Summary

PayPal’s new virtual card program should offer more opportunity to earn rewards and additional protection against online fraud and identity theft. Keep reading to learn more about PayPal Key, including its benefits and drawbacks.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

The digital payments industry has seen significant growth as the coronavirus pandemic accelerates the shift to online shopping, which makes it easier for us to get the things we need – safely and from the comfort of home.

But while contactless payments keep you safe from germ-laden credit cards and cash, shoppers remain susceptible to other kinds of danger online, including fraud. That’s where virtual credit cards can come in handy.

Since its founding in 1998, PayPal has become practically synonymous with digital payments. Its latest service, PayPal Key, offers another way to protect yourself against cybercriminals the next time you click “Place Your Order.” Here’s what you need to know.

See related: Is PayPal safe?

What is PayPal Key?

PayPal Key is a virtual account number connected to your PayPal account that you can use when making payments online or over the phone.

A virtual card such as PayPal Key hides the real details associated with your payment account, providing an extra layer of protection against fraud and identity theft while you shop. It’s similar to the virtual account numbers issued by Eno, Capital One’s virtual assistant, or those generated by the Token app.

PayPal Key also gives you the ability to shop at any retailer that accepts Mastercard – including those based outside of the U.S. – even if the merchant doesn’t accept PayPal as a payment method at checkout. The service doesn’t charge any setup or usage fees, either.

How does PayPal Key work?

As a brand new product, PayPal Key isn’t currently available to all PayPal users, though it will be rolled out to more customers in the future. To find out whether you have early access, check the PayPal Key setup page:

Click “Set It Up Now.” If you see the following notice, it means you’re not eligible for the service (at least not yet):

If you are one of the lucky few, getting started with PayPal Key is simple. Here’s what to do:

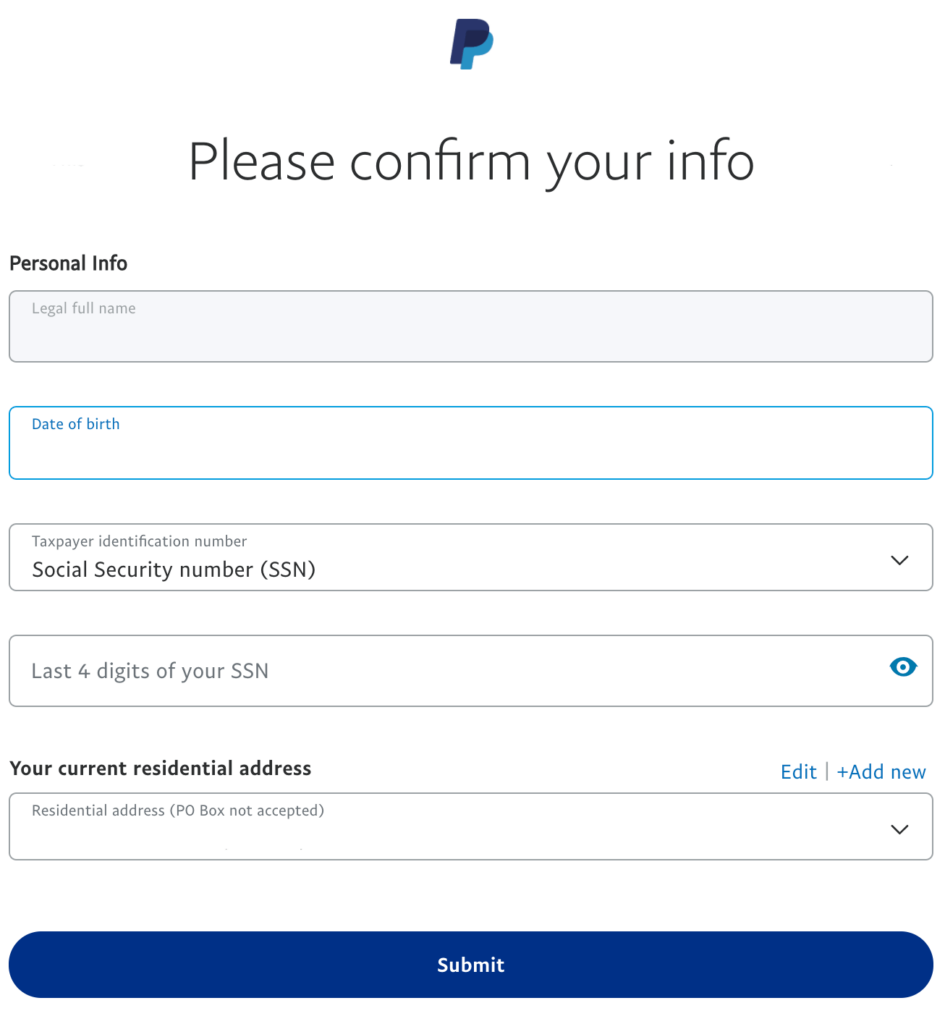

- Confirm your personal information, including your billing address and the last four digits of your Social Security number.

