Summary

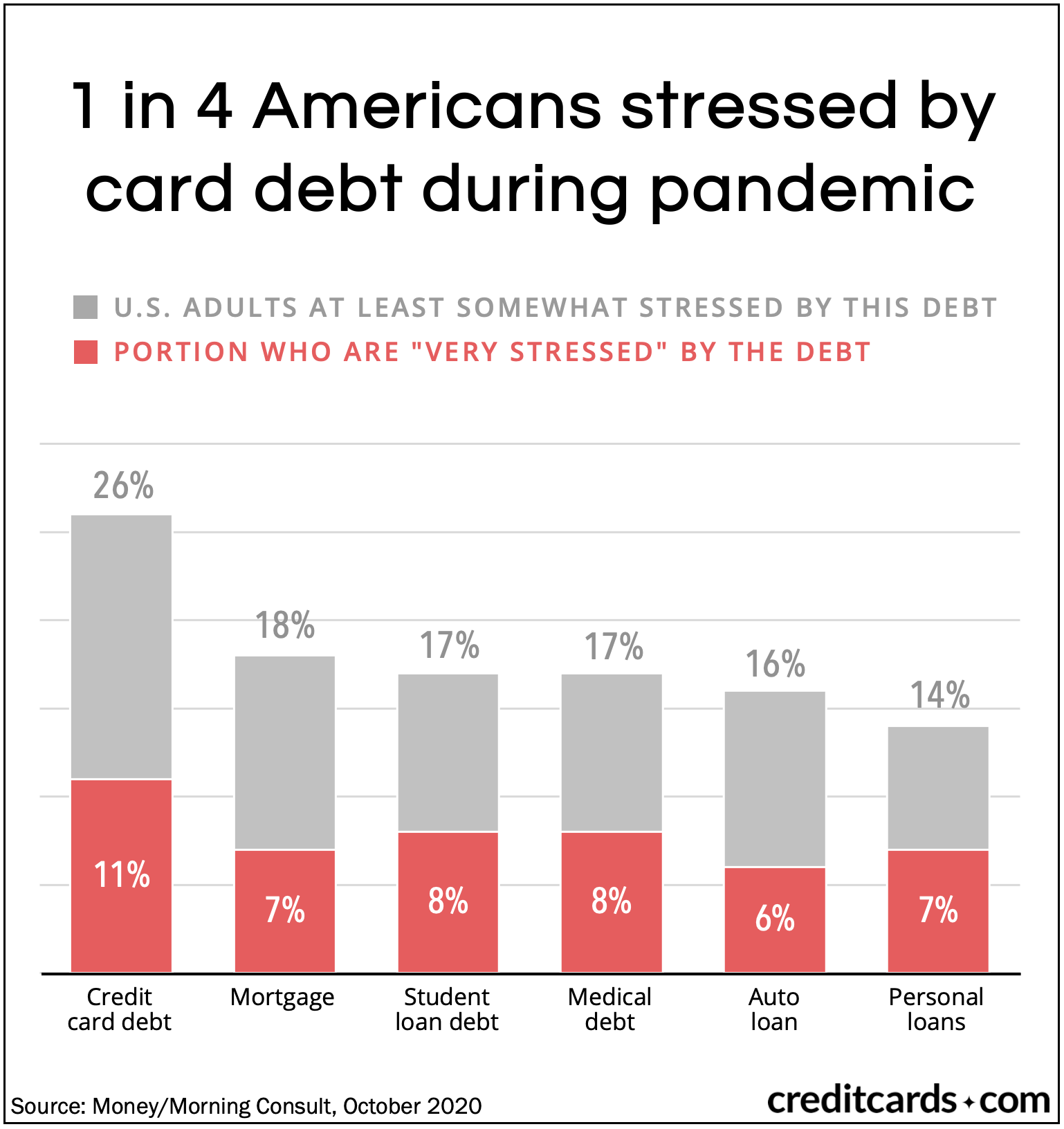

According to a recent survey by Money and Morning Consult, more than a quarter of U.S. adults (26%) feel at least somewhat stressed by credit card debt, with 11% saying they are “very stressed” by their card balances.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

Many Americans have been chipping away at their credit card debt during the coronavirus pandemic, but that doesn’t mean card balances aren’t causing them anxiety.

According to a recent survey by Money and Morning Consult, more than a quarter of U.S. adults (26%) feel at least somewhat stressed by credit card debt, with 11% saying they are “very stressed” by their card balances.

That’s more than all the other types of household debt, with mortgages coming closest – 18% feel some level of mortgage payment anxiety.

With many households experiencing reduced discretionary spending as a result of COVID-19 limitations, some are taking advantage of the situation to reduce their debt. In fact, the Federal Reserve reported that by July, Americans had reduced their collective card debt by almost $100 billion compared to the start of the year, bringing the total below $1 trillion for the first time in almost three years.

See related: Credit card debt drops for first time in eight years, Experian says

Still, 7 in 10 Americans indicated they have no plans to cancel or close any of their existing cards. Furthermore, close to a third (29%) report using their cards more since the pandemic began, especially for groceries and takeout (card use up 32%) and self-care supplies (up 18%).

Despite working to reduce their balances, Americans’ stress over card debt likely stems from the uncertainties many face in their personal finances, as well as how the overall economy will fare in the coming year. For Americans unsure about how reliable their next paycheck is, credit cards can provide a lifeline at the same time as a risk to be feared, if covering the payments becomes difficult.

Indeed, among survey respondents who had already lost their job or are dealing with a pay cut, a much larger share (37%) say they are stressed about their card debt.

Money and Morning Consult’s survey included 2,200 U.S. adults and was conducted between Sept. 8-10, with findings released Oct. 8.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.