| Rewards Rating: | 4.8 / 5 |

| Rewards Value: | 4.8 |

| Annual Percentage Rate: | 1.0 |

| Rewards Flexibility: | 5.0 |

| Features: | 3.0 |

| Issuer Customer Experience: | 4.0 |

In a Nutshell:

The Chase Sapphire Preferred Card offers valuable rewards for frequent travelers, as well as the potential for savvy rewards card users to glean some extra value out of their rewards.

Rewards Rate

|  |

Sign-up Bonus

|  |

Annual Bonus

|  |

Annual Fee |  |

APR 19.24% - 27.49% Variable |  |

Chase Customer Service Ratings

|  |

Other Notable Features: Earn 5X points on Lyft purchases (expires Sept. 30, 2027), 5X points on Peloton equipment and accessory purchases over $150 on up to 25,000 points (expires Dec. 31, 2027), No foreign transaction fee, trip cancellation/interruption insurance, auto rental collision damage waiver, baggage delay insurance, trip delay insurance, roadside dispatch, lost luggage reimbursement, travel and emergency assistance, travel accident insurance, VIP events and experiences, free DashPass subscription for one year (activate by Dec. 31, 2027)

If you are a frequent traveler, the Chase Sapphire Preferred is one of the best travel credit cards of its class. A flashy metal card design, lucrative rewards rate, and flexible redemption options make it a powerhouse for long-term value.

What are the pros and cons?

Pros

- Low annual fee given its strength

- Potent sign-up bonus

- No foreign transaction fees

- Can combine points from other Chase Ultimate Rewards cards

- $50 annual Chase Travel hotel credit

Cons

- No free checked bags

- No airport lounge access

- Somewhat complex rewards system

Why you might want the Chase Sapphire Preferred

The Chase Sapphire Preferred is one of the best travel credit cards out there. It offers a solid sign-up bonus, decent perks, rewards for ongoing spending and earns valuable Chase Travel℠ points. Here are a few reasons you might consider signing up for the Sapphire Preferred card.

Noteworthy sign-up bonus

The Chase Sapphire Preferred offers 75,000 bonus points after $5,000 in purchases in your first three months from account opening. Since points are worth at least 1 cent apiece when redeemed for travel through the Chase Travel℠ portal, 75,000 points come out to $750 in travel redemptions, which should be enough for at least a couple of reasonably priced round-trip flights. And that’s before you add the rewards you’d earn from spending $5,000.

Along with this one-time sign-up bonus, cardholders also enjoy an ongoing annual bonus of a $50 credit on hotels booked through Chase Travel℠, which alone offsets over half the card’s cost.

You’ll also get a 10% annual bonus based on your total spend each account anniversary year. This means if you spent $50,000 on your Sapphire Preferred during your anniversary year, you’d receive 5,000 bonus points at the end of the year. While this isn’t a massive amount of extra rewards, it could add up for heavy spenders.

Tip: Since Chase allows cardholders within the same household to transfer points to one another’s accounts, you and your spouse can each sign up for a Sapphire Preferred card, collect the sign-up bonuses and combine them.

Earning valuable Ultimate Rewards points

The rewards rate on the Chase Sapphire Preferred is designed with travelers and foodies in mind, offerin:

- 5X points on all travel booked through Chase Travel℠ (excluding hotel purchases that qualify for the $50 Anniversary Hotel Credit)

- 3X points on dining, select streaming services and online grocery shopping

- 2X points on other travel purchases

- 1X points on general purchases

Given Chase Ultimate Rewards points are some of the most valuable card rewards around, that’s a terrific amount of rewards category variety and includes a great mix of practical everyday categories.

Tip: Another valuable way to earn a few extra points is by leveraging Chase’s referral bonus policy. You can earn up to 100,000 Ultimate Rewards points per year by referring a friend for the Sapphire Preferred (10,000 points per approval).

Great mix of redemption options

Redeeming points on your Chase Sapphire Preferred account is easy, and you have several options. On the Chase Travel℠ portal, you can see your current account balance and all the different ways to use your points.

You can redeem Ultimate Rewards points for anything from travel purchases to gift cards. And while the value fluctuates depending on how you redeem your points, this is one of the few travel rewards cards that gets you a minimum of 1 cent per point back on non-travel redemptions like cash back. Many competing travel cards only offer a full 1-cent-per-point value on travel redemptions, limiting point value for cash back, merchandise and gift cards to 0.8 cents per point or less.