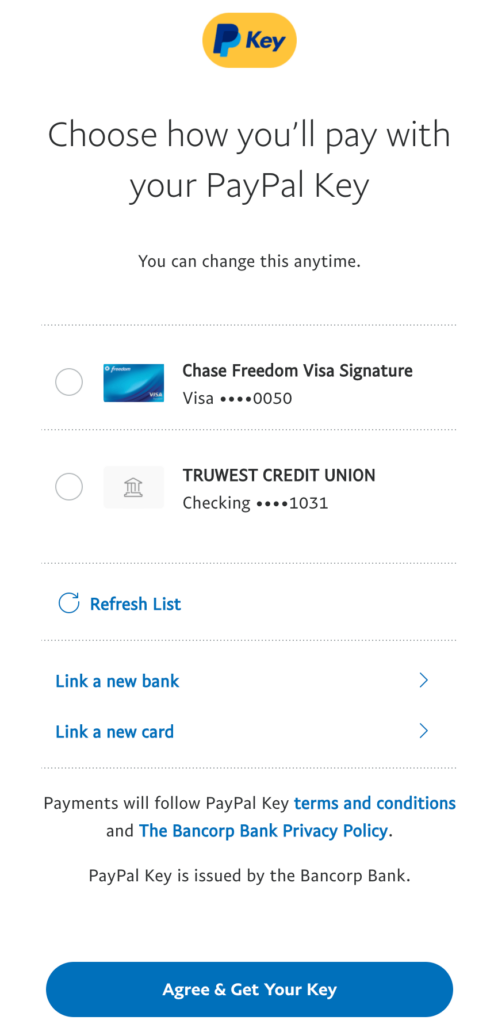

- Select any linked payment method from your PayPal Wallet, including a debit or credit card, a bank account, your PayPal balance or even PayPal Credit (more on that later).

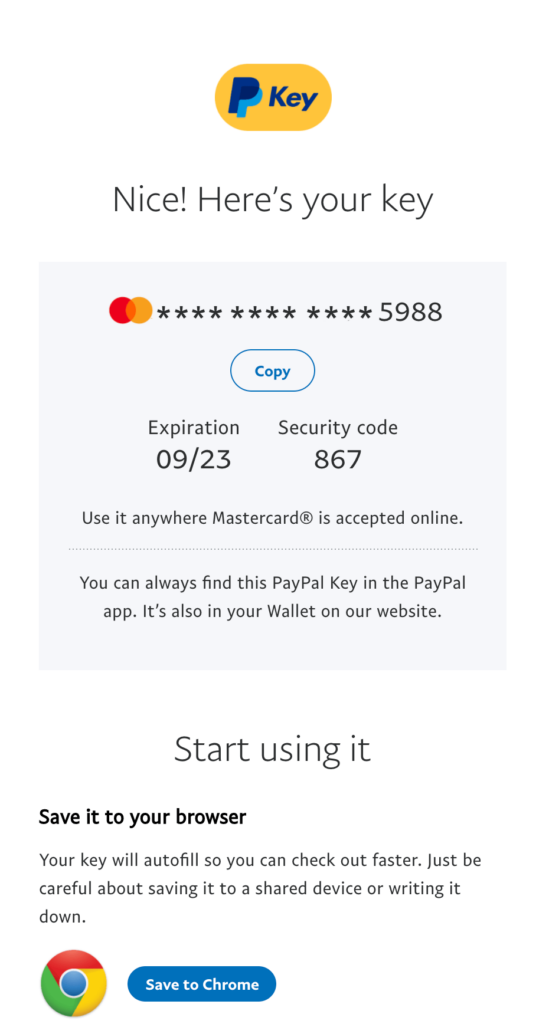

- Click “Agree & Get Your Key” to receive the virtual card number, expiration date and security code (a three-digit number similar to the CVV or CVS number on the back of a physical credit or debit card).

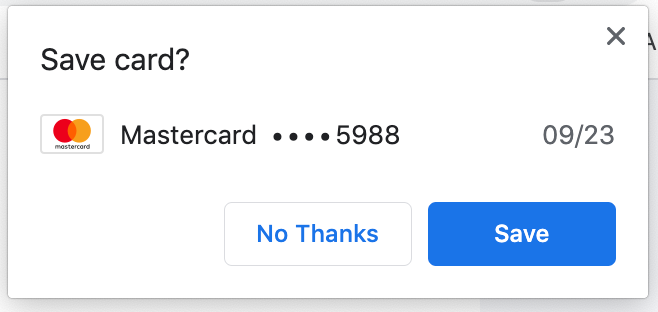

- Save your card details to your browser if you want easy access.

- Use PayPal Key just like any other card you use to shop online. You can also complete purchases over the phone by providing your virtual account number and other card details.

If you choose PayPal balance as your primary payment method, you’ll be asked to choose another one as a backup. The method you select is used to complete the transaction in the event you don’t have enough money in your balance to cover the purchase.

It’s worth noting that only a small subset of users will have the option to use PayPal Credit with PayPal Key, but those who do will still be able to access the same promotional financing offers they normally would.

Where can I use PayPal Key?

You can use PayPal Key at any online retailer that accepts Mastercard, including international merchants. It’s also compatible with Venmo (a mobile payment service owned by PayPal) and Google Pay (but only for online purchases).

