Summary

You can finance purchases directly with Amazon, through an Amazon co-branded credit card or through a third-party tool or credit card, all while avoiding interest charges.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

If you’ve had your eye on a few big-ticket items from Amazon.com but would rather not cover the full cost upfront, you’re in luck.

Amazon supports a number of different payment plans and flexible payment options, whether you finance a purchase through the site itself, sign up for a co-branded Amazon credit card, use a third-party financing tool to keep interest charges low or take advantage of a 0% introductory APR offer.

Here’s everything you need to know about paying off Amazon purchases over time and, hopefully, avoiding interest along the way.

See related: Best credit cards for Amazon purchases

Guide to Amazon financing

Does Amazon offer payment plans?

Yes. While the terms are fairly rigid, Amazon offers payment plans on eligible items to qualifying customers. The site also partners with a number of credit card issuers – including Synchrony Bank, Chase and Citi – to offer flexible payment options to cardholders.

Typically, your best bet in terms of both flexibility and cost will be either Amazon’s own Monthly Payments program, 0% promotional financing with an Amazon credit card or a new 0% intro APR credit card.

Amazon Monthly Payments

Monthly Payments is a little-known installment payment tool available on select items for eligible Amazon customers. Billed by Amazon as a way to “Get it now, pay over time,” Monthly Payments allows you to split the cost of an eligible item sold and shipped by Amazon across five months with no interest or finance charges.

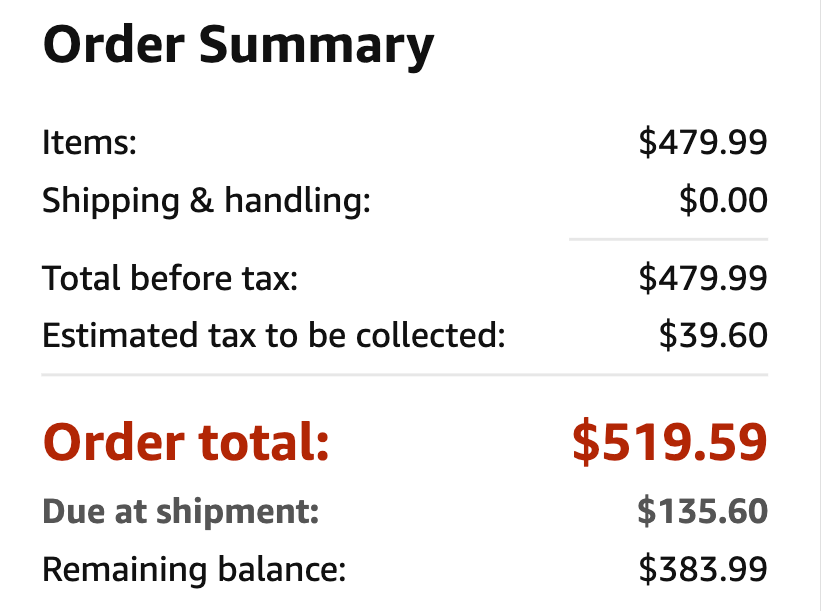

With Monthly Payments, the price of your item is divided into five equal installments, with your first payment due when your product ships – that’s 20% of the total price, plus any tax and shipping on the full price of the item. Every 30 days after that for the next four months, you’re charged the remaining balance in equal installments.

You can only use Monthly Payments for one qualifying product in each product category (such as electronics) or Amazon device family (such as Fire tablets and Kindle e-readers) in your cart at time of checkout, and you can only be enrolled in one monthly payment plan per product category.

Here’s a quick look at how Amazon Monthly Payments work, per Amazon’s terms and conditions:

| Payment | Due date |

| Initial payment (plus taxes and shipping) | Date of shipment |

| First payment | 30 days after shipping |

| Second payment | 60 days after shipping |

| Third payment | 90 days after shipping |

| Fourth payment | 120 days after shipping |

To get started with Amazon Monthly Payments, you’ll first need to check if your account is eligible. You can only use Monthly Payments if your Amazon account has been active for at least one year, you reside in the U.S. and you have a valid credit card tied to your Amazon account and a positive Amazon payment history.

Luckily, no credit check is required to determine your eligibility, so you won’t face the temporary credit score drop that comes from a hard pull of your credit report.

