Summary

Dosh is an easy-to-use, card-linked offer platform, allowing users to rack up additional cash back on the spending they already do.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

Many credit card holders are familiar with card-linked offer programs, which issuers promote as a way to earn more points or cash back on your everyday spending. Almost all major credit card issuers have some sort of program – from BankAmeriDeals® to Amex® Offers – ensuring that you can boost your rewards rate.

But what you might not know is that you can find these same great deals on third-party platforms. Even better, since they aren’t tied to any particular card issuer, you can link all of your credit and debit cards.

One of the most popular card-linked offer services currently on the market is called Dosh. Founded in 2016, Dosh has quickly grown to become a top competitor in the cash back space. This app combines top deals from local merchants (both online and in-stores) and huge savings at hotels around the globe. Read on to learn more about how Dosh works and how you can get the most from it.

Using Dosh: What you should know

What is Dosh?

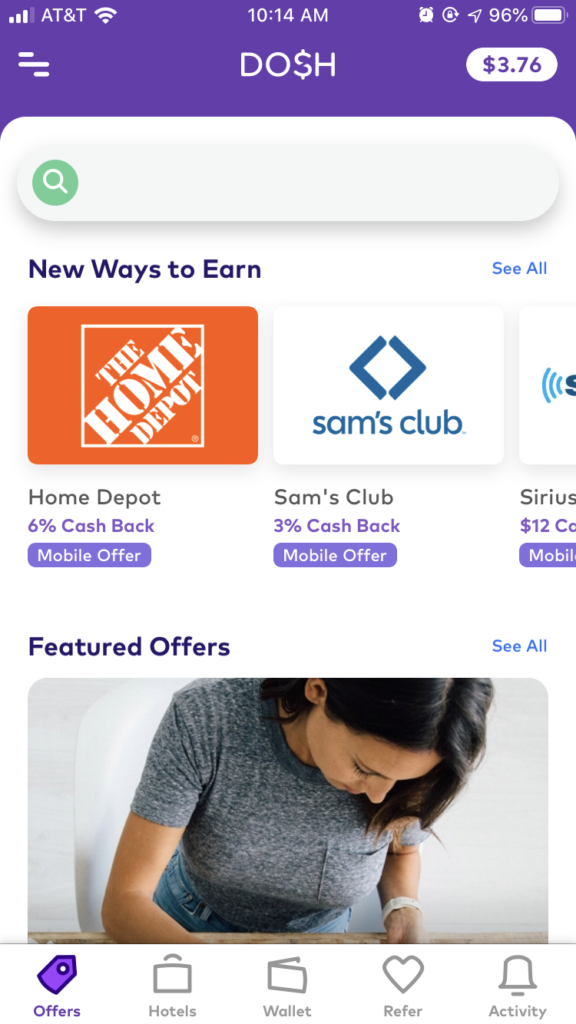

Dosh is a cash back app that partners with merchants and hotels in your area to offer you money back on the spending you already do every day. Dosh partners with hundreds of top retailers, including Sam’s Club, Sephora, Bark Box and Warby Parker. Additionally, Dosh offers cash back from hundreds of thousands of hotels across the country and abroad.

Dosh has a set-it-and-forget-it structure, meaning you don’t have to activate any of the deals to start earning cash back. You just need to link all your qualifying cards and shop as normal. (Note that some online deals and hotel bookings require you to navigate through the app.)

How does Dosh work?

To get started with Dosh, you’ll first have to download the app – available on both the Apple App Store and Google Play. After that, using Dosh is easy; check out all the steps below.

