Summary

Want to know how to use CardMatch? Use this guide to learn the steps and reap the possible benefits of new credit card offers.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

If you haven’t checked out CardMatch™ yet, head over now. The tool is an easy to use, one-stop shop for prequalified credit card offers, suggested cards for you and even elevated introductory bonuses.

The best part about using CardMatch to find limited-time offers is that there is no effect on your credit score. You are able to check regularly for targeted offers without worrying about any kind of penalty, and you can find them all in one place, when typically you would have to visit multiple sites.

Once you find an offer you like, CardMatch makes it easy to apply for the card and takes you directly to the issuer’s application.

What is CardMatch?

CardMatch is a service offered by CreditCards.com, designed to match users seeking credit cards with personalized offers. The platform combines prequalified credit card offers (which can signal your chance of approval), targeted introductory bonuses and suggested cards based on your credit profile.

Note that if you are prequalified for a credit card, it means you have met the initial criteria of the card issuer and your application is more likely than not to be approved for the offer you matched with. It is not a guarantee.

All of these recommendations and matches are determined by a soft pull to your credit – meaning there is no effect on your score. Your information and data is also protected with bank-level security encryption to prevent any stolen information.

CardMatch includes card offers from most major issuers – including American Express, Citi and Discover.

How the CardMatch tool works

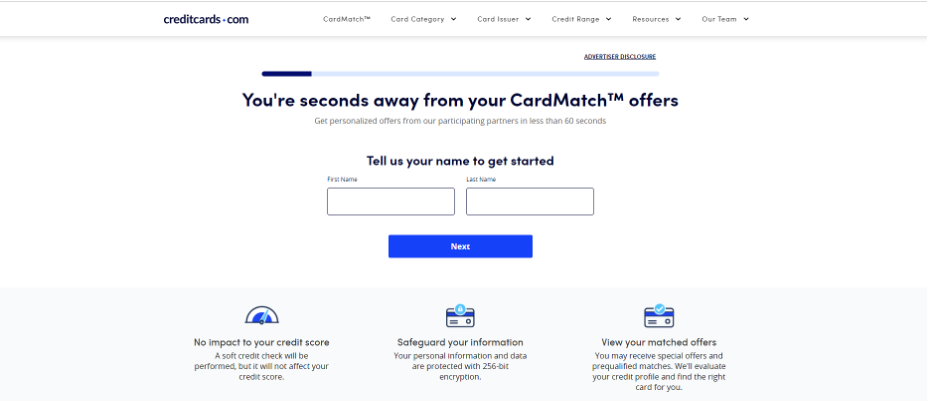

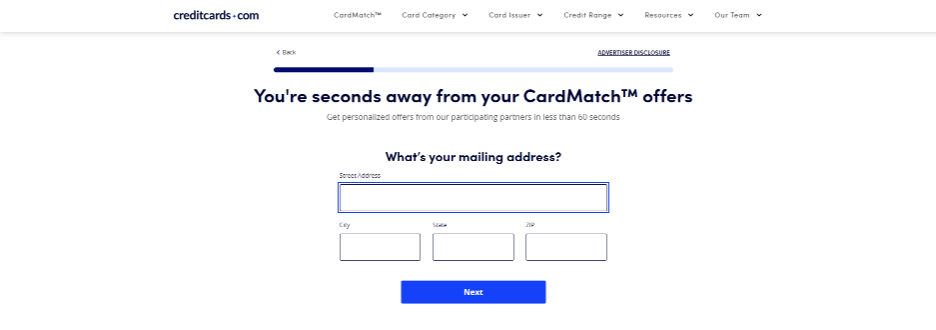

After navigating to the CardMatch tool, you’ll first be asked to enter some basic information such as first and last name along with your mailing address.

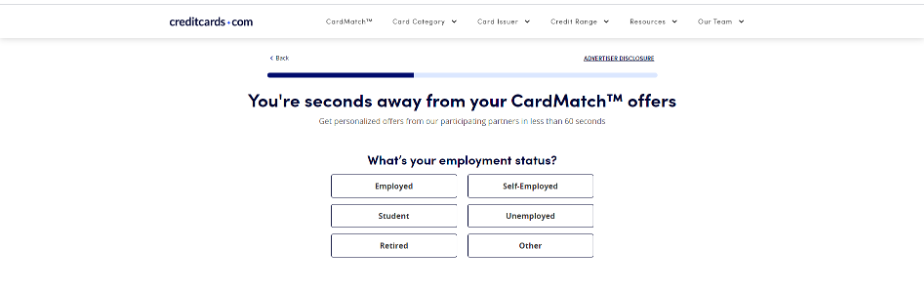

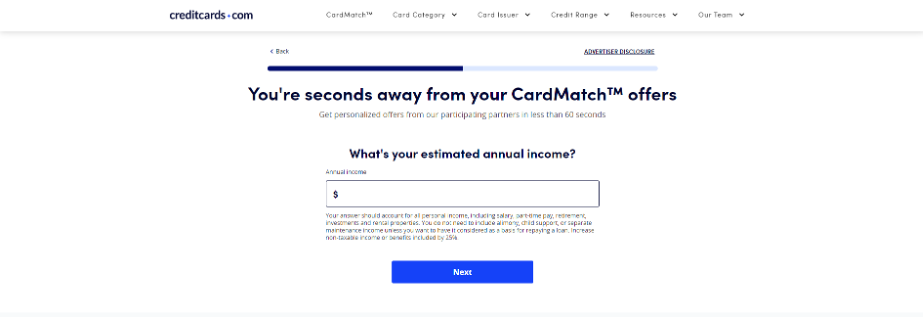

You will then be asked to select your employment status and choose from different options. Make sure to select the best one that aligns with your status and click next to submit an estimate of your annual income.

