Summary

A credit freeze prevents lenders from pulling your credit score or history to open a new loan or credit card, and it can protect you from fraud. Here’s how to freeze your credit with Experian.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

One of the best things you can do for your finances is protect your credit.

A good credit score and history are essential to getting loans and credit cards, not to mention qualifying for low interest rates. But your score can be jeopardized if your personal data gets hacked or someone fraudulently opens accounts in your name.

There is a way you can fight back, however, and that is by freezing your credit. A credit freeze prevents lenders from pulling your credit score or history to open a new loan or credit card. Even if an identity thief has your personal information, they won’t get far in opening a new account if your credit data is blocked.

See related: What you need to know about common identity theft techniques

When should you freeze your credit?

Any time your personally identifiable information (PII) is stolen or exposed through a data breach, you should consider freezing your credit. PII refers to details such as your name, address, birth date, Social Security number and driver’s license number.

You may also want to place a credit freeze if you’ve noticed fraudulent charges or withdrawals on your existing accounts. When that happens, you don’t know if the fraudster simply got a hold of your card information or whether they have the data to take out loans or credit lines under your name. Placing a hold as soon as you know you’ve been exposed will help you avoid having your money stolen or your credit destroyed.

It’s important to know that you have to file a credit freeze request with the three major credit bureaus, which are Experian, Equifax, and TransUnion. The tips below are specific to Experian’s credit freezing process.

