Summary

CardMatch can help you learn which card is right for you, as well as keep you informed about new offers and opportunities to earn rewards. Find out about current offers from American Express.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

Some of the offers below are no longer available and may be out of date.

Whether you’re new to the credit cards space or already own several cards, there are many reasons why CardMatch™is a great tool to find unique prequalified offers.

The tool presents personalized matches based off of your credit profile, all with no hard inquiry to your credit so there’s no impact to your credit score.

Not only do you get a prediction of your approval chances, you may even be targeted with higher introductory bonus offers, such as the The Platinum Card® from American Express’s current popular offer of up to 150,000 bonus points (after spending $6,000 in the first six months). Someone who loves traveling and taking advantage of several reward credits could snag this higher bonus, then use a large volume of points to cash in on some unforgettable vacations.

It’s worth making it a habit to stay up to date on CardMatch offers, since this is just one of several generous deals you might find on the platform. Note these may vary by person, but you will be able to find card suggestions and elevated offers all in one convenient place. Here’s a quick look at the selection of offers you might see right now.

150k bonus points with Amex Platinum offer and others on CardMatch

- What is CardMatch?

- Types of CardMatch offers

- Earn up to 150,000 points with the Amex Platinum

- Earn up to 75,000 points with the Amex Gold

- Earn $300 with Blue Cash Preferred

- Earn up to 150,000 points with Hilton Honors American Express Surpass Card

- Earn up to $150 cash back with the Amex Blue Cash Everyday

- Other offers on CardMatch

- Stay up to date with your CardMatch offers

What is CardMatch?

CardMatch is a service offered by CreditCards.com, designed to match users seeking credit cards with personalized offers for them. The platform combines prequalified credit card offers – which can help you predict your chance of approval – targeted introductory bonuses and suggested cards based on your credit profile.

Types of CardMatch offers

CardMatch is full of great offers, especially those from American Express. Most major card issuers – including Citi and Discover, also have offers featured.

There are several different kinds of matches you might see, from matched products to prequalified or preapproved offers – or even enhanced introductory bonuses.

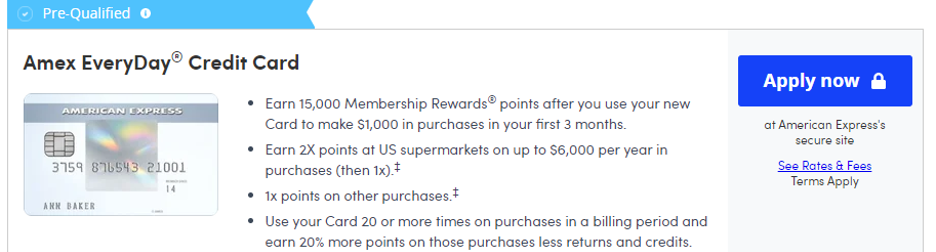

After you plug in all your personal information, you’ll see a list of offers tailored to your credit profile. You can tell what kind of offer it is by the ribbon at the top. It might be green or blue – or not have one at all.

A blue ribbon (as you can see below) indicates a prequalified offer, while a green ribbon indicates a preapproved offer. A preapproved offer gives you greater certainty of approval than a prequalified offer, thanks to more thorough evaluation of your qualifications. Neither kind of offer will impact your credit score.

Right now, American Express is the only issuer offering both prequalified and preapproved promotions in CardMatch. Read more about the difference between prequalified and preapproved.

One other thing to look out for on your matches is the phrase “special offer”. This can appear on either green or blue ribbons, and signals that the introductory bonus featured is enhanced in some way. That might mean more bonus points, a longer period to meet spend requirements or more, depending on the particular offer.

These promotions make it worth it to check CardMatch regularly and see if you’re targeted. Read on for a preview of the offers available as of the time of writing. (Note that the following offers may change at any time and may not be available to all users.)

