Summary

A review of 100 credit card cash advance policies found cash advance transactions can quickly consume an available credit line with fees, high interest charges, among other undesirable terms.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

Credit card cash advances are convenient, costly and even sneaky, according a new CreditCards.com survey.

A review of 100 credit card cash advance policies found cash advance transactions can quickly consume an available credit line with fees, high – and immediate – interest charges, and come with terms and transaction limitations regular card purchases don’t.

The survey’s key findings include:

- The average cash advance APR is 23.68 percent – nearly 8 percentage points higher than today’s average 15.79 percent purchase APR.

- Cash advances begin accruing interest as soon as the transactions post to a cardholder’s account. None of the surveyed cards offer an interest-free grace period for cash advances.

- In addition to high interest rates, 99 out of the 100 cards surveyed immediately charge a fee for each cash advance transaction, typically 5 percent of the transaction or $10, whichever is greater.

- You can unknowingly make a high-cost cash advance if you are unaware of your card’s cash advance terms. In addition to ATM cash withdrawals made with your credit card, wire transfers, money orders, legal gambling purchases and bail bonds charged to your card are often treated as cash advances.

Interest, fees unavoidable

If you make a purchase on a credit card, but pay off the balance by the established due date, you can avoid paying interest, regardless of the APR your card carries, thanks to the “grace period” card issuers offer under most circumstances.

Cash advance transactions are one of the exceptions. They don’t have this interest-free period, which – depending on your card’s APR and the amount of the transaction – can be costly.

| HIGHEST CASH ADVANCE RATES |

|---|

Surveyed cards with cash advance APRs higher than 26% are:

|

Unlike credit card purchase rates, cash advance APRs are rarely based on cardholder creditworthiness. This means that while you may have a card with a low purchase APR, your cash advance rate is likely much higher. CreditCards.com found that 79 percent of cards charge a cash advance APR greater than 20 percent. The most common cash advance APR is 25.99 percent, as charged by one-fourth of the surveyed cards.

And, just like interest, cash advance transactions are immediately assessed a fee, typically $10 or 5 percent, whichever is greater. All but one card in this year’s survey – Pentagon Federal Credit Union’s Promise Visa – charge a fee for cash advance transactions.

“I think many people understand that a cash advance carries a higher APR, but what they might not know is that cash advances are also typically charged fees,” said Linda Sherry, director of national priorities and spokeswoman for Consumer Action, a consumer education and advocacy organization. Because of this, “Reading card terms is really important,” she added.

While cash advance fees are all but guaranteed when cardholders seek quick cash, the fees can vary depending on the type of advance made, as noted by 22 cards in the CreditCards.com survey. For example, US Bank charges a 3 percent or $5 minimum fee for convenience check advances, while ATM cash advances are charged a 4 percent or $10 minimum fee.

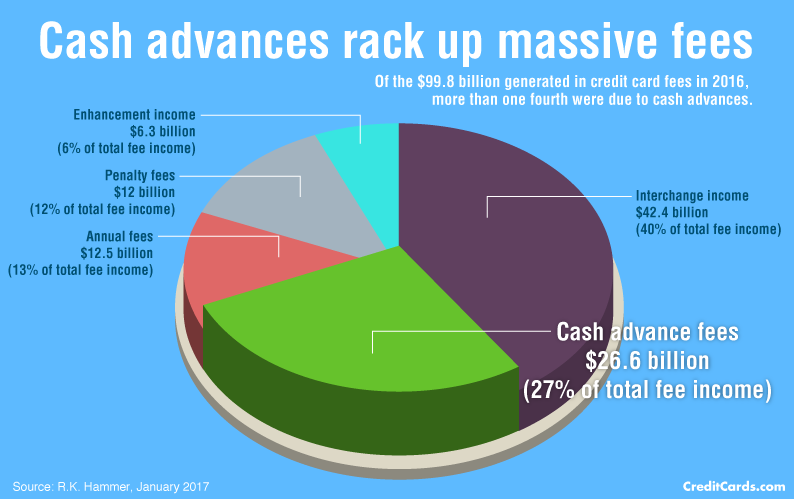

While the most recent figure indicating how common cash advance transactions are dates back to a 2015 Federal Reserve report, new issuer fee income data indicates cardholders are actively seeking quick cash – and paying for it. Cash advance fee income accounted for 27 percent ($26.6 billion) of issuer’s fee income in 2016, making it the second largest source of fee income next to interchange fees, per industry data compiled by R.K. Hammer.

| HOW MUCH DOES A CREDIT CARD CASH ADVANCE COST? | ||

|---|---|---|

| $1,000 purchase | $1,000 cash advance | |

| APR: | 15.79% | 23.68% |

| Transaction fee: | None | $50 (5% of the transaction) |

| Balance paid off in: | 30 days | 30 days |

| Interest costs: | None | $19.73 |

| Total cost: | $1,000 | $1,069.73 |

Minimum payments are not enough

The costs of a credit card cash advance can add up fast if you are also carrying additional balances, such as purchases or balance transfers, and revolve those balances month-to-month.

“The idea is pay more than the minimum because any amount exceeding the minimum goes toward paying down the balance with the highest rate, and if the cash advance has a higher rate, doing so will pay the cash advance down faster and save money,” explained Nessa Feddis, attorney and senior vice president for the American Bankers Association. “If someone only makes minimum payments each month, they’re not going to chip away at the cash advance balance.”