How to freeze your credit

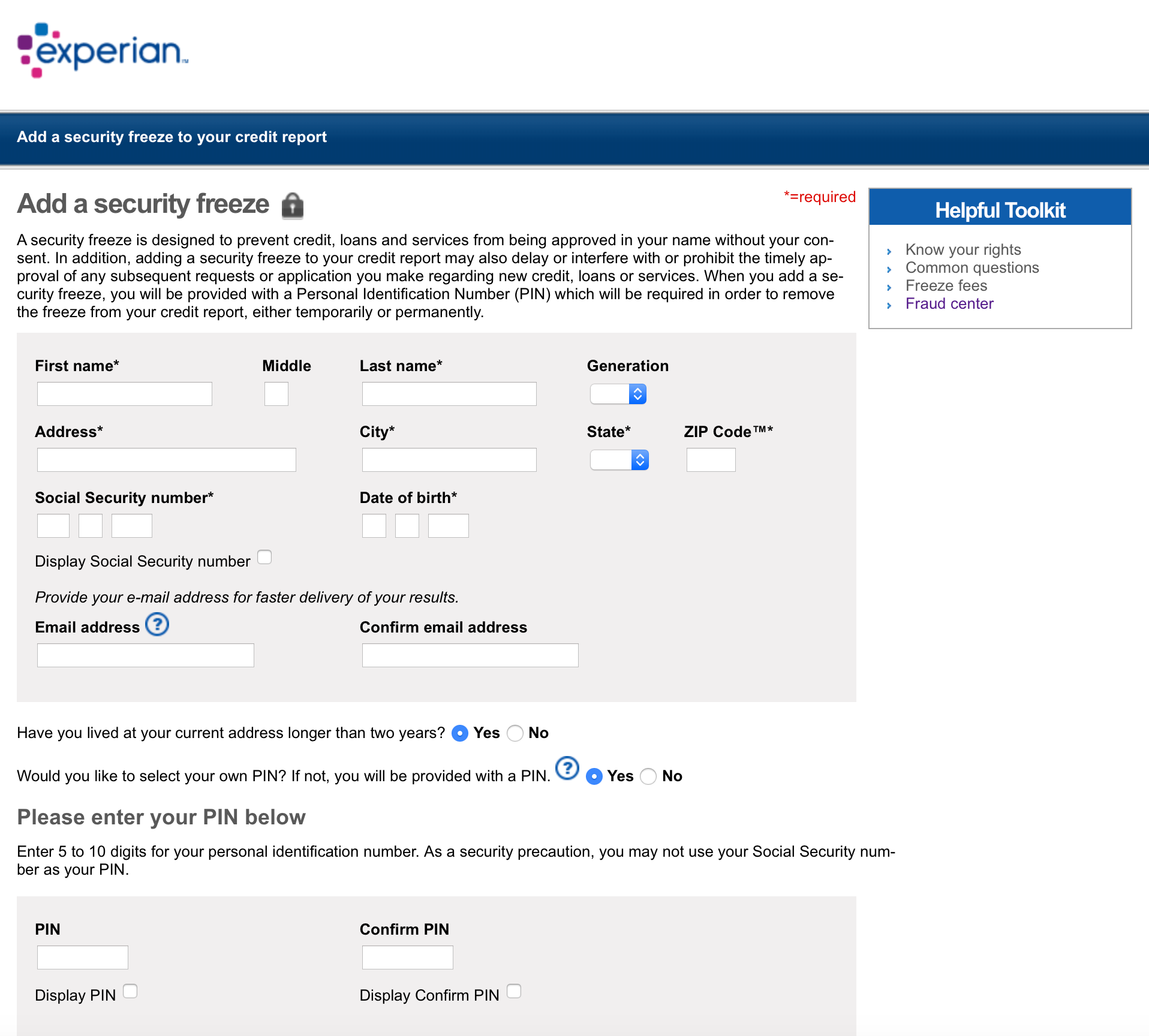

To freeze your credit with Experian, simply go to the Experian website and input your name, address, Social Security number, date of birth and email address. You’ll also need to create a PIN, which you’ll use to remove the freeze when you’re ready.

There’s no cost for placing a credit freeze, according to federal law, and it will take effect immediately if you place the request online. You can also call Experian or mail in a credit freeze request.

If your child’s information has been compromised, you can place a hold on their credit file as well. Same goes for anyone you’re caring for who is incapacitated and can’t advocate for themselves, and for whom you have a power of attorney document. Unlike freezing your own credit, however, you must mail in a freeze request, along with supporting documentation.

Does a credit freeze hurt your credit score?

A credit freeze does not impact your credit score or history. It simply blocks lenders from making a credit inquiry. That means you can’t open a new loan or card while it’s in place, but you won’t take a hit for having an active freeze.

A credit freeze can prevent damage to your score since no one can open accounts and run up huge balances without your permission.

What if you need to apply for a loan?

If you need to apply for a loan or credit card but don’t want to unfreeze your credit permanently, you can give the creditor one-time access to your Experian file by creating a single-use PIN. Simply go to the Experian website and request the special PIN, then provide that number to your prospective lender. You’ll need to get one-time PINs for every creditor you apply with while the freeze is in place.

When should you permanently lift a credit freeze?

This is up to you. If you’re applying for loans with several lenders – when you’re buying a home, for instance, and want to get quotes from different companies – placing temporary lifts for all of them may become tiresome, so you might choose to remove the freeze permanently.

Or, if you feel that your information is safe again, you can lift the freeze so you don’t have to remember to do it each time you want to open a new credit card or apply for a loan.

On the other hand, placing temporary lifts is a small price to pay for security and peace of mind. Ultimately, it comes down to your comfort level. If you feel confident that your data is secure, you may prefer to lift the freeze altogether. But if you’re more concerned with identity theft, you may opt to keep the freeze in place longer.

Another option is to lift the freeze but place fraud alerts on your account so that lenders will call you every time they receive an application in your name. That way, they won’t pull your credit unless they can verify that you actually want to take out a loan or open a new account. A fraud alert is a little less restrictive than a credit freeze, but it still helps protect you.

See related: Should I periodically replace my card to deter fraud?

How to lift a credit freeze

You can lift a credit freeze with Experian instantly by going to the bureau’s website, and you’ll need your PIN to remove the block. Experian also allows you to call directly to remove a credit freeze, or you can mail in the request. If you go the mail-in route, the freeze will be lifted within three days of Experian receiving it. The best bet is to take care of the freeze online or over the phone so you know it’s done right away.

Pros and cons of freezing your credit

Credit freezes help you protect your finances when your personal information has been exposed to identity thieves and fraudsters. They provide a buffer during which you can change your account passwords, review your transactions for signs of theft and call your current creditors to request that they send you new cards.

However, credit freezes aren’t foolproof for preventing fraud. If someone has your credit card or checking account information, they can still use that to withdraw money or make charges before you have a chance to alert your bank. A credit freeze only applies to new accounts, so you need to work with your lenders to safeguard your existing credit lines and deposit accounts.

You also need to place a credit freeze with each credit bureau individually. Fortunately, each allows you to request a freeze online and the process is fairly simple.

The other downside to a credit freeze is that you need to lift it every time you want to open a new account. To make this as painless as possible, the FTC recommends asking your lender which credit bureau it uses so you only have to place a temporary lift with that company.

See related: How to dispute an error in your Experian credit report

Bottom line

A credit freeze should be one element of a broader strategy that involves regularly reviewing your account transactions and requesting your yearly free credit report from Experian, Equifax and TransUnion. You can order all three from AnnualCreditReport.com, and it’s a good idea to review each closely to make sure there are no suspicious accounts or delinquencies.

Making sure you have secure passwords is another way to prevent fraudsters from accessing your accounts.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.