Summary

An authorized user is an additional cardholder added to a credit account through the permission of the primary cardholder. They receive their own card, but all charges, rewards and payments will be held on one account.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

Adding an authorized user to your Capital One credit card can have great benefits for both you and the authorized user, but there are some things that should be taken into account before making that decision. While you can boost both of your credit scores, or help a family member establish credit, you’ll also be responsible for paying off the balance they put on the card.

An authorized user is an additional cardholder added to a credit account through the permission of the initial primary cardholder. They’ll receive their own card, but all charges, rewards and payments will be held on one account.

Capital One’s authorized user policies

Here’s a look at Capital One’s authorized user policies:

- There is no limit on authorized users – you can add as many as you’d like.

- You can add family members as authorized users (such as a spouse or children), but authorized users don’t have to be related to you (like friends or coworkers, for example).

- There is no minimum age requirement to add an authorized user, as opposed to most other card issuers.

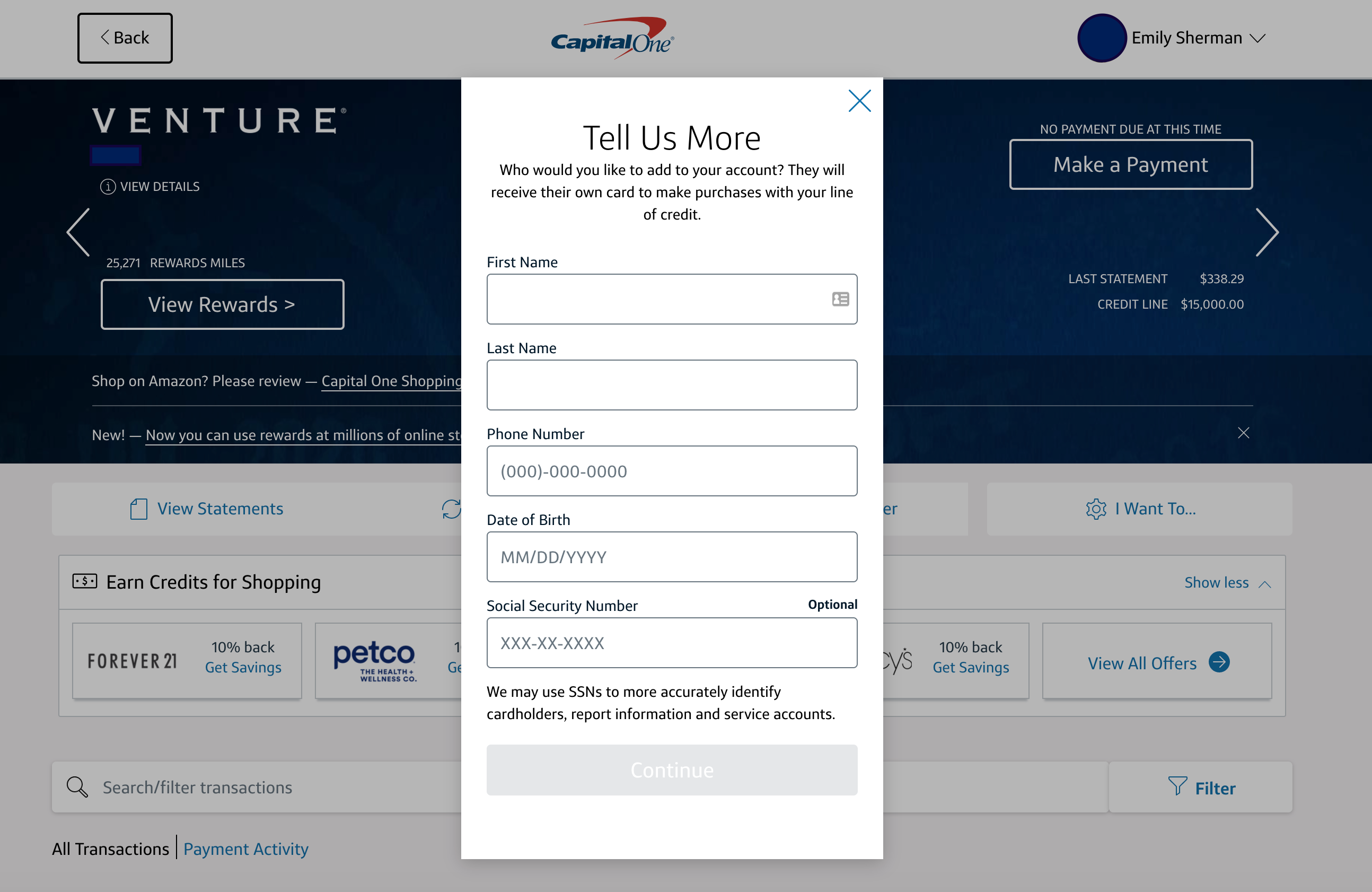

- You will need to provide names, phone numbers, Social Security numbers, dates of birth and the addresses of authorized users when adding them.

Prior to adding an authorized user, be sure that they’ll spend responsibly; not every card offers the option to impose spending limits to prevent authorized users from overspending on your account.

If you notice an authorized user is spending too much, in some cases, your only safeguard is to instantly lock their card. Unless you unlock it, the user will not be able to make purchases on the account.

You also have the option to remove them from your account by logging in, clicking “Services” and selecting “Manage Authorized Users.” Click on the name of the user that you’d like to remove, then check the “remove user” option.

Thankfully, your rewards cannot be cashed in by authorized users unless you authorize them to do so – so you won’t have to worry about missing points, miles or cash back.

How to add an authorized user to your Capital One account

- Log in to your account

- Click “Services”

- Select “Manage Authorized Users”

- Click “Add New User”

When adding a user, you’ll have to provide Capital One with that user’s name, date of birth and Social Security number.

Should you add an authorized user to your Capital One card?

Adding an authorized user to your Capital One card can provide great benefits to both you and your added users. However, there is a degree of risk involved when adding an authorized user, so you should consider this before deciding if it’s the right choice for you.

