| Cash Back Rating: | 4.5 / 5 |

In a Nutshell:

This card offers one of the best cash back rates on dining and entertainment purchases combined, but it’s not the best option for some cardholders due to its $95 annual fee.

The legacy Capital One Savor Cash Rewards Credit Card is no longer available on CreditCards.com and the offer details may be outdated. This card is no longer accepting new applications.

*All information about the Capital One Savor Cash Rewards Credit Card has been collected independently by CreditCards.com and has not been reviewed by the issuer. Capital One Savor Credit Card is no longer available through CreditCards.com.

Rewards Rate

|  |

Sign-up Bonus |  |

Annual Bonus |  |

Annual Fee |  |

Average Yearly Rewards Value ($1,325 monthly spend) |  |

APR |  |

Rewards redemption

Cons

|  |

Capital One Customer Service Ratings

|  |

Other Notable Features: No foreign transaction fees, $0 fraud liability on unauthorized charges, extended warranty, complimentary concierge services, price protection, car rental insurance, roadside assistance, premium experiences in dining and entertainment

| Find card offers for you: This card is not currently available on CreditCards.com, but you can still find a great card offer for you! Our CardMatch tool can help match you with prequalified offers and cards that align with your credit history – with no harm to your credit score. Get personalized offers from our partners in seconds. |

Capital One Savor Cash Rewards Credit Card Review: More Details

Designed with foodies in mind, the Capital One Savor Cash Rewards card comes with a generous earning rate on both dining and grocery store purchases – making it a great choice whether you prefer dining out or eating in. Plus, it comes with one of the highest rates of cash back on entertainment purchases, including a generous 8% on Vivid Seats ticket purchases.

On the downside, it comes with a high annual fee – putting it out of reach for some spenders. You’ll have to spend a decent amount on eating out each year to offset the cost with other benefits.

Here we cover:

Earning rate

The Capital One Savor card comes with a generous earning rate – especially if you spend a big portion of your budget on dining and entertainment. Cardholders earn 8% cash back on tickets purchased through Vivid Seats, 4% on dining, entertainment and popular streaming services purchases, 3% on grocery store purchases (excluding superstores like Walmart® and Target®) and 1% on other purchases. This is one of the best rates available among rewards cards on both dining and entertainment purchases.

See Related: Capital One Savor cards compete with top grocery cards

What counts as “entertainment” on the Savor card?

This card’s dining and grocery store bonus categories are pretty clear-cut, but at a glance the “entertainment” category may seem a bit unclear. Luckily, Capital One spells out clearly what counts as an entertainment purchase for the Savor card, defining it as any of the following purchases:

- Movie and theater tickets

- Concert tickets

- Record stores

- Video rentals (excluding digital streaming and subscription services)

- Tourist attractions

- Amusement parks

- Aquariums and zoos

- Dance hall, billiard and pool establishments

- Bowling alleys

- Live sporting events

How does the Savor one’s rate compare to that of other rewards cards?

When compared to other rewards cards, the Savor earns a high rate on every dollar you spend. In fact, when we compared it to rewards cards that also offer rewards on dining or entertainment, it had one of the highest rewards values per dollar spent (factoring in average earning rate and point value). (Note: To calculate the average earning rate we estimated both category and overall spend based on information from the Bureau of Labor Statistics.)

See related: Best fixed bonus category cash back cards

Sign-up bonus

The Capital One Savor sign-up bonus is an eye-catching feature – $300 if you spend $3,000 in the first three months. This is one of the highest flat cash back bonuses you can get on a cash back card and a nice extra for new cardholders.

Unfortunately, this is not the highest offer the card has ever had. When the Savor card initially updated its rewards scheme, cardholders could earn a $500 bonus. However, the $300 is still competitive — especially among cash back cards.

Redeeming cash back

Once you’ve racked up some cash back with your Savor card, redemption is simple. Your cash back never expires, and you can redeem any amount at any time. Whether you prefer a statement credit, check or gift card, cashing in your rewards is straightforward.

You can also set up automatic redemption by check or statement credit at a certain time each year or thresholds starting at $25.

Other benefits

The Savor is a Mastercard World Elite credit card, meaning it comes with a slew of extra perks that can save you money while shopping or traveling. Here’s a quick look at a few of the most valuable extras:

- Cellphone insurance – If you charge your cellphone bill to your card, you can be covered up to $800 in the case of damage or theft (with a $50 deductible).

- Lyft credits – If you take five rides in a calendar month, you’ll receive a $10 credit for your next Lyft ride (max one per month).

- No foreign transaction fee – Less common among cash back cards, the Savor does not charge an additional fee on foreign transactions.

- Extended warranty – Double the length of the original manufacturer’s warranty on qualifying purchases with warranties of 24 months or less.

- Price protection – For items purchased on your Savor card, if you find a lower price within 120 days you can be reimbursed for the difference.

- Car rental insurance – When you book and pay for a car rental with the Savor, you can receive secondary coverage in the case of damage or theft.

All of these perks add to the value of the card and make it a great choice for frequent shoppers and travelers. To take full advantage of the card’s benefits, be sure to put all major purchases on your Savor card.

