Summary

U.S. colleges and universities are more card-friendly, but fees for charging tuition are rising, according to a new CreditCards.com survey.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

Want to pay for college with a credit card? You increasingly have that option, but it comes at a price.

U.S. colleges and universities have become more likely to accept credit card tuition payments, but the fees associated with card payments are rising, according to a new CreditCards.com survey.

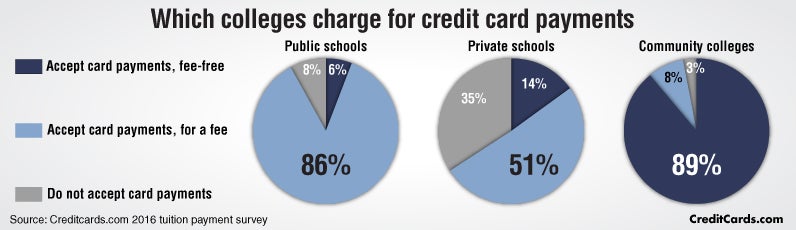

Of the 300 largest U.S. private, public and community schools, reviewed in August 2016 by CreditCards.com, 255 schools (85 percent) accept credit cards for tuition payments under at least some circumstances.

Among the schools that accept cards, 145 (57 percent) charge fees for card payments. That’s an increase from 2014, the last time we conducted this study.

That means students and parents who hope to earn big rewards by using a credit card to pay tuition may be disappointed. The average credit card payment convenience fee is 2.62 percent, enough to wipe out the value of most card rewards, the survey found.

“It may make sense to charge tuition if you get rewards points and have the funds to pay off the debt quickly, but not if you have to pay a service charge to do so,” said Joseph Orsolini, a financial planner with College Aid Planners.

Other survey highlights:

- Fees more common. Today, 145 schools charge a convenience fee for card payments, up from 142 in 2014.

- The most common fee is 2.75 percent of the payment amount, charged by 83 schools, compared to 76 in 2014.

- Fewer fee-free schools. Only 21 four-year institutions in this year’s survey accept card payments fee-free, down from 30 in 2014. Private schools have reduced free card acceptance the most, as only 15 schools take fee-free card payments today compared to 21 in 2014.

- Community colleges are card-friendly. Of the 100 community colleges surveyed, 97 percent accept credit cards for tuition payments and only 8 percent charge convenience fees. By contrast, 93 percent of public universities and 77 percent of private schools that accept credit cards charge fees for the service.

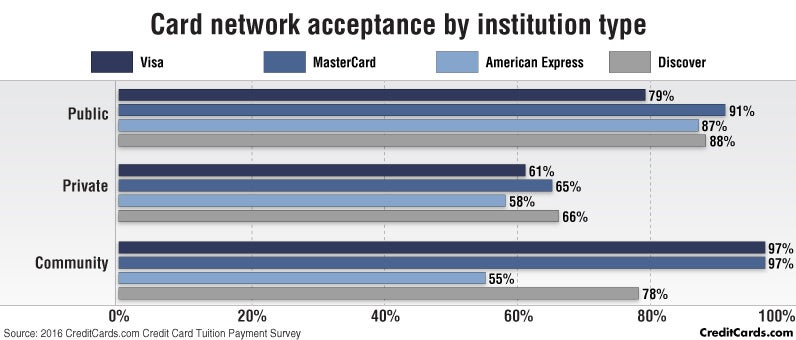

- Greater card network acceptance. Of the schools that accept credit cards for tuition payments, 70 percent take cards from at least all four major networks (Visa, MasterCard, American Express and Discover), up from 60 percent in 2014.

To view schools’ credit card policies for paying tuition, see “CreditCards.com 2016 Credit Card Tuition Payment Survey data.” See our survey’s methodology.

Card acceptance growing slowly

Borrowing money to pay for college is common, but students and their families typically rely on student loans, not credit cards, according to a 2016 study by student lender Sallie Mae. Just 2 percent of families paid tuition with a credit card in 2015, compared to 3 percent in 2014, according to Sallie Mae’s report.

However, families that paid for college with a credit card charged an average of $4,443 during the 2015-2016 school year. And as more schools accept card payments overall, according the CreditCards.com survey, those families may have an easier time paying with plastic this year.

For example, 179 of the 255 card payment-accepting schools surveyed accept cards from all four major networks – Visa, MasterCard, Discover and American Express. Some schools even accept smaller networks, such as JCB and Diners Club.

Some schools expand card payments

Although most schools restrict card usage to just online payments, 13 schools have expanded how they accept card payments over the past two years. For example, Texas Christian University in Fort Worth, Texas, now accepts card payments both in-person and online. Two institutions also now welcome card payments that didn’t before: the University of California at Berkeley and Belmont University.

Community colleges are the most card-friendly higher education institutions, as 97 percent of those surveyed accept tuition payments via plastic. Community colleges also tend to have more flexible card payment policies. For example, 90 community colleges take card payments at least online and in-person, compared to only seven public universities and 11 private schools.

| BY THE NUMBERS: SCHOOL TUITION CARD FEES |

|---|

|

Two community colleges surveyed by CreditCards.com also accept network-branded gift cards for tuition payments: The Lone Star College System in The Woodlands, Texas, and Collin County Community College District in McKinney, Texas.

Fee-free card payments disappearing

More schools are tacking on convenience fees for card payments than they did in 2014, according to the survey. Today, 86 public schools charge a fee for credit card payments, compared to 83 in 2014. Similarly, 51 private schools charge card payment fees, compared to 47 in 2014.

