Summary

Read on for what you need to know about the Bank of America Cash Rewards credit card’s 3-percent bonus, including how to choose a category and what purchases qualify for the bonus.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

The Bank of America content was last updated on March8, 2021.

The following post has been sponsored by our partner, Bank of America. The analysis and opinions in the story are our own and may not reflect the views of Bank of America. Learn more about our advertising policy

The Bank of America® Cash Rewards credit card recently introduced a new way for card members to earn rewards. As of Jan. 14, 2019, cardholders can select whether they want to earn a 3-percent cash back bonus on gas, online shopping, dining, travel, drug stores or home improvement/furnishings. Cardholders will also earn 2 percent cash back at grocery stores and wholesale clubs (on up to $2,500 in combined 2- and 3-percent categories each quarter) and unlimited 1 percent cash back on everything else.

| Bank of America® Cash Rewards credit card | |

The Bank of America Cash Rewards card allows customers to choose which categories line up best with their priorities. Since you can select a new 3-percent bonus category each month, a little planning ahead can help maximize your earning potential throughout the year. | Card details at a glance:

|

Read on for what you need to know about the 3-percent bonus, including how to choose a category and what purchases qualify for the bonus.

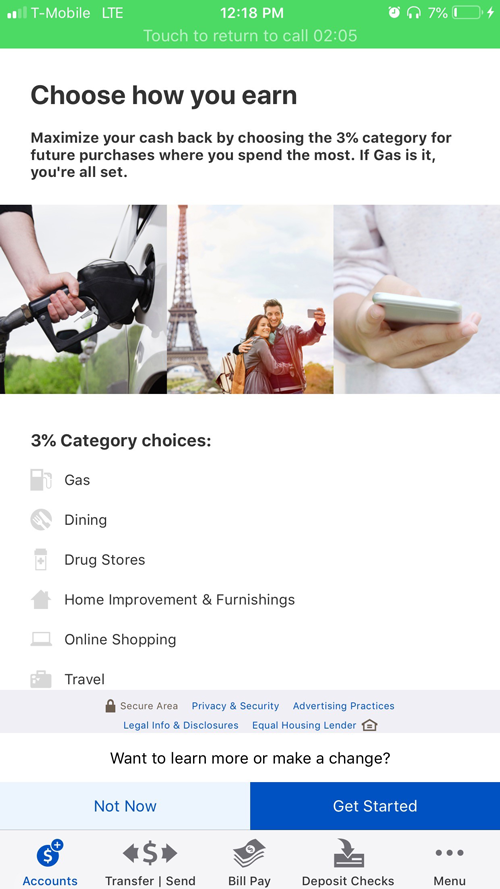

Selecting a 3-percent cash back bonus category

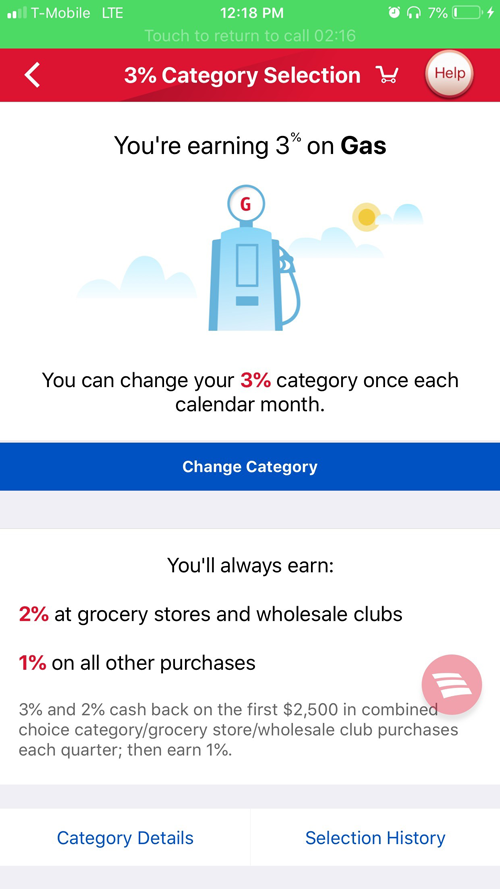

The Bank of America Cash Rewards card’s 3-percent bonus category, also referred to as the “choice category,” is automatically set to gas. However, card members can change the category one time each calendar month through online banking or using the mobile banking app.