Approval odds

The Capital One Savor is designed for users with good to excellent credit (above 670), so you’ll want to ensure you meet those qualifications before you apply. If you are worried about being approved and want to avoid a hard pull on your credit, you can take advantage of tools like CardMatch™ to see if you pre-qualify for the offer.

Capital One also limits the number of cards you can have open at a time, so if you already have five or more open credit cards with the bank, you might not be eligible for this card. Additionally, you cannot apply for a Capital One credit card more than twice in a 30-day period.

Customer service

Capital One has a decent customer service reputation, but not a great one. In J.D. Power’s 2020 customer satisfaction survey, the bank scored 808, ranking fifth out of 11 major card issuers. While the bank offers 24/7 customer service and an online chat feature, you may have to do some digging on the website to locate the chat.

The Capital One app does rank well among users, however, rating 4.8 out of 5 in the Google Play Store and 4.7 out of 5 in the Apple App Store.

How does the Savor card compare to other dining cards?

The Capital One Savor offers a generous sign-up bonus and one of the best rates of cash back available on dining purchases. However, depending on the other benefits you want to get out of your card, another dining card might make more sense for you. Here are a few of our most popular alternatives:

|  |  |

Rewards rate

| Rewards rate

| Rewards rate

|

| Sign-up bonus | Welcome bonus | Welcome bonus |

Annual fee

| Annual fee

| Annual fee

|

Other things to know

| Other things to know

| Other things to know

|

Bank of America Customized Cash Rewards credit card

A popular choose your bonus category rewards card, the Bank of America Customized Cash Rewards credit card now offers 6% cash back for the first year in the category of your choice: gas and EV charging stations; online shopping, including cable, internet, phone plans and streaming; dining; travel; drug stores and pharmacies; or home improvement and furnishings. You’ll automatically earn 2% cash back at grocery stores and wholesale clubs, and unlimited 1% cash back on all other purchases. After the first year from account opening, you’ll earn 3% cash back on purchases in your choice category.

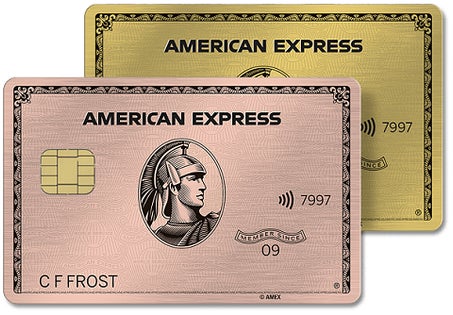

American Express Gold Card

If you want to earn a generous rewards rate on both worldwide restaurants and U.S. supermarket purchases, the American Express Gold Card offers one of the best combined rates you can get on these purchases. Cardholders earn 4 points per dollar on worldwide restaurant purchases (up to $50,000 in purchases per calendar year, then 1 point per dollar), 4 points per dollar on U.S. supermarket purchases (up to $25,000 in purchases per calendar year, then 1 point per dollar), 3 points per dollar on directly purchased airfare or flights booked through AmexTravel.com and 1 point per dollar on general purchases.

On top of one of the best rewards rates available for foodies, the Amex Gold card offers several perks for frequent travelers. On the downside, the card comes with a high $325 annual fee.

Chase Sapphire Reserve

Though the Chase Sapphire Reserve has a lower rate on dining purchases than the Capital One Savor, it is a great choice for frequent travelers who also want to earn dining rewards. It is packed with travel benefits, including a flexible $300 travel credit every year. While its high $795 annual fee can be a deterrent for some, cardholders who utilize the card’s credits and perks can easily offset this cost.

Who should get the Capital One Savor card?

- Cardholders who spend a lot on dining and entertainment purchases.

- Users who frequently use Vivid Seats to purchase tickets.

- Cardholders looking for a generous sign-up bonus.

- Cardholders who prefer cash back over points or miles.

How to use the Capital One Savor card:

- Use the card for all dining, entertainment and grocery store purchases.

- Spend at least $3,000 in the first three months to earn the sign-up bonus.

Is the Capital One Savor card worth it?

If you spend heavily on dining, entertainment and grocery store purchases, the Savor card is one of the most rewarding cash back options available. Plus, it comes with a generous introductory bonus unmatched by any other cash back card. However, more moderate spenders might be better off opting for a no annual fee alternative.

See related: Capital One Savor cards compete with top grocery cards

For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

*All information about the Bank of America® Customized Cash Rewards credit card has been collected independently by CreditCards.com and has not been reviewed by the issuer.

Our reviews and best card recommendations are based on an objective rating process and are not driven by advertising dollars. However, we do receive compensation when you click on links to products from our partners. Learn more about our advertising policy

All reviews are prepared by CreditCards.com staff. Opinions expressed therein are solely those of the reviewer and have not been reviewed or approved by any advertiser. The information, including card rates and fees, presented in the review is accurate as of the date of the review. Check the data at the top of this page and the bank’s website for the most current information.

Responses to comments in the discussion section below are not provided, reviewed, approved, endorsed or commissioned by our financial partners. It is not our partner’s responsibility to ensure all posts or questions are answered.