Summary

With Premium Access, Capital One cardholders can book exclusive reservations at in-demand restaurants through the popular restaurant reservation platform OpenTable.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

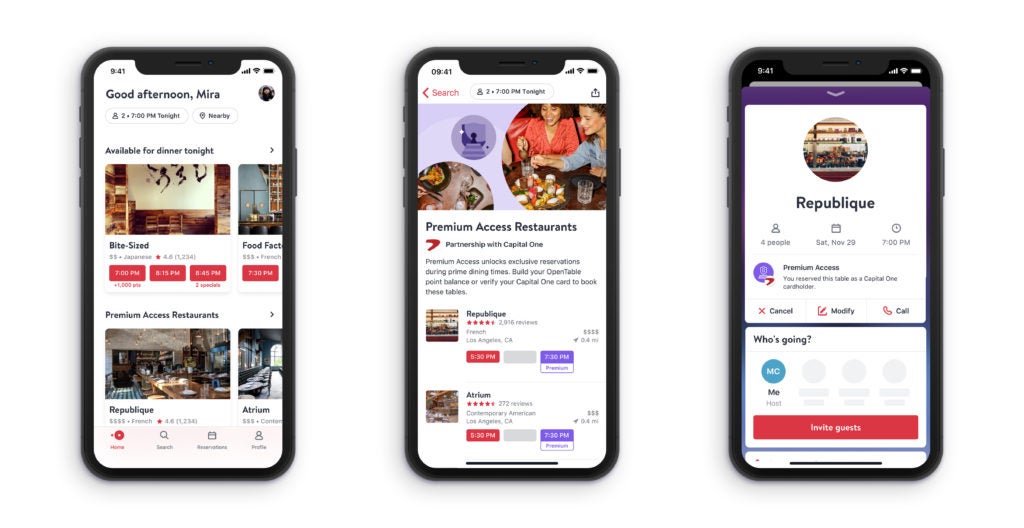

Capital One cardholders can now score exclusive restaurant reservations at peak times with Premium Access, a new loyalty perk available through the popular restaurant reservation platform OpenTable.

First announced in November of 2019, Capital One’s partnership with OpenTable makes it easy for foodies to book a spot across 20 U.S. cities at one of the program’s over 200 participating restaurants.

See related: Foodies unite: These are the best credit cards for restaurants in 2020

Snag reservations at hard-to-book restaurants

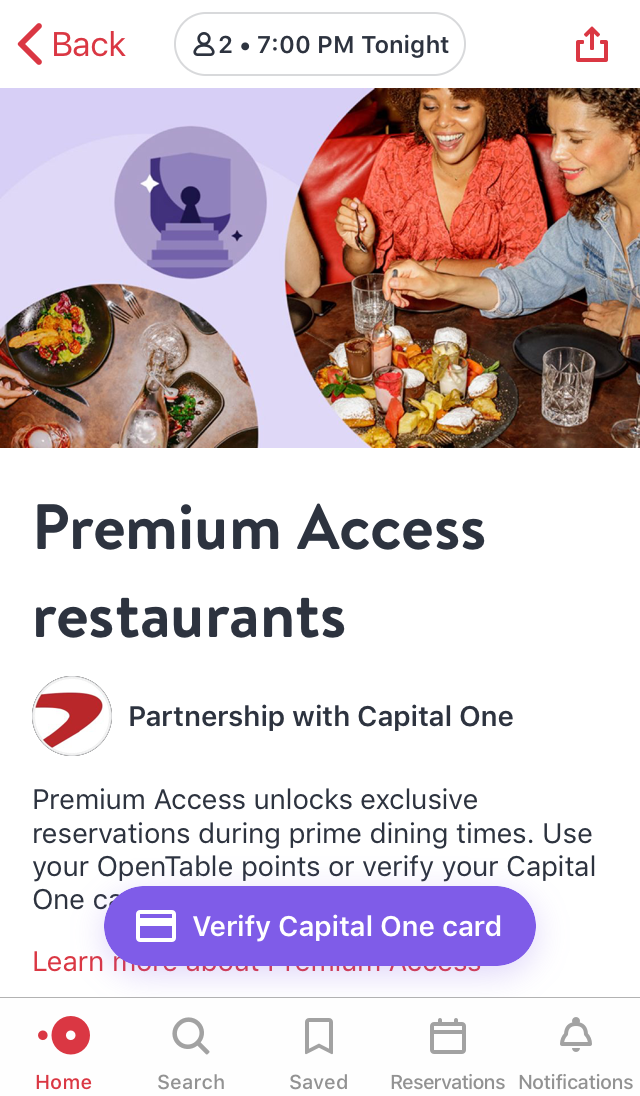

With Premium Access, Capital One cardholders can make reservations at high-end, exclusive restaurants at prime dining hours with less lead time. Set-up is a breeze, and there are no fees for creating an OpenTable account or making a Premium Access reservation.

