Summary

Eno is a multi-talented virtual assistant designed to keep users aware of their account activity. In addition to a comprehensive fraud alert system, it serves as a chat bot to answer basic questions and can also provide virtual card numbers for online shopping.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

If you have a bank account or credit card with Capital One, you might have come across Eno – the bank’s virtual assistant. From basic account help to top-notch security features, Eno can be an incredibly useful tool for its users.

But to take full advantage of Eno’s functionality, you should first know all that it has to offer. Eno goes far beyond your standard chat bot, but some features require you to opt in or download a browser extension to use them. We’ve got you covered with this complete guide to Eno.

What is Eno?

Eno is a multitalented virtual assistant, fully integrated into the Capital One app and desktop site. Designed to keep users aware of their account activity, Eno is equipped with a comprehensive fraud alert system. In addition, Eno serves as a chat bot to answer basic questions and can also provide virtual card numbers for online shopping.

What does Eno do?

Eno from Capital One has a lot of different features, but its main uses can be boiled down to three main categories: customer support, fraud alerts and virtual card numbers.

Get answers to all your account questions

Eno is first and foremost a virtual assistant, designed to help users get quick answers to any of their account questions. You can chat with Eno on your Capital One account page (both on the app and desktop site) to ask questions about your balance, bill due dates and more.

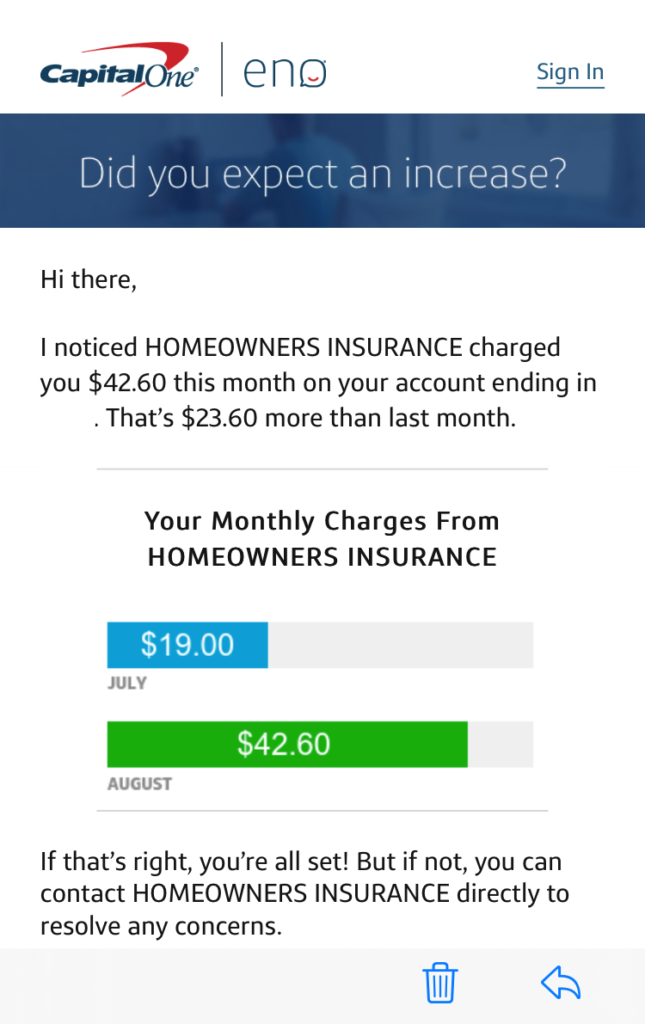

Receive alerts about suspected fraud

Eno also functions as a fraud alert tool, sending you notifications via text or email about suspected fraud and any other unusual account activity.

For example, Eno notified me when my renter’s insurance payment (which I have set to automatic debits) was significantly higher than usual. All was well – I had just moved and had an overlap in coverage – but it was reassuring to know my account was being monitored for abnormalities.

Use virtual card numbers for safer online shopping

The Eno browser extension has an additional feature for those worried about their data security – virtual card numbers. With this functionality, you can generate a secure card number while shopping online, keeping your actual card number safe from any fraud.

How to use Eno

If you own a Capital One credit card, odds are you’ve reaped the benefits of Eno without even realizing it. The virtual assistant is responsible for sending out fraud alert emails that are likely already in your inbox.

Other Eno features require a bit more activation, though. For instance, if you want to get text and push notifications about account activity, you’ll have to make sure you have notifications enabled from the Capital One app.

Additionally, if you want to start texting with Eno to get updates about your account information – like your current balance or payment due date – you need to opt in to this functionality.

You’ll be prompted to confirm your phone number, and Eno will show you which accounts are eligible for this feature. From there, you can talk with Eno about things like your balance, latest transactions and bill due dates.

Finally, if you want to take advantage of Eno’s virtual card numbers for online shopping, you’ll need to add the service’s browser extension. For now, the Eno extension is available only for Chrome, Firefox and Microsoft Edge.

Bottom line

Capital One Eno is an incredibly useful tool for keeping track of your bank accounts and credit cards, making it simple to ask questions about your money. Plus, Eno virtual card numbers make online shopping more secure.

If you don’t already use all of Eno’s great perks, consider adding the browser extension and opting in to texts. Eno has a lot to offer – and it’s super easy to use.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.