Summary

In a new survey, about three-quarters of consumers whose incomes were affected by COVID indicate they are concerned about their ability to keep current on bills and loans. One of the ways they’re making ends meet is with credit cards.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

Almost 4 in 10 Americans are still experiencing a hit to their income due to the coronavirus pandemic, and credit cards are a significant element of the financial mix keeping them afloat.

A year ago, more than half of U.S. adults reported decreased incomes due to COVID-19, according to surveys by credit reporting agency TransUnion. And though that proportion has come down considerably, TransUnion’s latest survey shows 38% still say their income hasn’t recovered.

Of these respondents, about three-quarters (74%) indicate they are concerned about their ability to keep current on bills and loans. In fact, the average estimated amount of time until they run out of money to meet their obligations is just over four weeks.

One of the ways they’re making ends meet is with credit cards. Some are using more of their existing credit limits, while others are opening new cards to increase the amount of credit they have available.

See related: How to increase your credit limit

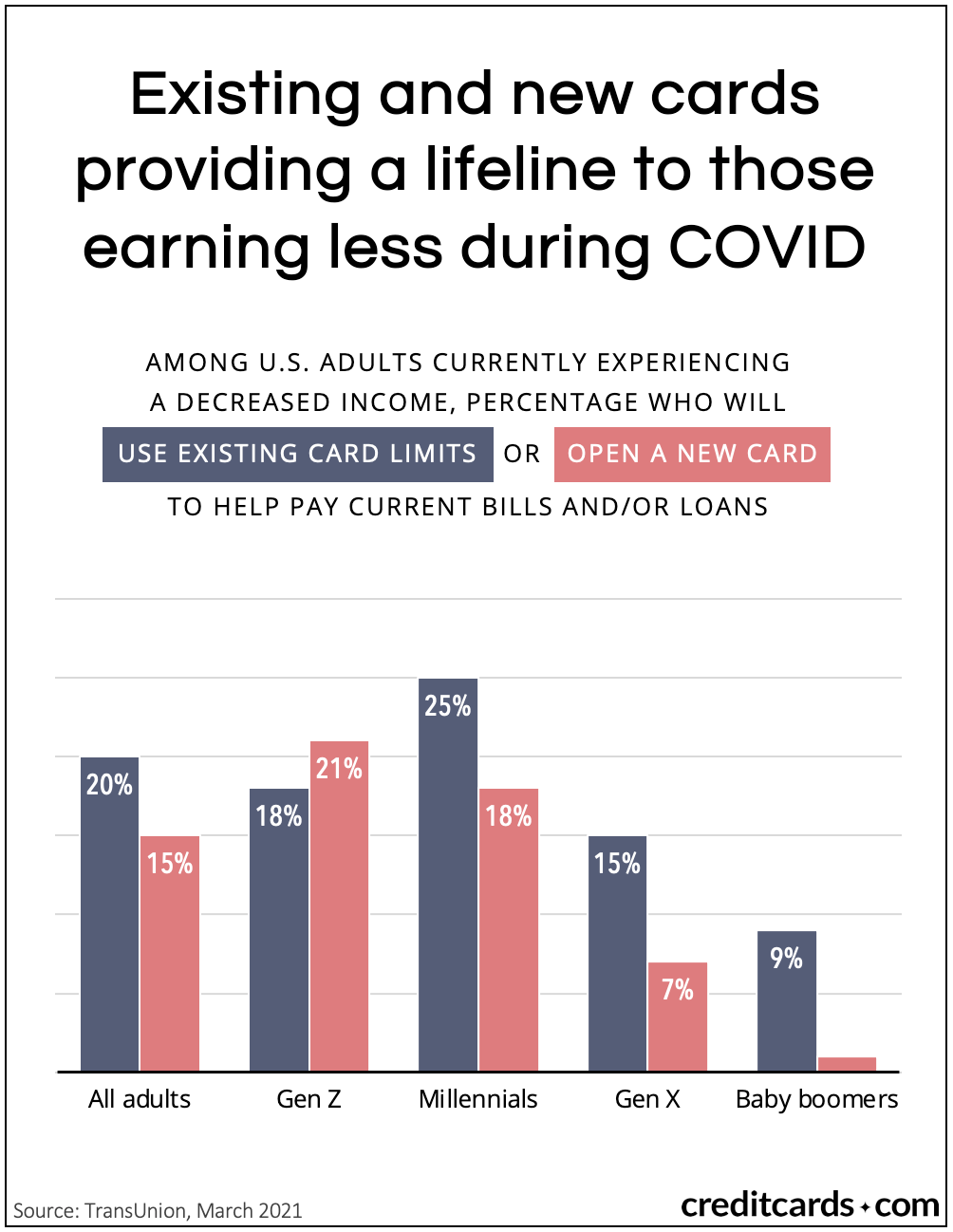

Overall, a fifth of U.S. adults with COVID-reduced incomes (20%) say they are using their existing card limits to help pay their bills and loans, while 15% reported opening a new card.

The youngest adults, Gen Z, are most likely to have opened a new credit card, with 21% indicating they had done so. Millennials are also opening new cards at a substantial rate, with 18% saying they’d opened a new card. However, among millennials the use of existing credit limits was significantly more common, at 25% of respondents.

As respondents with decreased income age up, they are more likely to say they’ll use their stimulus money to cover their bills and loans, and less likely to draw on cards, especially new cards. Only 7% of Generation X adults and 1% of baby boomers said they had opened a new card during the pandemic.

TransUnion’s survey is the 16th installment in its Consumer Pulse series. The nationally representative data were collected from Feb. 26 through March 1, and released March 18.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.