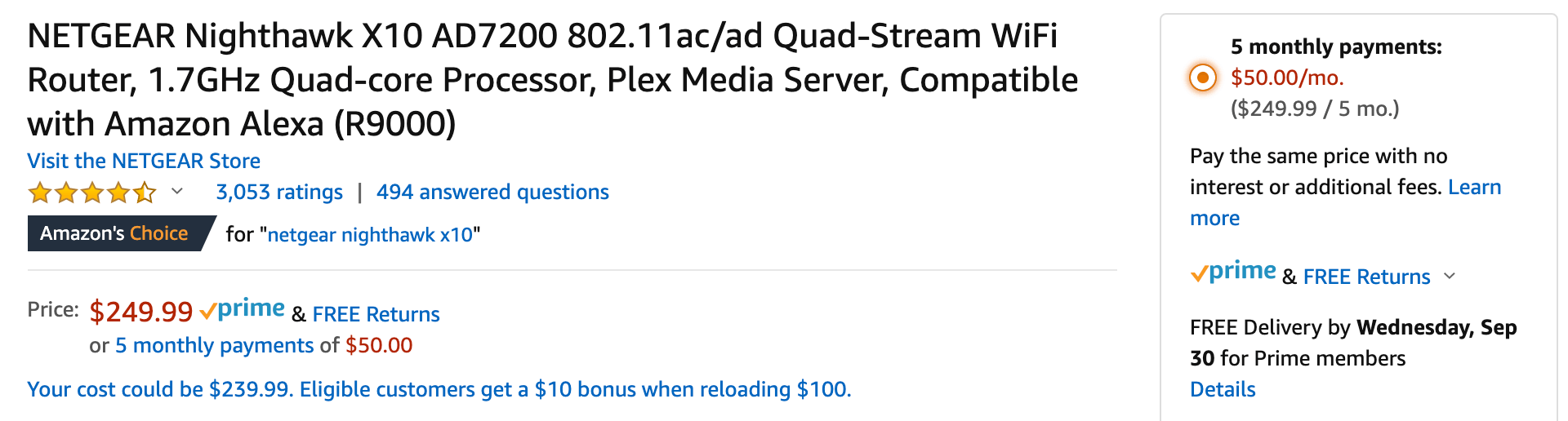

While qualifying for Monthly Payments is relatively straightforward, only certain items are eligible for an installment plan. To see if an item is eligible for financing through Monthly Payments, check for the “5 monthly payments” option on the product listing.

Here’s how to make monthly payments on Amazon, step-by-step:

- Enable monthly payments for your account. Once you’ve signed in and verified that your account is eligible for Monthly Payments, you’ll need to enable the feature. Visit the Monthly Payments page and click “Enable monthly payments.”

- Find an eligible product and select monthly payments. Products eligible for financing through Monthly Payments feature the text “or 5 monthly payments” below the standard price on the product listing. You can choose between “5 monthly payments” and “One-time payment” before you add an item to your cart.

- Pay your first month, plus taxes and shipping. At checkout, your Order Summary lists the total cost of your item, the amount you’ll be charged immediately and the remaining balance, which will be billed in equal installments over the next four months.

- Pay off your remaining balance over the next four months. Every 30 days, your card will be charged an equal portion of the remaining balance.

Amazon credit cards: Equal Pay vs. Special Financing

If your Amazon account or the item you have in mind doesn’t qualify for Monthly Payments, or if you think you’ll need more than five months to pay off your purchase, an Amazon credit card could be a good alternative. Not only do these cards carry exclusive financing offers, but they’ll also help you earn rewards on some of your regular Amazon purchases.

If go the new card route, you’ll choose from either the Amazon Store Card suite issued by Synchrony Bank – which includes the Amazon and Amazon Prime store credit cards, as well as the Amazon Prime Secured Card – or the Amazon Rewards Visa suite issued by Chase, which includes the Amazon Rewards Visa Signature Card* and the Amazon Prime Rewards Visa Signature Card*.

Depending on the card and the size of your purchase, you may be eligible to choose between two main types of financing for Amazon purchases: Equal Pay and Special Financing.

See related: Amazon store cards vs. Amazon Visa credit cards

Amazon Equal Pay financing

Equal Pay is similar to Monthly Payments, but offers much longer payment plans for large purchases – based on the size of your purchase.