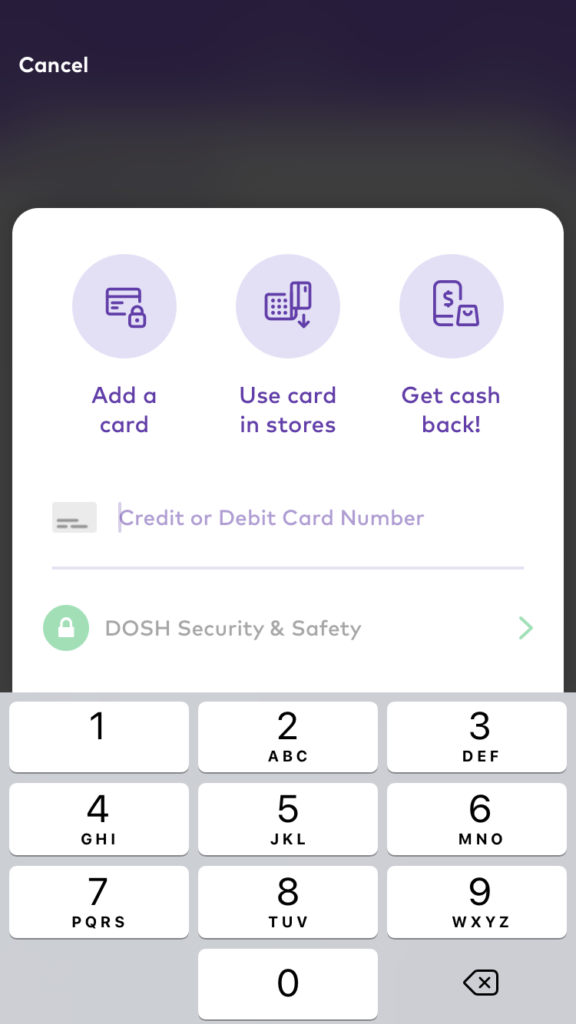

Link your cards

First, you’ll want to link all of your credit and debit cards to Dosh to start earning. Even if you are already earning rewards on a linked card, you can stack with cash back from Dosh to earn even more on your spending. Plus, you can link as many cards as you like.

Dosh is fully secured with bank-level encryption technology, so you don’t have to worry about the safety of your card information. For now, Dosh is compatible with Visa, Mastercard and American Express. Unfortunately, you can’t currently connect a Discover card to the app.

If you already use a linked card with another cash back program, like a Rewards Network dining program or Rakuten (formerly Ebates), you might not be able to also earn on Dosh. Many of these services have restrictions in place to prevent you from double-earning on the same purchase. Some sites have noted success stacking Dosh rewards with other programs, but if you notice you aren’t getting cash back, you should probably remove the card from every platform but Dosh.

Shop in-store or online

Once you link your cards to Dosh, using the service couldn’t be any easier. You can browse available offers on the app to see what merchants near you are offering extra cash back.

Unlike some other card-linked offer programs, Dosh doesn’t require you to activate cash back offers to receive the bonus. Instead, you can just shop at your favorite stores as normal and automatically get cash back on any qualifying purchase.

In addition to rewarding purchases at brick-and-mortar merchants, Dosh frequently offers cash back for online shopping. In this case, you usually have to click through the Dosh app to your favorite online store to ensure you qualify for cash back. Check out the terms and conditions of each individual offer for rules and restrictions.

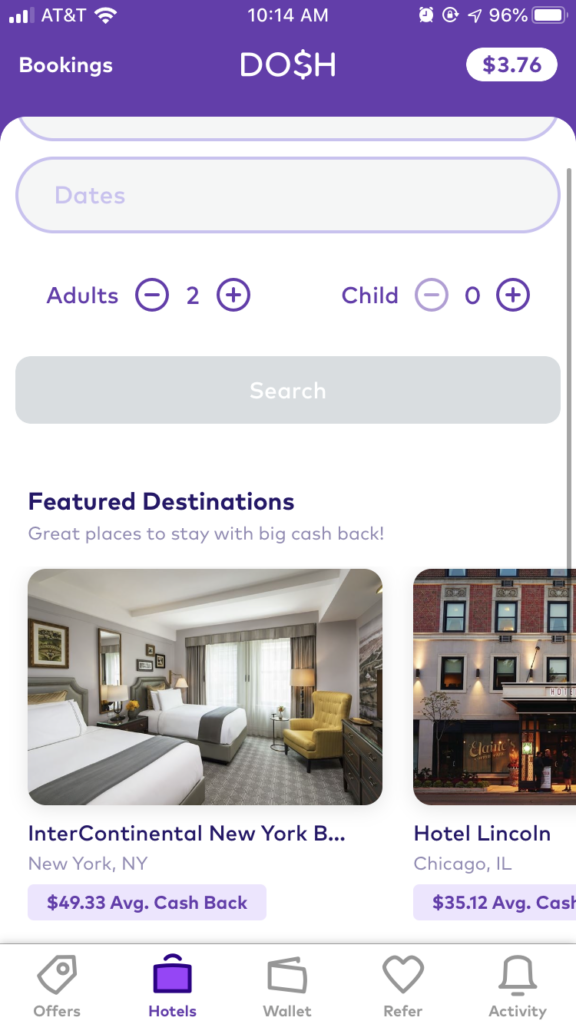

Reserve hotel stays

Many stores on Dosh offer incredible rates of cash back, but the real gold mine of the service lies in hotel reservations. By booking your next stay through Dosh, you can get up to 40% of the cost back.

