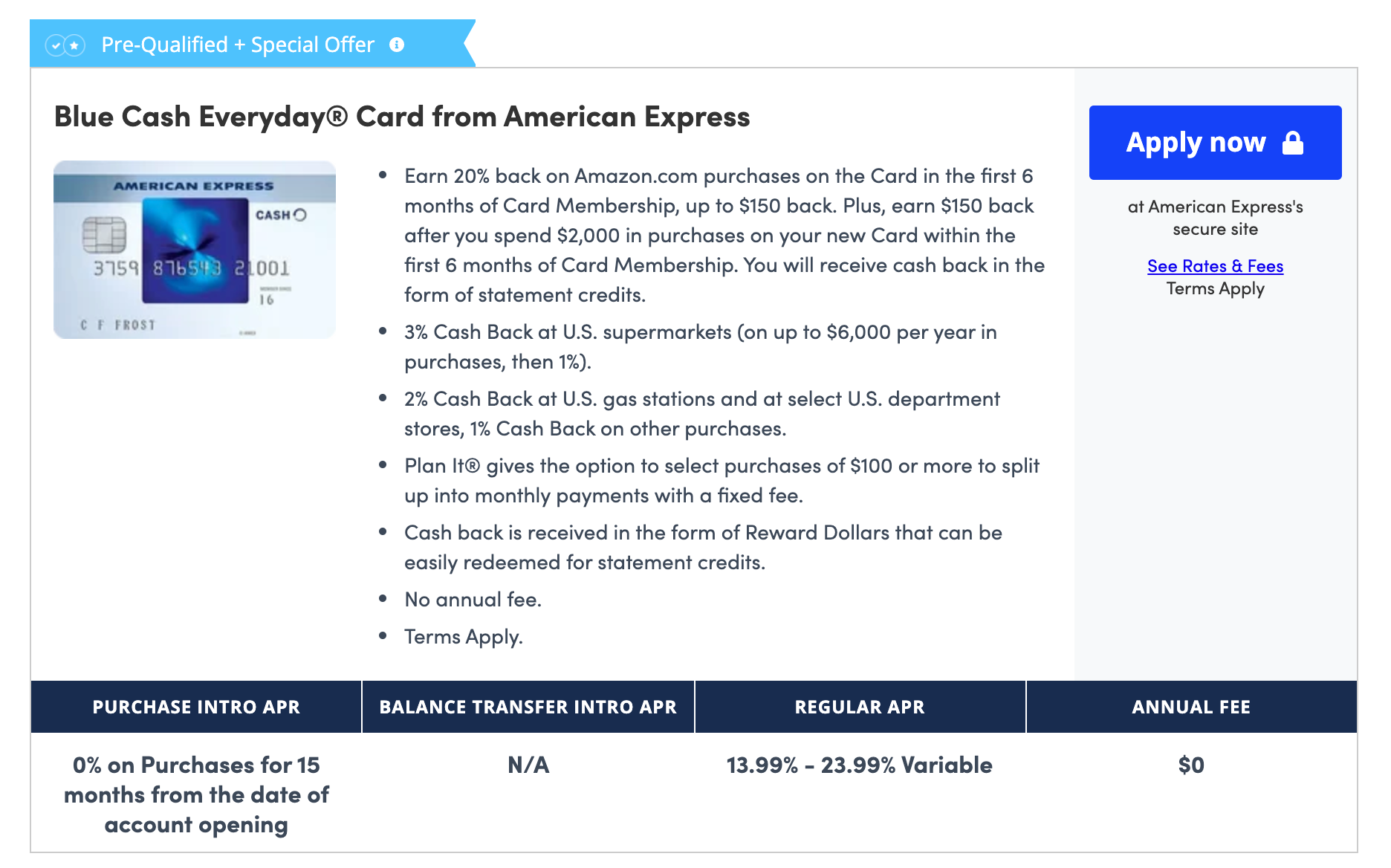

For instance, this is a prequalified offer we identified on July 15, 2021.

