Summary

See how much American Express points are worth and how they compare to other rewards programs’ points.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

American Express Membership Rewards points are more valuable than the average rewards point, for a variety of reasons: The points are fairly flexible, with no expiration dates or blackout dates to worry about; you have a plethora of redemption options to choose from; plus American Express has a large list of airline and hotel partners that you can transfer points to at a good value. However, not all of the redemption options are worthwhile.

The Platinum Card® from American Express | |

Why should you get this card? The Amex Platinum card comes with a massive list of perks – including the most extensive lounge access of any credit card and hundreds of dollars in travel credits – making it the best value for a luxury traveler. Learn more | More things to know:

|

American Express points value

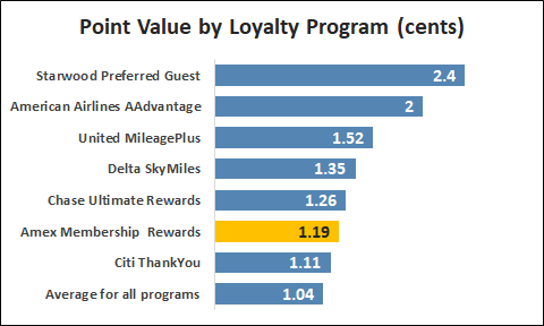

We value Membership Rewards points at 1.19 cents on average. This is a solid value for a general credit card rewards program, most of which fall around the 1 cent per point range. However, it’s outperformed by the Chase Ultimate Rewards program as well as many miles-based rewards programs.

Membership Rewards points do offer a wide range of redemption options, so your points’ value can vary greatly depending on how you redeem them. Not all of these options are a great deal, though. Cash back fans will be especially disappointed to learn that Amex offers a paltry 0.6 cents per point for statement credits.

| Redemption option | Point Value |

| The Business Platinum Card® from American Express airline bonus (one designated airline only) | 1.35 cents |

| Membership Rewards portal airfare (except Blue card) | 1 cent |

| Other Membership Rewards portal travel rewards (cruises, hotels, rentals, vacations) (except Blue card) | 0.7 cent |

| Membership Rewards portal travel with Blue card (including airfare) | 0.5 cent |

| Uber | 1 cent |

| Gift cards/Vouchers | Up to 1 cent |

| Shopping partner (Amazon, Best Buy, Boxed, Dell, Grubhub, Newegg, PayPal, Rite Aid, Saks Fifth Avenue, Seamless, Staples, Walmart) | 0.7 cent |

| Pay with points at checkout (select merchants) | 0.7 cent |

| Shopping portal | 0.5 cent |

| Ticketmaster | 0.5 cent |

| Statement credit | 0.6 cent |

| Charity donation | 1 cent (up to 500,000 points, 0.5 cent thereafter) |

| Excise tax offset fee (for transfer to travel partner) | 0.5 cent |

On the other hand, airfare redemptions are generally the most valuable option. In fact, they can boost Membership Rewards points’ value substantially, especially if you take advantage of American Express’ transfer option – you can get more than 2 cents of value per point with certain partners:

| Transfer option | Point value (Includes transfer ratio and excise fee) |

| Singapore KrisFlyer | 2.36 cents |

| Iberia Plus | 1.7 cents |

| Aeromexico | 1.6 cents |

| Delta SkyMiles | 1.55 cents |

| Avianca LifeMiles | 1.5 cents |

| Aeroplan | 1.5 cents |

| All Nippon Airways (ANA) | 1.48 cents |

| British Airways | 1.4 cents |

| JetBlue | 1.16 cents |

| Emirates Skywards | 1.1 cents |

| Hawaiian Airlines | 1.08 cent |

| Aer Lingus | 1 cent |

| Alitalia MilleMiglia | 1 cent |

| Asia Miles | 1 cent |

| Etihad Guest | 1 cent |

| Flying Blue | 1 cent |

| Qantas | 1 cent |

| Virgin Atlantic | 0.8 cents |

| El Al Israel Airlines | 0.05 cents |

Other Advantages of Membership Rewards points:

Membership Rewards points don’t expire

As long as you own at least one Membership Rewards card, you don’t need to worry about your points expiring.

There’s no limit to how many Membership Rewards points you can earn (for the most part)

There’s no cap on the overall number of Membership Rewards points that you can collect (though you may be limited on how many bonus points you can earn on a particular card)

See also: 9 ways to earn American Express points

You can redeem Membership Rewards points for a variety of rewards

Even if they vary in value, you can’t complain about a lack of redemption options with the Membership Rewards program. Besides redeeming points for travel, cash back, gift cards and merchandise you have several unique options for redeeming points, including trading them for Uber credits for a decent value of 1 cent per point.

You can transfer Membership Rewards points to most of Amex’s travel partners at a 1:1 rate

American Express’s long list of travel partners is the secret sauce that puts extra oomph into Membership Rewards points – you can transfer your points to most travel partners at a 1:1 rate for a good value. Just beware of a few transfer partners with terrible transfer ratios.

Your points pool into a common account

Unlike some competitors (e.g., Chase Ultimate Rewards), Membership Rewards points aren’t connected to a specific credit card account. All your points pool into a single Membership Rewards account, which makes life a little easier. You don’t have to transfer points from one card to another, nor do you have to worry about shuffling around points if you cancel a card.

Disadvantages of Membership Rewards points:

Watch out for hidden fees

Unless you’re a Platinum cardholder, a few fees are lurking beneath the surface of the Membership Rewards program. Booking airfare through the American Express travel portal will cost you $6.99 for a domestic plane ticket and $10.99 for an international plane ticket, and booking through the phone will cost you even more – $39 per reservation.

Also, you have to pay a 0.06 cent per point excise fee (up to $99) when transferring points to one of Amex’s domestic airline travel partners. It’s a small fee, but you should factor it into the overall value of your transfer.

Most redemption options (including cash back) have a poor value

The Membership Rewards program really falls short on its cash back redemption option with a very low value of 0.6 cents per point when you redeem points for statement credits. This really cuts into the Membership Rewards program’s flexibility, as you’re stuck redeeming points for travel (or a few other options) if you don’t want to lose out on value.

There’s a minimum threshold to redeem points

You can’t just redeem your points any time you please. You have to wait until you have a sufficient number of points to redeem them – 1,000 points for a statement credit or transfer to a travel partner and 5,000 points for flights. These aren’t difficult thresholds to reach, but this does further limit the program’s flexibility.

See also: Best ways to spend American Express points

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.