Summary

Installment payment services like QuadPay let users pay for their purchases over time without incurring interest. Here’s how it works – and how you can decide if it’s right for you.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

Between an ongoing explosion in payment technology and the closure of most retail stores during the coronavirus pandemic, online shopping has never been more prevalent.

From home office equipment and fitness goods to books, games and other entertainment options – not to mention essential grocery items – more and more people are turning to the web to get the stuff they need. And the way they’re paying for those purchases is changing, too.

While fintech startups like Klarna and Afterpay were already growing pre-pandemic, Morning Brew reports that these alternative payment solutions are “on the list of retail trends accelerated by the COVID-19 economy.” One of the most popular “buy now, pay later” services is QuadPay, which lets users break down the cost of their shopping sprees into four equal payments.

If you think that sounds like a credit card, you’re right, but there’s one notable exception: Purchases made with QuadPay won’t incur any interest – ever. Keep reading to learn more about how QuadPay works, its pros and cons and how you can make the most out of this installment payment plan.

Online shopping with QuadPay

What is QuadPay?

Founded in 2018, QuadPay is a payment platform that gives shoppers a way to pay for their purchases in four interest-free installments spread out over six weeks, rather than in one lump sum. When you select QuadPay as your payment method, the company’s automated system evaluates your eligibility based on its “customer assessment guidelines.” QuadPay doesn’t share the details of those guidelines, only saying that it “use[s] information from a number of third parties” to determine whether you qualify.

If you’re approved, you’ll fork over 25% of your order total at the time of purchase. The remaining 75% is divided into three equal installments and automatically billed to your linked credit or debit card every two weeks until you’re paid in full. While QuadPay charges no interest, customers do pay a $1 “convenience fee” per installment. But provided you make all of your payments on time, you pay no other fees for using the service.

How QuadPay works

To sign up for a QuadPay account, you need to meet a few basic requirements:

- You live in the U.S.

- You’re at least 18 years old.

- You have a valid and verifiable mobile number.

- You have a U.S.-issued credit or debit card (cannot be prepaid).

There are a couple of different ways to use QuadPay. Depending on whether the retailer you are shopping with is a QuadPay partner, either might work for you.

QuadPay Checkout

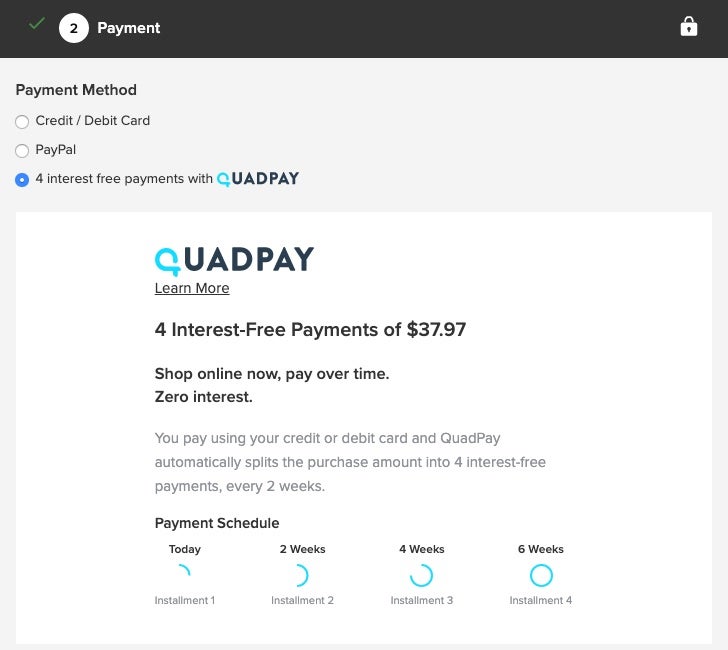

The first, called QuadPay Checkout, is where you shop online directly with a partner retailer and select QuadPay as your payment method at checkout. You’ll see the QuadPay option in your cart:

As you move through the checkout process, you’ll continue your order on the QuadPay website:

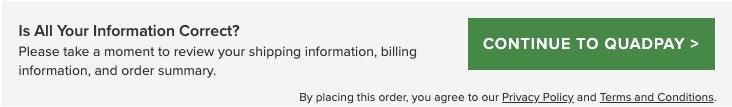

Once there, you’ll provide your mobile number so that QuadPay can send you a confirmation code. (It uses this in part to verify your identity.) You’ll be prompted to create a QuadPay account by entering your date of birth and other basic personal information. This is also where you give QuadPay permission to evaluate your purchase request:

