| Cash Back Rating: | 4.5 / 5 |

| Rewards Value | 3.7 |

| APR | 3.0 |

| Rewards Flexibility | 3.0 |

| Features | 3.0 |

| Issuer Customer Experience | 3.0 |

In a Nutshell:

It offers terrific value to low-maintenance cardholders and rewards experts alike since it automatically rewards your top spending category each billing cycle. Just be sure you aren’t missing out on accelerated rewards in your second- and third-highest categories.

*All information about the Citi Custom Cash® Card has been collected independently by CreditCards.com and has not been reviewed by the issuer.

Rewards Rate

|  |

Sign-up Bonus

|  |

Annual Bonus None |  |

Annual Fee $0 |  |

APR 17.49% - 27.49% (Variable) |  |

Rewards Redemption

Cons

|  |

Citi Customer Service Ratings

|  |

Other Notable Features: Citi Entertainment, theft protection, free FICO score access, World Elite Mastercard

If you’re looking for a low-maintenance way to maximize rewards and fill gaps in your rewards strategy, the Citi Custom Cash is a great option. The Citi Custom Cash Card lets cardholders maximize rewards in key eligible categories by automatically adjusting the highest cash back rate to their greatest spend category for that billing cycle. Although it offers minimal flat-rate rewards on every purchase, it provides some of the best cash back rates available on eligible purchases.

It’s especially good for cardholders who want to supplement their existing rewards cards and who want to get a higher-tier Citi travel card and transfer points to Citi’s travel partners. Plus, it features a great intro APR for a cash back card.

Pros

Cons

Why you might want the Citi Custom Cash Card

This cash back card from Citi carries an impressive rewards rate in popular categories like groceries, dining and gas, but simplifies the earning process by automatically giving you the highest rate in whichever eligible category you’ve spent the most in each billing cycle. This means there’s no need to enroll in rotating categories or commit to a bonus spending category year-round. However, you may want to plan to do the majority of your spending in a single category each billing cycle to capture maximum value.

See related: How do cash back credit cards work?

Generous rewards rate and great variety

You’ll automatically earn 5% back on purchases in your top spending category each billing cycle (on up to $500 in spending per billing cycle, then 1%). Eligible categories include restaurants, gas stations, grocery stores, select travel, select transit, select streaming services, drugstores, home improvement stores, fitness clubs and live entertainment. You’ll also earn unlimited 1% back on all other purchases.

A year-round, 5% cash back rate in any category is very generous for a no-annual-fee card, but the Citi Custom Cash card’s rewards rate really shines in the grocery, dining and gas categories. It’s one of the highest rewards rates you can get in these popular and practical categories on a card with no annual fee.

There are a few caveats to keep in mind, however. The 5% back is limited to a $500 billing cycle spend limit and, per the card’s terms, the restaurant category excludes “third party dining delivery services” like Uber Eats. Also, as is the case with most grocery rewards cards, the Citi Custom Cash card’s grocery category excludes “discount superstores [and] wholesale/warehouse clubs,” so this isn’t the best choice for people who want to use the card at Walmart, Costco or other stores like these.

Citi’s online user interface makes it easy to keep track of which category you’re earning the most in during a billing cycle. Your account lists all the eligible 5% categories, the total you’ve spent so far in each, and how much you’re spending outside these categories. This tracking is a big help when you’re trying to make the most of your bonus category, but can also give you a heads-up on any secondary categories where you’re missing out on boosted rewards.

The Custom Cash is also a good fit for modest spenders. If you’re able to max out your 5% cash back category each billing cycle, your Citi Custom Cash Card earnings could exceed some of the best flat-rate cash back cards’ earnings.

The following breakdown assumes you’ve maxed out your 5% cash back category each billing cycle with the Citi Custom Cash.

| Card | Rewards calculation | Total |

| Citi Custom Cash Card | $6,000 ($500 per billing cycle) x 5% back + $9,900 x 1% back = | $399 |

Although you’ll have less flexibility with your purchases each quarter, you can maximize rewards for moderate spending with a little planning. While this limits the amount you may earn back in rewards on large purchases, it’s ideal for those who only spend $500 or less each billing cycle.

