Summary

When it comes to credit cards, one size does not fit all, as different factors influence the interest rate consumers pay and the fees they are charged.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

Credit card fees and interest rates determine your true cost of borrowing. In the past decade, regulatory and market changes have impacted those costs.

The Credit CARD Act of 2009 set limits on rate increases and fees that could be charged to credit cardholders. The card industry changed in response to the law: Instead of offering low rates upfront with big back-end rate hikes, it became more transparent and set truer upfront rates. That has resulted in slightly higher initial rates for consumers, but fewer surprise punitive fees and rate hikes.

According to Federal Reserve Board’s Report on the Economic Well-Being of U.S. Households in 2020, 83% of U.S. adults have at least one credit card, about half of whom carried a balance at least once over the previous 12 months. Those who carried a balance paid interest at some point.[1]

The good news for cardholders is that interest rates have not increased back to pre-pandemic levels. However, a 2020 fee survey by CreditCards.com found that the average credit card has 4.48 fees associated with it, with late fees and cash advance fees being the most common.[2]

Common fees incurred by cardholders

Late payment fee

Federal regulation sets limits on credit card late fees. A 2020 Consumer Financial Protection Bureau (CFPB) report noted that the maximum late fee that can be charged on a first delinquency is $29 and $40 for subsequent delinquencies. These amounts can be adjusted annually for inflation, and these maximum late fees for 2019 were $28 for a first delinquency and $39 for subsequent delinquencies. The maximum late fees for 2018 were $27 and $38.[3]

Overall, “superprime” consumers, who hold 59% of card accounts, paid only 21% of the late fees by volume in 2018, while “deep subprime” consumers, who hold about 6% of card accounts, paid 24% of the late fees generated, according to the CFPB’s 2019 Consumer Credit Card Market report.

Higher fees generally function as payment for lucrative reward programs. According to the CFPB report, late fees are more common on private label cards, such as store and gas cards, than on general cards. This is true both overall, and across all credit categories.[4] However, total fees on private label card accounts amounted to 5.8% of balances overall at the end of 2018, while fees on general-purpose cards were 2.2%.

Annual fees

Only 26 of the 100 cards surveyed by CreditCards.com in October 2020 charged an annual fee, and the most common fee was $95. Seven of those 26 don’t start charging an annual fee until after the cardholder’s first year, while one may waive the annual fee beyond the first year.[2]

Cash advance fees

According to the fee survey, cash advance fees are typically 5% of the amount being withdrawn. Of the 100 cards sampled, four cards allowed cardholders to avoid cash advance fees, and two of them only do so in select circumstances. Another three cards do not allow cash advances at all.[2]

Debt suspension fees

Known as payment protection, debt protection or debt cancellation plans, these fees are becoming less prevalent in the card market, and less burdensome to cardholders. Before the 2009 CARD Act, nearly one in five accounts incurred the fee, falling to just over 6% of accounts by 2015.[4]

In 2016 the incidence of the fees continued to decline from 5.8% of general-purpose fees charged to 3.3%.[5] According to a 2011 Government Accountability Office report, fees for debt protection programs ranged from 85 cents to $1.35 per month for every $100 of balance.[6]

Balance transfer fees

The number of cards featuring balance transfer offers has declined from 90 out of 100 in 2019 to 85 out of 100 in 2020, according to CreditCards.com’s fee survey. Most of those – 72 out of 85 – always charge a fee, while nine don’t charge a fee. However, cards that don’t charge a fee impose the regular APR on the transferred balance, while those that charge a fee typically impose a lower APR on the balance for a promotional period. Four other cards let cardholders choose between avoiding the balance transfer fee if they accept the regular APR on the balance and paying the fee and accepting a lower APR for a period of time. The most common balance transfer fee is 3% of the balance.[2]

Foreign transaction fees

Foreign transaction fees have fallen since 2015 when 77 out of 100 cards charged them. In 2020, that number had dropped to 42 cards charging the fees out of 100. Competition for frequent-traveling cardholders led card issuers to drop the fees in an attempt to lure them. That’s good news for consumers who are planning to travel again after the pandemic. The most common foreign transaction fee is 3%.[2]

Returned payment fees

If you make a payment that is rejected by your financial institution, most credit cards will charge you for it. Of the 100 cards surveyed in CreditCards.com’s fee survey, 80 levied a returned payment fee. The most common cost was $39.[2]

