Summary

After all the buzz surrounding Experian Boost, I just had to check out the program for myself. I was pleasantly surprised by the outcome.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

My score isn’t the greatest; chalk it up to adolescent spending with no guiding hand to show me that, yes, you do have to actually pay back what you charged.

So, now that I’m older (and acutely aware of my horrible past financial decisions), I’m working on building up my credit score. Here is my personal review of Experian Boost.

See related: Experian Boost: How to sign up, how soon it ‘boosts’ score

Why I decided to give Experian Boost a try

Now, I had heard a lot about Experian Boost but didn’t see many reviews. Programs like Experian Boost and UltraFICO are designed to help consumers with their credit scores – whether it’s simply to expand the customer base for lenders or genuinely help consumers remains to be seen.

The key difference between Experian Boost and UltraFICO, however, is Boost focuses on payment histories while UltraFICO looks at your bank account for lack of overdrafts and an average balance over the past three months.

Experian Boost seemed too good to be true. The option to raise my score a significant amount in real time was completely unheard of, hence my skepticism. Also, since both are fairly new programs, there isn’t a lot of information yet about how effective they are.

Nevertheless, Experian Boost seems a helpful initiative as it takes into account phone and utility payment histories. Those who sign up for the service give Experian access to their bank accounts in order to look at these bills – which aren’t normally used when calculating credit scores.

After a bit of research, I decided to give it a try. I figured it couldn’t hurt. Here are the steps I took and what you can expect if you sign up.

Signing up for Experian Boost

While I did do my homework, I signed up for Experian Boost completely on a whim. I was even able to do everything from my phone; it was that easy.

I went to www.experian.com/boost on my phone’s browser and followed the on-screen directions.

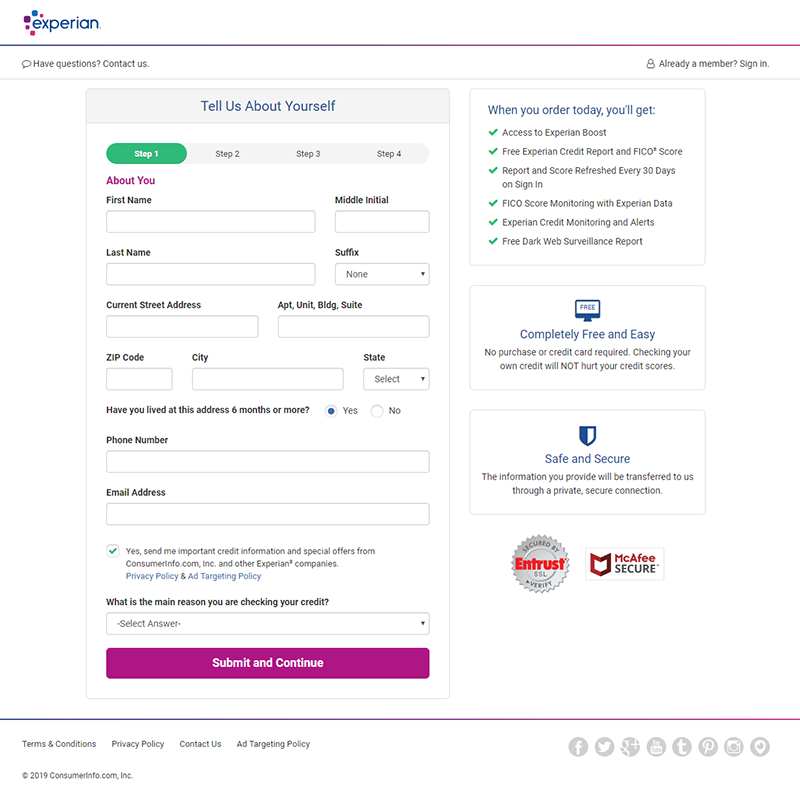

Experian asks for your personal information in step one while showing you what you will gain from creating an account.