Although Capital One authorized users will make charges to the same account as the primary cardholder, the primary cardholder is the one responsible for paying off the balance. Because of this, it’s important to ensure your authorized users won’t overspend. Before adding an authorized user on your Capital One credit card, make a plan concerning how much each person can spend and when or how they will pay your back.

Becoming an authorized user could be a great way to help build someone’s credit. Whether this is a spouse or child, by adding them as an authorized user, you’ll be helping them boost their credit score or build their credit from the ground up. Whenever you make an on-time payment, not only will it appear on your credit report, but also on those of your authorized users.

A benefit for the primary cardholder is that, depending on which Capital One card they hold, they’ll be able to boost their rewards haul. For example, if you have a rewards card like the Capital One Venture Rewards Credit Card, authorized users earn 5X miles on hotels and rental cars booked through Capital One Travel and 2X miles on all other purchases when they pay with the card.

There are both pros and cons to consider when adding an authorized user to your card. Authorized users are typically able to enjoy some of the card’s perks while the responsibility falls on the primary cardholder. Keep reading for a summary of the associated risks and rewards:

Pros

- Build and boost credit. Every on-time payment made to your account not only positively affects your credit score but eventually boosts the credit of any authorized users. Furthermore, you can help someone, such as a family member, establish a credit history by adding them to your account.

- Increase rewards points. If you own a rewards credit card, any purchases on your account made by authorized users will contribute to your total rewards. All points earned across users will pool in one account.

Cons

- Overspending and missed payments. Since not all credit cards allow you to set a spending limit on an authorized user’s card, you may find yourself in a situation where they’ve spent more than you’ve anticipated. Since the primary cardholder is responsible for the bill, you could be left with a balance you’re unable to pay off.

- Higher credit-utilization ratio and interest charges. By having more payments made on your account, it’s likely to increase your credit utilization ratio. When your credit utilization ratio is too high, it negatively impacts your credit score. Also, if you’re not paying off your balances in full each month, you could be subject to higher interest rates.

Bottom line

Adding an authorized user to your Capital One credit card has both risks and rewards. You can increase your total rewards haul, but you could also end up with an expensive bill. Because of the various pros and cons, it’s important to fully think through the decision and plan ahead before adding an authorized user to your account.

Thankfully, Capital One makes it easy to add an authorized user if you decide it’s the right choice for you.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.