Valuable Chase Ultimate Rewards transfer partners

Adding to the Sapphire Preferred card’s flexibility, Chase allows cardholders to transfer their points to several travel partners at a 1:1 ratio. Since many airline and hotel points are worth more than 1 cent per point, you can use this option to stretch your rewards even further. Here are Bankrate’s latest point and mile valuations to give you an idea of this potential value.

| Transfer partner | Estimated point value (cents) |

| Singapore Airlines | 1.6 |

| World of Hyatt | 2.3 |

| Iberia Plus | 0.9 |

| JetBlue Airways | 1.3 |

| United Airlines | 0.9 |

| British Airways | 0.7 |

| Emirates | 1.2 |

| Air France/KLM | 1.5 |

| Aer Lingus | 1.8 |

| Virgin Atlantic | 2.6 |

| Marriott Bonvoy | 0.7 |

| IHG | 0.7 |

| Air Canada | 1.6 |

| Southwest Airlines | 1.5 |

While several other rewards programs, including those from American Express and Capital One, also offer the ability to transfer points, Chase may offer travelers the most useful list of partners, including three major U.S. airlines and some valuable airline partners abroad. Other issuers, like Amex, largely feature airlines more suited to international travel.

Pairing the Chase Sapphire Preferred with other Ultimate Rewards cards

Another major advantage of the Chase Sapphire Preferred card is that you can use it with other cards to complete the Chase trifecta and boost your rewards earnings.

For example, the Chase Freedom Flex®* offers 5% cash back on rotating bonus categories that you activate each quarter (up to $1,500 per quarter) and the Chase Freedom Unlimited® offers at least 1.5% cash back on all purchases. All the rewards you earn with these cards, including their sign-up bonuses, can be transferred to the Sapphire Preferred card and redeemed for travel with Chase at 1 cent per point. If you use Freedom Unlimited for general purchases, the Sapphire Preferred for dining, online grocery shopping and travel, and the Freedom Flex for rotating bonus categories, you can easily cover a wide swath of your everyday and special occasion spending.

These Ultimate Rewards cards create one of the most valuable card combinations of any major rewards program, so if you enjoy juggling cards to maximize rewards, Ultimate Rewards may be the program for you.

Why you might want a different card

While the Chase Sapphire Preferred is an outstanding credit card, it may not be a slam dunk for every wallet. Here are a few reasons why you might consider other cards.

More luxurious perks

The Chase Sapphire Preferred does a good job of balancing valuable rewards, benefits and perks with a modest $95 annual fee. But there’s no denying that there are cards that offer higher-end and more luxurious perks.

Cards like the Capital One Venture X Rewards Credit Card and The Platinum Card® from American Express offer substantially more entertainment and travel benefits, albeit at an annual fee that’s hundreds of dollars more.

Somewhat complex rewards structure

For all of the extra value the Chase Sapphire Preferred brings to the table with its flexible Chase Ultimate Rewards points, there is a drawback. The card’s rewards can be tough to keep track of since you’ll have to pay attention to bonus categories, redemption values and how much your points will be worth after you transfer them.

Some cardholders may not want to put in the additional work and research required to maximize the value of this card’s rewards. If that sounds like you, consider a more straightforward rewards card like the Wells Fargo Active Cash® Card.

No TSA PreCheck or Global Entry

The Chase Sapphire Preferred does not offer a credit for Global Entry or TSA PreCheck. And it’s not only luxury credit cards that offer such a credit – there are a few cards with annual fees under $100 that offer this credit, including the Capital One Venture Rewards Credit Card (Venture – Receive up to a $120 credit for Global Entry or TSA PreCheck®) and Bank of America® Premium Rewards® credit card, all of which carry similar annual fees as the Sapphire Preferred. If that’s a benefit you want, you might want to consider one of those cards.

How does the Sapphire Preferred compare to other travel cards?

