Summary

Our team has compiled statistics on U.S. credit card delinquencies over the years, as well as collections and much more.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

When it comes to credit card bills, many Americans are on their best behavior.

According to the Federal Reserve System, the delinquency rate for credit card bills at least 30 days past due stood at a historically low 1.89% in the first quarter of 2021. The highest 30-day delinquency rate ever recorded for credit cards was 6.77% in the second quarter of 2009, toward the tail end of the Great Recession.1

Data from the Federal Reserve Bank of New York tell a different story for people with credit card bills at least 90 days past due.2

- In the first quarter of 2021, the 90-day delinquency rate was 9.98%, compared with 9.09% at the same time in 2020, according to the Federal Reserve Bank of New York. In other words, delinquencies of 90 days or more actually went up during the pandemic.

- Those figures, however, fall short of the 90-day-or-more credit card delinquency rates amid much of the Great Recession and even in its aftermath. During all of 2010, the first full year after the Great Recession, the quarterly 90-day delinquency rate exceeded 13%.

Figures from the Federal Reserve Bank of New York also show which age groups are most likely and least likely to head into 90-day-or-more delinquency territory with their credit cards.2

- In the first quarter of 2021, Americans age 18 to 29 had 9.63% of their credit card balances drifting toward 90-day delinquency. That was the highest percentage for any age group. The lowest percentage in the first quarter of 2021 was 3.71% for those aged 60 to 69.

Card delinquency rates in the pandemic

The COVID-19 pandemic triggered what could be dubbed the Great Debt Cutback.

According to the Consumer Financial Protection Bureau, Americans who previously had and had not run into trouble paying bills over covering expenses slashed their credit card debt during the pandemic.3

For those who had not encountered bill or expense difficulties before the pandemic, credit card debt fell 13.6% from February to June 2020.

Among those who had experienced difficulties, the percentage was even greater (17%).

Meanwhile, thanks in large part to federal stimulus checks and household belt-tightening, the 30-day credit card delinquency rate dropped during the pandemic.

- It landed at 1.89% in the first quarter of 2021, roughly one year after the onset of the COVID-19 pandemic in the U.S. That’s the lowest rate since the Federal Reserve System started tracking credit card delinquency data in 1991.

- By contrast, the rate was 2.7% in the first quarter of 2020 and 2.54% during the same period in 2019.

Yet as data from the Federal Reserve Bank of New York shows, longer-term delinquencies have been nagging at Americans during the pandemic.2

During all of 2020 and into the first quarter of 2021, the 90-day delinquency rate was over 9%. By comparison, the same rate never went past 8.32% throughout 2019. The year before, the rate didn’t exceed 8.01%.

On a positive note, the Fed’s data show the percentage of balances flowing into serious delinquency decreased from the first quarter of 2020 to Q1 2021 for all loan types, including credit cards.

Credit card delinquency rates by age group

Among all age groups, 3.78% of credit card balances were creeping toward 90-day-or-more delinquency in the first quarter of 2021, the Federal Reserve Bank of New York says.2 But the percentages vary widely among the nation’s age groups:

- 18-29 – 5.12%

- 30-39 – 4.51%

- 40-49 – 3.98%

- 50-59 – 3.43%

- 60-69 – 2.94%

- 70-plus – 3.77%

These numbers indicate that the older someone is, the less likely they are to be veering toward 90-day-or-more delinquencies for credit card bills – with the notable exception of those 70 and over.

Collection agencies and delinquency rates

Collection agencies work on behalf of lenders and third-party debt collectors to reclaim past-due debts. But fewer people are getting calls from collectors. That’s been especially true during the pandemic.

- In the first quarter of 2021, just 7.38% of consumers had one or more debts in collections, according to the Federal Reserve Bank of New York.2 That’s the lowest percentage since at least 2003. Throughout all of 2020 and into the first quarter of 2021, that percentage never went above 8.93%. For the sake of comparison, the same figure was 9.2% in the first quarter of 2019 and 14.64% in the first quarter of 2013.

- In 2020 and into early 2021, the average amount owed totaled more than $1,400. That compares with more than $1,500 during various quarters in the post-Great Recession years of 2012, 2013 and 2014.2

Some studies also show that credit card debt may not be collectors’ top priority.

- In 2016, credit card debt made up 1% of total debt collected, the Association of Credit and Collection Professionals reports, with healthcare debt making up 46.8% of the collections, followed by student loan debt at 21.2%.4

In a 2021 report, the U.S. Consumer Financial Protection Bureau reported that debt collection made up 15% of all complaints received in 2020.5

Credit card delinquency consequences

Credit card delinquency – a bill that’s at least 30 days past due – can have dire consequences for consumers, particularly if the debt goes unpaid for several months. Among them are:

