Summary

Despite what you might think, a higher credit limit could be within your reach. If you have an American Express card, a bigger credit line can be just a short phone call or web form away.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

Requesting a higher credit limit on your credit cards has a lot of potential benefits – from improving your credit utilization ratio to giving you the flexibility to pay off a big purchase. As long as you avoid taking on purchases you can’t pay off in full, a higher credit limit can be an incredible tool.

Despite what you might think, a higher credit limit could be within your reach.

If you have a credit card with American Express, requesting a credit line increase is incredibly simple. Read on to learn more about the process and what to expect.

Requesting a higher credit limit with American Express: Things to know

Eligibility requirements

American Express does not have any public requirements for credit limit increase eligibility, but you should keep a few things in mind. Granting a bigger credit line requires a lot of trust in a credit card holder, so you are more likely to qualify if the following are true:

- You’ve had your card open for at least 60 days.

- You have a positive history of on-time payments and responsible card use.

- You haven’t requested a credit limit increase in the last six months.

If you’ve demonstrated that you can use your American Express card responsibly, making on-time payments for an extended account period, it signals to the issuer that you can take on a higher limit. Cardholders who overextend themselves and don’t pay on time won’t get as much trust from the issuer.

In the same vein, you don’t want to seem greedy when requesting a bigger credit line. Avoid making several requests in a short period of time or requesting an additional increase just a few months after you’ve gotten one.

Finally, you are more likely to be approved for a higher credit limit if your circumstances have changed since your last evaluation. Say, for instance, you’ve gotten a raise since you initially applied for a card – boosting your annual income. Or, you want to transfer a balance that wasn’t initially in your plan. Either way, you have a stronger argument for a higher limit if you have a reason to justify it.

Before you request a credit limit increase

Requesting a credit limit increase is easy, but you can make the process even simpler by getting all necessary information together before you make the call.

First, you should calculate what credit limit you want to shoot for. It is important not to ask for an unreasonable credit limit, but don’t undersell yourself either. While it is unlikely you’ll get bumped up to 10 times your limit, there are plenty of reports online of Amex cardholders having their credit lines doubled – or even tripled. Just make sure that you can manage your new limit responsibly, and don’t ask for more than you can feasibly pay off.

See Related: 6 things to know before requesting a credit-line increase

It’s also a good idea to understand your credit standing and why you are a sound investment. Know your credit score, annual income and other factors that make you a good candidate for a high credit limit. It might be a good idea to pull your credit report and see just how you look to lenders.

Often, the first question you’ll get after requesting a higher credit limit is why you need one. Make sure you have a good answer to this question – if Amex suspects you want more credit just to overextend your spending, it’s unlikely they’ll approve the query.

There are plenty of good answers to this question, so ask yourself why you want the bigger line. Has your income changed, improving your creditworthiness? Do you want to use your card to pay off a large purchase over time? Write down your response to this question before you make the request.

Finally, if you’ve been making only minimum payments on your card or carrying a hefty balance, it might be a good idea to switch up your strategy. American Express will want to see that you can responsibly make higher payments before giving you more credit to work with.

Process for requesting a credit limit increase

Once you have your credit score, income and other information gathered, you are ready to request a higher credit limit. With American Express, there are a few different avenues you can try.

Automatic credit line increase

In some circumstances, American Express might boost your credit line without provocation. The issuer keeps close tabs on your account and might extend a higher limit just for using your card responsibly. There is no designated timeline for this process – and it won’t happen for every cardholder – but you should watch your account just in case.

Requesting a higher limit online

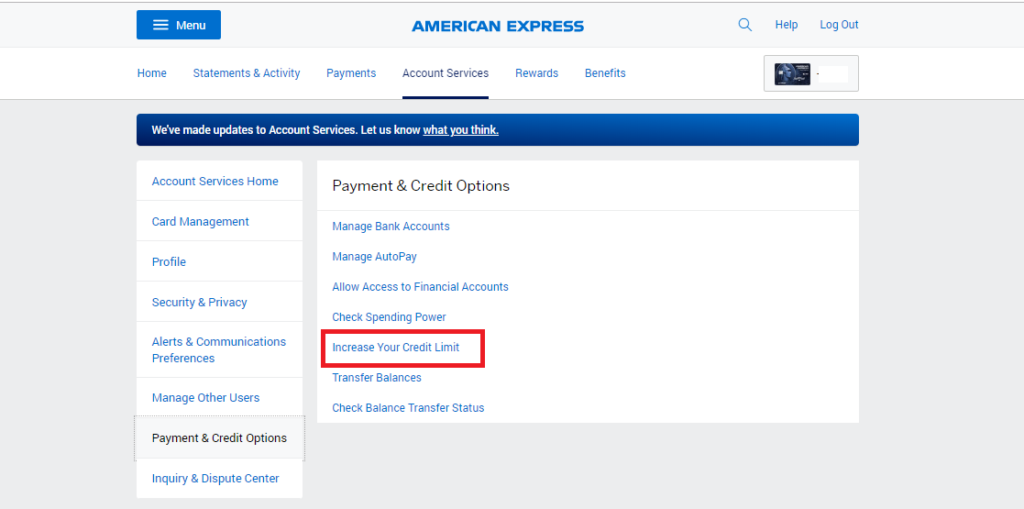

Perhaps the easiest way to request a higher credit limit on an Amex card is online. When you log in to your account, you can access the request form under “Payment and Credit Options.”

You’ll be prompted to enter information including your new, desired credit limit and current annual income. I tested the portal and got an immediate decision, but you might be required to wait for official notice.

Calling customer service

The final way to ask for a higher credit line is to call the customer service number listed on the back of your American Express card. Ask to be connected to a representative to talk about an increase, and then offer up all the information you’ve collected about the limit you want and reasons why you need it.

By most accounts, American Express does not do a hard pull to offer you a higher credit line. That means you don’t have to worry about a negative effect to your credit score – whether or not your request is approved. Nevertheless, if you are worried about keeping your credit pristine, it is a good idea to confirm with the customer service representative that there is only a soft pull.

If your credit limit increase is denied, don’t worry

American Express seems to be one of the more generous issuers when it comes to offering a higher credit limit, but it is always possible that your request will be denied. If this is the case, ask why you didn’t receive the boost so you can improve your chances down the line.

You can also follow these steps to better your standing for your next request:

- Improve your credit history steadily by paying bills on time and reducing your credit utilization.

- Use your card more regularly. American Express might be less inclined to give you a higher limit on a card you rarely use.

- Update your income on the American Express website.

- Consider asking during a different time of year. A 2018 TransUnion study showed credit limit increases are more common between January and May.

- Consider applying for a new credit card. Sometimes applying for a new card is the best way to increase your overall credit limit because it can increase the total amount of credit available to you.

Pros and cons of a higher credit limit

Before you decide if you should try to boost your credit line with American Express, consider these pros and cons:

Pros

- You can lower credit utilization and potentially boost your credit score.

- You’ll have more flexibility to pay off larger purchases.

- You can earn more rewards on more spending.

- There is no hard pull to your credit.

Cons

- A higher credit line might tempt you into spending more than you can afford to pay off.

- You might not be approved for as high of a limit on new credit card applications if you already have a lot available to you.

Bottom line

If you have an American Express card, a higher credit limit can be just a short phone call or web form away. As long as you are armed with information proving your creditworthiness and a good reason for a bigger credit line, requesting one is incredibly easy.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.