Those fees are inching higher, too. Nine schools in this year’s survey have higher card payment convenience fees than in 2014. One such school is Roger Williams University in Bristol, Rhode Island, which now charges 3 percent (the highest convenience fee in this year’s survey), up from 2.99 percent in 2014.

Over the past two years, eight schools have introduced a fee for card-paying students and parents. One of those schools, the University of North Texas, says it can’t afford to cover the costs of card payments anymore.

“Providing a complimentary credit or debit card payment service has become prohibitively expensive because of the processing fees assessed by the credit card companies and financial institutions,” according to the university’s website. Before Jan. 1, 2015, the University of North Texas footed the card processing bill, which reduced the funds available for other school needs, the school’s statement says. The recent change to tacking on fees to card payments“is expected to save nearly $2 million,” according to the university.

Private schools also cite burdensome card-payment processing costs. For example, the University of Dayton in Dayton, Ohio, stopped accepting credit card tuition payments in July 2014 and states on its website the decision was made because: “Credit card payments have become prohibitively expensive due to fees charged to the university by credit card companies.”

In order to allow card payments but reduce the costs and work associated with card processing, many U.S. higher education institutions now contract with third-party payment processors, such as CASHNet, to accept card-based tuition payments.

“Processing credit card payments on campus efficiently can be quite involved, and it can be easy to forget that it’s more than just pushing transaction data through the banking rails,” explained Edward Worrilow, head of marketing and communications for CASHNet, a payment platform owned by Higher One, a technology provider for higher education institutions. CASHNet secures card transactions, ensures they are compliant with network rules and reconciles them with school records.

| SCHOOLS THAT NO LONGER ACCEPT CARDS |

|---|

Seven schools in the 2016 tuition payment survey have stopped taking cards since our 2014:

|

Such partnerships often push credit card payments online to simplify the card transaction process even further. Based on the CreditCards.com survey, 90 percent of public schools (up 3 percent from 2014) and 76 percent of private schools (up 10 percent from 2014) have online-only policies for credit card tuition payments.

It’s typically third-party payment processors that charge and receive the convenience fees, not the school. As University of Colorado Boulder noted online about its card fee, “CU does not charge or receive this fee. NelNet Business Solutions charges this fee to cover the cost of transaction fees assessed by credit card companies.”

Payment restrictions to reduce card use

Instead of working with a payment processor that passes on a convenience fee, some schools cut costs by decreasing the type of payments student account offices will accept, allowing only certain students to pay with plastic.

For example:

- At Northeastern University in Boston, only students in the College of Professional Studies and most graduate programs are allowed to pay tuition with a card. Undergraduate students cannot pay with credit cards.

- Only graduate students at LeHigh University in Bethlehem, Pennsylvania, are allowed to charge tuition and related fees. Undergraduate students may pay with plastic only for summer sessions.

- Boston University prohibits full-time students from paying tuition with a credit card, but permits part-time students to pay with a card.

Card payment policy quirks

In addition to card fees and network acceptance, CreditCards.com found a few other card payment policy details parents and students should note:

- Debit card payments aren’t free, either. Debit card acceptance was not part of this survey, but 34 schools specifically noted that credit card policy rules apply to debit card payments. However, all surveyed schools have at least one fee-free payment option, such as electronic check or cash.

- Minimum fees may apply. Among the 145 schools that charge a convenience fee for card tuition payments, 20 schools charge card payers a minimum $3 convenience fee.

- Convenience fees may show up as separate charge on your card statement. Card payers are given a heads-up about this by four fee-charging schools in the CreditCards.com survey.

- Card fees are non-refundable. If you pay your tuition bill with a card, but drop a class or two, you won’t get your convenience fee back from any tuition reimbursements, according to eight fee-charging schools.

- International card payments may cost more. While international credit card payment information was not formally researched in this year’s tuition payment survey, three schools – University of Cincinnati, University of Delaware and York College of Pennsylvania – specifically noted on their websites that parents and students paying with international credit cards may face a higher card convenience fee of 4.25 percent.

Is charging tuition OK?

For some, credit cards can be a convenient, short-term payment option for covering a tuition bill while waiting for a student loan disbursement or to stem a temporary cash-flow problem. And when no convenience fee is charged, paying large tuition bills with a credit card could even rack up big card rewards.

However, the problem with using a credit card is that interest rates are typically much higher than those on federal or even private student loans. Unless you can quickly pay off a hefty tuition charge, credit card interest will add up. For example, if you charge a $10,000 tuition bill to a general purpose card with a 15 percent APR and slowly pay it off over five years, you would incur $4,273.94 of interest, assuming you don’t use the card for anything else. Compare that to a federal student loan with a 3.76 percent interest rate that doesn’t start accruing interest until six months after graduation, and it’s a no-brainer, as credit card interest starts accruing immediately.

“If you need long-term financing, first look to federal student loans and then private student loans before using a credit card,” Orsolini said. “Or pick a different, cheaper college. Credit cards are not designed to finance long-term debt such as student loans.”

Survey methodology:

The Credit Card Tuition Payment Survey of 300 higher education institutions from the continental U.S. was conducted in August 2016 by CreditCards.com: The largest 100 private, 100 public institutions and 100 community colleges, based on U.S undergraduate, first-time enrollment figures from the U.S. Education Department. The same selection of schools was reviewed by CreditCards.com in 2014.

The average convenience fee was calculated using all rates provided by each institution that accepts credit card tuition payments and charges an additional fee – a total of 145 schools across all three institution categories. Flat rate fees were not included in this calculation.

See related: CreditCards.com 2016 credit card tuition payment survey data, Credit Card Tuition Payment Survey 2014: Fees, restrictions wipe out dreams of rewards

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.