Summary

Pay Yourself Back allows you to redeem points for statement credits in select categories – at a very attractive rate.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

Rewards credit cards can be an amazing tool for avid travelers and rewards enthusiasts, allowing them to earn (and spend) points and miles on travel and other purchases.

However, many rewards programs also give you alternate redemption options to provide more flexibility. And when it comes to flexibility, Chase Ultimate Rewards is one of the best rewards programs you can find.

In May 2020, Chase launched a tool called Pay Yourself Back to offer even more redemption options to its customers. Pay Yourself Back allows cardmembers to apply points to pay for all or a portion of existing purchases in select categories and get paid back with a statement credit. When using the feature, cardmembers will still earn points on their purchases, making this an especially valuable perk.

In this guide, you’ll learn how the Chase Pay Yourself Back tool works and whether it’s the best use of your Ultimate Rewards.

How does Pay Yourself Back work?

The tool originally launched for the Chase Sapphire Preferred® Card and Chase Sapphire Reserve®, but last October, Chase also added it to other eligible Ultimate Rewards cards.

If you have an eligible card and would like to use Pay Yourself Back, head over to your account and navigate to the Chase Ultimate Rewards menu.

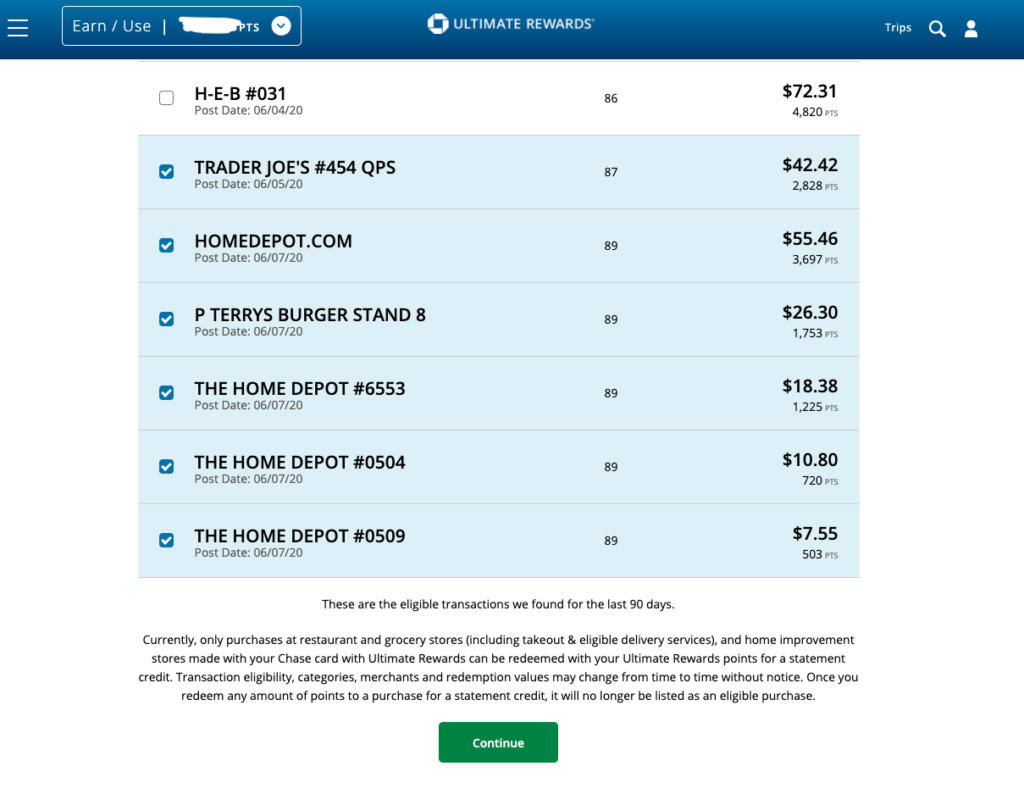

Once there, you’ll see a list of recent eligible purchases from the last 90 days. Select those you’d like to redeem and click “continue” at the bottom.

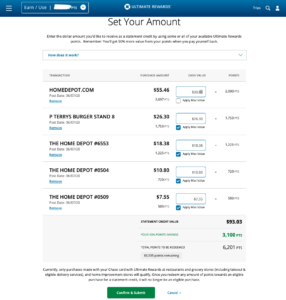

Next, you’ll get an option to choose the amount you want to redeem. As you can see from the example below, it can be a portion of the purchase, or you can check “Apply Max Value” to pay the purchase in full. If you’ve changed your mind about a certain purchase, you can also remove it from the list at this stage.

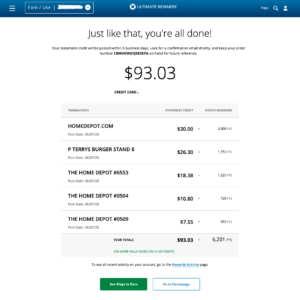

Once you’re ready, click “Confirm & Submit” at the bottom. You’ll see a screen with a summary of the total value of your redemption and a breakdown per purchase.

You will also receive this summary by email and see the statement credit reflected on your account within the next three days.

Which purchases qualify?

Besides adding more cards to the feature, Chase introduced new eligible purchase categories.

Through March 31, 2022, the categories on Sapphire cards include Airbnb and Away purchases. Reserve cardholders can also redeem their points for purchases in the dining category. These redemption options come with an increased rewards rate on qualifying purchases – 1.5 cents per point for Sapphire Reserve cardholders and 1.25 cents per point for Sapphire Preferred users.

If you have the Ink Business Preferred® Credit Card or Ink Business Plus® Credit Card (which is no longer available to new applicants), you can redeem points for purchases made at office supply stores, select advertising purchases and internet, cable and phone service purchases through March 31, 2022 (with a 1.25 cents per point redemption). Through December 31, 2022, cardholders will also get 1.25 cents per point when donating to eligible charities.

Eligible purchase categories vary by card, so you’ll need to confirm the exact categories that work for your specific card.

Is Pay Yourself Back a good redemption option?

Such high value is typically only reserved for travel purchases made through the Ultimate Rewards portal.

But according to our estimates, you get even more value from your Ultimate Rewards by transferring points to one of a number of Chase travel partners. For example, you can transfer points to Singapore Airlines at a value of 2.36 cents per point or to World of Hyatt at a value of 2 cents per point.

That said, securing airfare with rewards can take some effort and flexibility, so you may prefer other redemption options. In that case, travel purchases through the Ultimate Rewards portal or Pay Yourself Back redemptions will get you the second-best value.

Compared to the rate of 1 cent per point you get when redeeming Ultimate Rewards for statement credits, Pay Yourself Back is an excellent redemption option.

Additionally, in times when you might have no travel plans for a while, being able to get a high-value statement credit for qualifying purchases is a great deal.

It’s not yet clear if the next set of eligible Pay Yourself Back categories will get the same point value, but the feature is still a good option to have – especially since you get to keep the points you’ve already earned on purchases even after you use the Pay Yourself Back tool to cover them. Plus, current categories make up a good portion of many cardholders’ spending, and we expect Chase to continue to offer competitive options.

Bottom line

The Pay Yourself back feature is a great way to get some more bang for your buck out of your Chase credit card rewards. While redeeming your points directly with travel partners may stretch your rewards points even further, this tool can be especially helpful if you’re not planning to travel in the near future but still want to get the most value out of your Ultimate Rewards.

All information about the Ink Business Plus® Credit Card has been collected independently by CreditCards.com and has not been reviewed by the issuer.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.