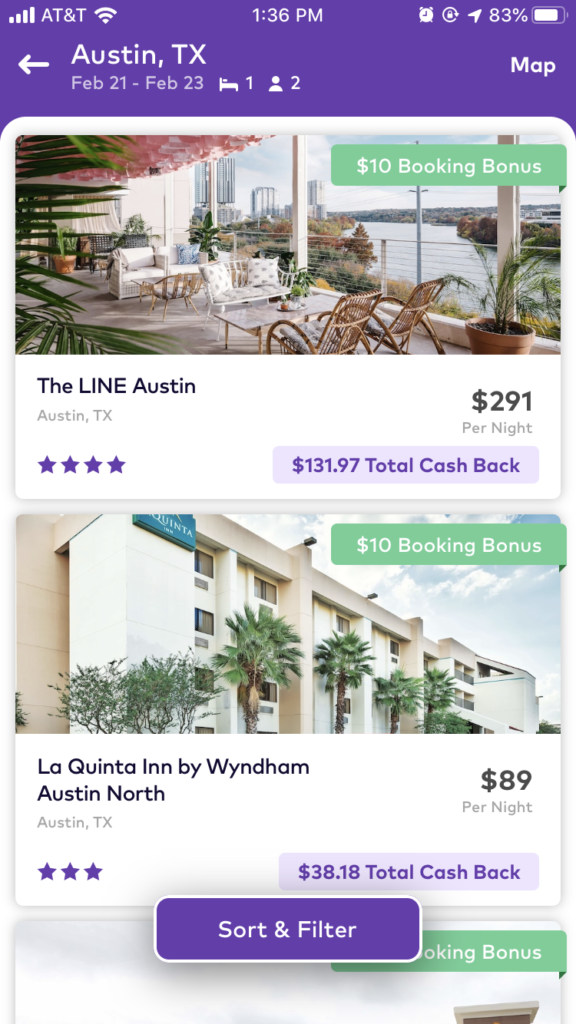

Rewards rates vary by date and property, but if you are willing to do some digging – you can find a great deal. You can filter through popular properties or put in your preferred destination and travel dates like with any other booking site.

On each listing, Dosh will show you the price per night, total cash back you can earn and any booking bonuses available. The default result list displays the highest cash back percentage (based on the nightly rate) first, but you can also opt to sort by room cost.

Note, all hotel reservations made through Dosh are prepaid and non-refundable. You also won’t be able to alter your reservation dates. If you need more flexibility in your trip, you might be better off booking through another site.

