Summary

With the impacts of COVID-19 tightening many households’ finances, those shopping for a new credit card are putting a higher premium on earning cash back than they did pre-pandemic, according to new data from Debt.com.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

With the impacts of COVID-19 tightening many households’ finances, those shopping for a new credit card are putting a higher premium on earning cash back than they did pre-pandemic.

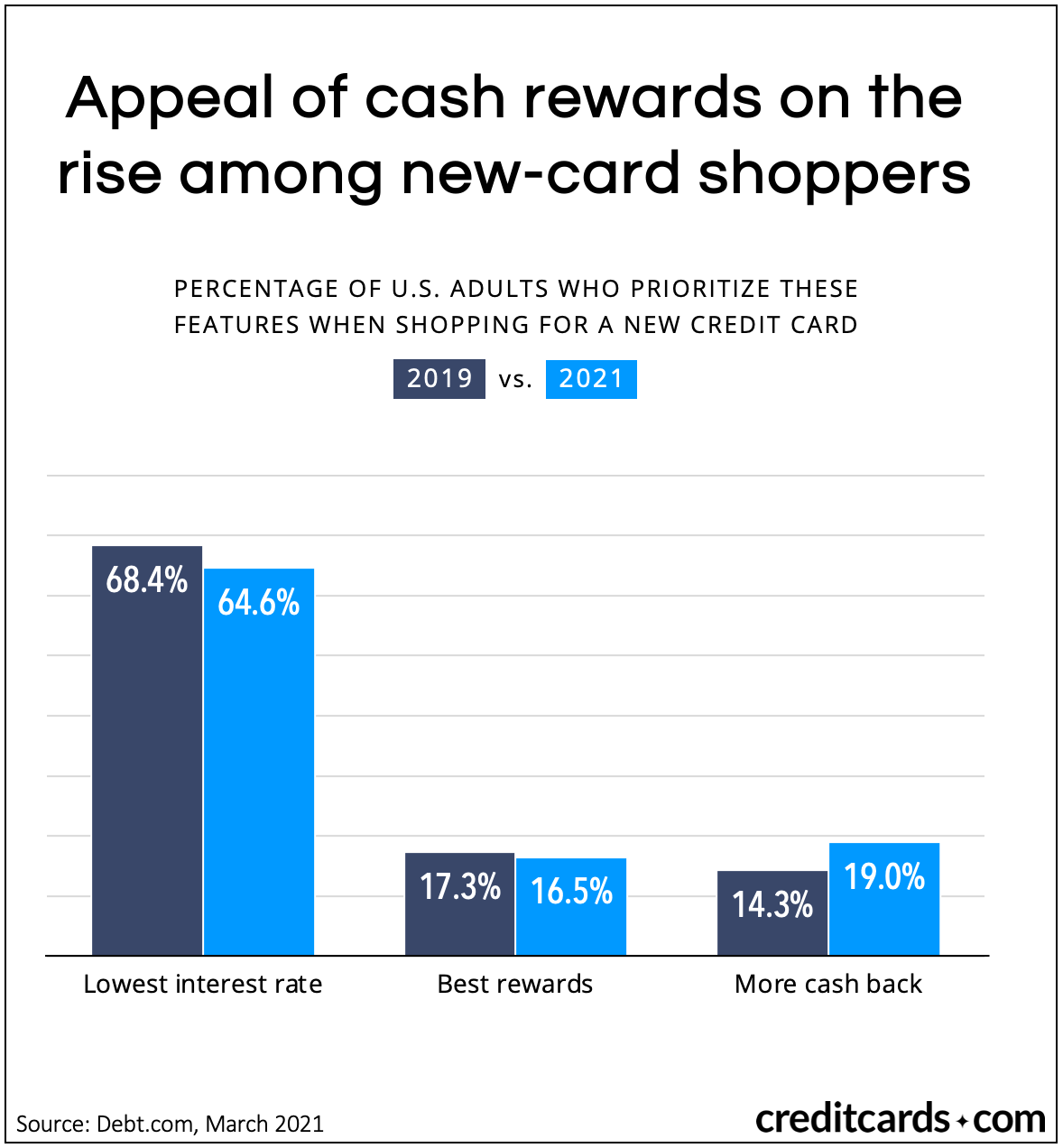

A recent survey by Debt.com showed that almost 1 in 5 U.S. card shoppers (19%) now say they are looking for higher cash back rewards, compared to just 14.3% of respondents who said this was their top priority in 2019.

Meanwhile, fewer card shoppers say they are focused on interest rates or on finding the best rewards than indicated two years ago. Those prioritizing the lowest interest rate dropped from 68.4% to 64.6% over the two-year span, while those striving for the best rewards, in general, decreased from 17.3% to 16.5%.

See related: Cash back vs. points: Which is better?

The pandemic has also had other impacts on credit card usage. While more Americans say they are using credit cards post-pandemic than pre-pandemic (84.6% in 2019 versus 89.7% now), they simultaneously report they are using fewer cards. Two years ago, 35.6% indicated they were actively using three or more cards. Today that percentage is just 29.5%.

Cardholders are also hitting their limits less frequently. More than half (51%) of the 2019 respondents reported maxing out one or more cards in the past year, with 11.6% saying that they hit their limit every month. Today, those figures are down to 42.2% and 8.8%, respectively.

Debt.com’s latest survey installment was conducted among 1,003 U.S. adults from mid-January through mid-March of this year, with results released March 30.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.