Earn up to 150,000 points with the Amex Platinum

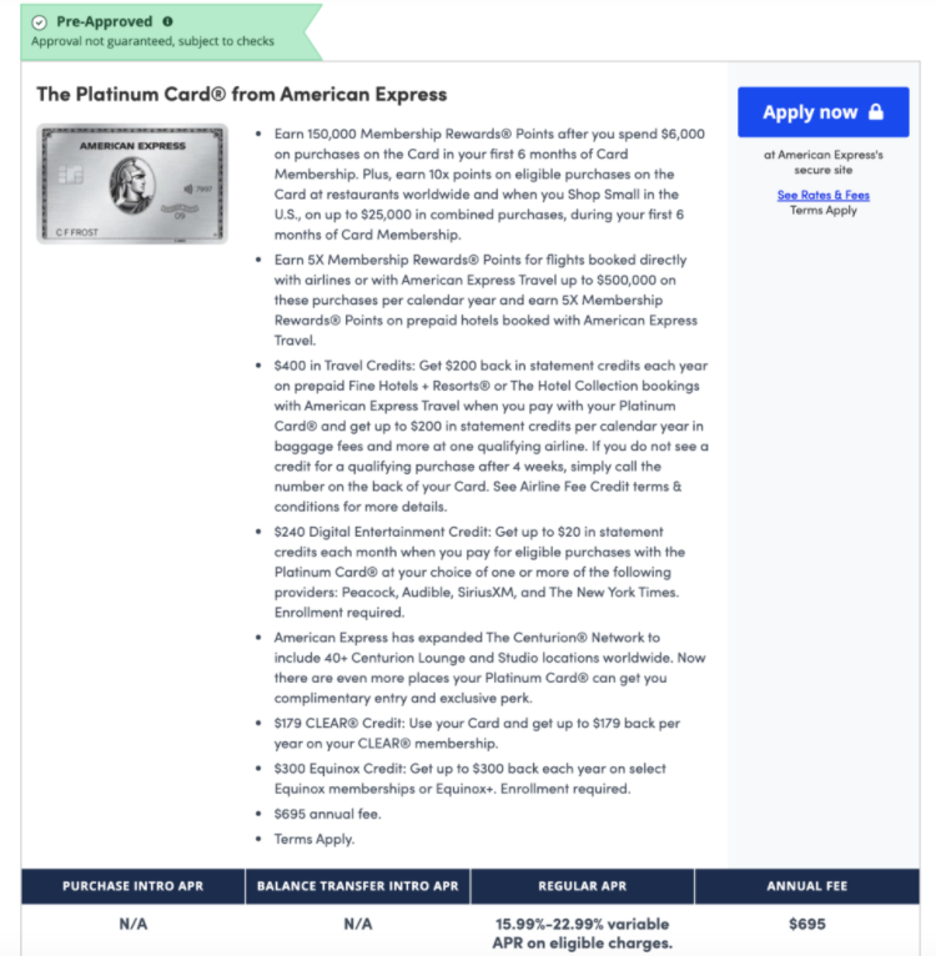

Perhaps the most exciting offer we’ve found on CardMatch is for the Amex Platinum card. This luxury card offering is a fan favorite of frequent travelers, thanks to its valuable rewards currency, Membership Rewards. It is definitely pricey, with a $695 annual fee, but a good bonus and maximizing all the rewards offered can help offset some of that cost and leave you with a good amount left to spend.

Taking full advantage of benefits and perks that alone are worth more than $1,400 leaves you with a little more than $700 in value after offsetting the annual fee. The card can easily pay for itself and could be the right fit for you depending on your spending habits. We’ve seen multiple different targeted offers for the Amex Platinum on CardMatch (as of July 1, 2021) that include elevated introductory bonuses for new cardholders.

Typically, the Amex Platinum offers 100,000 points if you spend $6,000 in the first six months. But with the special targeted offer above, you can score 150,000 points for spending $6,000 in the first six months. Plus, you’ll earn 10 points per dollar on eligible purchases at restaurants worldwide and when you Shop Small in the U.S. (up to $25,000 in combined purchases) during your first six months with the card.

Additionally, on July 15, 2021, we found an increased preapproved offer for the Amex Platinum: 150,000 points if you spend $6,000 in the first six months with the same 10-point boost on restaurant and Shop Small purchases as indicated above. Remember, preapproved offers signal the best approval chances on CardMatch without a hard inquiry.