Redeem cash back

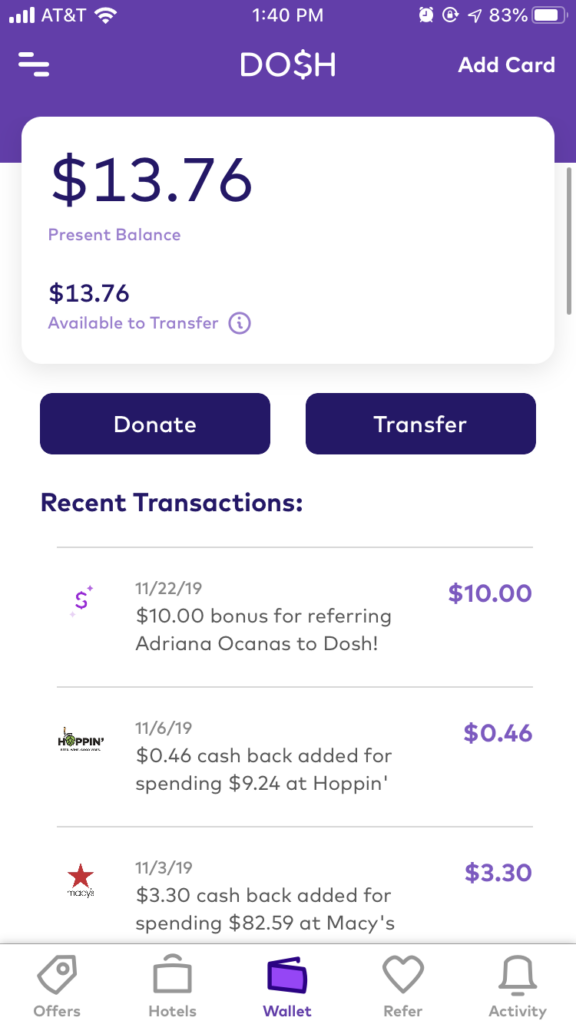

As you earn cash back, you’ll see transactions and total cash back stack up in your Dosh wallet. There, you can see the total balance available in your account as well as the spending that helped you get there.

To redeem cash back earned on Dosh, you’ll need to meet a $25 minimum balance. From there, you can link your PayPal, Venmo or bank account to transfer over your rewards.

Drawbacks to Dosh

Dosh has a lot to offer frequent shoppers, putting a little extra cash back into their pockets. However, you should keep these drawbacks in mind when using the platform.

- You can’t link a Discover card.

- You won’t get your hotel elite benefits since you are booking through a third-party site.

- Hotel bookings can’t be altered or cancelled for any refund.

- Debit cards don’t always earn rewards if they can’t be processed as credit for a particular transaction.

Most of these drawbacks don’t sacrifice too much value, but there are two that are particularly important for frequent travelers: You won’t receive hotel elite benefits, and hotel bookings are nonrefundable.

If you’ve grown accustomed to loyalty perks like free Wi-Fi or complimentary breakfast at your favorite hotel brand, consider if it is worth sacrificing those perks for a little bit of extra cash back.

Additionally, keep in mind that Dosh doesn’t have a system for inputting reward program information, so you won’t earn points on your stay. You can always call the hotel and ask to link your account after you book through the app, but it is likely they won’t award you both Dosh cash back and loyalty points.

Finally, travelers worried about flexibility to change their reservation – or needing to cancel for an emergency – should also stay away from booking through Dosh. All Dosh hotel reservations are completely non-refundable and can’t be altered.

Tips for maximizing Dosh

Once you get started with Dosh, follow these tips to ensure you get the most cash back possible.

- Stack Dosh with a rewards credit card to maximize return.

- Always choose credit when swiping your card.

- Before shopping online, check for a Dosh offer. You might score cash back on a purchase you wouldn’t usually earn rewards on.

- Compare hotel rates to other travel sites to ensure you’re getting a good deal.

- Carefully read the terms and conditions of all cash back offers, in case there are spend requirements. Some stores also have lifetime maximum cash back limits.

- Refer your friends to earn extra cash (typically a $5 bonus, but Dosh occasionally runs promotions for a higher amount.)

- Save up for larger redemptions above the $25 minimum.

Dosh alternatives

Dosh is far from the only source of cash back at your favorite stores – especially for online shopping. Sites like Rakuten are renowned for their online rewards. Hotel and airlines also frequently offer shopping portals that allow you to earn points or miles when you shop online. In many cases, your credit card issuer will have a card-linked offer program with similar benefits.

See related: A guide to card-linked offer programs: A simple way to earn more rewards

But when it comes to earning cash back for your purchases, we recommend taking advantage of more than one portal – rather than trying to pick the best one.

Dosh is easy to set and forget – you link your cards and wait for cash to roll in from your shopping. In addition, you can use sites like CashBack Monitor to look for other great cash back deals across the web.

That way, you can compare rates from credit card-linked offer programs, sites like Rakuten and hotel and airline shopping portals.

Just keep in mind that when it comes to online purchases, you can’t usually stack offers from more than one service. So, make sure you’re getting the highest rate of cash back before you hit the link.

Final thoughts

Whether or not you are the kind of cardholder who scours the internet for ways to maximize return, cash back offers linked to your credit card spending can be very valuable. Just by linking your cards and shopping as normal, you can earn a little extra pocket change to stash for a rainy day.

Plus, going the extra mile and digging for top hotel deals and referring friends to the service can be even more lucrative.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.