Summary

Adding authorized users to your American Express credit card can help them boost their credit while boosting your own rewards earning, plus it’s easy to do. Here’s how.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

Having a strong credit score is important. Consumers need it to get approved for a mortgage or car loan — and to qualify for the best credit cards at the lowest interest rates.

Adding someone as an authorized user on your American Express credit card account can help them build a credit score if they lack one or improve one that’s weak. Just be careful: Authorized users can cause you financial pain if they overspend each month.

An authorized user is someone who can use your credit card account to make purchases. Every purchase that an authorized user makes goes onto your account, but they are not financially responsible for paying those charges. That’s up to you. So, it’s crucial to add only authorized users you trust to use your card responsibly and to reach an agreement first on how much they can charge and when they need to pay you for those purchases.

Adding an authorized user to your American Express card primarily benefits them, not you. Every time you make an on-time payment, it’s reported to the three national credit bureaus, which helps your authorized user improve their score, as well as yours.

One benefit for you as the primary cardholder? If you have an American Express credit card that earns rewards, authorized users can help you build those points or cash back faster. All purchases authorized users make on your card will count toward your rewards bonuses. And if it goes awry, you can easily remove that person from your American Express account whenever you like.

You can add anyone you’d like as an authorized user. Most people add family members, maybe their spouse or children. However, you can add friends or even people who work for you, such as a nanny or babysitter.

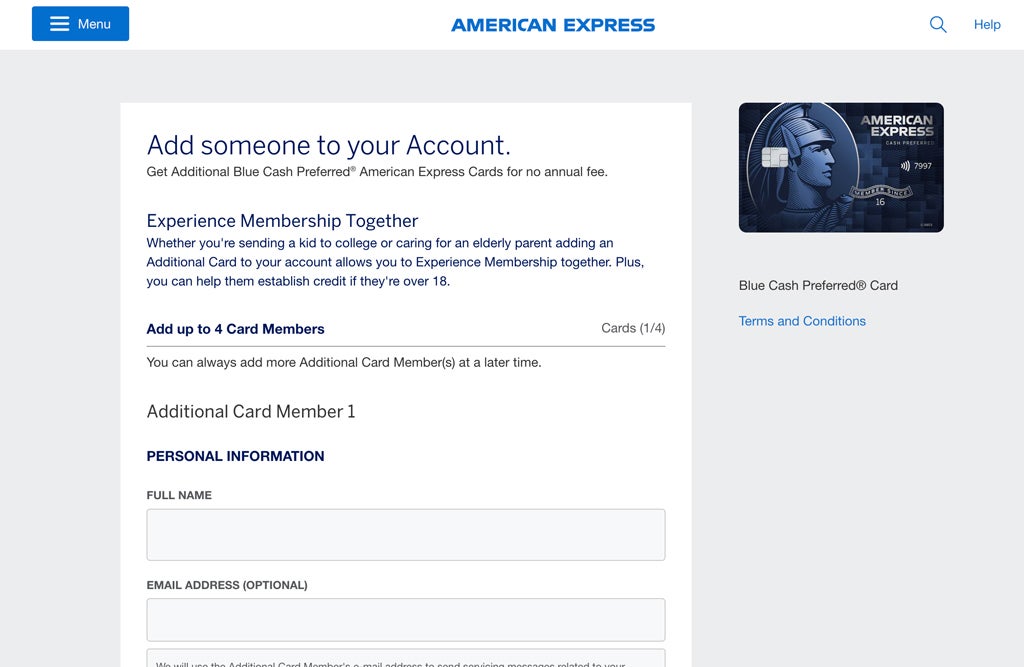

How to add an authorized user to your American Express account

Adding authorized users to your American Express account is a simple process. First, log in to your American Express account. Then click “Account Services”, which can be found at the top of the page and click “Manage other Users.” From there, you can select “Add Someone to your Account.”

When adding authorized users, you need to provide the person’s name, date of birth and Social Security number. You don’t have to provide authorized users’ birth dates and Social Security numbers immediately when applying for the card, but American Express does require you to provide this information within 60 days of application. If you don’t, the authorized user’s card will be deactivated. One other limit: All authorized users must be at least 13 years old.

Your authorized user will usually get the same card that you hold. If you hold the Blue Cash Everyday® Card from American Express, for example, your additional card member will also receive that card.

There are exceptions, though. If you hold The Platinum Card® from American Express, you can sign your authorized users up for either the Platinum Card or Gold Card (not to be confused with the American Express® Gold Card). The advantage of the authorized user Platinum Card is its benefits from the Platinum Card, whereas the Gold Card for authorized users only gives credit for Global Entry or TSA PreCheck.

You can add as many authorized users as you’d like, though some cards may begin to charge you annually the more users you add. And if you have more than one American Express card, you can add authorized users to any of them.

Fee for adding an authorized user

Some American Express cards charge a fee for adding authorized users. Others don’t. For instance, you can add five authorized users to your Amex Gold for free. If you want to add more, you’ll pay an annual fee of $35 for each extra one.

Adding authorized users to the American Express Platinum Card is costlier: You’ll pay a total annual fee of $175 to add three additional Platinum Card authorized users. If you want to add more, you’ll have to pay $175 a year for each one. You can do the same with The Business Platinum Card® from American Express, but it’ll cost you $300 each.

Other than the Platinum Card, the Delta SkyMiles® Reserve American Express Card and the Delta SkyMiles® Reserve Business American Express Card also charge a $175 annual fee for each authorized user you add. All other American Express cards don’t charge you for adding authorized users.

Managing authorized user access

American Express does give primary cardholders some control over the authorized users on their account. First, the charges that each authorized user makes on your account are itemized on your monthly statements. American Express also allows you to check the balances on your additional cards through your online account at any time.

Unlike some credit card providers, American Express lets you set a monthly spending limit for each of your authorized users. You can set this limit as low as $200 up to your full credit limit.

Pros and cons of adding an authorized user

There are both benefits and potential pitfalls to adding authorized users to your American Express card.

Pros

- Increased rewards: The purchases your authorized users make all count toward your rewards points and cash back bonuses. So, adding authorized users can help you earn rewards and cash back at a faster pace.

- You can help your children build credit scores: Want your kids to steadily build strong credit scores? Adding them as authorized users can help do this. Many younger adults have no credit score at all because they haven’t established any credit history yet. Every time you make an on-time payment on your American Express account, it will strengthen your credit score, as well as help users who don’t have a score build one of their own.

- Help to those with damaged scores: Maybe you know a family member or friend with a weak credit score. By adding them as authorized users, you can help them repair their low scores. Since the payments you make on your own card and your authorized user’s card are reported to the credit bureaus, they will also count toward your user’s score.

Cons

- You’re responsible for authorized users’ charges: In good times and in bad, you are liable for any charges your authorized users make each month. If they run up an excessive amount of debt and refuse to pay for it, you’re responsible for covering that payment. You can control some of this by setting spending limits for authorized users.

- A damaged debt-to-income ratio: Your debt-to-income ratio, a measure of how much of your gross monthly income your monthly debts consume, is an important number for your credit score. If your authorized users add too much debt to your American Express card and refuse to pay it off, it could hurt this ratio. This is especially true if you can’t afford to pay off those charges on your own.

Should you add an authorized user to your American Express card?

Adding authorized users is a worthwhile move if you want to help a family member or friend boost their credit. The move, though, could be risky if your authorized user charges too much each month. Only add authorized users whom you trust to abide by any spending rules you set up for them so that you can make it a win-win scenario.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.