Only use numerals – no commas or periods – when submitting your income and monthly rent or mortgage payment amount. You will be asked to enter that next.

Note, it’s OK to give an estimated average and include income from side gigs or family that you receive on a regular basis. And if you live with a roommate or partner, you can base your rent payment on what you spend as an individual rather than the full cost.

The last couple pieces of identifying information that you’ll need to add include the last four digits of your Social Security number and phone number.

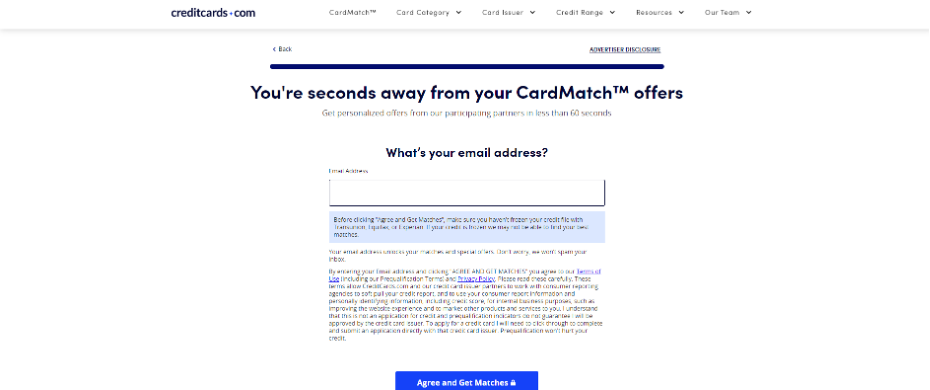

After that, the last step is entering your email address, and you are on your way to personalized matches.

It’s important to note that before you click “Agree and Get Matches,” you should make sure your credit file is not frozen with credit reporting companies like Experian, TransUnion or Equifax.

After agreeing, within seconds, matches and preapproved offers based on your credit profile will appear.

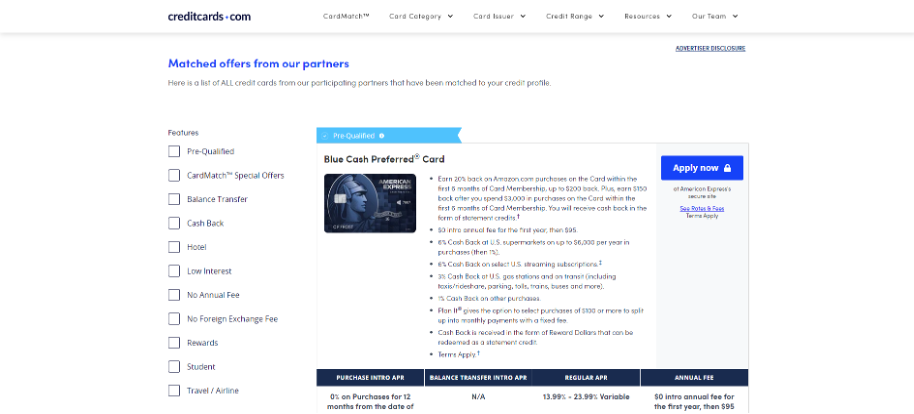

Having trouble sorting through your options? Navigate the cards and offers suggested through our unique features tab on the left-hand side of the screen, as shown below:

Select from different category options, including cards for low interest, balance transfer or hotel reward offers, for example.

If you find an offer you like, applying for the card is easy, and the CardMatch tool will redirect you to the card issuer’s application to submit.

Who should use the CardMatch tool?

Whether you decide to apply for a credit card or not, it’s important to know your options and understand what your goals are with a card. People who already have established credit may be focused on earning rewards on travel or dining. Meanwhile, others who want to start building a credit history may want to find a card with the lowest interest rates and minimal fees.

Either way, using the CardMatch tool is an ideal way to quickly compare your options, and it could potentially award you with limited time offers. Since it doesn’t harm your credit, you can check CardMatch on a regular basis to see if you score an offer that’s tempting.

Check your CardMatch offers regularly

You can check your matches frequently to see if card issuers will target you with specific preapproved offers and occasionally snag a targeted welcome bonus offer for a higher amount of points or cash back.

For instance, on July 1, 2021, we found offers for up to 150,000 Membership Rewards points (after $6,000 spend in the first six months) on American Express Platinum Card® and up to 75,000 Membership Rewards points (after $4,000 spend in the first three months) on the American Express® Gold Card.

Check out some of the best special offers we’ve been able to find on the platform, plus how to use it to your advantage.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.