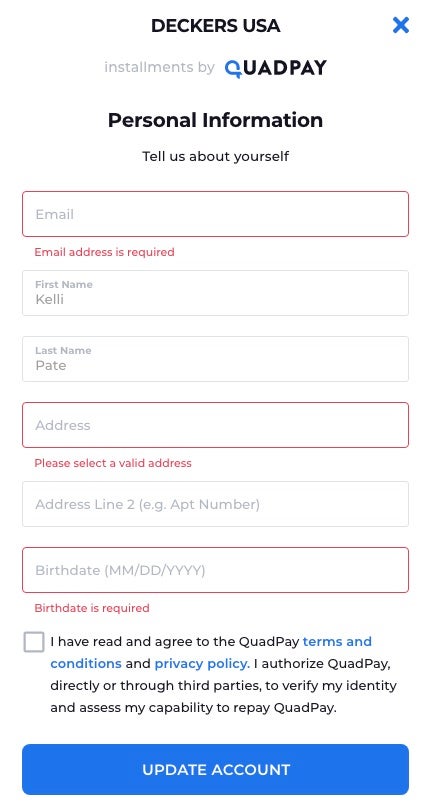

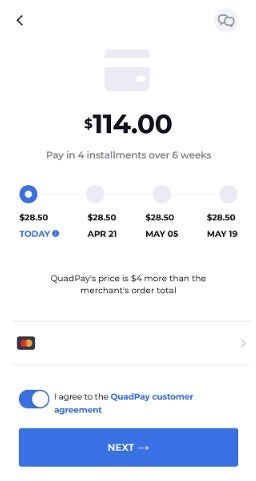

If you’re approved, QuadPay will generate an installment schedule based on your order total, and you’ll link your credit or debit card to make your first payment:

Your card information is saved for future installment payments, which QuadPay automatically deducts every two weeks on your scheduled due dates. You can manually pay off your balance early without a prepayment penalty, but you can pay only one installment at a time. You won’t be able to make one lump-sum payment and call it a day.

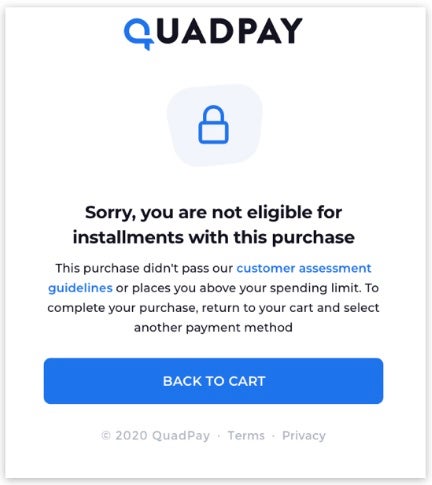

If you’re not approved, you’ll receive the following notice:

Because each order request is evaluated at the time of purchase, you can always try QuadPay again in the future if you’re declined the first time around.

QuadPay Mobile

In addition to QuadPay Checkout, the second option, called QuadPay Mobile, lets you shop in-store or online via the QuadPay app. Unlike QuadPay Checkout, you can make purchases with QuadPay Mobile at just about any merchant – not just those that partner with the company. If a retailer accepts Visa, you can use QuadPay as your payment method.

To get started with QuadPay Mobile, download the app from either the Apple Store or Google Play Store and create your QuadPay account. After that, the process of making a purchase is largely the same, whether you’re shopping from your couch or in a store. Here’s how to do it:

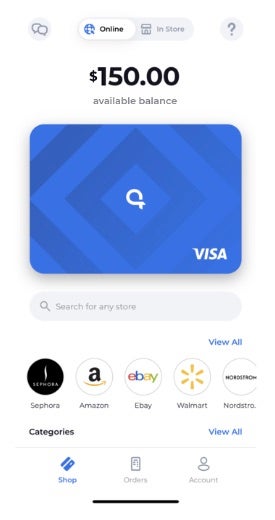

First, open the QuadPay app. At the top of the screen, you’ll see two options: “Online” and “In Store.” Tap whichever one applies to continue.

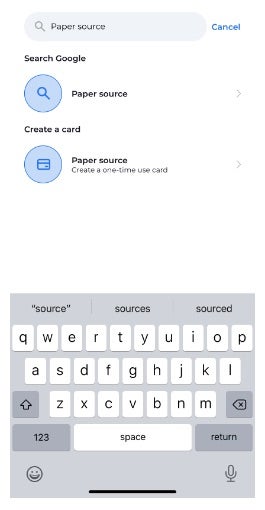

Next, type the name of the retailer or its website address into the search box. Once you’ve found the right store, tap “Create a card.”

