Summary

Citi cardholders will soon experience a reduction in card benefits – here’s what to expect.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

Citi is a CreditCards.com advertising partner.

Citi cards are lauded for having competitive travel and shopping benefits for cardholders – including the now hard-to-find price protection – but that might be changing soon. According to a recent update from Citi on cardmember accounts, several of these protections will be discontinued beginning Sept. 22, 2019.

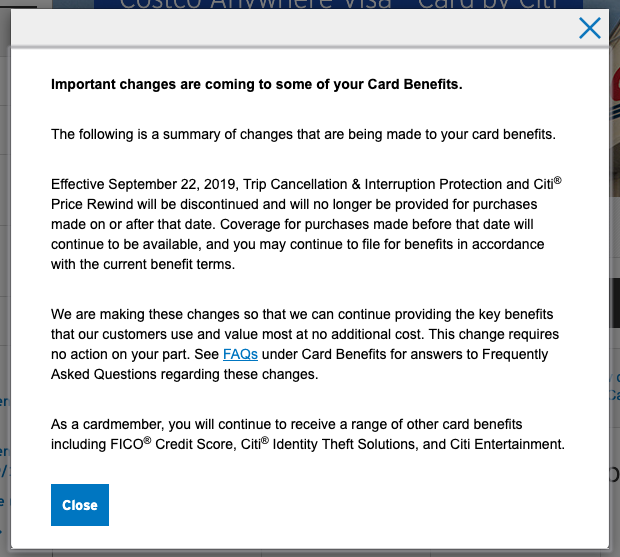

When Citi rewards cardholders log in to their account, they will receive a pop-up detailing which benefits will no longer be available.

According to the messaging, benefits such as Citi® Price Rewind and trip cancellation and interruption protection will no longer be provided on purchases on or after Sept. 22. Any eligible purchases made before that date will continue to receive coverage.

A Citi representative cites the change as a result of low usage.

“Citi continuously evaluates our products to ensure that associated benefits best meet the needs of our customers. Due to sustained low usage, we will no longer offer select credit card benefits such as Citi Price Rewind and Trip Cancellation & Interruption Protection as of September 22, 2019 so that we can continue providing key benefits our customers use and value most at no additional cost,” says the statement.

Despite reports that these benefits are not used to their full potential, this update is a huge blow to frequent travelers and savvy shoppers who chose a Citi card for its inclusive perks. Benefits like price protection and car rental insurance can save hundreds of dollars when used strategically, so their removal from Citi cards represents a loss in value.

Which benefits are going away?

Each pop-up on the Citi website is tailored to the specific perks your Citi rewards card currently offers, so exact messaging may vary. According to reports from Doctor of Credit, the following benefits will no longer be available across Citi cards, beginning Sept. 22:

- Car rental insurance

- Trip cancellation and interruption protection

- Worldwide travel accident insurance

- Trip delay protection

- Baggage delay protection

- Lost baggage protection

- Medical evacuation

- Citi Price Rewind

- Return protection

- Missed event ticket protection

- Roadside Assistance dispatch service

- Travel and emergency assistance

We recommend signing into your Citi account to get a complete look at which of your card perks are going away. You can also continually view which benefits are offered by your card in Citi’s card benefits center.

Take advantage of your benefits before they disappear

Until Sept. 22, cardholders can continue to charge all major purchases to their Citi card to take advantage of these perks. If you have any of these benefits included with your card, be sure to use them to their full potential before they are no longer available.

See Related: 5 credit card perks that save you money

For example, one valuable benefit disappearing from all Citi cards in September is Citi Price Rewind – a price protection perk that reimburses cardholders for the difference in price when the cost of a qualifying item goes up within 60 days of the original purchase date. To ensure you eke as much value out of the benefit as you can before it is gone, register all eligible purchases made prior to Sept. 22 by 60 days after that date.

Consider another card with better perks

While this removal is a major one, credit card issuers regularly change what benefits and perks are available to cardholders and what they cover. Be sure to evaluate whether your card is still a valuable choice for you regularly, especially when it comes to travel and shopping protections.

See Related: 5 perks that make picking a travel credit card a no-brainer

If you find your Citi card no longer provides the coverage you want, there are plenty of great rewards cards with extensive coverages. Several Chase credit cards offer inclusive travel protections, such as primary car rental insurance on the Chase Sapphire Preferred® Card. Many American Express cards, including the American Express® Gold Card, offer baggage insurance – which can cover you for lost or stolen luggage. For frequent travelers, benefits like these can help save money and even offset a card’s annual fee.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.