Summary

Incorrect information in your credit report can lower your credit score, and that could mean that you pay higher interest rates on credit cards and loans. You might even be turned down if you’re applying for new credit. Here’s how you can dispute an error in your Experian credit report.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

Finding an error in your credit report is a terrible inconvenience, and it’s more common than you may think.

Nearly 20% of the complaints submitted to the Consumer Financial Protection Bureau (CFPB) in 2018 were from people who said their credit reports contained incorrect information. And 7% of complaints focused on the credit reporting agency’s investigation into their problem.

For Experian, the CFPB report found nearly 17,000 complaints about incorrect information on credit reports, and 6,400 complaints about the company’s investigation into an ongoing issue.

Incorrect information in your credit report can lower your credit score, and that could mean that you pay higher interest rates on credit cards and loans. You might even be turned down if you’re applying for new credit.

The place to start if you want to check the accuracy of your credit report is to request a copy from Experian, as well as the other two main credit bureaus – Equifax and TransUnion. All three bureaus are required to provide you with a free copy of your credit report every 12 months under the Fair Credit Reporting Act.

You can request your report at AnnualCreditReport.com. The free reports don’t include your credit score.

See related: The three national credit bureaus: How Equifax, Experian and TransUnion work

Common credit report errors

The CFPB says common errors to look for in your credit report include:

- The wrong name, address or phone number

- Accounts belonging to someone else, whose name is similar to yours

- Accounts opened under your name due to identity theft

- Accounts that have been closed but are listed as open

- Accounts incorrectly listed as late

- The same debt listed more than once

- Incorrect balances on accounts

- Incorrect information reappearing on the account after it was already corrected

How to file a dispute with Experian

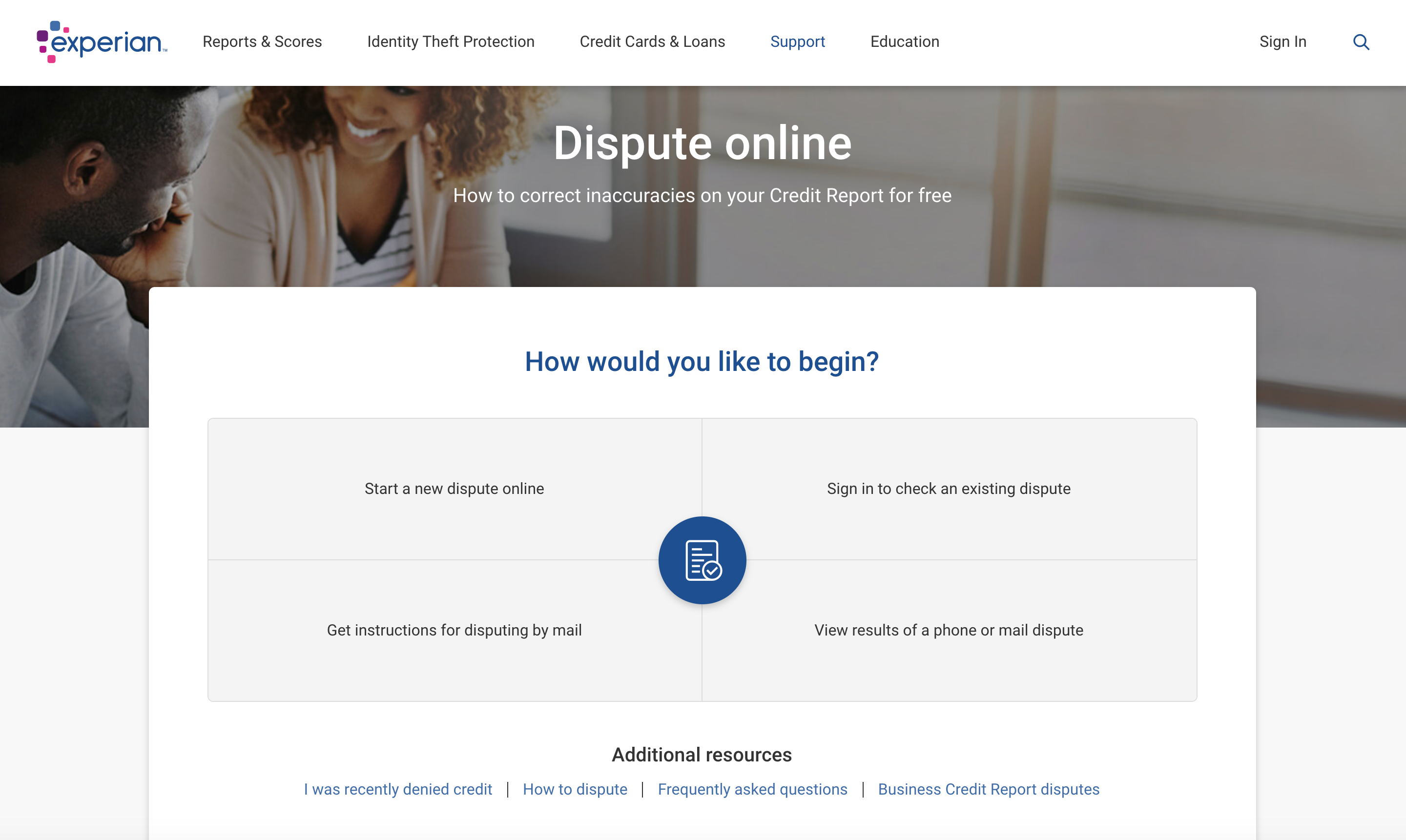

If you have an error in your credit report from Experian, you can file a dispute at the company’s online dispute center, or you can initiate a complaint by phone or mail. There is no charge for disputing an item on your credit report.

To file a dispute online, you’ll have to provide personal information to verify your identity, such as your home address and Social Security number, and answer several questions about such things as your previous employer and date of birth.

Once you sign in, you’ll be able to dispute various parts of your credit report. The report is divided into sections on personal information, accounts and inquiries. Some reports also have a section on public records. Items that could be affecting your credit may be listed as “potentially negative.”

You’ll use a drop-down box to dispute various items, and you may have to provide additional information or documentation to substantiate your dispute. You can scan pages and upload them to support your claim.

You can also dispute items on your credit report by mail. Experian provides information on how to dispute an item by mail. The letter should be sent to:

Experian

P.O. Box 4500

Allen, TX, 75013

If you want to start a dispute by phone, you’ll need to request a copy of your credit report and call the number listed on it.

See related: How to remove negative items from your credit report

After you’ve filed

Once you’ve filed the dispute, you’ll get emails from Experian charting its progress. The company says it will send an email when the dispute has been opened, as well as updates and another email when it has results.

You can also follow the progress of your dispute in the “Alerts” section of Experian’s dispute center.

Experian says information that is incorrect will be fixed and information that can’t be verified will be deleted or updated.

The credit bureau may have to contact the company that provided the information that is in dispute. If that company – whether it’s your card issuer or another creditor – says the information is correct, it can’t be removed from your report.

You also can contact the company that provided the information. The CFPB has a sample letter that you can use to send to creditors.

Experian says disputes typically are resolved within 30 days.

If you disagree with the outcome, you can dispute the item again if you have additional information to support your claim.

You also can add a statement of dispute to the Experian credit report. With it, you can explain why the information is incorrect. A potential lender who sees your Experian report will also see your statement and might ask you for more information.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.