This payoff period ranges from six to 24 months on the Amazon store card and from six to 18 months on the Amazon Visa cards. The latter cards also require a lower minimum purchase price to take advantage of a payment plan.

Equal Pay options on Amazon store cards from Synchrony include:

| Offer period | Minimum purchase |

| 6 months | $150 |

| 12 months | $600 |

| 24 months | $800 (select purchases only) |

On Chase cards, the following offers apply:

| Offer period | Minimum purchase |

| 6 months | $150 |

| 12 months | $250 |

| 18 months | $500 |

Like Monthly Payments, Equal Pay allows you to split the cost of your item equally across the offer period. As long as you make your installment payments on time and in full, you won’t be charged any interest or other fees.

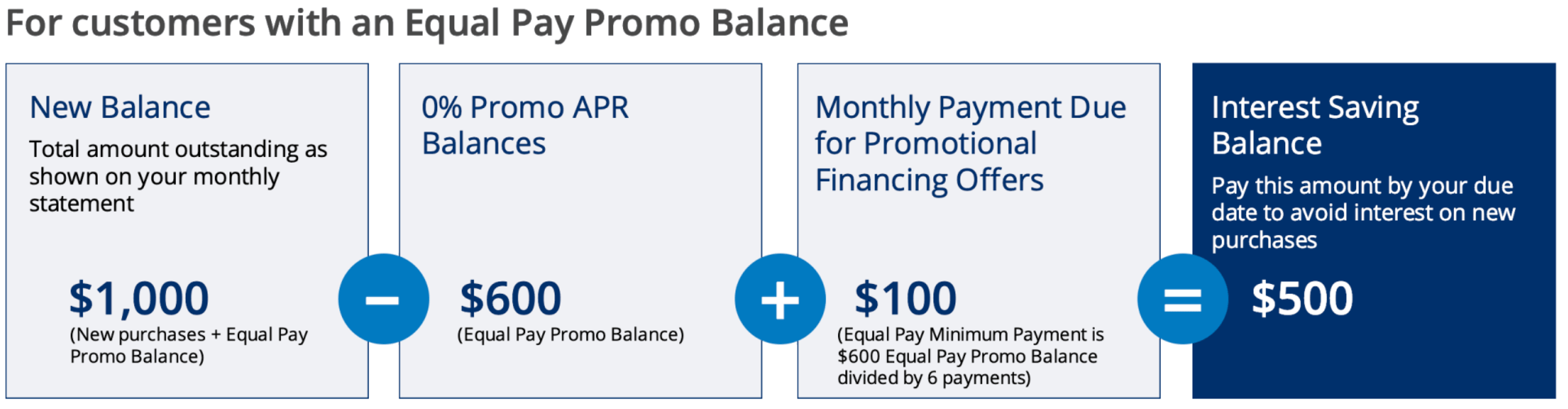

Instead of charging installments on a monthly basis, however, Equal Pay charges you for the total purchase amount when your item ships. Your required installment payment is then included as part of your minimum payment due each card statement period. This could get a bit confusing if you’ve used your Amazon credit card for new purchases in addition to an Equal Pay purchase.

Luckily, Chase makes it clear what you need to pay to avoid interest on new purchases by listing an “Interest Saving Balance” on your statement. Your Interest Saving Balance includes both the monthly payment due as part of your Equal Pay plan and any non-promotional balances you have. As long as you pay your Interest Saving Balance in full, you’ll avoid interest charges and be on track to pay off your Equal Pay purchase.

For example, if you used Equal Pay to split a $600 purchase across six months and also made $400 in other new purchases during a statement period, you’d have a total balance of $1,000. Your Interest Saving Balance, however, would be just $500 – that’s your $400 in new purchases, plus your $100 installment payment for the month.

