Summary

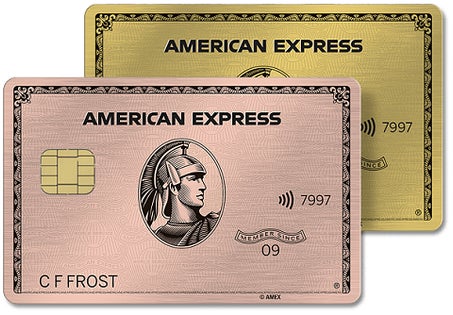

The Chase Sapphire Preferred and American Express Gold Card offer some of the most lucrative credit card rewards and benefits out there. Read on to see how they stack up against each other and help you choose which card to apply for.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

The Chase Sapphire Preferred® Card and American Express® Gold Card are two of the best rewards credit cards available. Both cards earn flexible and transferable points — either Chase Ultimate Rewards or American Express Membership Rewards. Both cards also provide solid welcome offers and earning potential, and each card can unlock powerful redemptions.

Deciding between the two comes down to what you’re looking for in a credit card and how much you’re willing to pay for extra services and perks. Let’s take a look at the Amex Gold versus the Chase Sapphire Preferred and see which card may be right for you.

Card details

| Cards |  American Express Gold Card |  |

|---|---|---|

| Welcome bonus | 60,000 Membership Rewards points after you spend $4,000 in the first 6 months | 80,000 Ultimate Rewards points after you spend $4,000 on purchases in the first 3 months |

| Rewards rate |

|

|

| Annual fee | $250 | $95 |

| Other benefits |

|

|

Chase Sapphire Preferred vs. Amex Gold Card

Now let’s take a much closer look at how these two cards stack up against each other regarding their welcome bonuses, rewards structures, redemption options and bonus perks.

Welcome bonus

| Chase Sapphire Preferred | Amex Gold Card |

|---|---|

| 80,000 Ultimate Rewards points after you spend $4,000 on purchases in the first 3 months | 60,000 Membership Rewards points after you spend $4,000 in the first 6 months |

The winner: Amex Gold Card

While the Sapphire Preferred offers the chance to earn a higher bonus in the early months of having the card, the American Express Gold Card gives you six months to reach this milestone, whereas the Chase Sapphire Preferred only gives you three months. This makes it much easier to take advantage of the welcome bonus with the Amex Gold Card.

Still, we should mention that the dollar amount of the sign-up bonus on the Sapphire Preferred gives it a leg up. Since the Sapphire Preferred boosts points redeemed for travel through the Ultimate Rewards portal by 25 percent, the 80,000-point welcome offer is worth around $1,000, compared to only $600 on the American Express Gold Card.

Rewards structure

| Chase Sapphire Preferred | Amex Gold Card |

|---|---|

|

|

The winner: American Express Gold Card

Both cards earn valuable points across various bonus categories, plus their rewards are worth about the same. Nevertheless, the category bonuses of the American Express Gold Card are decidedly better than those of the Chase Sapphire Preferred, for most consumers.

The Sapphire Preferred card earns 5 points per dollar on travel through Chase Ultimate Rewards, 3 points per dollar on restaurants, select streaming services and online grocery purchases and 2 points per dollar on other travel purchases. Thanks to its partnership with Lyft, it also gives 5 points per dollar on eligible Lyft purchases, through March 2025. We should note that your 5X points on Chase Ultimate Rewards travel won’t kick in until you’ve used your annual $50 Ultimate Rewards Hotel Credit. Plus, at each card anniversary you’ll receive 10 percent of all the points you’ve heard in the previous year.

The Amex Gold Card is similar in offering earns 4 points per dollar at restaurants and 3 points per dollar on flights booked directly with airlines or Amex Travel. It is true that the Sapphire Preferred’s travel category is less restrictive than only flights on the Amex Gold. Still, once you consider that the American Express Gold Card also gives 4 points per dollar at U.S. supermarkets (on up to $25,000 in purchases annually, then 1 point per dollar), most people will likely earn more from ongoing spending with the American Express Gold Card.