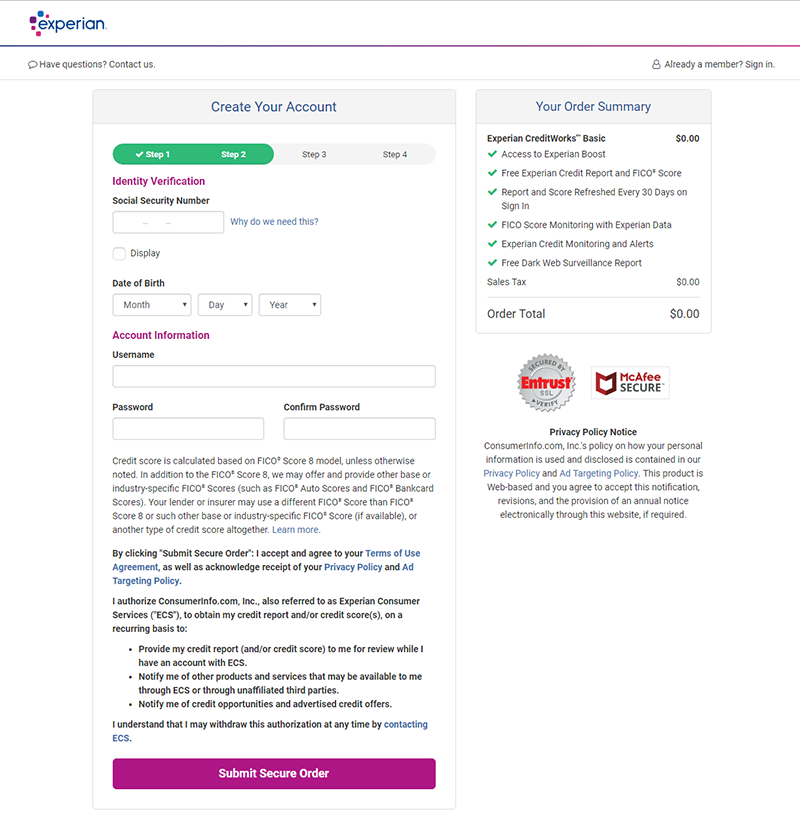

Experian then asks for your Social Security number and you must enter a username and password in step two. Don’t forget to read everything on-screen.

- You have to create an account with Experian (which is completely free) in order to access Experian Boost.

- They ask you for your personal information followed by questions pertaining to your Social Security number, like any car loans or mortgages you may have.

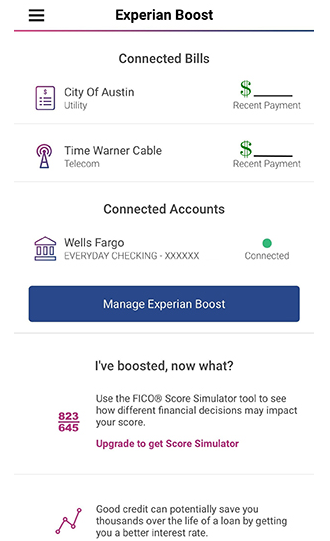

- Finally, you enter your banking information. The process is very streamlined; if you already have a banking app, you’re transferred in order to sign in before being directed back to Experian.

My review: the Experian Boost effect on my credit score

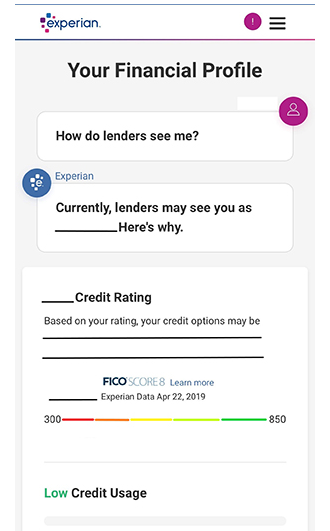

The wait time was about 10 minutes – they had to collect all of my information, after all. I downloaded the Experian app while I waited so I could easily transition from browser to app once I had my results. I was then immediately shown the impact of my sign-up.

My Experian score went up 44 points.

- Everything was done in real time. I looked at my Experian financial profile on the app and saw my new score.

- I also saw what bills the service pulled. My utilities and internet bills were collected (13 payments and 21 payments, respectively), and it was all available on one screen.

- The platform only pulls positive payment history, so if you’re worried a blemish might rear its ugly head, don’t sweat it. Boost bypasses derogatory data.

- Sadly, however, if you pay your utilities with a credit card, Boost won’t pull that data.

The information is broken down in a succinct manner, allowing consumers to see their updated score along with possible next steps.

Experian Boost: The fine print

While Experian Boost is free, you are given the option of upgrading your account for as low as $5 a month. The different plans available offer different services such as CreditLock and Score Simulator and all are broken down in your Experian app.

Experian Boost also isn’t permanent. If you decide it isn’t for you, you can remove your data via Boost at any time.

It’s important to note, however, that the credit score calculated through Experian Boost is based off the FICO Score 8 model and works with FICO 9, VantageScore 3 and VantageScore 4.

So, if you were counting on Boost to help you get that home loan or credit card, keep in mind that a lender may use a different model or report.

There’s also no guarantee your score will go up. This means your experience might not be the same as mine, just like yours might not be the same as your neighbor’s. The service is designed to help those with thin credit files and/or low scores.

Don’t quit now – keep ‘boosting’ your credit score

While Experian Boost certainly helped me – my Experian score used to be the lowest of the three bureaus but now it’s the highest – that doesn’t mean I’m done working on my credit. I plan to apply for the right credit card so I can add to my payment history while keeping my credit utilization low.

It’s great if the service can give you a bit of an edge on one of your credit scores, so use that as a jumping off point.

Boost can certainly be used as a motivation for those struggling with their credit score. With proper debt management, Experian Boost can go a long way in helping consumers.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.