Summary

If you want to earn more rewards on household spending and get the full value out of your card credits, getting authorized user Amex Gold cards for family members can make a lot of sense.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

There are plenty of reasons to become an authorized user on another person’s credit card account. But there are also benefits that go to the primary cardholder when someone else has an authorized user card tied to their account.

Having an authorized user card can help you build credit history when you don’t have any, and it can potentially even help increase your credit score. You can also get access to a credit card and some perks that you may not be able to qualify for on your own.

As a primary cardholder, on the other hand, having an authorized user allows you to earn more points on another person’s purchases.

The American Express® Gold Card is a popular rewards credit card that makes sense for people who spend a lot on dining and groceries. Since this card earns flexible points in the Membership Rewards program, however, it’s also a popular card for travel enthusiasts.

If you plan to apply for this card and are considering adding an authorized user, you may be wondering which benefits they receive. Keep reading to learn which cardholder perks authorized users get from the Amex Gold Card – and which ones they’ll go without.

American Express Gold Card: At a glance

| American Express® Gold Card | |

Who should get this card? Apply if you’re a foodie who spends a lot at grocery stores or someone who loves dining out. Read full review | More things to know:

|

Which benefits are extended to additional cardholders?

The American Express Gold Card has some valuable perks that can help you justify the $250 annual fee. However, authorized users you add to your account will only enjoy a handful of the benefits. The following chart explains which perks authorized users receive.

| Benefit | Do authorized users qualify? |

| Earning rewards points | Yes; all points are pooled in the primary cardholder’s account |

| Welcome bonus | No; only the primary cardholder earns a welcome bonus |

| $100 airline fee credit | No; there are only $100 in credits per account (not per card), but purchases made on the authorized users card can count |

| $120 dining credit | No; there are only $120 in credits per account (not per card), but purchases made on the authorized users card can count |

| Transfer points to Amex airline and hotel partners | Yes; all points are pooled in the primary cardholder’s account, at which point they can be transferred to airline and hotel partners |

| Free ShopRunner membership | Yes; authorized users can sign up for their own free ShopRunner membership |

| Amex Offers | Yes; authorized users can add Amex offers to their own card |

One of the most important authorized user benefits is the fact that they earn Membership Rewards points. This perk can be valuable if you want to rack up as many points as possible and if your spouse or partner pays for a lot of purchases on their own. By having an authorized user card, they could help you get closer to the $25,000 spending cap on which you earn 4x Membership Rewards points at U.S. supermarkets, for example.

Also, note how authorized users can take advantage of the $100 airline fee credit and the $120 dining credit. Once again, this can be helpful if you might have trouble maximizing those credits on your own.

How much does it cost to add an authorized user to the American Express Gold Card?

While the American Express Gold Card comes with a $250 annual fee for the primary cardholder, you can add an authorized user to your account with no annual charge (for the first five cards). For six or more cards, the annual fee is $35 per card. This makes doing so a no-brainer if you want to earn points on all your authorized user’s purchases or if you want to share your annual credits with them.

Amex Gold authorized user card vs. Amex Platinum authorized user Gold cards

Though they share a similar name, there is an important difference between an American Express Gold Card authorized user card and an authorized user card you can add to The Platinum Card® from American Express.

Interestingly, The Platinum Card from American Express lets you add authorized user cards to your account that are known as “Gold cards.” These authorized user cards can also be added to your Platinum account for free, yet they don’t come with the same benefits.

See related: Amex Platinum authorized user perks

While The Platinum Card from American Express comes with elite perks like airport lounge access, Hilton Honors gold status and hundreds of dollars in statement credits, the authorized user Gold card only gets to access one main benefit the primary cardholder receives – a credit for Global Entry or TSA PreCheck.

However, you should note that the Amex Platinum does offer the option to add another Platinum card to your account for $175 per year (up to three additional cards). This secondary account would let you access perks like statement credit benefits, airport lounge access, car rental elite status and more. The fourth or any additional card after that carries a fee of $175 per year per card.

Should you get The Platinum Card from American Express instead?

At this point, you may be wondering if you should just get The Platinum Card from American Express in the first place, then add an authorized user card to that account. Doing so can make sense since both cards let authorized users rack up points for the primary cardholder and both cards have an option to add an authorized user.

Before you decide between these two cards, take time to compare the benefits and costs involved in either option.

The Platinum Card from American Express comes with a steep $695 annual fee, and the way you rack up points is drastically different. Once you apply, you’ll earn 5 points per dollar on airfare booked with airlines and airfare or prepaid hotels booked with American Express Travel (up to $500,000 on these purchases per calendar year), as well as 1 point per dollar on other purchases. That makes this card a better option for someone who spends a lot on travel, versus the Amex Gold – which is geared to foodies.

To the Platinum card’s benefit, it comes with superior perks like airport lounge access and over $1,400 in statement credit benefits. That’s really just the tip of the iceberg in terms of the benefits you can receive. If you decide to take advantage of these benefits, you can offset the card’s annual fee.

See related: American Express Gold card vs. American Express Platinum Card

Since both of these options earn Membership Rewards and offer perks for authorized users, take a close look at what each card has to offer before deciding which is best for you.

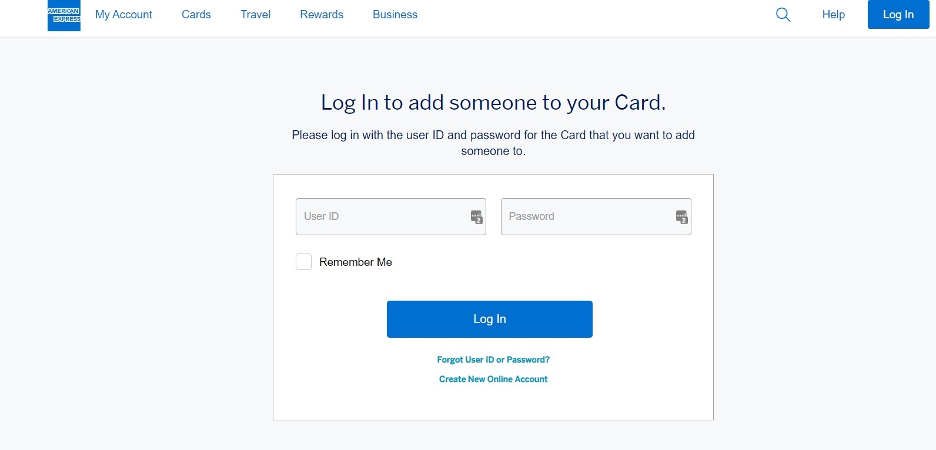

How to add an authorized user on the Amex Gold Card

Adding an authorized user to your Amex Gold card is a piece of cake. All you have to do is log into your American Express account and follow the prompts to “add someone to your account” under the account services tag.

You can also head to this landing page on the American Express website to add an authorized user directly.

Either way, you’ll be asked for some basic information about your authorized user including their name, Social Security number and birthday. Once you add an authorized user to your account, your final task is waiting for the card to arrive in the mail.

Should you add an authorized user to your Amex Gold card?

If you want to earn more rewards on household spending, getting authorized user cards for family members can make a lot of sense. After all, you’ll begin earning Membership Rewards points on all purchases made with cards tied to your account. Over several months or years, the difference in the rewards you earn could be substantial.

Just remember that there are risks involved in adding an authorized user to your credit card account. The primary cardholder is ultimately responsible for repaying every dollar charged to their card and authorized user cards, so only get additional cards for people you can trust.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.