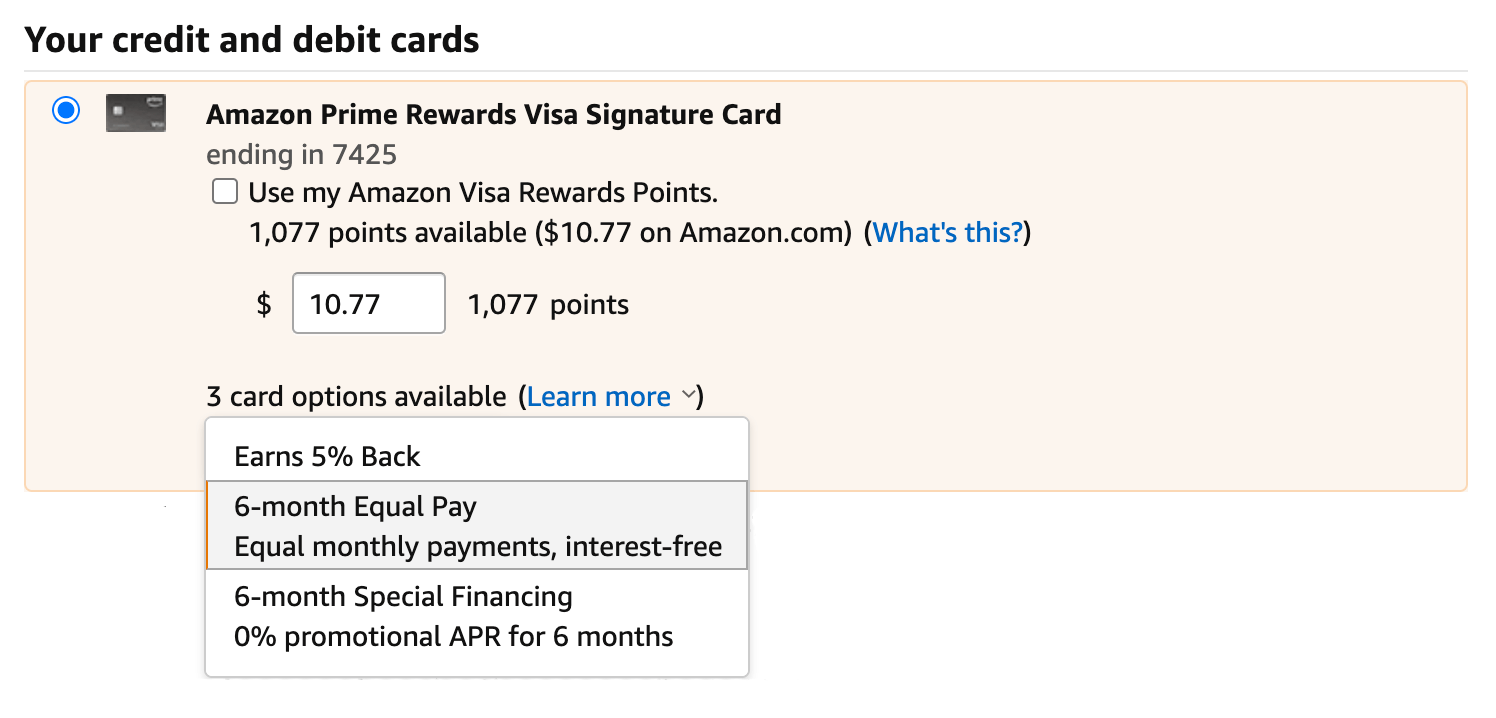

To take advantage of an Equal Pay offer on an Amazon credit card, add items to your cart as you normally would. Then, at checkout, choose your Amazon credit card as your payment method and select the Equal Pay option from the “card options” drop down list.

Unfortunately, you must choose between either financing or earning rewards on your Amazon card. If you opt for financing, you’ll miss out on any cash back you’d otherwise earn on Amazon purchases.

Amazon Special Financing

The other financing option on Amazon credit cards is called Special Financing. However, it’s not particularly “special” – it’s just the sort of deferred interest financing offer you’ll find available with many retailers and store credit cards.

With Amazon Special Financing, you get a promotional 0% APR for six to 24 months, depending on the size of your purchase. As long as you pay off your purchase in full by the end of the promotional period, you’ll avoid interest charges. Without set installment payments, how much you pay over the minimum is up to you, though if you pay only the minimum each month, you won’t pay off your balance in time.

Here’s how 0% promotional Special Financing breaks down by purchase size:

| Offer period | Minimum purchase |

| 6 months | $150 |

| 12 months | $600 |

| 24 months | $800 (select purchases only) |

Additionally, since Special Financing uses deferred interest, if you have even $1 remaining on your balance at the end of the promotional period, you’ll be charged interest going back all the way to the original purchase date.