The impact of interest

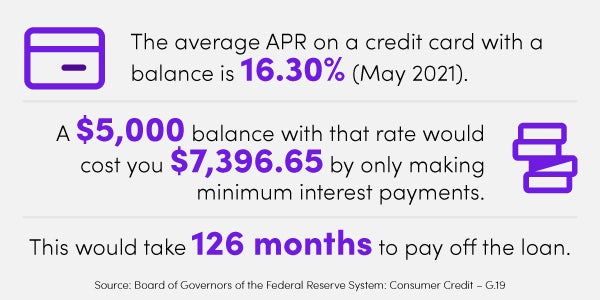

For consumers who carry a balance, interest can be expensive. The average annual percentage rate (APR) on a credit card with a balance was 16.30% in May 2021, according to the Federal Reserve’s G.19 consumer credit report.[7] That means a $5,000 balance with that rate could cost you $7,396.65 in interest payments if you make only minimum payments, which would pay off the loan in 126 months. The average APR for all cards, including those that do not carry a balance, was 14.61% in May 2021.[8]

For new card offers tracked by CreditCards.com’s weekly rate survey, the average APR on the 100 most popular credit cards (not just accounts assessed interest) stood at 16.16% in July 2021. Credit card APRs have been experiencing a downward trend since the pandemic began. In March 2020, the national average was 17.08%.[9]

Most cards have variable APRs that are pegged to the banks’ prime rate. And banks set their prime rate in step with changes in the Federal Reserve’s benchmark federal funds rate.

APR by credit card types

The type of credit card you have can impact the rate. Business credit cards have lower rates. The average APR on a business card in July 2021 was 14.22% compared to the 16.16% national average. New student-oriented card offers had an average APR of 16.78%, while cards geared toward consumers with bad credit had an average APR of 25.05%.[8]

Annual credit card fees by issuers

Fees levied vary based on the card issuer. One reason may be that different issuers target different audiences, such as travelers, students or consumers with low credit scores.

For example, the Citi® / AAdvantage® Executive World Elite Mastercard®, which is geared toward well-heeled travelers, charges a $450 annual fee. Some of Citi’s lower-cost annual fee cards include the CitiBusiness® / AAdvantage® Platinum Select® Mastercard®, which has an annual fee of $99, and the Expedia® Rewards Voyager Credit Card from Citi, which has a $95 annual fee.[9]

On the other hand, none of Discover’s credit cards charge annual fees.[10]

Annual credit card fees by users

Annual credit card fees also vary depending on the type of cardholder. For example, someone’s credit score can impact the types of fees they pay. Annual fees tend to be higher for superprime cardholders – people with the highest credit scores. One reason could be because those cardholders tend to be offered cards with the most lucrative rewards, which tend to have higher annual fees.

According to the CFPB’s 2019 Consumer Credit Card Market report, superprime cardholders paid, on average, nearly $100 in annual fees in 2018. In comparison, prime cardholders paid slightly over $60 on average; near-prime cardholders paid about $50; and subprime and deep subprime cardholders paid slightly over $40.[4]

However, the prevalence of annual fees was lowest among cards geared toward superprime cardholders. In 2018, approximately 25% of cards held by subprime and deep subprime cardholders had an annual fee. In comparison, about 20% of cards held by near-prime users had annual fees; roughly 18% of cards held by prime users had annual fees and about 15% of cards held by superprime users had annual fees.[4]

Students may also be offered different terms

According to Student Monitor’s Spring 2020 financial services report, 33% of four-year, full-time U.S. undergraduates have a Visa, Mastercard, American Express or Discover card account in their own name.[11]

While only 47% said they know their APR, the average APR among those students is 3.4%, a number that could reflect the offering of 0% promotional rates, suggests Eric Weil, managing partner of Student Monitor. Of the 38% of undergrads who have credit cards, 5% say they have been charged with a late fee at least once.

Bottom line

When it comes to credit cards, one size does not fit all, Different factors influence the interest rate consumers pay and the fees they are charged. When evaluating a credit card offer, consumers should consider the APR and any fees to determine the true cost of credit.

Sources

- Board of Governors of the Federal Reserve System: Report on the Economic Well-Being of U.S. Households in 2020

- CreditCards.com 2020 Credit Card Fee Survey

- Bureau of Consumer Financial Protection: Truth in Lending (Regulation Z) Annual Threshold Adjustments (Credit Cards, HOEPA, and Qualified Mortgages

- Bureau of Consumer Financial Protection: The Consumer Credit Card Market 2019

- Bureau of Consumer Financial Protection: The Consumer Credit Card Market 2017

- United States Government Accountability Office: Credit Cards

- Board of Governors of the Federal Reserve System: Consumer Credit – G.19

- CreditCards.com Weekly Credit Card Rate Report

- Citi

- Discover

- Student Monitor: Spring 2020 Financial Services Report

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.