Summary

Adding an additional cardholder can help you earn extra rewards while also boosting their credit, as long as you trust them to spend responsibly.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

You already know that your on-time Wells Fargo credit card payments boost your credit score. But did you know that your payments could also help increase the credit score of a family member or friend with a lower score? Or that your payments could help your children build their own credit scores?

It’s true. This can all happen if you add friends or family members – or anyone else – as authorized users to your Wells Fargo credit card account.

An authorized user is someone who has access to your credit card account. When you add an authorized user to your account, that person receives a credit card in the mail with its own unique number. But when they make purchases with this card, the charges go onto your account.

You’d add an authorized user to your Wells Fargo credit card to help that user build or repair credit. Every time you make an on-time payment on your card, it’s reported to the three national credit bureaus: Experian, Equifax and TransUnion.

Just be careful: While adding authorized users can help others build or repair credit, it could leave you with some financial pain if your authorized users don’t follow your spending rules.

How to add an authorized user to your Wells Fargo account

You can add anyone as an authorized user to your Wells Fargo credit card account. This includes family members, of course, but can also include friends, employees or anyone else you’d like to add.

To add authorized users, you must provide their name, address, date of birth and Social Security number.

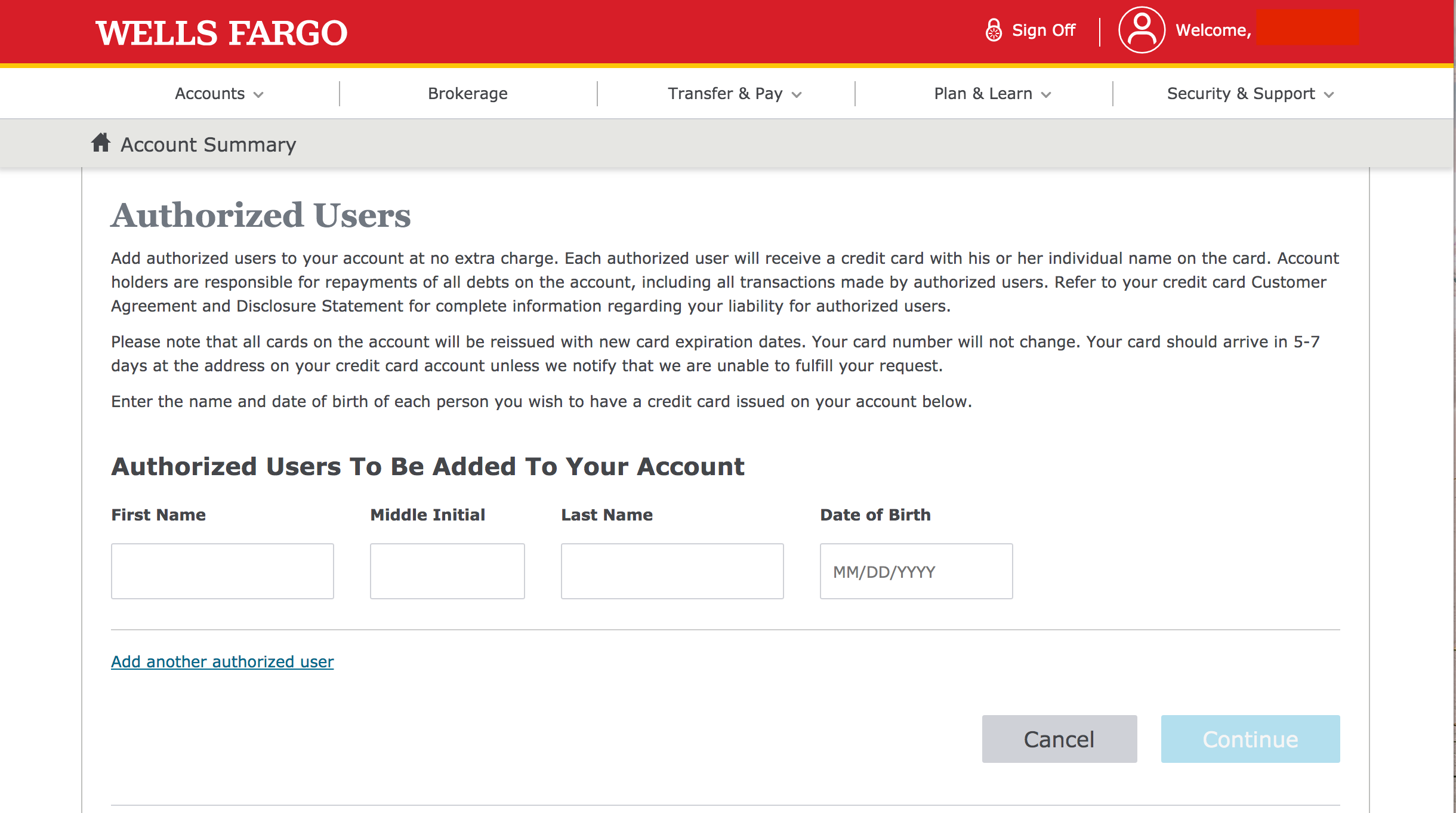

You can easily add an authorized user to your account by first logging on to Wells Fargo Online Banking. After logging in, click on the “Account Services” tab and then click “Credit Card Service Center.” Next, click on the “Request credit card features” heading. You can then click the “Additional cardholders for your account” link, which will allow you to add authorized users.

Is there a fee for adding an authorized user to your Wells Fargo credit card account?

Good news: There are no fees for adding an authorized user to your Wells Fargo credit card.

Should you add an authorized user to your Wells Fargo card?

There are both risks and rewards for adding an authorized user to your Wells Fargo card.

Pros

- Credit score boost: When you add authorized users, you can help them repair damaged credit. When you make an on-time payment on your Wells Fargo card, that payment is reported to the national credit bureaus, which will provide a boost to your credit score and the scores of any authorized users.

- Building credit scores: Some people don’t have enough of a history to have a credit score. This often happens with young adults who haven’t yet applied for their own credit cards or taken out any loans. You can help these consumers build their credit scores by adding them as authorized users. They’ll get the benefits of positive credit history without having to qualify for a card themselves.

- A boost to your rewards: When authorized users make purchases with their Wells Fargo card, those charges go onto your account. This can help you earn rewards and cash back bonuses at a faster rate.

Cons

- Overspending: You are responsible for any charges made by your authorized users. If they refuse to pay you for their charges, you’ll have to make the payments – something that could bust your monthly budget.

- A higher credit-utilization ratio: Your credit utilization ratio – a measure of how much of your available credit you are using – can help or hurt your credit score. If that ratio is high, your score will take a dip. If authorized users run up your credit card balance and then don’t pay you back for your charges, your credit utilization ratio could rise, and your credit score could fall.

- You could hurt your authorized users’ scores, too: If you make a payment 30 days or more past your due date, your credit score could fall by 100 points or more. And if you have authorized users on your account, their scores will fall, too. Only add authorized users if you’re certain that you’ll always make your credit card payments on time.

Bottom line

Adding an authorized user to your Wells Fargo credit card could improve the credit of your spouse, children or friends. But don’t ignore the risks. If authorized users run up charges on your account, you’re the one responsible for paying them off.

The key? Add only authorized users whom you fully trust. And be sure to reach an agreement on how much these authorized users can charge and when they must pay you back for their charges.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.