Summary

Despite the coronavirus pandemic, or perhaps because of it, more Americans are paying off their full credit card balance every month than at any time in the past dozen years, according to data from the American Bankers Association.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

Despite the coronavirus pandemic, or perhaps because of it, more Americans are paying off their full credit card balance every month than at any time in the past dozen years.

The notable milestone was reported by the American Bankers Association, whose “Credit Card Market Monitor” has tracked U.S. cardholder behavior every quarter since the beginning of 2008, when the Great Recession was just taking hold.

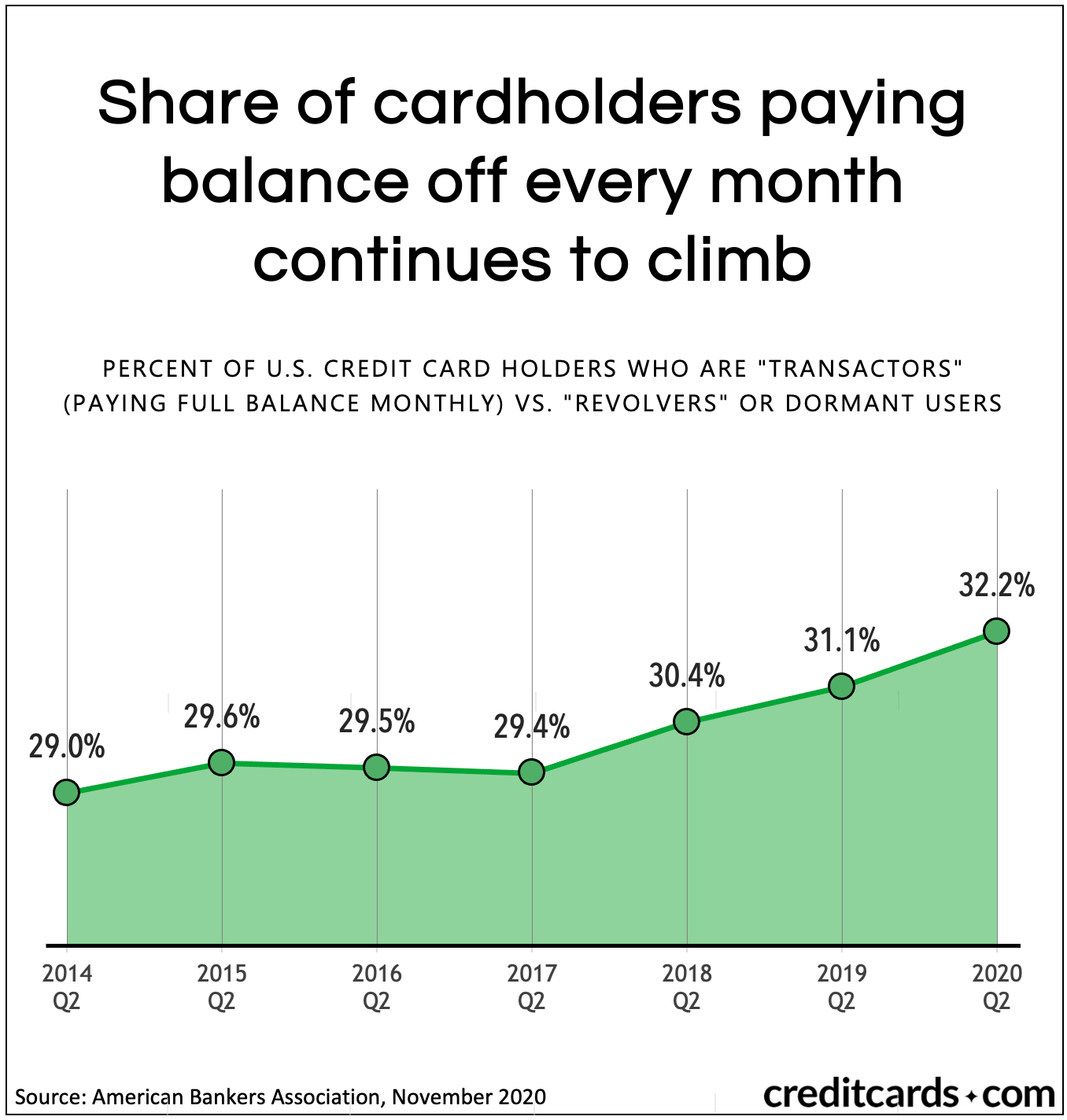

In its highest reading over those 12-plus years, the ABA finds that the share of transactors – those who pay their monthly balances in full each month – climbed to 32.2% during the second quarter of 2020, which includes the months of April, May and June.

That’s up from 31.1% a year earlier, and 30.4% the previous year. Prior to that, the share of transactors hovered between 29% and 29.6% during the second quarters of 2014-2017.

Meanwhile, the share of cardholders who carry over a monthly balance, or revolvers, dropped 2.2 percentage points this quarter to 42.4% of U.S. cardholders, its lowest proportion since 2015’s fourth quarter.

See related: What is revolving credit?

The remaining quarter of cardholders are those classified as dormant, with no balance or active charges on any of their cards. Dormant cardholders were up 1.7 percentage points in the most recent quarter.

With many Americans experiencing tighter finances as a result of the pandemic, many are trimming and pausing expenses, leading to monthly credit card spending recently dropping 25% to 30% (seasonally adjusted).

“The share of those paying their monthly card balance in full rising to an all-time high is a positive indication that many consumers are better positioned to weather the economic downturn triggered by the pandemic than first expected,” said ABA Senior Economist Rob Strand.

The ABA’s Credit Card Market Monitor draws on data from a nationally representative sample provided by Argus Information Services. Its 2020 second quarter data was released Nov. 5.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.