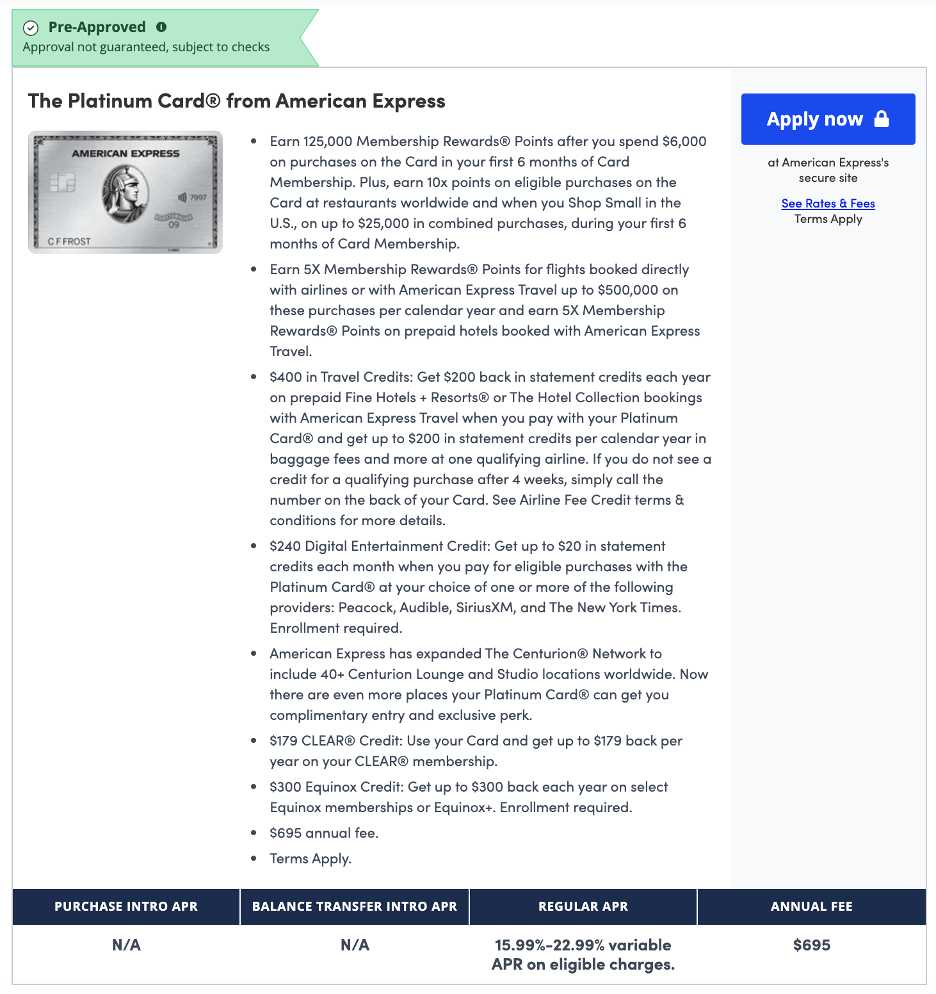

Don’t worry if you don’t get targeted with the 150,000 points offer. You may still be targeted with a higher offer like the one below, where you can earn 125,000 points after meeting the same six-month spending requirement.