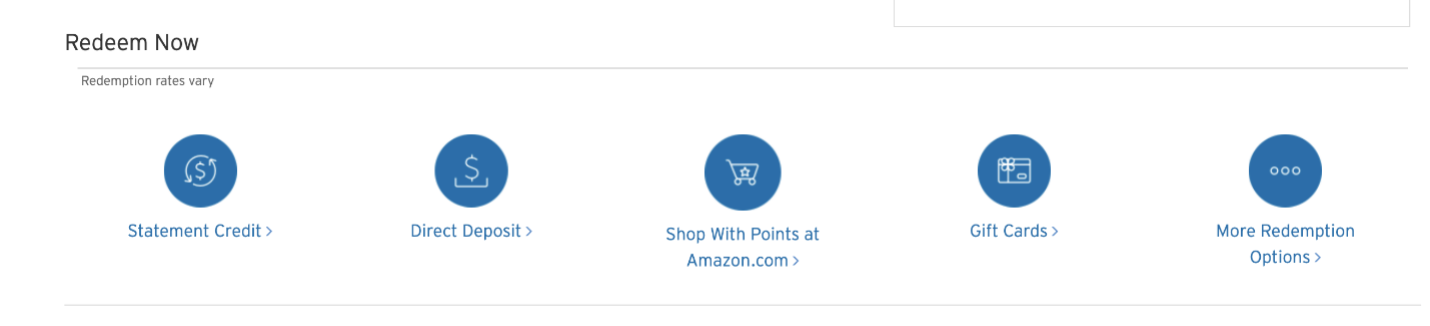

Great options for travel points

Though it’s marketed primarily as a cash back card, the Citi Custom Cash Card technically earns Citi ThankYou points. Each point is worth 1 cent toward cash back, gift cards and Citi travel bookings. You can redeem your cash back in any amount as a statement credit or direct deposit, or opt for a check when you’ve earned at least $5 worth of cash back.

You may be able to stretch the value of your points further if you pair the Citi Custom Cash Card with a higher-tier Citi rewards card like the Citi Premier® Card(The Citi Premier Card is no longer available) or Citi Prestige® Card* to make the Citi card trifecta. As with the Chase trifecta, combining cards for everyday spending and travel rewards allows you to pool and transfer your points to one of Citi’s travel partners at a potentially higher value.

For example, you could transfer Citi ThankYou points at a 1:1 ratio to any of Citi’s travel transfer partners. Though ThankYou points are typically worth just 1 cent each when redeemed for travel, you may be able to increase their value by transferring them to an airline or hotel partner with a higher value. Based on Bankrate’s latest point valuations, ThankYou points could be worth an average of 1.9 cents each with the right transfer partner.

This makes the Citi Custom Cash Card a terrific choice for frequent travelers looking for a rewards card to supplement their earnings on a dedicated Citi travel card.

Decent sign-up bonus

Along with its generous ongoing cash back rewards, the Citi Custom Cash Card features a decent sign-up bonus: You can earn $200 cash back (20,000 ThankYou points that can be redeemed as cash back) after spending $1,500 in your first six months as a cardholder. Previously, this card’s bonus only required spending $750 in your first three months to earn $200. Although the higher spending requirement disappoints, you’ll just need to spend at the same rate ($250 per month) for twice as long to secure the offer.

When you factor in the spending requirement, this bonus falls somewhere in the lower-middle among popular no-annual-fee cash back cards. The Chase Freedom Flex® card also offers a $200 bonus but only requires spending $500 in the first three months. Still, you should easily reach the spending requirement with the Custom Cash if you max out your 5% cash back each month.

$0 annual fee and 0% intro APR

The Citi Custom Cash costs nothing to hold, so you won’t have to worry about maximizing your earnings to make up for an annual fee. Compare this with the Blue Cash Preferred® Card from American Express, which carries a slightly more competitive 6% cash back rate on U.S. supermarket purchases (up to $6,000 in purchases per year, then 1%), but also has a $95 annual fee ($0 introductory annual fee for the first year). While you could certainly offset these fees with cash back earnings, an annual fee inevitably introduces some level of risk, making the Custom Cash a lower-maintenance grocery rewards option.

The Citi Custom Cash card also comes with a generous introductory APR on both balance transfers and new purchases It’s one of only a handful of rewards cards that offer both types of intro APR. This perk gives the card some additional utility over competitors. The Citi Double Cash, for example, offers an intro APR only on balance transfers.

Why you might want a different card

The Citi Custom Cash card is a great choice for moderate spenders and those who spend consistently in one of the card’s bonus categories. However, it has its limitations to keep in mind. The Custom Cash card is only viable for cardholders who won’t spend well beyond its $500 cap each billing cycle in a single category.

High balance transfer fee

While the Custom Cash card’s introductory APR on balance transfers and new purchases could be a big help if you need to chip away at existing card debt or pay off a larger purchase over time, the card carries a high balance transfer fee compared to many balance transfer cards.