Redemption options

| Chase Sapphire Preferred | Amex Gold Card |

|---|---|

|

|

The winner: Chase Sapphire Preferred Card

The best way to get the most value per point for Membership Rewards points and Ultimate Rewards points is to book travel directly with your issuer or transfer your points to a travel partner. Both American Express and Chase have a variety of hotel and airline transfer partners — Amex boasts 20 different transfer partners, whereas Chase has 14 transfer partners. While the two brands share a few partners (Air France/KLM, British Airways and Marriott Bonvoy for instance), for the most part deciding which partnerships are worth more will depend on how you travel.

In most cases, both rewards programs allow you to transfer to airline miles and hotel points at a 1:1 ratio, and both American Express and Chase offer periodic temporary transfer bonuses to various partners.

Though the Amex Gold Card offers many other redemption options, when it comes to redeeming points directly for travel, Chase Ultimate Rewards points are distinctly superior. You can book flights through amextravel.com at a rate of 1 cent per Membership Rewards point, but for other types of travel (hotel, car rentals, etc.), you will only get a value of 0.7 cents per point. Ultimate Rewards points redeemed by a Chase Sapphire Preferred cardholder, however, get a value of 1.25 cents per point on all Ultimate Rewards travel such as airfare, lodging, rental cars and even some travel experiences.

Bonus perks

| Chase Sapphire Preferred | Amex Gold Card |

|---|---|

|

|

The winner: American Express Gold Card

The Sapphire Preferred loses out on this battle against the Amex Gold because most of its benefits are insurances — only coming in handy when emergencies occur — whereas the Amex Gold Card has more perks that you can take advantage of immediately.

Regardless, the Chase Sapphire Preferred has lots of noteworthy perks — including the highly coveted trip cancellation/interruption insurance. Other useful benefits are extended warranty and purchase protections, plus a free DoorDash DashPass membership. Another nice benefit is its auto rental collision damage waiver. The Preferred Card offers primary rental car coverage, meaning you don’t have to file with your own insurance carrier first.

The Amex Gold does provide some handy travel insurances such as car rental loss and damage insurance. However, its advantage lies in its numerous statement credits. First, there is a $120 Uber Cash credit — the most recent addition to the list of American Express Gold Card benefits. With this credit, you can use up to $10 per month on Eats or Rides in Uber Cash when you add your Amex Gold as the payment method in your Uber app.

The card also comes with up to $120 in dining credits throughout the year. After enrolling, you can get up to $10 in statement credits each month when you use your Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar and participating Shake Shack locations. If you book a hotel stay of two nights or longer through The Hotel Collection, you’ll also get up to $100 credit and upgrade (when available) to spend on any qualifying activities.

Which card should you get?

Put simply, the Chase Sapphire Preferred is an excellent travel card through and through, providing great rewards and travel insurances to ease your experience while vacationing. The Amex Gold functions best as a grocery card, though it’ll do well for travel when needed.

- If you want to save on an annual fee: In that case, it’s a no brainer. The Chase Sapphire Preferred Card’s annual fee of $95 is cheaper than the Amex Gold’s $250, while still offering you solid rewards-earning potential and plenty of redemption options.

- If you care about travel: The Chase Sapphire Preferred Card has a higher redemption value when booking travel than the American Express Gold Card has. Plus, its numerous travel insurances will give you peace-of-mind in case you experience any delays or are forced to cancel your trip altogether.

- If you will utilize the additional statement credits: The American Express Gold Card offers many more bonus perks surrounding dining and Uber purchases that can help offset the cost of the pricey annual fee. Most consumers will get more use out of dining and Uber credits than the Sapphire Preferred’s travel insurances.

Bottom line

If you’re comparing the American Express Gold Card versus the Chase Sapphire Preferred, you can make a case for both cards in your wallet.

Foodies will love the high earnings on restaurants and U.S. supermarkets offered by the Gold card. On the other hand, the higher value welcome offer, increased value in redeeming points and lower annual fee mean that the Sapphire Preferred will likely provide more value for most people, especially during the first year of having the card. Take a look at your spending and travel patterns and decide which card is best for you.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.