Unfortunately, at this time PayPal Key can’t be added to other mobile wallets, like Apple Pay or Samsung Pay.

Benefits of PayPal Key

One obvious benefit of using a virtual card like PayPal Key is that it offers another way to safeguard your payment accounts from fraudsters who want to steal your information.

As more people shop and pay their bills online – and as EMV chip cards make point-of-sale fraud harder to pull off — cybercriminals have turned their focus away from brick-and-mortar stores, giving rise to so-called “card-not-present” fraud. Plus, using a virtual card helps protect your information in the event of a data breach (like the one at Equifax in 2017).

In addition, PayPal Key lets you earn points, miles and cash back just as you would with any credit card in your PayPal account. In fact, with a bit of strategy, you might be able to earn even better rewards.

For instance, let’s say you have the Discover it® Cash Back, which offers cash back in rotating bonus categories throughout the year upon activation. For Q3 2020 (which ends Sept. 30, 2020), the Discover cash back calendar includes 5% cash back at restaurants and on PayPal purchases, money transfers and PayPal Here transactions (on up to $1,500 in quarterly spending, then 1%).

By setting your Discover card as your PayPal Key payment method, you can get that 5% bonus rate even at websites that don’t normally accept PayPal, thereby maximizing your overall cash back earnings.

Chase’s cash back calendar is also offering PayPal as a bonus cash back category for Chase Freedom and Chase Freedom Flex℠ cardholders in the fourth quarter of 2020, just in time for holiday shopping. From Oct. 1, 2020 to Dec. 31, 2020, you can earn 5% back on the first $1,500 you spend on purchases using PayPal (upon enrollment, then 1%).

Another benefit to PayPal Key is that you won’t have the option to save your payment information to your retail accounts. Although that may be a drawback for some, one-click ordering makes shopping online a bit too easy sometimes – so if you’re prone to overspending with a mobile wallet, taking the extra step of entering a virtual card number at checkout gives you a bit more time to think over your purchase and decide whether it’s really worth the money you’re shelling out.

Other pros of PayPal Key:

- Delete your virtual card number (and generate a new one) at any time for added security.

- Save money when you shop internationally. PayPal Key purchases made in currencies other than U.S. dollars incur a 1.1% foreign transaction fee, whereas many other credit cards charge 3%.

- Use PayPal Key when signing up for free trials so they don’t turn into recurring subscriptions before you forget to cancel.

- Use PayPal Key when an online retailer doesn’t accept cards from certain issuers (like Amex and Discover).

- Enjoy the same purchase protection you’d get with other PayPal transactions.

- Add your PayPal Key browser extension to Google Chrome, Safari and Internet Explorer for easier checkout.

- Change your PayPal Key payment method at any time using the website or app.

Drawbacks of PayPal Key

PayPal Key may boost both your credit card rewards earnings and overall spending power, but that doesn’t mean the service is right for everyone.

For starters, certain purchases can result in a temporary hold on your payment method for up to 60 days, during which your credit line or available balance will be reduced accordingly.

Not having access to your own money can be frustrating, particularly if you live on a budget and can’t wait that long for the transaction to settle. And while it can help you resist impulse buying, the extra time it takes to enter your PayPal Key details at checkout might be annoying for some shoppers.

If you’re interested in PayPal Key for its security benefits, take note that virtual or temporary credit cards aren’t 100% effective against fraud, as your address and account password may still be vulnerable to thieves.

Other cons of PayPal Key:

- You can’t use it for in-store shopping.

- It’s not compatible with most widely used mobile wallets, such as Apple Pay and Samsung Pay. And though PayPal Key does work with Google Pay, you can only use it for online purchases.

- Per PayPal Key’s terms and conditions, you must be based in the U.S. and have a PayPal Cash or Cash Plus account to be eligible for PayPal Key. Since the service is still in the rollout phase, even users who meet those requirements may not have access yet.

- PayPal Key transactions qualify for purchase protection from PayPal, but the benefits are no substitute for the more robust protections you’ll find on many credit cards.

Should you try PayPal Key?

If you can already generate a virtual card number via your existing card account, PayPal Key may not provide much in the way of additional benefits or fraud protection.

But if your credit card company doesn’t offer that kind of service – and if shopping online without divulging your real account information gives you added peace of mind – PayPal Key is probably worth a try.

However, don’t abandon the usual rules when it comes to keeping your payment cards safe in cyberspace:

- Use a unique password for each of your retail accounts.

- Avoid making purchases on public Wi-Fi.

- Shop with reputable merchants, and if you’re unfamiliar with a particular site, do a bit of research before checking out.

- Regularly review your account statements and credit reports for suspicious activity.

Overall, PayPal Key should be a clear winner for avid PayPal users. Aside from the security benefit of a virtual card number, PayPal Key should offer additional flexibility when you pay online.

You can use your PayPal virtual card number to pay bills or make purchases using your PayPal balance, and if you’re a Chase Freedom Flex or Discover it Cash Back cardholder, PayPal Key could help you earn rewards when shopping on websites that don’t accept PayPal.

See related: Best credit cards for online shopping

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.