Given the potentially high APR on Chase’s Amazon cards (14.24% to 22.24% variable) and the high APR guaranteed on Synchrony’s Amazon cards (25.99% variable), slipping up on a deferred interest financing offer could end up costing you a ton.

While marketing for Special Financing offers is more prominent on Synchrony’s Amazon cards, you may qualify for Special Financing with a Chase Amazon card as well. As with Equal Pay, simply choose your Amazon credit card as your payment method and select Special Financing from the “card options” drop down list.

Other Amazon financing options

While Amazon Monthly Payments or an Amazon credit card will likely offer the most flexibility, a number of other flexible payment tools may be a better fit for you. Keep in mind, however, that a few of these methods will require you to pay at least some interest.

Citi Flex Pay

Citi has partnered with Amazon to allow eligible Citi cardholders to finance Amazon purchases using Citi Flex Pay. This feature lets you split the cost of most Amazon purchases of more than $100 into equal monthly payments when you use an eligible Citi card as your payment method at checkout.

While you generally can’t avoid paying some interest with this option, the standard fixed promotional APR is quite low, and you may qualify for much a longer payment plan than you’d find in other financing plans.

Here’s a breakdown of standard Citi Flex Pay Amazon payment plans:

| Offer period | Minimum purchase | Promotional APR |

| 3 months | $100 | 6.74% |

| 6 months | $149 | 6.74% |

| 12 months | $300 | 6.74% |

| 18 or 24 months | $600 | 6.74% |

| 36 or 48 months | $1,200 | 8.74% |

As with Amazon’s Equal Pay and Special Financing offers, you can opt into Citi Flex Pay financing on a purchase by setting your Citi card as your payment method and selecting the monthly payment plan that works for you. Before you check out, you’ll see your payment plan displayed below your order total.

Pay It Plan It

A flexible payment tool available on select American Express credit cards, the “Plan It” portion of the Pay It Plan It program allows eligible cardholders to split purchases of more than $100 into monthly payments with a fixed fee. Payment plans run from three to 24 months and can be used for up to 10 eligible purchases at a time.

To use “Plan It” with an Amazon purchase, simply charge the full cost of the item to your eligible Amex card, then log in to your Amex account and choose the purchase that you want to pay over time. You’ll be offered one to three payment plans and can see how many payments you’ll make, the amount you must pay each month and the required fees.

New 0% intro APR card

A new credit card that offers a 0% introductory APR on purchases will allow you to carry a balance for several months and save on interest on all new purchases.

Two of your best options at the moment are the Blue Cash Preferred® Card from American Express and the Blue Cash Everyday® Card from American Express.

That’s because not only do both cards come with a 0% introductory APR on new purchases (the Blue Cash Everyday offers a 15-month 0% intro APR period, while the Blue Cash Preferred offers a 12-month 0% intro APR period, with both carrying a 13.99% to 23.99% variable APR after that), they also offer rewards on Amazon purchases as part of their welcome offer.

The Blue Cash Everyday and Blue Cash Preferred cards offer 20% back on Amazon.com purchases for your first six months as a cardholder, with a $150 and $200 cash back cap, respectively.

The Discover it® Cash Back card is another great choice. It comes with a 0% introductory APR on purchases for the first 15 months (11.99% to 22.99% variable APR after that) and the Discover cash back calendar for 2021 lists Amazon.com purchases as eligible for 5% cash back from October through December (upon enrollment, on up to $1,500 in spending, then 1%).

Bottom line

If you’re looking for payment flexibility as you browse Amazon, you have a ton of options to choose from, many of which will help you avoid interest charges for six months or more.

If you want to avoid opening a new credit card, Amazon Monthly Payments may be your best bet but if you need more time to chip away at the cost of a large purchase, an Amazon co-branded credit card or a new card with a 0% introductory APR on purchases may be worth the temporary credit ding that comes with a new application.

Whichever route you take, be sure you have a payoff plan in place before you check out. You’ll also want to keep a close eye on your balance and payment schedule to ensure you don’t end up drowning in fees or interest charges.

See related: Best credit cards for large purchases

*All information about the Amazon Rewards Visa Signature Card and Amazon Prime Rewards Visa Signature Card has been collected independently by CreditCards.com and has not been reviewed or approved by the issuer.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.