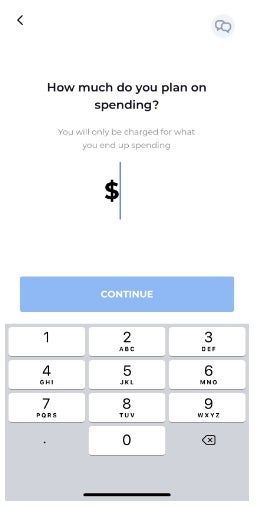

Then, make your purchase request by entering the amount you expect to spend. You’ll also be given the option to add 10% to your purchase request to cover taxes and, if applicable, shipping costs.

QuadPay recommends overestimating how much you need, whether in the previous step or by adding this discretionary 10%. If the amount requested isn’t high enough, your purchase will be denied. But don’t worry: If you don’t spend the entire amount, whatever’s left over is refunded back to you.

Once you choose a purchase amount, your estimated payments and due dates are displayed on your screen. You’ll have to consent to the $1 “convenience fee” per installment as well as the QuadPay customer agreement.

You’ll then see a prompt letting you know about a temporary hold on your payment card for your first installment. When you tap “Next,” your QuadPay virtual card number, expiration date and CVC appear at the bottom of your screen.

If you’re paying through the app, you simply copy and paste the card info into the appropriate fields during checkout. If you’re paying at the retailer itself, provide your QuadPay card info to the store employee for manual entry.

Alternatively, if the business accepts Apple Pay, you can add the card to your Apple Wallet and hold your phone up to the contactless reader to complete your purchase. Note that QuadPay doesn’t currently support Google Pay, but it plans to in the future.

Pros and cons of paying with QuadPay

Whether you choose QuadPay Checkout or QuadPay Mobile, there are benefits and drawbacks you should keep in mind when using the installment payment service. Here’s what you need to know:

Pros

- QuadPay doesn’t pull your credit report when you make a purchase request, so you won’t be dinged for a hard inquiry.

- You can pay off larger purchases over six weeks with just 25% down and no interest.

- You can have multiple QuadPay orders at once.

- Unlike some other installment payment services, you can use QuadPay anywhere Visa is accepted, both online and at brick-and-mortar stores.

- Provided you make all of your payments on time, the only cost to use QuadPay is a $1-per-installment fee at non-participating retailers.

- Late-payment fees are capped at $14 ($7 the first day, and an additional $7 if you’re seven days past due).

- QuadPay may report your account activity to the credit bureaus, which can help you build credit if you maintain a history of on-time payments.

- By using a rewards credit card to make payments, you can still earn cash back or points for your purchases.

Cons

- QuadPay offers just one payment plan: four equal installments over six weeks.

- You may be waitlisted when you first apply (you can try again in 30 days).

- Each purchase request is valid for only 24 hours. If you don’t complete your order in time, you’ll have to start from scratch.

- Spending limits can vary, making it difficult to plan ahead for your shopping trip.

- QuadPay has fewer partner merchants than some of its competitors, which can make it harder to avoid paying the installment fee.

- You’ll have to generate a new virtual card number every time you use QuadPay Mobile.

- QuadPay accepts only Visa or Mastercard for payments.

- QuadPay may report late payments or defaults to the credit bureaus, which can drag down your credit score.

Tips for maximizing QuadPay

If you decide to take advantage of QuadPay’s interest-free installment plan, keep the following tips in mind.

Be strategic about your payment card

If you use a rewards credit card to make your installment payments, you can earn points or cash back on your QuadPay purchases. But if you think there’s a chance you won’t be able to pay your credit card bill in full every month, link your QuadPay account to a debit card to eliminate the potential for interest charges.

Always pay on time

Because late payments can incur fees (not to mention hurt your credit), make sure you have enough money on your payment card to cover each installment. If you miss a payment, contact QuadPay about a refund on your late fees once you bring your account current.

Keep an eye on your budget

You can have multiple QuadPay installment plans at once, but don’t take on more than you can afford to pay off on time. The same goes for individual purchase requests: Just because you’re approved for a certain spending limit doesn’t mean you have to use the full amount available to you.

Shop through QuadPay Mobile

Because QuadPay Mobile generates a virtual credit card that can be used at any merchant that accepts Visa, choose that over QuadPay Checkout to broaden your shopping options.

Final thoughts

QuadPay’s “buy now, pay later” solution allows customers to shop anywhere Visa is accepted, offers fast approval and requires just a 25% down payment. With no interest and few fees, this can be a convenient option if you want to make a purchase but need a bit more time to pay it off in full.

However, with only one installment plan available, you may want to look into similar services that offer multiple payment options.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.