See related: American Express Gold card vs. American Express Platinum card

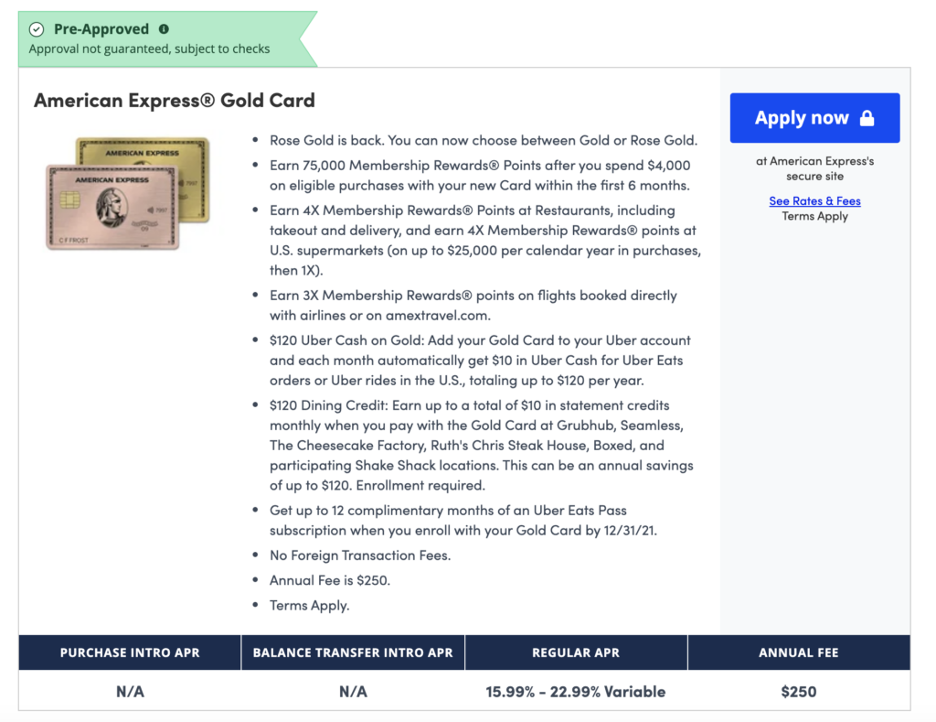

Earn up to 75,000 points with the Amex Gold

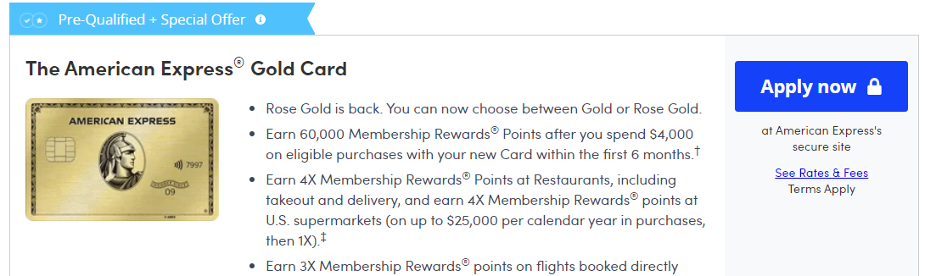

Like with the Amex Platinum offer, you might not get this same bonus when you check your CardMatch offers. But we found a great deal on the American Express® Gold Card on July 1, 2021.

This introductory bonus offers 75,000 points for spending $4,000 in the first three months, an additional 15,000 points from the standard offer.

As of July 15, 2021, we also identified a similar preapproved offer.

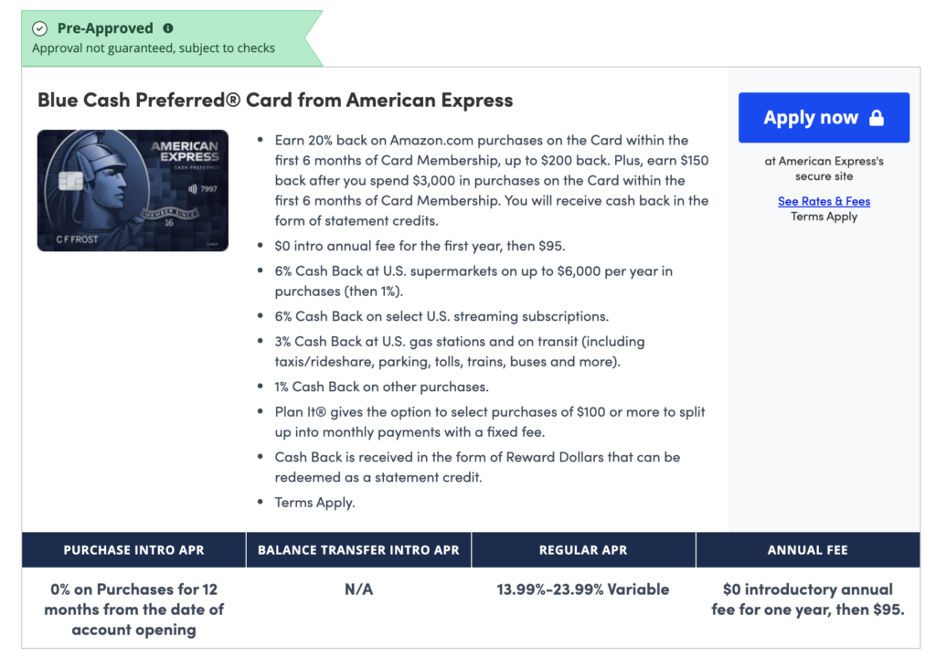

Earn $300 with the Blue Cash Preferred® Card from American Express

On July 1, 2021, we also came across this offer on the Blue Cash Preferred® Card from American Express: $300 in statement credits after you spend $3,000 in purchases within the first six months.

Another preapproved offer, identified on July 15, 2021, enables users earn up to $150 cash back after spending the same $3,000 in purchases within the first six months. And on top of that, users can earn 20% back on Amazon.com purchases made in the first six months (capped at $200 back).

As with other offers on CardMatch, exact terms may vary.

Earn up to 150,000 points with Hilton Honors American Express Surpass® Card

Avid travelers might find some excellent offers on CardMatch as well. As of July 1, 2021, the 150,000-point bonus offer for spending $3,000 within the first three months on the Hilton Honors American Express Surpass® Card was still available on CardMatch.

Current Surpass offer: 130,000 Hilton Honors points if you spend $2,000 in eligible purchases within the first 3 months of card membership. Plus, you can earn an additional 50,000 points after you spend a total of $10,000 in purchases in the first 6 months.