While standard OpenTable users are required to redeem Dining Points from their OpenTable Rewards account to book a reservation with Premium Access, Capital One cardholders can do so at no charge.

To book a Premium Access reservation as a Capital One cardholder, follow these steps:

- Download the OpenTable mobile app (available for iOS and Android devices).

- Create an OpenTable account or log in to your existing account on the mobile app.

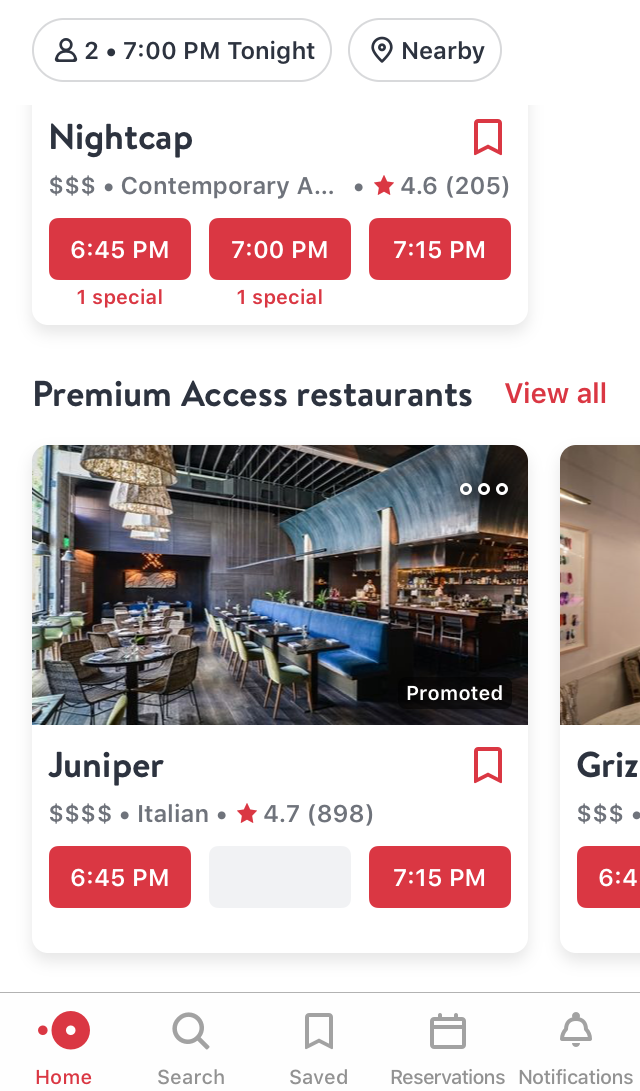

- Find the “Premium Access restaurants” carousel to browse participating restaurants.

- Select a restaurant.

- Tap Verify Capital One card.

- Enter your Capital One card information.

- Once your card is verified, select the restaurant you’d like to book and reserve a reservation date and time.

“We want to ensure we’re giving diners what they want,” Joseph Essas, OpenTable’s Chief Technology Officer, said in a statement, “and getting into the best restaurants at prime dining times topped the list.”

Premium Access is available at more than 200 restaurants across the U.S. including upscale spots like Vivere and Jeong in Chicago and Crown Shy in New York, so frequent travelers who love to experience local food scenes should also get a lot of mileage out of the program.

“We know that coming across a 7pm Saturday night reservation at the hotspot can sometimes feel impossible,” Debby Soo, OpenTable’s Chief Commercial Officer said in a press release. “Now, there’s a way to get those reservations without scouring our site or planning months in advance.”

Pair with a card that rewards dining and entertainment

If you’re a foodie looking to earn rewards on your spending at these trendy dining spots and beyond, the Capital One® Savor® Cash Rewards Credit Card should be a great fit. Along with the Premium Access perk you’ll enjoy as a Capital One cardholder, the Savor card will get you 4% cash back on dining and entertainment, 2% back at grocery stores and 1% back on other purchases.

Why should you get this card? The Capital One Savor card offers one of the best cash back rates on dining and entertainment purchases combined, plus other perks for foodies. | Other things to know

|

Final thoughts

Capital One offers a diverse portfolio of great rewards cards, and partnerships like this only increase their potential value. If you are choosing between dining rewards cards, don’t forget to consider extras like these.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.