Summary

With Zogo, you can earn gift cards while learning about various aspects of personal finance – and Amex can help you get your rewards faster.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

They taught us many fascinating things at school. There were tangents and cotangents, nucleic acids and protein synthesis, and literary elements in “The Great Gatsby.” What wasn’t there for most of us, however, is basic financial education. There were no classes on budgeting or saving, on credit scoring, investment basics or retirement accounts.

Luckily, there are some great, fun ways to fill out the gaps in your financial knowledge. Some will even reward you for learning about money.

Zogo is a financial education app that uses quizzes to teach users everything personal finance in a fun, game-like way, all while rewarding them with gift cards.

Read on to learn more about Zogo and its new partnership with American Express – and how it can make your financial education even more rewarding.

Read more from our credit card experts.

Young Americans want to learn about personal finance

I don’t know about you, but I don’t remember a thing about cotangents (I apologize, trigonometry lovers!), but I regularly find myself wishing they taught us personal finance basics at school.

I know I’m not alone in this. A Credit Karma study from 2019 found that 63% of American adults thought that personal finance education should be taught at school. The numbers are even higher for Gen Z. The same year, Experian found that 76% of Gen Z consumers thought their high school should have offered a class on managing finances.

It’s no wonder then that 3 in 4 consumers agree that they will educate themselves more about their finances in 2021, according to Amex Trendex.

In response to these trends, Amex has partnered up with Zogo to help cardmembers better understand how to manage their finances in a fun and engaging way. For this pilot program, American Express will offer additional incentives on Zogo, including a welcome bonus and increased earning rate, as well as custom-tailored content.

“Financial literacy is critical and isn’t always taught in the classroom,” says Muge Sencalis, vice president, U.S. Consumer Lending, American Express. “That’s why we teamed up with Zogo to provide a new, engaging and rewarding way for cardmembers who are new to credit to learn more about personal finance.”

How does Zogo work?

Zogo is the Duolingo of personal finance. “Built by Gen Z for Gen Z” – Zogo was founded by a group of Duke University students – the app aims to teach financial literacy in a way the young generation loves. Users can learn about money right on their phone, through gamified experience with incentives embedded.

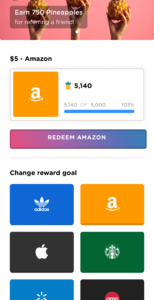

In the app, users work through modules in various topics, from health insurance to debt repayment to homebuying. At the end of every module, they get quizzed to test their new financial knowledge. For each correct answer, they get pineapples, the app’s currency that can be converted into gift cards. That’s one adorable currency, if you ask me.

Amex has added a personal touch to creating modules, too.

“To make financial education more engaging, we partnered with Zogo to launch “bite-sized” learning modules and quizzes for those who are new to credit and are already hearing great feedback from our cardmembers using the app,” says Sencalis.

Each gift card is $5 in value and costs 5,000 pineapples. Zogo offers gift cards from major retailers such as Amazon, Apple, Walmart, Target and others.

With Amex, you can get 500 pineapples right off the bat when you download and sign up for Zogo – just use the issuer’s access code AMEX when creating an account. That’s 10% of the pineapples you need to gather toward a gift card, so I say it’s a good deal.

The access code only works for new Zogo users and provides special access for an initial period of six months. After that, Zogo will move your account to the standard version of the app.

Should you sign up for Zogo with Amex?

If you want to learn about finance, signing up for Zogo is a no-brainer. I did, and about an hour later earned my first Amazon gift card while learning about health insurance plans – one of the areas of finance that used to turn my every thought into a panicky “What?” Now, I can probably advise you on which type of plan would work best for you. And I have $5 to spend on Amazon.

The app is absolutely fun and filled with essential personal finance education in an easily digestible form. I can see why Amex cardmembers love it. Just look at this snippet from a story about Zo the Pineapple and Paul the Papaya! Adorable.

I’m always happy when people are striving to learn more about money, and I’m happy when institutions provide them with good tools to do so. The pilot program from Amex and Zogo is exciting, and I hope to see even more from their partnership in the future.

For now, I’m going to get back on Zogo and learn about investing. I have a Barnes & Noble gift card to earn.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.