If you are a frequent traveler trying to maximize your travel rewards, the Chase Sapphire Preferred is one of the best options. However, there are a few other travel cards that compete.

|  |  |

Rewards rate

| Rewards rate

| Rewards rate

|

| Welcome bonus | Welcome bonus | Welcome bonus |

| Annual fee $795 | Annual fee $95 | Annual fee $325 |

Other things to know

| Other things to know

| Other things to know

|

Chase Sapphire Preferred vs. Chase Sapphire Reserve

The Chase Sapphire Reserve is a more luxurious version of the Sapphire Preferred. This card comes packed with travel perks like Global Entry, NEXUS, or TSA PreCheck® credit, complimentary airport lounges and offers a generous $300 travel credit that you can use cover anything from airfare to baggage fees.

If you spend a lot on travel and believe you’ll use those included luxury perks, the Reserve could be more rewarding despite the $795 annual fee. Not to mention that you get a 50 percent boost on all points redeemed through Chase Travel℠.

See related: Chase Sapphire Preferred vs. Chase Sapphire Reserve

Chase Sapphire Preferred vs. Capital One Venture card

With the Venture card, your miles are only worth 1 cent each when redeemed for travel, which means they won’t take you as far as Sapphire Preferred points. However, the Venture offers a competitive 2X miles on every purchase and 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel. This can compensate for the lower miles value depending on your spending habits.

While it doesn’t have as many benefits as the Sapphire Preferred, for people who like to redeem miles on travel, it’s a great option for earning miles on everyday purchases.

See related: Chase Sapphire Preferred Card vs. Capital One Venture Rewards Credit Card

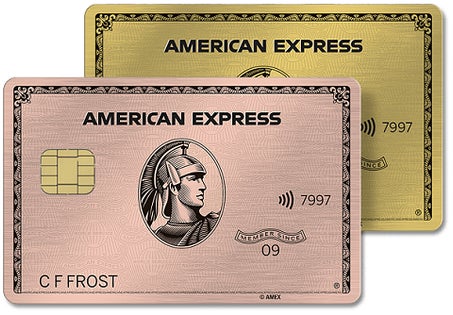

Chase Sapphire Preferred vs. American Express Gold Card

The American Express Gold Card offers one of the best rewards rates you can find on U.S. supermarket and worldwide restaurant purchases, making it a valuable choice for foodies looking to earn travel rewards. It also offers up to a $120 dining credit ($10 credits per month, enrollment required) for select restaurants and other valuable food-centric perks that easily justify its annual fee.

One drawback may be the point value for the card, which is 1:1 for most travel partners while the Chase Sapphire Preferred averages 1.5 points per dollar. However, you can make up for this value with the card’s various annual credits.

Learn More: Who Should Get the Amex Gold?

Who should get the Chase Sapphire Preferred

The Chase Sapphire Preferred is an excellent all-around rewards card, though it especially suits cardholders who:

- Like to have flexible rewards

- Regularly travel and can take advantage of the card’s earning categories

- Wish to pursue or complete the Chase trifecta

- Enjoy maximizing their rewards by transferring points to travel partners

- Want a card that offers robust travel protections

How to use the Chase Sapphire Preferred:

- Use your card for all travel and dining purchases to boost points earning.

- Spend at least $5,000 in the first three months to secure the sign-up bonus.

- Redeem your points for travel – you will get the best rewards rate for Chase Travel℠ portal travel redemptions and transfer partners.

- Pair with another Ultimate Rewards card with bonuses in different spending categories to maximize rewards.

- Use the card when you rent a car to take advantage of its primary car rental coverage.

Is the Chase Sapphire Preferred card right for you?

If you want to supercharge your rewards, the Chase Sapphire Preferred card is great for spearheading that effort. The Sapphire Preferred has a lot of potential value for frequent travelers and rewards are easy to earn and redeem. And though you’ll need to pay an annual fee, the introductory offer alone can offset this cost several times over. If you’re looking for an upgrade in the world of travel rewards, the Sapphire Preferred may be worth a look.

*All information about the Chase Freedom Flex have been collected independently by CreditCards.com and has not been reviewed by the issuer.

All reviews are prepared by CreditCards.com staff. Opinions expressed therein are solely those of the reviewer and have not been reviewed or approved by any advertiser. The information, including card rates and fees, presented in the review is accurate as of the date of the review. Check the data at the top of this page and the bank’s website for the most current information.

Responses to comments in the discussion section below are not provided, reviewed, approved, endorsed or commissioned by our financial partners. It is not our partner’s responsibility to ensure all posts or questions are answered.

Partner Offer