Summary

Splitit offers a refreshing, new take on the installment payment solution. It has no late fees, interest rates or long-winded application process. This means alternative payment is more accessible with Splitit than with other services.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

If you are saying yes to a luxury item, but your bank account is saying no, installment payment programs can be your saving grace. Assistance from these popular solutions can help make big purchases more feasible.

Splitit is a uniquely shopper-focused and convenient option. It allows you to choose the number of installments you pay, giving you autonomy and peace of mind with your finances.

Splitit also keeps your payments small, so a luxury item can be yours without the fear of climbing interest and hidden fees.

With Splitit, you can save money each month in a stress-free and straightforward way. This leaves you with more money to prioritize the purchases that matter to you and enjoy life’s luxuries.

Guide to Splitit

What is Splitit?

Splitit is a payment solution that divides a purchase into smaller monthly installments. The service partners with retailers like James Avery and SofaClub to help users select a payment plan for their lifestyle and finances. These equal payments can span from three to 24 months, with no interest as long as you pay on time.

With Splitit, the shopper conveniently uses their existing credit or debit card. There is no registration involved, so you can access the payment option as you check out from the retailer.

Splitit also avoids separate applications and credit checks – once your card is accepted, the transaction is good to go. These standout features make for an easy shopping experience, so you can buy the items you love without breaking the bank.

How does Splitit work?

Splitit is an option built directly into its partner retailers’ online checkout.

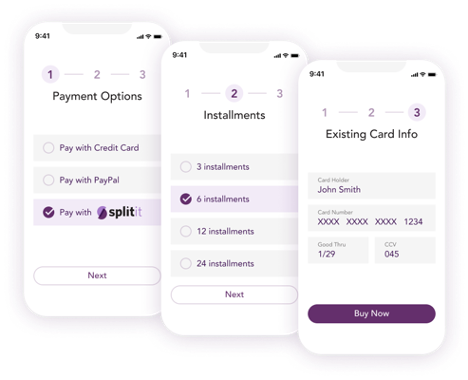

Once the shopper selects Splitit as their payment option, they will first choose the number of interest-free payments they want to make. These payments can be made over three, six, 12 or 24 months. However, some retailers limit the number of payments possible.

Next, the user inputs their credit or debit card information. Since Splitit uses your existing card, there is no credit check, application or waiting period for the service. Anyone whose payment method is accepted at checkout can utilize Splitit to manage their purchases.

A screenshot of Splitit payment options, via Splitit.com

The shopper is charged for the first payment after the retailer confirms shipment. Splitit and the retailer communicate directly, making the process easier for the customer.

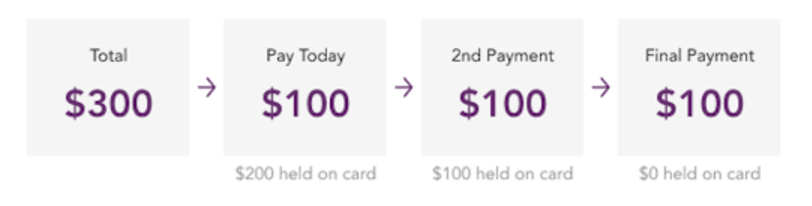

For credit cards, the remaining balance is held on the card until the final installment payment is made. Every month, the balance held is reduced as each payment is confirmed. Below is a demonstration of how credit card payments work with Splitit.

A screenshot of Splitit credit payments, via Splitit.com

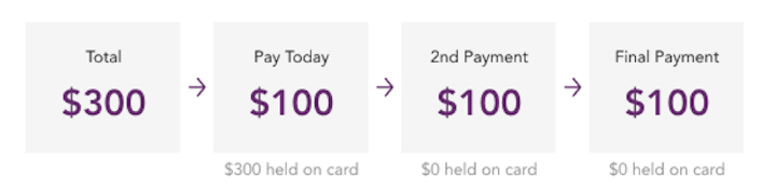

Splitit uses an alternative method to hold the balance on debit cards. The entire amount is placed as a temporary hold, then released after five business days.

However, it is important to note that some retailers only accept credit cards for Splitit capability. Below is a demonstration of the installment process with a debit card.

A screenshot of Splitit debit payments, via Splitit.com

Making and monitoring your payments is also simple with Splitit. When you purchase an item, Splitit asks you to provide an email. Your email enables you to set up an account with the support portal on the Splitit website.

You can use this portal to monitor your installments and make payments. Beyond the portal, you will also see the installments on your monthly card statement, and Splitit sends a monthly email confirming the payment.

A unique and exciting feature of Splitit is that its installment plans will not impact your credit score. Every month, your bank will only see the installments made. Even if your payment method is declined, your credit score remains unscathed.

However, any late payments will be charged interest at your card’s APR until they are paid off. It is still important to pay attention to your payment’s due dates and make timely payments.

Pros and cons of using Splitit

Splitit’s many shopper-friendly qualities – like no credit check or application – set it apart from the competition. However, there are some cons to Splitit that you’ll want to keep in mind.

Pros

- Splitit doesn’t charge interest for payments made on time.

- Splitit has no fees, even for late payments. This is unique for the market.

- Splitit does not require a credit check, and it will not decrease your credit score. This even applies in situations like declined payment methods.

- There is no application process to use the service.

- You can make early payments through the Splitit portal.

- If you use a rewards credit card, you will continue earning points. Splitit does not interfere with your credit card perks, so you can keep saving.

Cons

- Splitit has limited payment options. Competing services like Klarna offer alternative options like financing.

- It partners with limited retailers. Many payment installment services use a wider base of merchants or let you pay anywhere with a virtual card number.

- Splitit places a hold for the full balance on your credit card. This may be an issue if you have a low spending limit. It can also negatively impact your credit utilization.

- Retailers may place maximum or minimum purchase values on the customer. For example, James Avery requires a minimum $10,000 purchase to utilize Splitit.

- Some Splitit-compatible retailers do not accept debit cards.

- Splitit only accepts Visa and Mastercard.

- Since Splitit does not check your credit or report to a credit bureau, you cannot use Splitit as a tool to improve your credit score.

See related: Split any online purchase into 4 installments with Klarna

Tips for maximizing Splitit

Splitit is a great option for many people seeking a convenient installment payment service. However, using these tips will help you reap Splitit’s many benefits.

Choose your retailer wisely

Some retailers make you spend a specific amount of money to pay with Splitit. Check the Splitit website’s list of retailers and their terms for collaboration, to make sure you can make the purchase you want with the service.

Make payments early if you can

Unlike competing services, Splitit offers the ability to pay your installments early. Taking full advantage of this early payment opportunity helps you take greater control of your finances.

Although there are no late fees with Splitit, any late payments will be charged interest at your card’s APR until paid off. For this reason, it is important to pay on time or early if possible.

Go for luxury items

Many of Splitit’s partner merchants are small-to-medium sized businesses with expensive products. Capitalize on Splitit’s ability to let you finance more expensive items without fear of a credit check or an application.

If you would ordinarily opt out of luxurious purchases, Splitit helps break them down to realistic chunks of payments. However, if you are looking for larger and less expensive businesses, other installment payment options offer more retail partnerships.

Final thoughts

Splitit offers a refreshing, new take on the installment payment solution. It has no late fees, interest rates or long-winded application process. This means alternative payment is more accessible with Splitit than with other services.

However, this service is not ideal for people who want to browse an ample variety of retailers. Splitit is also only available for Visa and Mastercard, alienating cardholders with American Express and Discover cards.

Nonetheless, Splitit is concise and easy to use. Its simplicity makes it a viable option for shoppers and merchants alike.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.