You’ll pay a transfer fee of 5% (or $5, whichever is greater) with the Citi Custom Cash, which could prove costly if you need to transfer a large balance. This is only disappointing because dedicated balance transfer cards charge a balance transfer fee of just 3%. A balance transfer card, like the Discover it® Balance Transfer Card(offer expired), could be a better option. It offers a slightly longer intro APR period on balance transfers with a 3% intro balance transfer fee, up to 5% fee on future balance transfers (see terms).

That said, balance transfer cards often don’t have the same flexible cash back potential that you find on the Custom Cash card. Although you’ll pay a higher fee on the Custom Cash to transfer a balance for a shorter period, you can make up the difference with cash back on new purchases. Transferring a balance of $1,000 will cost you $50, but if you spend $1,000 on new purchases in your top eligible category split evenly between two billing cycles, you will earn $50 worth of cash back rewards.

Limited to a single bonus category each billing cycle

Though the Citi Custom Cash features a wide variety of bonus categories, you’ll only earn 5% back in your top spending category each billing cycle (on up to $500 in spending per month, then 1%), with other categories earning just 1% back.

Since a few of the card’s bonus categories make up a good portion of the average person’s budget, you’ll leave a lot of cash back on the table in your next two highest spending categories if you use the Citi Custom Cash as a standalone rewards card. While other rewards cards may carry a lower maximum rewards rate, they could also allow you to earn more than 1% back in multiple categories at once.

Given these limitations, the Citi Custom Cash Card may work best when supplemented by a flat-rate rewards card. Fitting your monthly spending habits into a limit of $500 may be difficult – even for moderate spenders. By positioning this card into a portfolio of other rewards cards, you can meet that $500 threshold in your top category and use a card like the Citi Double Cash card to earn 2% back (1% when you buy and 1% as you pay) instead of 1% on all purchases after $500.

The card’s $500 spending cap applied each billing cycle is also a bit more restrictive than the $1,500 quarterly cap you’ll find on most rotating bonus category cards, like the Discover it® Cash Back. By imposing a $500 cap on each billing cycle instead of a $1,500 cap each quarter, the Custom Cash has less flexibility to earn rewards on large purchases. The Discover it® Cash Back earns 5% cash back after activation on rotating categories each quarter (up to $1,500 in purchases, then 1%).

For example, because of the Citi Custom Cash card’s $500 cap each billing cycle, a single $1,500 purchase in an eligible bonus category would earn just $35 in cash back (5% back on the first $500 and 1% back on the next $1,000), versus $75 in cash back with the Discover it® Cash Back.

Subpar perks and bonuses

The Custom Cash is a Mastercard World Elite credit card and is eligible for valuable perks you might not find on other no-annual-fee cash back cards, like:

- Cellphone protection: You’ll get up to $800 per claim and up to $1,000 per year in cellphone insurance coverage against theft or damage if you pay your cell phone bill with the card (subject to a $50 deductible).

- Complimentary three-month DashPass subscription: You’ll receive a free DoorDash DashPass membership for three months and $5 off your first two orders each month as a DashPass member.

- Lyft credits: Each month you take at least three Lyft rides, you’ll earn a $5 Lyft credit toward your next ride.

- HelloFresh discounts: You’ll earn 5% back on every HelloFresh order, which can be used for future HelloFresh orders.

- Complimentary ShopRunner membership: ShopRunner gets you two-day shipping and free returns at more than 100 online retailers.

However, Citi doesn’t specifically list these benefits on its website. It’s best to contact Citi to verify whether you’ll receive these World Elite benefits with your Custom Cash card. The card otherwise offers select Citi card staples like $0 fraud liability, virtual account numbers, free access to your FICO credit score and Citi Entertainment, which gives you special access to ticket sales and exclusive experiences. These additional features are solid, but still lagging behind the perks that the top no-annual-fee rewards cards offer, even when you factor in the World Elite perks.

How does the Citi Custom Cash Card compare to other cash back cards?

The Citi Custom Cash Card offers impressive rewards in your top spending category each billing cycle, but because all other categories earn just 1%, you’ll inevitably miss out on some rewards-earning opportunities if you lack another rewards card to use for purchases in your second- or third-most common categories.