To update the category in the mobile app, simply select the Bank of America Cash Reward card, click on the “Rewards” tab and select “Get Started.” If you want to choose a category other than gas, click “Change Category.”

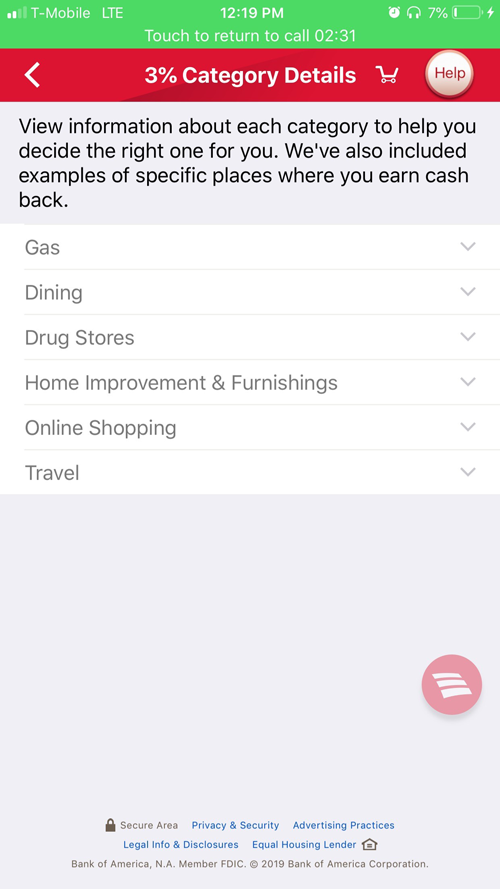

To get detailed information about each choice category, select “Category Details.” You can also view your previous choice categories by clicking “Selection History.”

Keep in mind that you don’t have to change the choice category every month, or at all in fact. It will remain the same until you decide to update it.

How much can you earn?

Cash Rewards cardholders will earn a 2-percent bonus on grocery store and wholesale club purchases, and a 3-percent bonus on choice categories on up to $2,500 in combined purchases each quarter. Once the cap has been reached, cardholders will earn 1 percent cash back for the remainder of that quarter. All other purchases earn unlimited 1 percent cash back.

So, for example, if you travel frequently and spend around $250 each week on hotel stays and rental cars, you’ll likely benefit most from the travel category. If you select the travel category for one quarter, you can easily max out the $2,500 bonus earning cap and receive $80 cash back.

| Cash back earned on $3,000 quarterly spend in choice category | |

| ($2,500 travel spend x 3% cash back) + ($500 travel spend x 1%) = $80 cash back | |

If you simply max out the 3-percent bonus category each quarter for a year, you can potentially earn $300 cash back for that year. Combine that with the $200 sign-up bonus after $1,000 spend in the first 90 days of account opening, and you can earn at least $450 cash back in the first year alone.

| First year cash back ($2,500 quarterly spend in choice category + sign-up bonus) | |

| ($2,500 travel spend x 3% cash back) x 4 quarters + $200 sign-up bonus = $500 cash back | |

Check out Bank of America’s rewards calculator to see how much cash back you can earn based on your spending.

What purchases qualify for a cash back bonus?

Every purchase you make using your card is categorized using a merchant category code (MCC). Merchants are assigned an MCC based on the products and services they offer. While Bank of America does not have control over how a merchant classifies itself, they do group similar MCC’s into grocery store, wholes club and choice categories to help maximize your bonus.

See what purchases qualify for bonus spend categories below.

Grocery store and wholesale clubs category

Grocery store merchants and wholesale clubs include supermarkets, freezer or meat lockers, candy, nut or confection stores, dairy product stores and bakeries. Superstores and smaller stores that sell groceries, such as drug stores and convenience stores, do not earn the bonus rate.