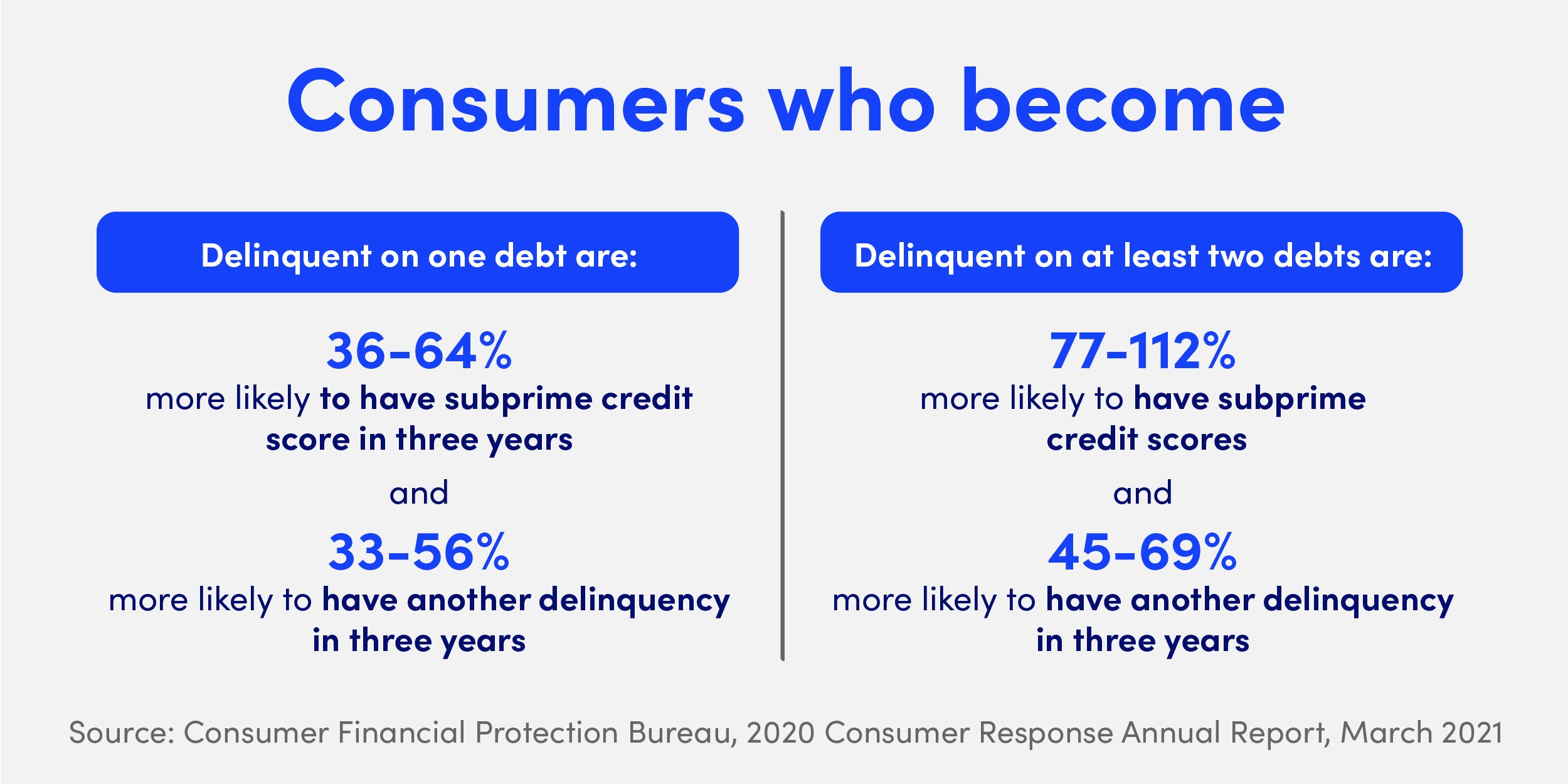

- Damaged credit. Consumers who become delinquent on one debt are 36% to 64% more likely to have a subprime credit score in three years and 33% to 56% more likely to have another delinquency in three years, according to a 2019 report from the Urban Institute.6 Consumers who become delinquent on at least two debts are 77% to 112% more likely to have a subprime credit score and 45% to 69% more likely to have another delinquency in three years.

- Closed account. If your credit card bill is more than a few months delinquent, the card issuer may close your account.

- Debt in collections. After a few months, a credit card issuer might turn over your debt to a debt collection agency. The agency may try to recover your debt on behalf of the card issuer or even after buying your debt from the card issuer.

- Wage garnishment. A credit card issuer or debt collector might garnish, or take, some of your wages to recover your overdue debt.

- Bankruptcy. One hefty credit card debt or several debts that are seriously delinquent could force you to file for bankruptcy. A bankruptcy stays on your credit report for seven or 10 years, depending on the type of bankruptcy case.

How to avoid credit card delinquency

Now that you know what can happen if a credit card delinquency heads into the danger zone, what can you do to avoid it? Here are four tips.

- Set up autopay so that you’re never late in making a credit card payment.

- Pay your credit card balances in fulleach month. This not only keeps your credit card accounts in good standing but also means you pay no late fees or interest.

- Create a budget and stick to it. A budget can help prevent overspending. Spending beyond your means can lead to delinquencies if you’re leaning too heavily on credit cards to cover everyday expenses.

- Establish an emergency fund. Experts generally recommend that an emergency fund contain enough money to take care of three to six months’ of living expenses. This fund can be a lifesaver if you’re hit with unforeseen expenses, like major car repairs or a long hospital stay, and might save you from racking up overdue credit card debt.

Bottom line

In good times and bad, credit card delinquencies affect millions of Americans. Sometimes we simply forget to make a monthly payment. Other times we get financially overwhelmed and find ourselves swimming in overdue credit card debt. If you take steps to get your finances in order, you can steer clear of becoming part of our country’s credit card delinquency statistics.

Sources

- Federal Reserve, Charge-Off and Delinquency Rates on Loans and Leases at Commercial Banks, Q1 2021

- Federal Reserve Bank of New York, Household Debt and Credit Report, Q1 2021

- Consumer Financial Protection Bureau, “Credit card debt fell even for consumers who were having financial difficulties before the pandemic,” December 2020

- ACA International Fact Sheet, January 2019

- Consumer Financial Protection Bureau, 2020 Consumer Response Annual Report, March 2021

- Urban Institute, Delinquent Debt Decisions and Their Consequences over Time, March 2019

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.