Consider these alternatives, which carry more flexible cash back limits, impressive rates in several of the Citi Custom Cash Card’s eligible bonus categories or a higher flat rewards rate:

|  |

|

Rewards rate

| Rewards rate

| Rewards rate

|

Introductory bonus

| Introductory bonus

| Introductory bonus

|

| Annual fee $0 | Annual fee $0 intro annual fee for the first year, then $95. (see rates and fees) | Annual fee $0 |

Other things to know

| Other things to know

| Other things to know

|

Citi Custom Cash vs. Citi Double Cash Card

Offering one of the best flat cash back rates available, the Citi Double Cash Card is a great no-frills, all-purpose rewards card. You earn 2% cash back on all purchases (1% when you buy and an additional 1% as you pay off those purchases) with no spending caps or select categories, unlike the Citi Custom Cash Card, which limits you with a $500 spending cap in a single category each billing cycle.

If you would rather not worry about tracking spending or going over a limit in a single billing cycle, the Citi Double Cash is a solid low-maintenance option. It will also help you earn more cash back for purchases outside your biggest spending category each month, potentially resulting in more cash back overall for the year.

Citi Custom Cash card vs. Blue Cash Preferred Card from American Express

The Blue Cash Preferred Card from American Express comes with one of the best rewards rates for purchases at U.S. supermarkets and U.S. gas stations available. It offers 6% cash back at U.S. supermarkets (up to $6,000 in purchases per year, then 1%), 6% back on select streaming services and 3% cash back at U.S. gas stations. Though the card carries an ongoing $95 annual fee ($0 intro annual fee for the first year), you can offset this fee easily if groceries and gas make up a big chunk of your budget. Since the card earns bonus rewards in multiple categories at once, it could make for a better all-purpose option than the Custom Cash.

Citi Custom Cash card vs. Bank of America Customized Cash Rewards credit card

A popular choose-your-bonus-category rewards card, the Bank of America Customized Cash Rewards credit card now offers 6% cash back for the first year in the category of your choice: gas and EV charging stations; online shopping, including cable, internet, phone plans and streaming; dining; travel; drug stores and pharmacies; or home improvement and furnishings. You’ll automatically earn 2% cash back at grocery stores and wholesale clubs, and unlimited 1% cash back on all other purchases. After the first year from account opening, you’ll earn 3% cash back on purchases in your choice category. While this rate is lower than the maximum rate available on the Citi Custom Cash Card, you can cover more categories thanks to its additional year-round 2% bonus category. This card’s cash back variety could make it a great addition to your wallet if you spend heavily in its bonus categories and want to cover more purchases with higher cash back rates than you’d get with the Custom Cash Card.

How to use the Citi Custom Cash Card:

- Be strategic with your purchases to maximize your 5% rewards each billing cycle. For example, consider paying a year’s worth of streaming services or gym membership dues during a single billing cycle.

- Pair the Citi Custom Cash Card with a tiered-bonus category card that rewards your second- and third-highest spending categories.

- Pair the Citi Custom Cash Card with a flat-rate card to maximize purchases outside your top spending category.

- Take advantage of one of the intro APRs to maximize the card’s cost-saving capabilities.

Is the Citi Custom Cash Card right for you?

Used strategically, the Citi Custom Cash Card is absolutely worth having. This card could easily become one of your wallet’s most valuable rewards cards if you take full advantage of its impressive cash back rate for your top spending category.

On top of being a good fit for low-maintenance cardholders, it’s also ideal for card experts looking to round out their rewards strategy. This is especially true for travel lovers can take advantage of the point transfer capabilities between the Custom Cash and Citi’s premium reward card offerings.

But if you already have cards that earn rewards at a solid rate in some of the Citi Custom Cash card’s more popular categories, novelty categories like fitness clubs and live entertainment likely won’t make up enough of your spending to warrant a new card application. And when used as a solo card, the $500 cap each billing cycle and flat 1% cash back rate on all purchases outside your top spending category could leave you missing out on rewards on some of your purchases. To not fall victim to the card’s biggest shortcoming, round out any spending that exceeds $500 for that billing cycle with a rewards card that earns more than 1% in the categories not covered by the Custom Cash.

*Information about the Citi Prestige Card and the Bank of America® Customized Cash Rewards credit card has been collected independently by CreditCards.com. The issuer did not provide the details, nor is it responsible for their accuracy.

Frequently Asked Questions

All reviews are prepared by CreditCards.com staff. Opinions expressed therein are solely those of the reviewer and have not been reviewed or approved by any advertiser. The information, including card rates and fees, presented in the review is accurate as of the date of the review. Check the data at the top of this page and the bank’s website for the most current information.

Responses to comments in the discussion section below are not provided, reviewed, approved, endorsed or commissioned by our financial partners. It is not our partner’s responsibility to ensure all posts or questions are answered.