Summary

The new no annual fee X1 Card is targeting Gen-Z, but it can be a great choice for any consumer – if it lives up to its potential.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

Back in 2018, Discover conducted a survey that found young Generation Z adults, age 18 to 21, were the least likely to be earning and redeeming credit card rewards, with 40% saying they earned none.

It’s fair to assume that this trend might have begun to shift in the last two years with more “Zoomers” entering the workforce. But now that the COVID-19 pandemic has changed the way consumers spend money, some may wonder whether expensive rewards credit cards are worth it. Not to mention, a credit card may be harder to get approved for during the economic turndown.

Younger consumers with less established credit histories are likely to find it especially hard to qualify for rewards credit cards, which typically require a good to excellent credit score.

Enter X1 Card, a new credit card product advertised as “reimagined for a new generation.” The card has now officially launched and is available to the public, starting with its waitlist of 350,000 people.

The X1 Card, originally unveiled in 2020, promises smart technology, an unparalleled rewards program, higher limits, lower interest rates and no annual fees. Considering the card requires only a soft pull, it can be an excellent offer for the younger generation – and beyond.

What the X1 Card offers

The X1 Card, a Visa Signature partner, is designed by a company co-founded by Twitter alums Deepak Rao and Siddarth Batra. It’s backed by PayPal co-founder Max Levchin and founding COO David Sacks, Libra co-creator and Instagram’s former head of product Kevin Weil and more.

With such big names in tech behind it, it seems like the X1 Card is destined to be unique and innovative – and its offerings don’t disappoint.

Rewards on every purchase

The X1 Card gives points for every single purchase, and the rewards rate is rather competitive, especially considering the card comes with no annual fee.

The card earns:

- 2 points per dollar on all purchases

- 3 points per dollar on all purchases for the year if you spend $15,000 on the card in that year

- 4 points per dollar on all purchases for a month for every friend you refer. If you bring in 10 friends, for example, you’ll get 4 points per dollar on every single purchase for 10 months.

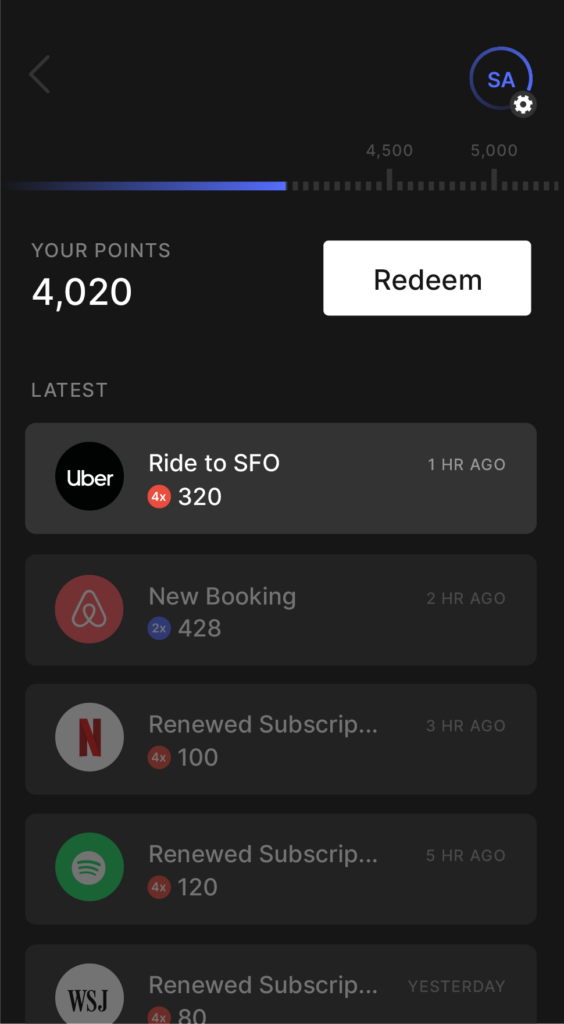

You can redeem points for purchases at a 1-cent-per-point rate at more than 100 top brands – including Apple, Airbnb, Asos, Casper, Crate & Barrel, Glossier, Nike, Patagonia, Peloton, REI, Sephora, Supreme, Wayfair and more. You can also redeem for cash back but at a lower rate of 0.7 cents per point.

Courtesy of X1 Card

“This actually sounds quite good,” said Ted Rossman, senior industry analyst at CreditCards.com. “The main catch I see is that you need to redeem points for purchases made at specific merchants. So, they’re not as flexible as statement credits or airline/hotel transfers. The list of supported merchants is impressive and varied, though.”

According to Rossman, if you spend at least $15,000 per year on the card or refer friends, it’s hard to beat these rewards earnings of 3% to 4% back – assuming you’re fine with redeeming with the participating merchants.

“If you get the standard 2% cash back ratio, that’s still good, but in line with other cards like Citi® Double Cash Card (which earns 1% when you make a purchase and another 1% when you pay off the purchase), the PayPal Cash Back Mastercard and the Fidelity Rewards Visa Signature card. It’s easier to redeem on those cards.”

Higher limits, lower interest rates and fees

By looking at current and future income instead of credit score, the X1 Card can set smart credit limits advertised to be up to five times higher than traditional credit cards. The card also offers automatic credit line increases as cardholders advance in their careers. The higher limit gives cardholders the opportunity to have a lower credit utilization ratio, allowing them to increase their credit score faster.

Besides having no annual fee, the X1 Card charges no late fees or foreign transaction fees and offers comparatively low interest rates. Its APR ranges from 12.9% to 19.9%, and it has a balance transfer fee of 2%.

“X1 Card reminds me of the Petal® Visa® Credit Card and TomoCredit, both of which target young adults and practice cash flow underwriting, going beyond the credit score to examine your financial picture in more detail,” Rossman said.

“This is good for people who are just getting started and may not have much credit information on file, but maintain responsible habits like paying bills on time (even if they’re not credit, like cell phones and streaming services) and spending less than you earn.”

Smart digital features for better shopping

Generation Z are digital natives, and as such will appreciate smart features that come with the X1 Card. For instance, it uses proprietary smart technology that lets cardholders cancel subscription payments in one click, end free trials automatically with auto-expiring virtual credit cards, get instant notifications on refunds, attach receipts to purchases and split the check seamlessly. Cardholders will also be able to shop anonymously with incognito mode.

A sleek metal design

Finally, the X1 Card is simply a pleasure to look at and hold. It’s made with 17 grams of sleek, stainless steel, giving it a modern look. As metal cards are generally associated with high-end credit card products, this is a nice touch.

Courtesy of X1 Card

Should you apply?

“This is a strong offer. I’m intrigued, and I’m probably 10 to 15 years older than most of their target demographic!” Rossman shared. “It almost sounds too good to be true. Not to be too much of a skeptic, but I do wonder how sustainable these rewards will be.”

Indeed, since the X1 Card is a new product, certain questions come to mind. Can the company afford to give 2%, 3% or 4% cash back long-term? And when will the card be widely available to those not on the waitlist?

Still, if the card lives up to its promise, it’s an excellent offer for people establishing credit and interested in earning credit card rewards. Moreover, the X1 Card has a lot to offer even to consumers with higher credit scores.

“Overall… I’m impressed,” Rossman said. “They’re acting like their target audience is people just getting started, but I see appeal well beyond that. Low fees, higher credit limits and easy subscription cancellations are nice benefits even beyond rewards.”

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.