See related: Hilton Honors rewards program guide

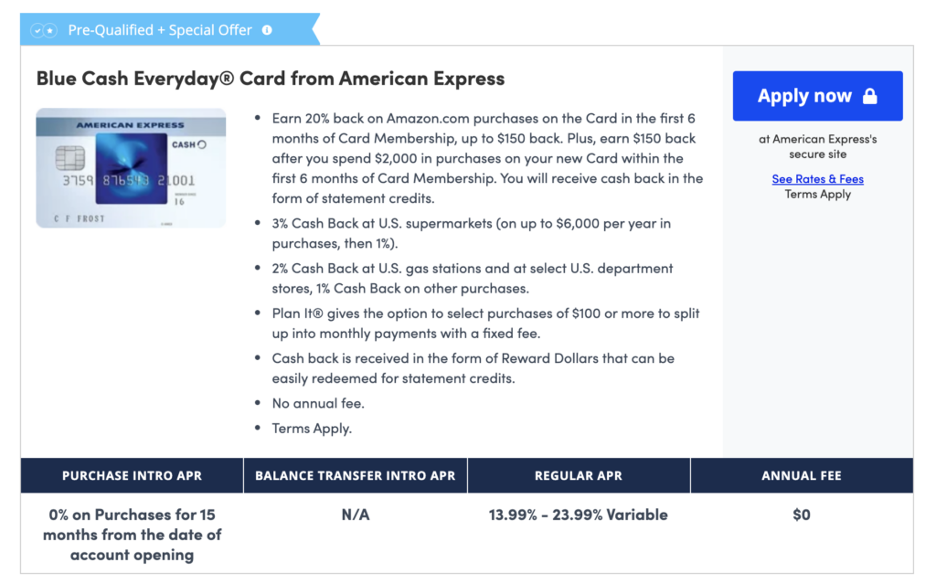

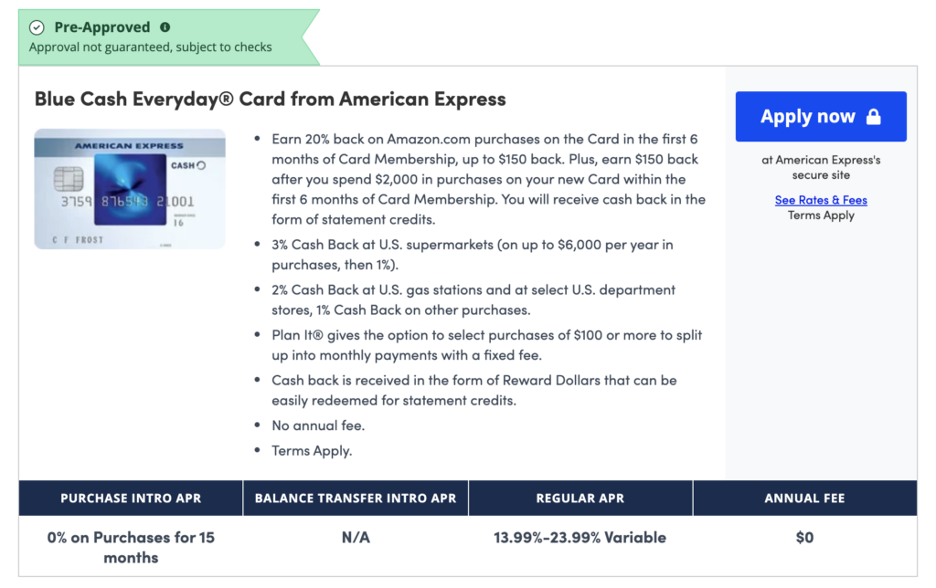

Earn up to $150 cash back with the Blue Cash Everyday® Card from American Express

For those who like to earn cash back on frequent grocery and gas purchases, the Blue Cash Everyday card from Amex has a special prequalified offer, as of July 15, 2021.

Within the first six months of card membership you can earn up to $150 cash back (in the form of statement credits) after spending $2,000. You’ll also earn 20% back on Amazon.com purchases in the first six months (capped at $150 back).

Below is a preapproved offer from the same date:

Other offers on CardMatch

While these are some of the more valuable offers we’ve found on the platform lately, they are just a selection of the great deals you can find.

It’s important to note that CardMatch combines both prequalified and preapproved credit card offers with matches tailored to you. Not all the cards listed will be prequalified. Make sure you see a “prequalified” or “preapproved” flag before assuming it’s a certain kind of offer.

Stay current with your CardMatch offers

We’ll continue to update this story with some of the best special bonuses available through CardMatch, but you should check back regularly to see if there is a good deal for you without any impact to your credit score.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.