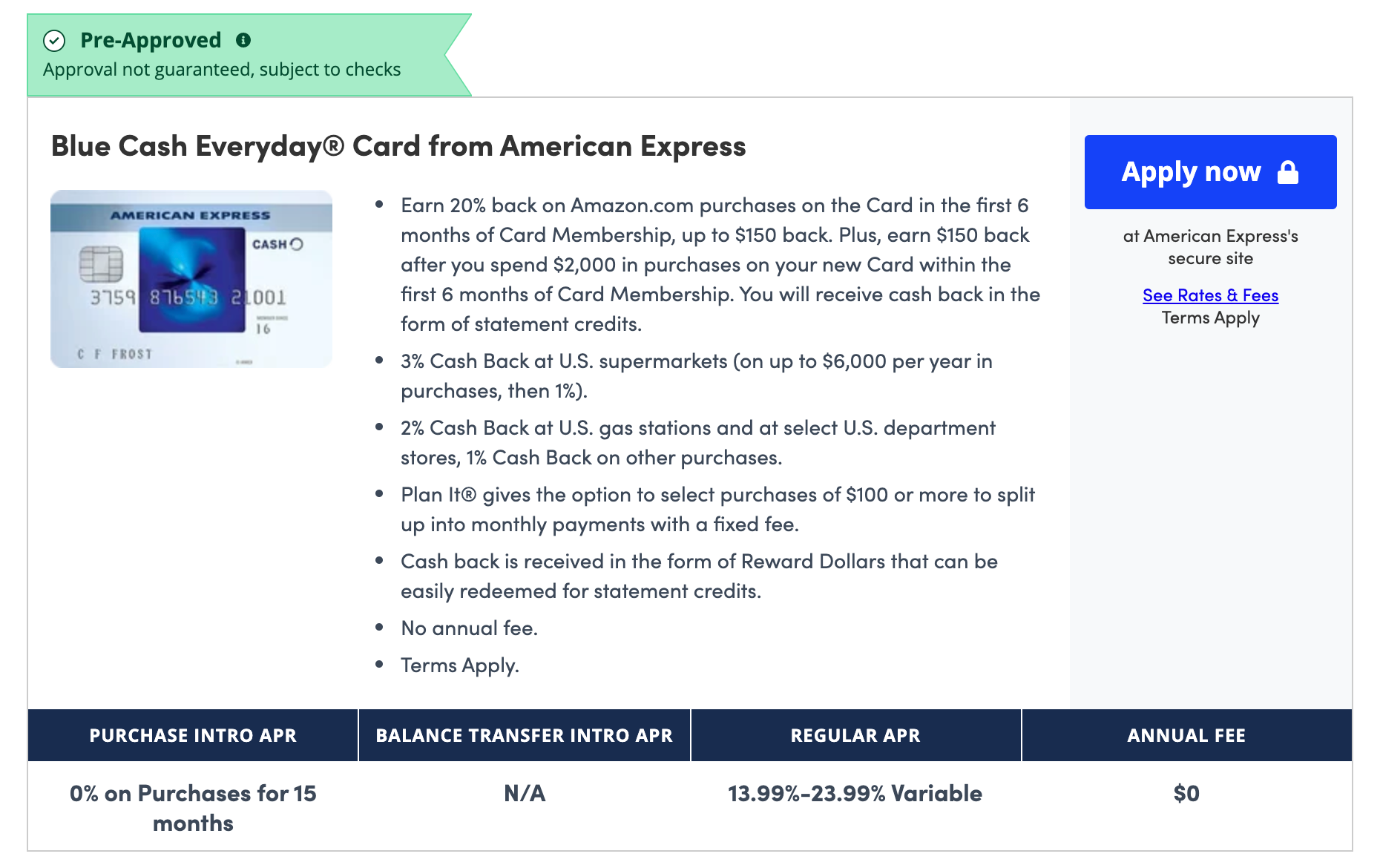

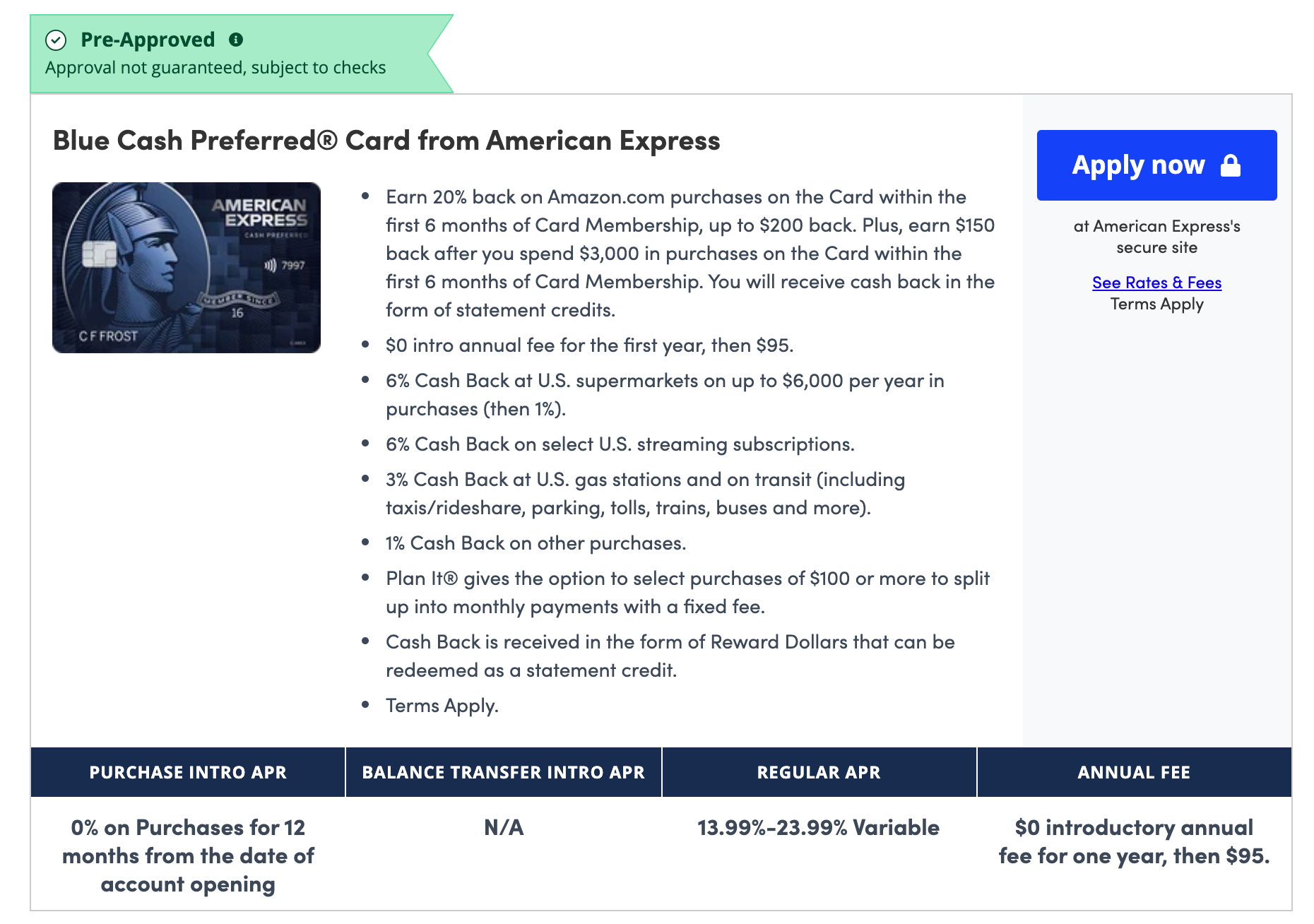

Here’s an example of a preapproved offer from the same date.

Like any offer on CardMatch, prequalified and preapproved offers may change at any time and may not be available to all users.

See related: How to increase your chances of getting preapproved on CardMatch

Amex preapproved offers in CardMatch

The most exciting preapproved offer we’ve been able to find in CardMatch is 150,000 points for spending $6,000 in six months with the Amex Platinum – up from the regular offer of 100,000 points for the same spend requirement. We identified this offer on July 15, 2021.

Note that the offers vary from user to user, and you might not get the same exact terms.

Another attractive preapproved offer we found on July 15, 2021, is this elevated offer on the Amex Gold.

This is 15,000 points more than the card’s regular offer, which you may also be preapproved for in CardMatch. As we’ve mentioned, users may get access to different offers and their variations.

The Blue Cash Everyday and Preferred cards are also getting preapproved badges – for instance, we’ve identified this offer on July 15, 2021.

Should you use a preapproved offer?

When you apply for a credit card, it’s always a bit of a gamble. A CardMatch offer simply shows a high probability of being approved.

Still, nothing is guaranteed. When you apply, the issuer will consider multiple eligibility requirements, including your credit score, any previous history you may have with the issuer, negative items on your credit report and more. At this point, the lender will also pull your credit.

Preapproved offers may help eliminate some of this gamble. While the lender still can’t guarantee approval until you agree to a hard inquiry, preapproval in CardMatch indicates the best possible odds at this stage of the process.

For that reason, if you check CardMatch and see you’re preapproved for a card you’re interested in, it may be a good idea to apply. Plus, the offers in CardMatch change. The next time you check, you might find a different set of offers. You may not want to wait to avoid losing your preapproval.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.