Summary

If you have a Bank of America credit card, it can be easy to get a cash advance. But whether you should get one is a different story, as this is one of the costliest ways to borrow money.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

When you’ve depleted your savings and urgently need cash, a cash advance can give you quick access to emergency dollars. The problem, though, is that this is an expensive way to borrow, and you should avoid unless you have exhausted all other options for borrowing.

If you have a Bank of America credit card, there are a few ways you can use it to receive cash. Read on to learn how to do it and what you should keep in mind before taking out cash from your credit card.

What is a cash advance, and why is it usually such a bad idea?

A cash advance is a type of credit card transaction that allows you to borrow cash against your credit line. It’s similar to getting cash from your debit card – just more expensive. Cash advance terms can make such transactions very costly.

Sky-high interest rates

What are the negatives of a cash advance? First, you’ll pay far more interest on such transactions. Cash advance APRs are typically higher than the purchase APRs credit card providers charge.

No grace period

You also don’t get a grace period on a cash advance (another difference from regular credit card purchases). Instead, interest starts to accumulate right away.

Compare this with a traditional credit card purchase. If you charge $400 for a new laptop, you won’t have to pay interest on that purchase if you pay it off, in full, on or before your card’s next due date. If you take out a cash advance of $100, though, your card provider will immediately charge interest on the transaction.

Costly fees

There are expensive fees to keep in mind with a cash advance. Bank of America charges a high variable APR if you take out a cash advance with a check, and that percentage tends to be higher if you take one out at an ATM.

Further, Bank of America also charges a fee of $10 or 3% (whichever is greater) of the amount you withdraw if you take out a cash advance with a check or $10 or 5% (whichever is greater) of the amount you withdraw if you take out a cash advance at an ATM.

This is why it’s best to avoid getting cash from your credit card. Explore all other options before turning to a cash advance to avoid putting a strain on your budget due to snowballing interest and fees.

Consider other cards

Note that some credit cards come with a significantly lower cash advance APR than what you’d be charged with a Bank of America card. The Power Cash Rewards Visa Signature® Card, for example, charges only a 17.99% APR on this type of transaction. It’s still expensive, but it also doesn’t charge a cash advance fee.

However, if you find that a cash advance is indeed the best option in your situation, there are several ways you can get one with Bank of America.

How to get a cash advance with Bank of America

Bank of America offers four options for getting a cash advance. Choose the most convenient one for you:

Go to a Bank of America branch

You can request a cash advance in person at your local Bank of America branch. Make sure to bring your Bank of America credit card and a government-issued ID to verify your identity.

Use an ATM

You can get a cash advance from your Bank of America credit card from any ATM that displays Visa and Mastercard logos. You’ll need a PIN to use your credit card for this type of transaction, and you can request it through your online account or call the number on the back of your card.

Get a convenience check

Another option to get cash from your Bank of America credit card is to use a convenience check. A convenience check works like a regular personal check that draws funds from your checking account, but the convenience check allows you to draw money from your credit line.

Banks sometimes mail convenience checks as a promotion, but if you haven’t received any from Bank of America, you can contact the issuer to request them.

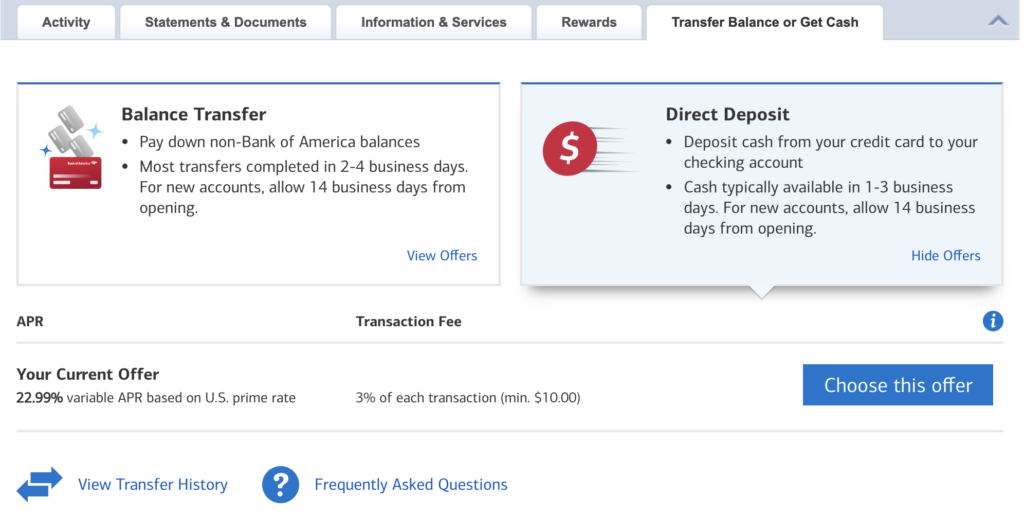

Deposit cash into your checking account

Probably the most convenient way to get a cash advance from Bank of America is to transfer funds directly into your checking account. Log in to your online account to request a cash advance. The deposit normally takes up to three business days.

Alternatively, for an extra fee, you can use the same-day transfer option to send money to your Bank of America checking account.

Not all cardholders are eligible to use the deposit feature. If you try to request a cash advance this way and get a message that the transaction can’t be completed, the issuer suggests calling in to discuss your options.

What to consider before getting a cash advance

While Bank of America makes it easy to get cash from your credit card, it’s important to be aware of how much a cash advance can cost you before you use this option.

Consider other options for borrowing money. You might apply for a personal loan that comes with a lower interest rate. You can also go directly to a bank or credit union or search for online lenders.

An even better option might be to borrow from family members or friends who are willing to give you a loan. Just make sure to pay your loan back on time so you don’t risk damaging your relationship.

The best choice, though, is to build an emergency fund that contains up to six months of daily living expenses. That way, if you face a financial emergency, you can draw from your emergency fund instead of resorting to borrowing expensively.

Bottom line

There are multiple ways to get a cash advance from your Bank of America credit card, but it’s an expensive kind of debt. It’s best to consider this option a last resort and work on building an emergency fund so you can avoid needing it in the future.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.