Gas category

The gas category includes gas and fuel merchants whose primary line of business is the sale of automotive gasoline that can be purchased inside the service station or at the automated fuel pump as well as gasoline purchased at boat marinas. Fuel dealers whose primary line of business is the sale of heating oil, propane, kerosene and other fuels are also included.

Online shopping category

The online shopping category consists of online and mobile app purchases made at a variety of retailers, such as bookstores, department stores, specialty retailers and sporting goods stores. For example, Amazon.com, Bestbuy.com, Ticketmaster.com, QVC.com, Americanairlines.com, Starbucks.com and Uber.com are included in this category.

Merchants that provide non-retail services, such as doctors and hospitals, government services and taxes, insurance, membership organizations, schools and utilities are excluded from the category.

Dining category

The dining category includes eating places, restaurants, fast food restaurants, bars, cocktail lounges, discotheques, nightclubs, taverns and drinking places. For example, McDonald’s, Starbucks, The Cheesecake Factory, Domino’s Pizza and Grubhub all fall under this category.

Travel category

A variety of purchases – ranging from everyday travel expenses to vacations and getaways – qualify for the travel category. Merchants include, but are not limited to, parking lots and garages, tolls, taxis and rideshares, commuter passenger travel, tourist attractions and exhibits, airlines, amusement parks, cruise lines, hotels and car rentals.

For example, Delta Airlines, Airbnb, E-Zpass, Sunpass, Uber, Marriott. Enterprise Rent-A-Car, Amtrak and Expedia are considered qualifying merchants.

Drug stores category

The drug stores category includes purchases made at drug stores, pharmacies, drug proprietors and druggist sundries, such as CVS Caremark, RiteAid, Walgreens and Duane Reade.

Home improvement/furnishings

Merchants that qualify for the home improvement/furnishings category include hardware stores, contractors, air conditioning and refrigeration repair shops, antique shops, carpet and upholstery cleaning services, lawn and garden supply stores, paint stores, household appliance stores, miscellaneous house furnishings specialty shops and more.

For example, Ace Hardware, Menards, Bed Bath and Beyond, IKEA, Pottery Barn, Lowes, Sherwin-Williams, Williams-Sonoma and Trugreen are included in this category.

Keep in mind that since purchases and transactions are submitted and categorized by the merchant, and not Bank of America, some of your purchases may not fall into the category that you would expect.

Receive a 25- to 75- percent rewards bonus

If you are a Bank of America Preferred Rewards client, you will receive a 25- to 75-percent rewards bonus on every purchase. So instead of earning 3 percent cash back from the choice category, Preferred Rewards customers can earn 3.75 to 5.25 percent back.

To enroll in Preferred Rewards, you must have an eligible Bank of America personal checking account and a three-month average of $20,000 or more in qualifying Bank of America banking accounts and/or Merrill Edge and Merrill Lynch investment accounts. See the Preferred Rewards earning tiers below.

| Tier | Gold | Platinum | Platinum Honors |

| Credit card rewards bonus | 25% | 50% | 75% |

| Required balance (3-month average combined balance) | $20,000 to $49,999 | 50,000 to $99,999 | $100,000 or more |

Redeeming your rewards

The Bank of America Cash Rewards card offers a variety of ways to redeem your rewards. You can redeem your cash back for statement credits, deposits made directly into your Bank of America checking or savings account or for credit to an eligible account with Merrill Lynch or Merrill Edge. There is a minimum redemption amount of $25 for contributions to a qualifying 529 account with Merrill Lynch or Merrill Edge or a for a check.

Automatic redemptions, starting at $25, can be set up for eligible Bank of America, Merrill Lynch or Merrill Edge account. However, statement credits, checks and contributions into a 529 account do not qualify for automatic redemptions.

Which choice category should you choose?

Choosing the right choice category to optimize your rewards earnings throughout the year depends on your spending habits. For example, November and December are great months to select the online shopping category and earn a 3-percent bonus on Black Friday and Cyber Monday shopping. Check out our suggestions of which categories to choose each month to help boost your bonus earnings in 2019.

See related: How to maximize the Bank of America Cash Rewards card’s 3-percent bonus

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.