If balance-carrying cardholders read their card terms closely, they will see how making only minimum monthly payments can work against them. CreditCards.com found phrases such as the following in 22 card terms, in regards to how card payments are applied: “Generally, we will apply your minimum payment first to lower APR balances (such as purchases) before balances with higher APRs (such as cash advances). Payments made in excess of the minimum payment will generally be applied to balances with higher APRs first before balances with lower ones.”

| WHY ARE CASH ADVANCE RATES HIGHER? |

|---|

| In the eyes of card issuers, cash advances are considered risky transactions, according to American Bank Association’s Nessa Feddis. Not only may a cash advance indicate a consumer’s financial instability, but such transactions are also more susceptible to fraud. |

So how can you avoid getting stuck in a costly, revolving balance cycle? Here’s an example: “If you have a $600 cash advance balance and you have a minimum payment due on a purchase balance, if you send in $600 plus the minimum amount due, it should work out that the $600 is paid directly to the cash advance because that’s probably the highest interest rate balance you have,” Sherry explained.

Paper convenience checks prevail

While plastic payments have taken over the U.S. payment ecosystem, consumers may still receive paper cash advance convenience checks in the mail, that, when cashed, are treated the same as ATM cash advances.

CreditCards.com found 69 percent of the cards surveyed make convenience checks available to cardholders in some way. Convenience check availability may depend on an individual’s creditworthiness, account history, current bank promotions or only sent out upon request.

The reason for their continued use lies in that there are a lot of things that are still difficult to pay with a credit card, as Feddis and Sherry both explained.

“For example, if you are having work done in your home, and they don’t take cards, they might take a check,” Feddis said. “And there are also still a lot of small businesses that only take cash and checks.”

Cash advances not limited to ATM withdrawals, convenience checks

If you thought the only time you may face the high cost of a credit card cash advance is when you take out paper bills from an ATM or use a convenience check, you might be surprised.

The CreditCards.com survey found credit card cash advance transactions can include wire transfers, traveler’s checks and money orders, legal gambling purchases and bail bond purchases. Additionally, if you hold a checking account with the same bank that issues your credit card and opt-in for overdraft protection, overdraft coverage pulled from your credit card may also be considered a cash advance transaction.

“I think a lot of people find out about this the hard way,” Sherry said. “Like, they are in Las Vegas, buy some casino chips and boom, they just took out a cash advance.”

Additional rules and restrictions apply

In addition to being assessed immediate (and high) interest rates and fees, cash advance transactions aren’t as flexible.

For example, if you were hoping that taking out a large cash advance would be a fast and easy way to rack up card rewards, you’re out of luck. Cash advance transactions typically don’t count as reward-earning transactions, as 15 reward cards in the survey specifically noted.

And, if you read your monthly card statement closely, “It will disclose the amount you can withdraw in cash,” Sherry said. “And that amount is typically less than your total credit limit. Cash advances are almost always only allowed to take up a portion of your credit limit.”

“People should understand what they are getting themselves into.” |

| u2014 Nessa Feddis American Bankers Association |

CreditCards.com’s survey findings back up that claim: Separate cash advance limits were noted by 76 cards. Some cards may even impose restrictions how many cash advance transactions can be made each day.

Use as a last resort

In a perfect world, cardholders should be able to avoid the costs that come along with credit card cash advances. “We hope they would be able to plan enough in advance and have enough in their savings to cover what they need,” Sherry said. “We don’t believe the consumers should be taking cash advances on credit cards.”

However, life happens and sometimes the need for cash (or a check) is immediate.

“Maybe a person came to fix something in their apartment, and that person doesn’t take cards,” Feddis explained. “You have to be careful in that there are fees and costs involved, but sometimes people just need cash.”

If the need for cash isn’t as urgent, Sherry recommends spending some time exploring other options. “I would find an alternative to making a cash advance with a credit card. Maybe borrow money from family and friends,” she said. “But definitely avoid taking out a payday loan.”

If a cash advance is the best – or only – option, people should understand what they are getting themselves into, Feddis said.

Before making a cash advance, review your card’s terms and conditions and look more closely at your monthly statement. If a cash advance is made, the cardholder should pay it off as quickly as possible to minimize interest costs.

“It’s always a good idea to be cautious about using a credit card,” Feddis said. “Use it thoughtfully and deliberately.”

Methodology:

The Credit Card Cash Advance Survey of 100 U.S. credit cards was conducted in April 2017 by CreditCards.com. The 100-card survey pool is the same group of cards used to calculate CreditCards.com’s Weekly Rate Report, and is a representative sampling of cards from all major U.S. card issuers. Information was gathered from the cards’ terms and conditions documents, any publicly available cardholder agreements and phone calls to issuers.

The average cash advance APR was determined using the rates provided by 80 cards, excluding 20 cards that set individual cardholder’s cash advance rates based on creditworthiness and purchase APR. For the cards with a range of cash advance rates based on cardholder creditworthiness, the lowest possible APR was used in the average rate calculation.

See related: 2015 Cash Advance Survey: Convenient cash will cost you plenty, Use 0-percent promotions to create an emergency savings account

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.